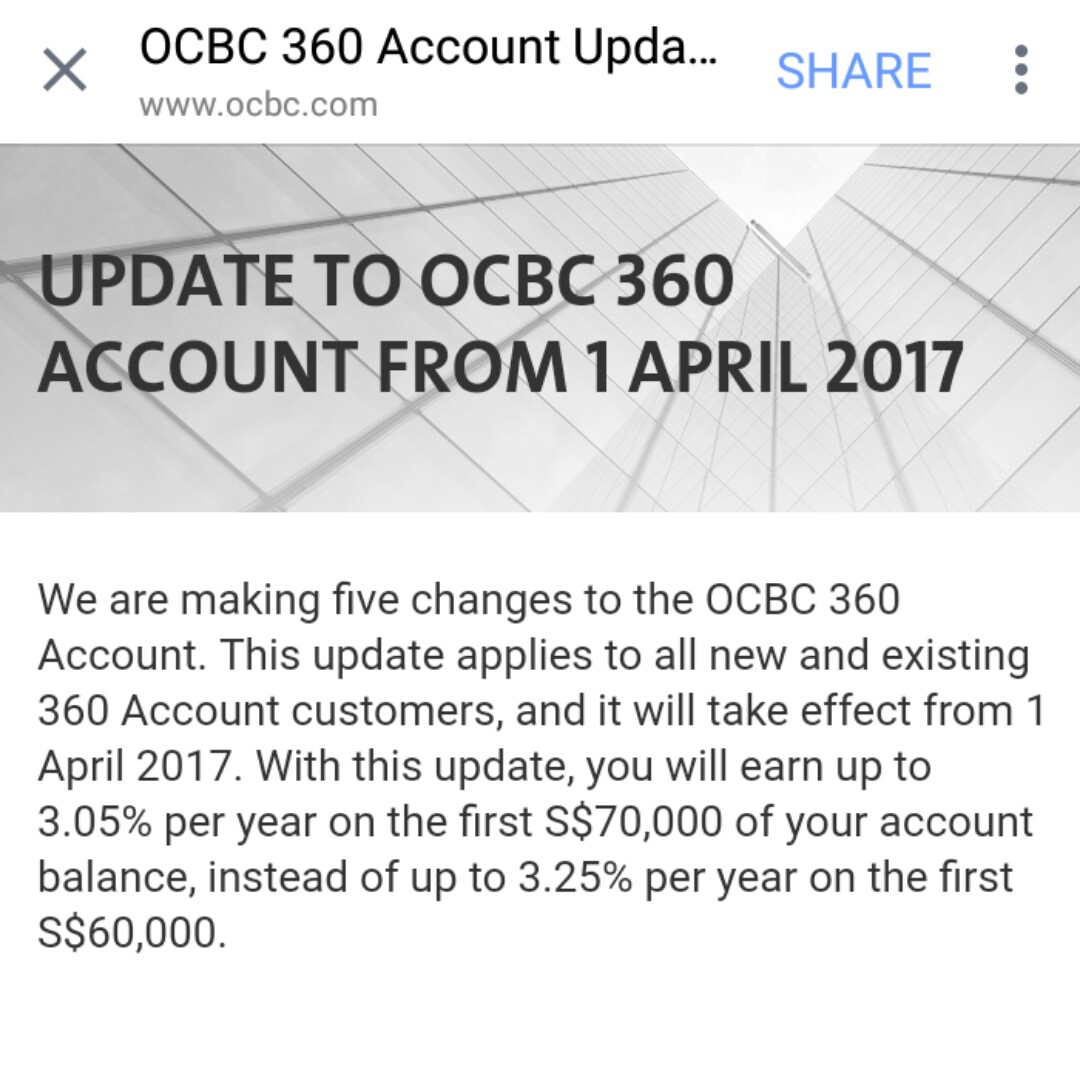

OCBC 360 has just announced further changes to their bank accounts.

Good or bad? Should you stay or switch?

