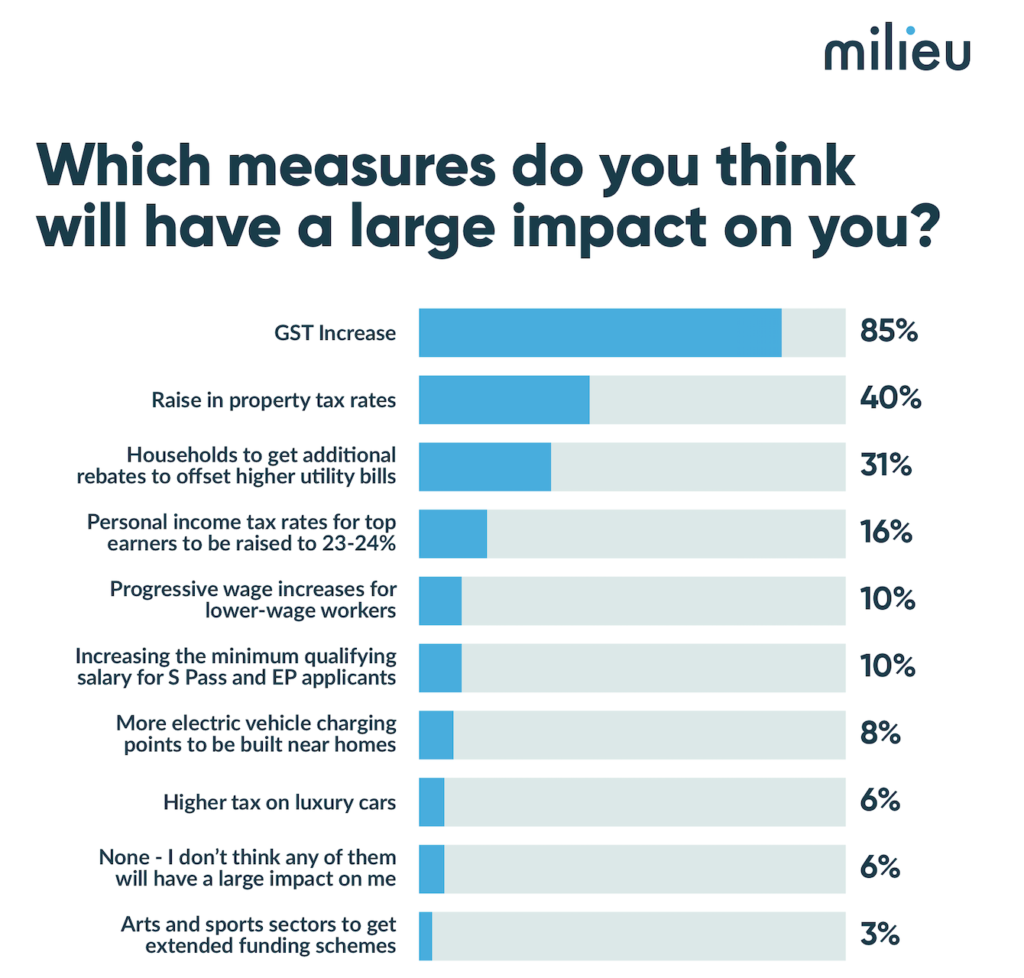

With the upcoming increase in property taxes, 4 in 10 Singaporeans said they will be affected by the higher taxes. But is that really true? I decided to calculate the numbers to find out.