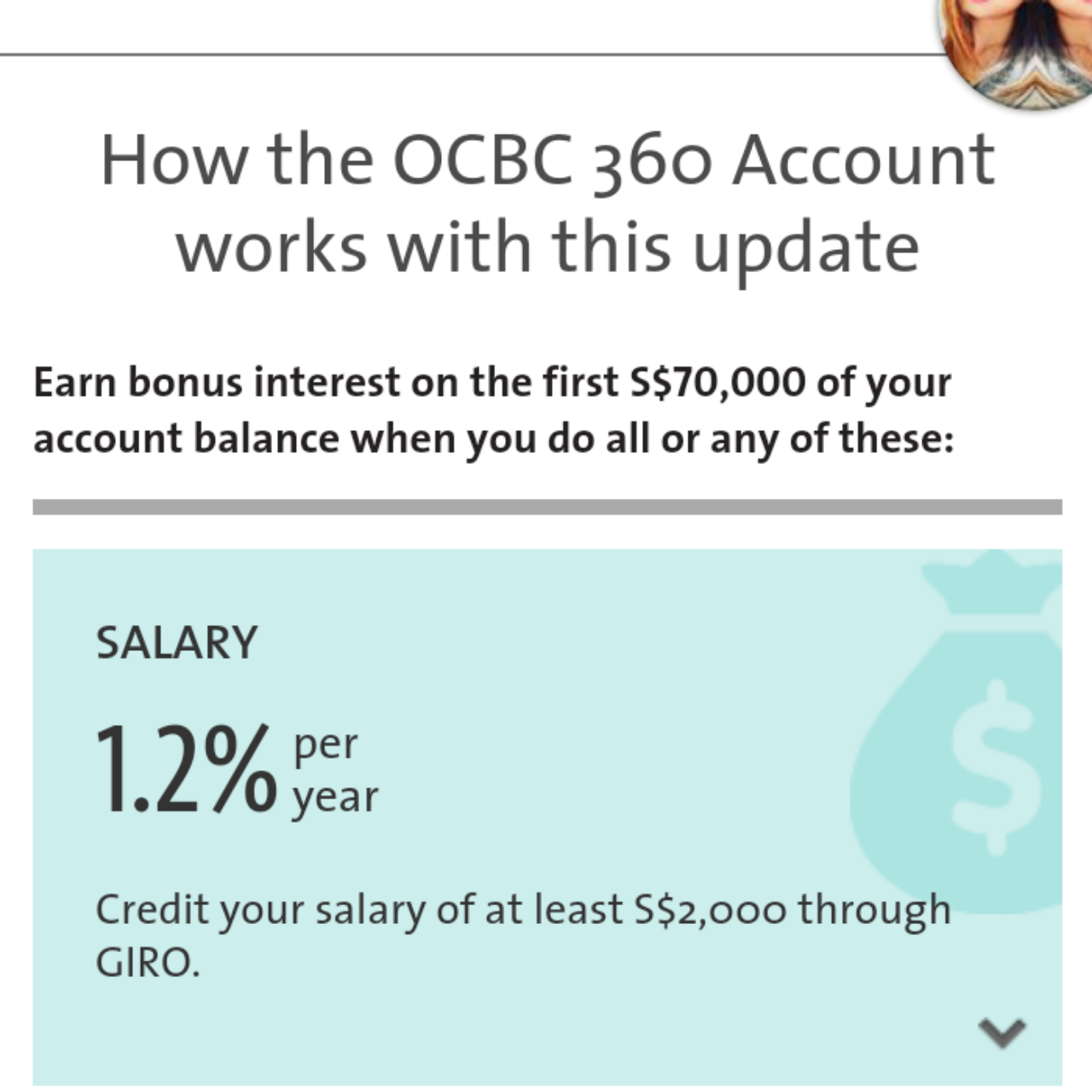

Salary credit is still good. I may still keep this purely for the salary credit.

For those earning above $6000 a month, BOC SmartSaver might be a better option.

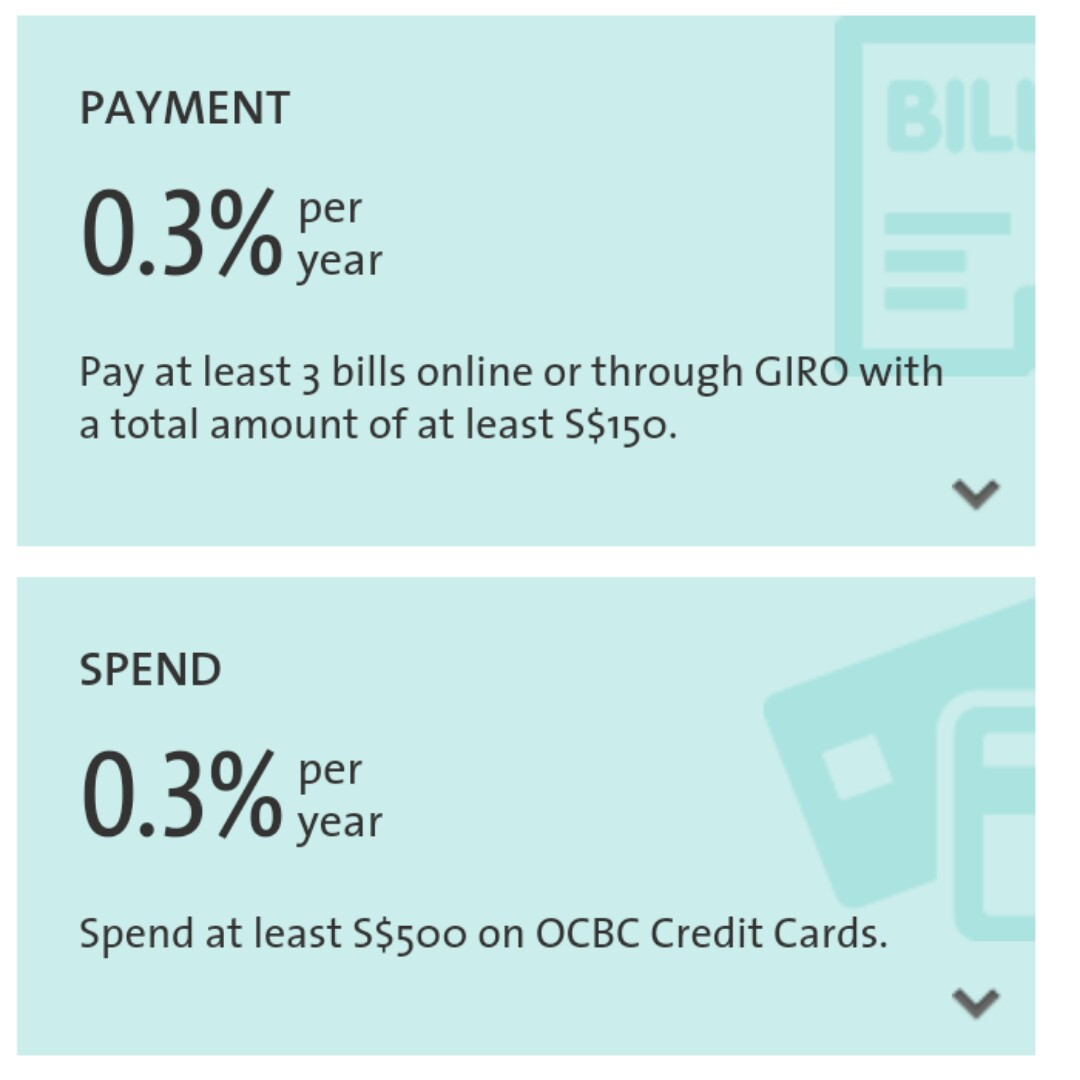

Payment Bonus

Reduced from 0.5% to 0.3% per year. To qualify, pay at least 3 bills and they must also add up to at least S$150.

This is the second time OCBC has reduced their bill payment bonus. And this time, they've set an additional criteria that your bills should hit at least $150. Not too much a problem for me, but for those who have been using your smaller bills to clear, you've to now rethink your method.

Summary: there's now less incentive for me to pay my bills using OCBC 360.

Not great changes to us as consumers.

Credit Card Spend Bonus

Reduced from 0.5% to 0.3% per year.

OCBC cards, especially their 365 card, aren't that bad but neither are they fantastic. The most appealing factor to me is their 6% cashback on weekend dining (where prices also tend to be higher).

I've to relook this now and evaluate if it'll be better switching to another credit card now that the "double kill" method no longer earns me much extra money. There are other better cashback cards around.