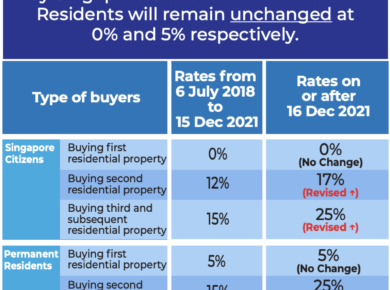

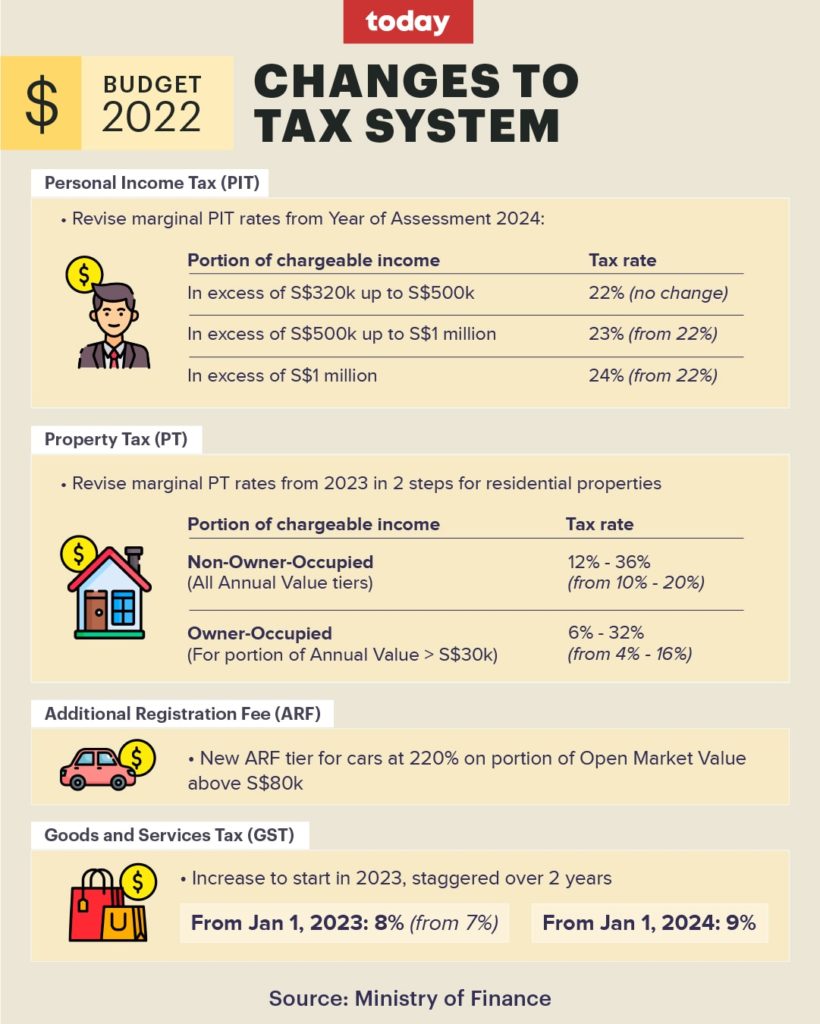

Property tax is currently Singapore’s principal means of taxing wealth, so it comes as no surprise when Finance Minister Lawrence Wong announced in the latest Budget 2022 that the government will be raising these taxes, which haven’t been raised since 2015. At first glance, the headline rate of 6% – 32% (for owner-occupied) and 12% – 36% (for non-owner-occupied) may sound like a steep increase, but how many Singaporeans will actually be affected by the change?

As it turns out, not much.

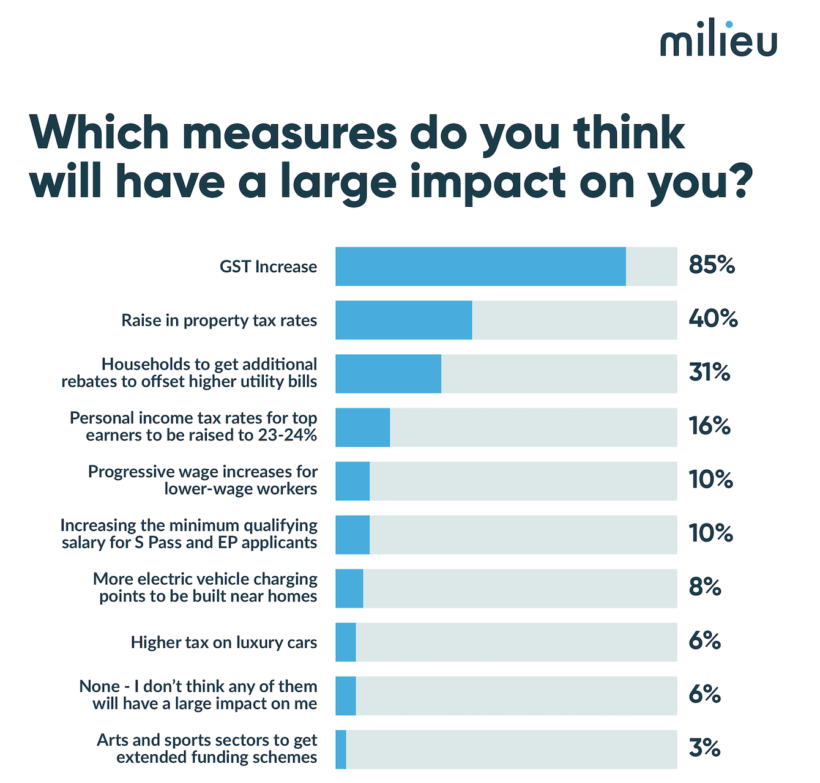

Aside from the GST hike, the second most pressing concern was that of the higher property tax rates, with 4 in 10 Singaporeans saying that it would have a “large impact” on them. But here’s some facts:

The majority of homes in Singapore have an AV of less than $30,000.