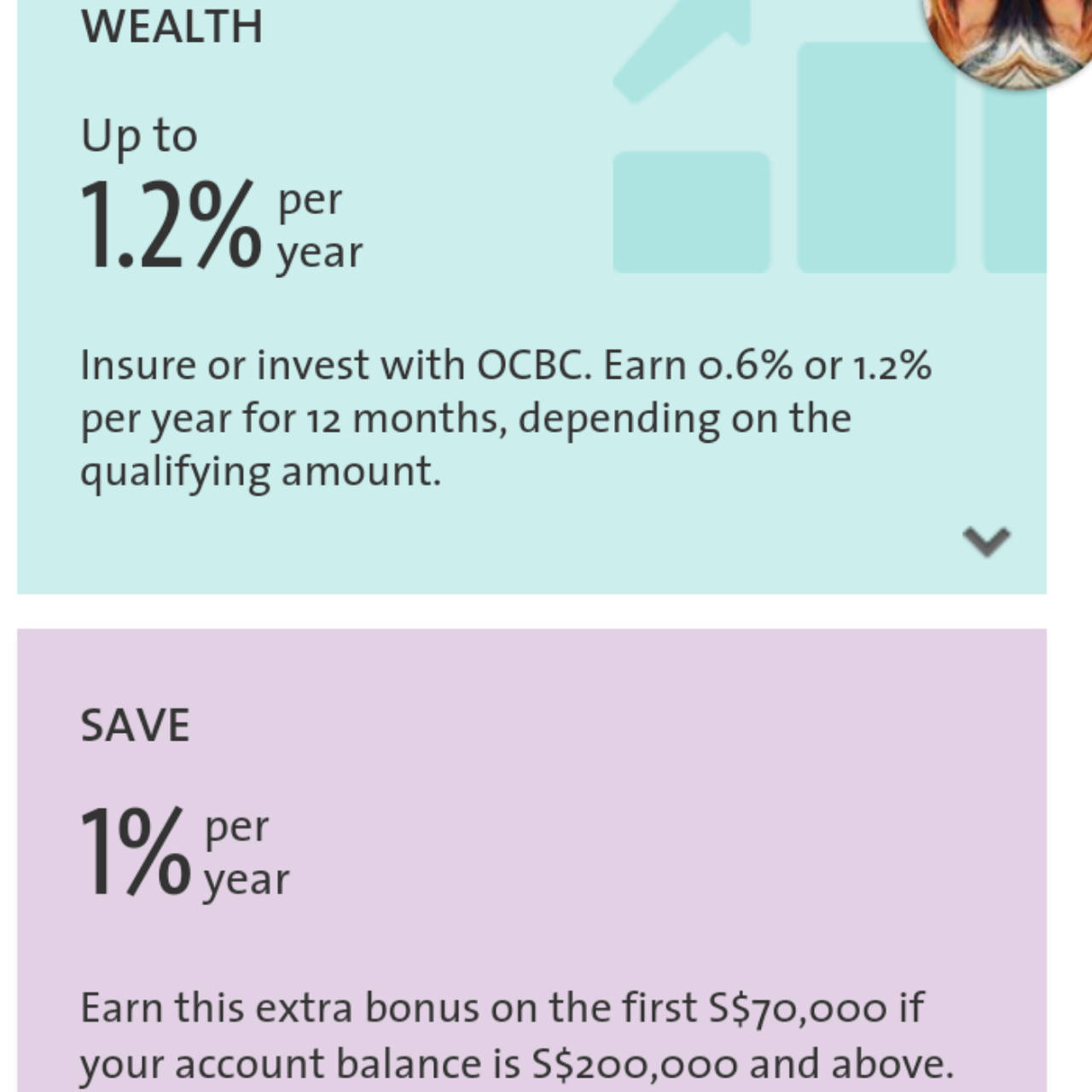

We've already examined how bank insurance policies are terrible products in my opinion.

Save Bonus

Earn 1% per year on the first S$70,000 if your account balance is S$200,000 and above, instead of earning 1% per year on your incremental balance.

My initial strategy for maximising these high-yield accounts was to park just the right amount of money in each so I could earn more interest. I've kept my cash balance in OCBC 360 under $60,000 due to the capped interest rule previously.

Even though they've changed this to $70k, I'm now left worse off, because I don't have – and neither do I intend to park – $200,000 in their account.

Omg so many campers. Is it you guys also all have OCBC 360!

Summary of OCBC Changes

I've always ignored the wealth and save bonus interest because realistically speaking, most of us are probably earning our bonus interest from the salary credit, bill payments and credit card spending.

When I first opened my OCBC 360 account, it gave me 3% for meeting these 3 requirements.

After their last change, it became 2.2%.

Come April, you'll only receive 1.8% in bonus interest. Seriously?

Other options:

UOB One

BOC SmartSaver

Bank of China SmartSaver Account

I've already analysed BOC SmartSaver on my blog before so if you're interested you can key into the search bar to look for it!

Earn up to 3.55% p.a. on the first S$60,000 of your account balance when you perform the following designated transactions:

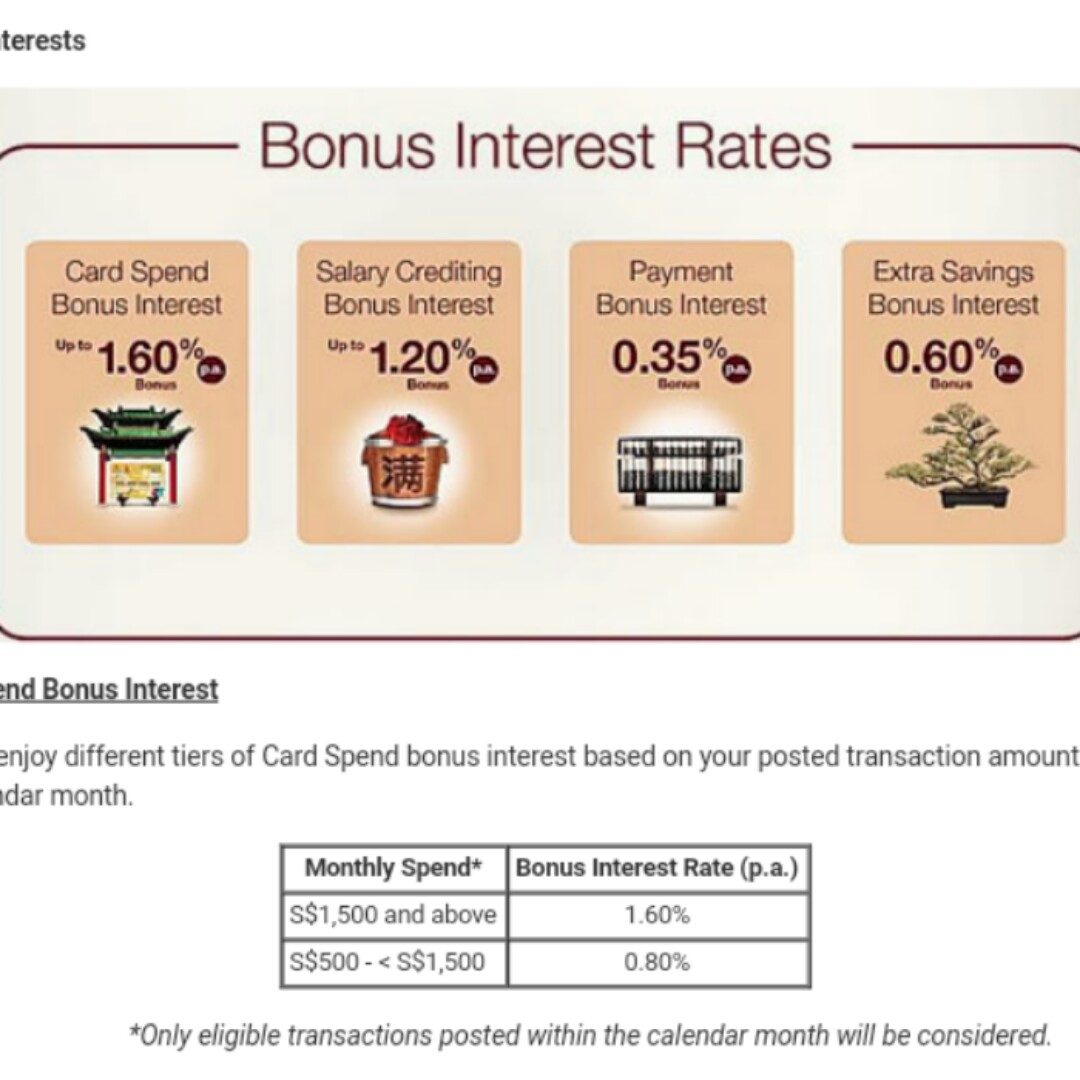

Card Spend

Salary Crediting

Payment

In addition, enjoy 0.6% p.a. on your account balance above S$60,000 when you have fulfilled at least one of the above criteria.