If you stay in a HDB flat, you will not be affected because even the largest flats have an AV of under $10,000+. And even though IRAS has announced that they will be revising the Annual Values (AVs) of HDB flats upwards by 4% to 6% from this year onwards (to keep in line with the increase in market rentals), this will still not push the AV to above $12,000:

| Type of HDB | Median Annual Value (AV) | 4% AV increase | 6% AV increase |

| 1 or 2 Room | $5,100 | $5,304 | $5,406 |

| 3 Room | $7,680 | $7,987 | $8,141 |

| 4 Room | $9,600 | $9,984 | $10,176 |

| 5 Room | $10,380 | $10,795 | $11,003 |

| Executive & Others | $10,680 | $11,107 | $11,321 |

If you stay in a private residence instead, here’s how the annual value stacks up:

| Type of Property | Median Annual Value |

| Non-landed (includes Executive Condominiums) | $22,200 |

| Landed | $34,800 |

This means that the vast majority of homes – including HDB flats, condos and landed property in suburban areas and most mass-market condos – will NOT be affected by the increase in property tax rates as your AV is likely to be below $30,000.

Examples of properties with AV above $30,000

Most properties that go past $30,000 AV tend to be landed homes, industrial and commercial properties:

| Type of Property | Median Annual Value (AV) |

| Condos / Landed in central Singapore | $40,000 |

| Industrial | $36,000 |

| Commercial | $61,500 |

So if you own a private residential property in a central area, then there’s a chance that the AV will be higher than $30,000. To find out if that applies to you, simply log into your IRAS tax portal and click on the View Property Portfolio service.

How much more property taxes will I have to pay?

Owner-occupied residential properties will be taxed at 6% – 32% on a progressive tier (check the full breakdown of the rates here on IRAS website), which works out to be:

| Type of Property | Annual Value* | Current Property Tax | Revised Property Tax | Increase |

| HDB flat | $10,000 | $80 | $80 | – |

| Suburban Condo / Landed | $30,000 | $880 | $880 | – |

| Central Condos / Landed | $40,000 | $1,280 | $1,480 | $200 ($17/month) |

| Large landed property | $70,000 | $2,780 | $5,080 | $2,300 ($192/month) |

| Very large landed property | $150,000 | $12,580 | $27,980 | $15,400 ($1,283/month) |

Thus, if you live in a HDB flat or a mass-market condo, you are unlikely to be affected by these higher tax rates. But if you currently own a residential property which you’re not staying in, you will be taxed at significantly higher rates of 12% – 36%.

For non-owner-occupied residential properties, this is what the new tax implications may look like:

| Type of Property | Annual Value* | Current Property Tax | Revised Property Tax | Increase |

| HDB flat | $10,000 | $1,000 | $1,200 | $200 ($17/month) |

| Suburban Condo / Landed | $30,000 | $880 | $880 | $600 ($50/month) |

| Central Condos / Landed | $40,000 | $1,280 | $1,480 | $1,400 ($117/month) |

| Large landed property | $70,000 | $2,780 | $5,080 | $5,900 ($492/month) |

| Very large landed property | $150,000 | $12,580 | $27,980 | $19,200 ($1,600/month) |

If you have an existing second property which you’re not living in, be prepared to pay anywhere between $17 – $117 more in property taxes a month once the new rates kick in.

I’m planning to buy an investment property. Will the tax rates affect me?

In short, yes because investment properties are being taxed higher by the government as part of the latest move. However, it still depends on the actual AV of the unit you’re buying – if you’re purchasing a mass-market condo or a suburban private residential property, the increase of $50 a month should be minimal compared to your other property expenses.

However, it pays to be more prudent if you’re going for prime district condos or landed properties, as you will now be saddled with not only higher mortgage repayments but also higher property taxes every month. Be sure to factor these into your budget calculations.

Of course, I presume that landlords will likely try to pass some of the increase in property taxes and mortgage interest rates to tenants, which will result in higher rental rates from here.

Unsure whether your finances are sufficient for your property purchase? My husband has agreed to help advise my readers in his professional capacity, so if you need some guidance and lack a trusted advisor, you can always DM me on Instagram here and I’ll link you up.

Important Disclaimer: The information presented here is for reference and educational purposes only. To get an accurate assessment of your property tax payable and annual value of your house, please login with your SingPass to IRAS myTax portal and retrieve your information. I do not represent nor speak on behalf of any government agencies or statutory board, and definitely not for HDB or IRAS.