So for salary credit alone, you can get 1.2% + 0.6% if you earn above $6000 a month AND have more than $60k sitting in your account (a year of salary will get you close).

Not too bad isn't it!

But for us lesser mortals who don't earn that much, you can still get 0.8% salary credit + 0.8% credit card spend + 0.35% bill payments + 0.6% bonus interest if you've saved up above $60k 😊

The only downside is that they don't have as many branches around Singapore and their online banking system isn't as good as the other banks.

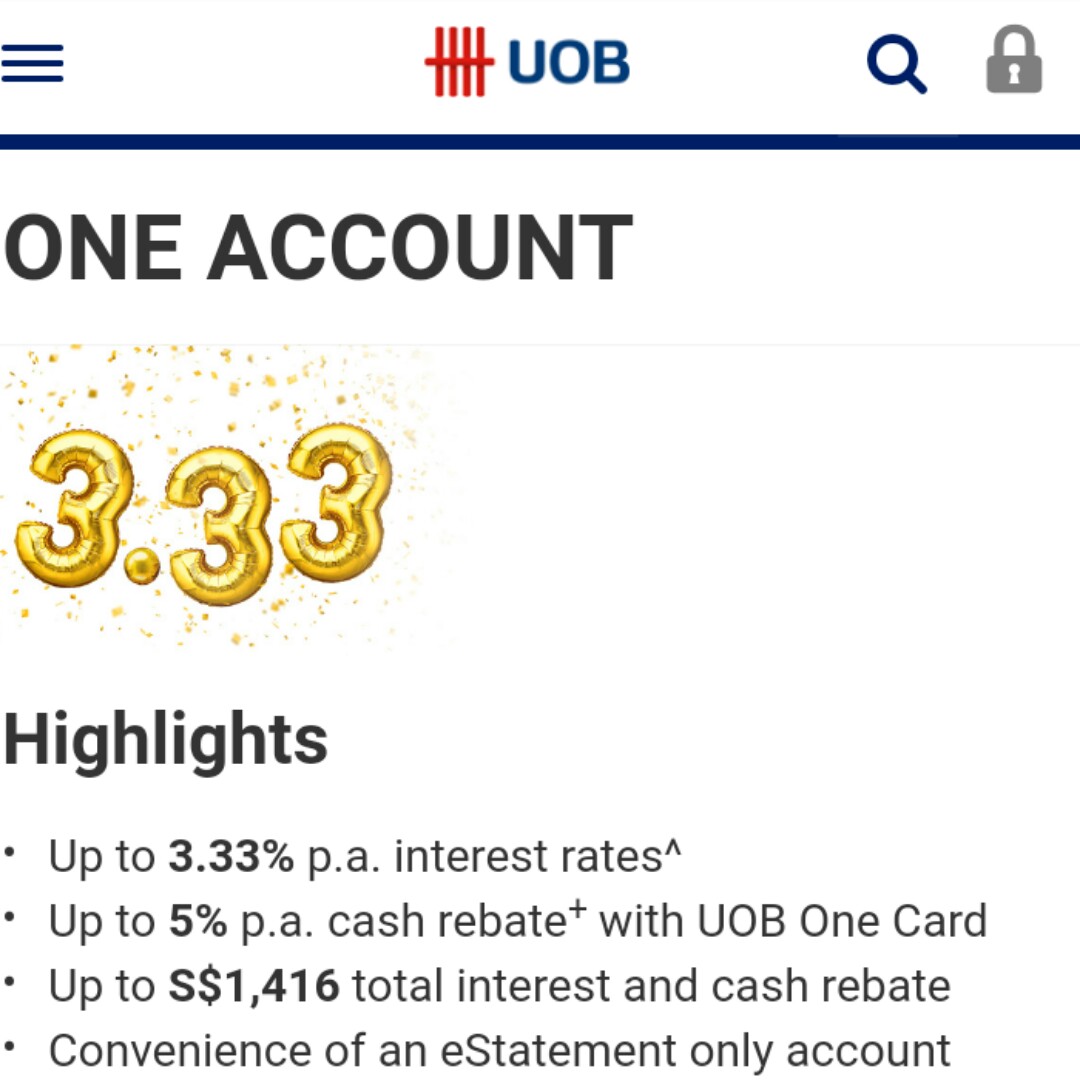

UOB One Account

The 5% cash rebate is not very achievable for most mortals so we can ignore that marketing speak lol.

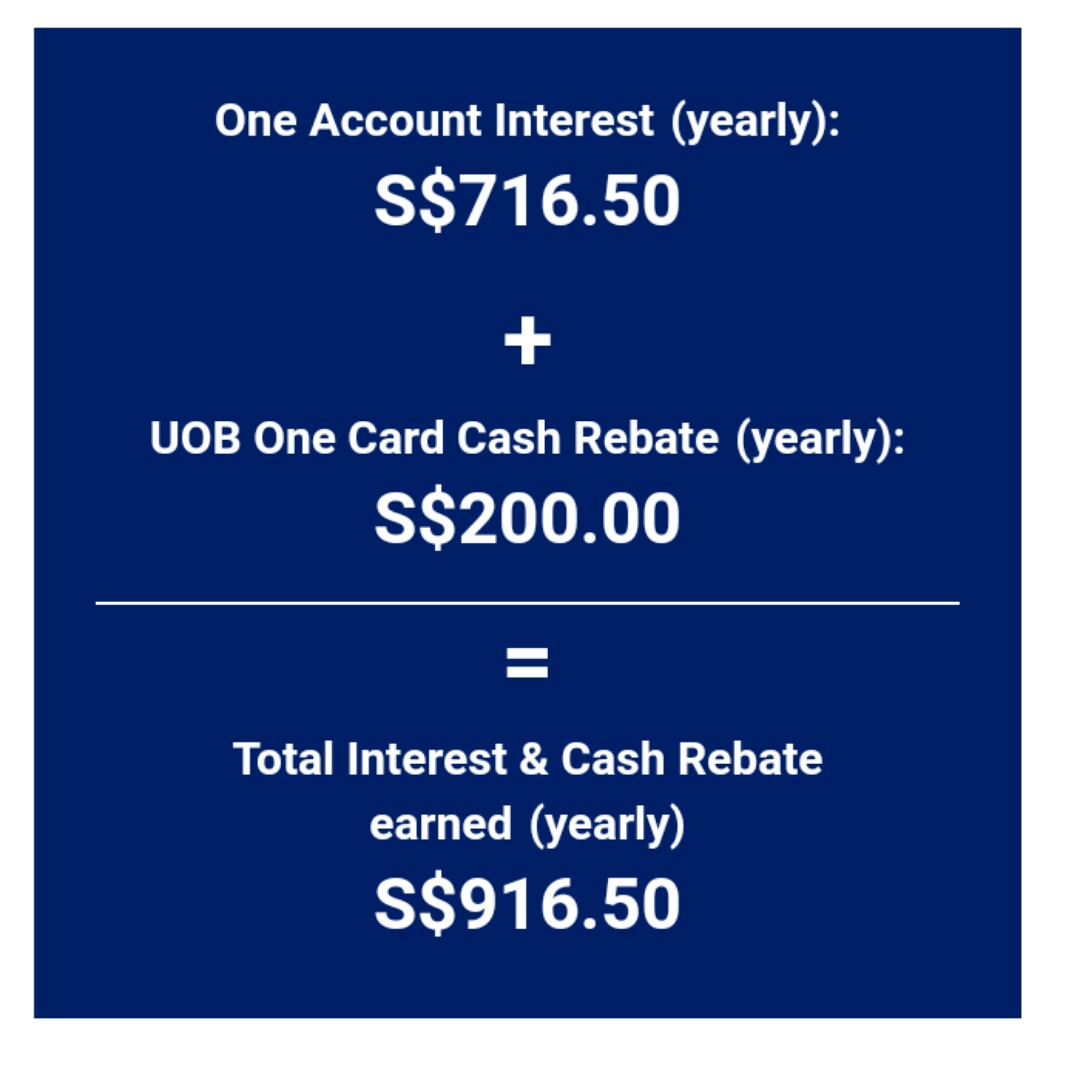

My take on UOB One and explanation of its tiered interest rates system on the blog.

UOB interest rate is a little harder to explain as they use the tiered system to distribute your interest payments. I also have a blog post exclusively on this account (and where I compared against OCBC 360) previously so you guys can head over to www.sgbudgetbabe.com for that.

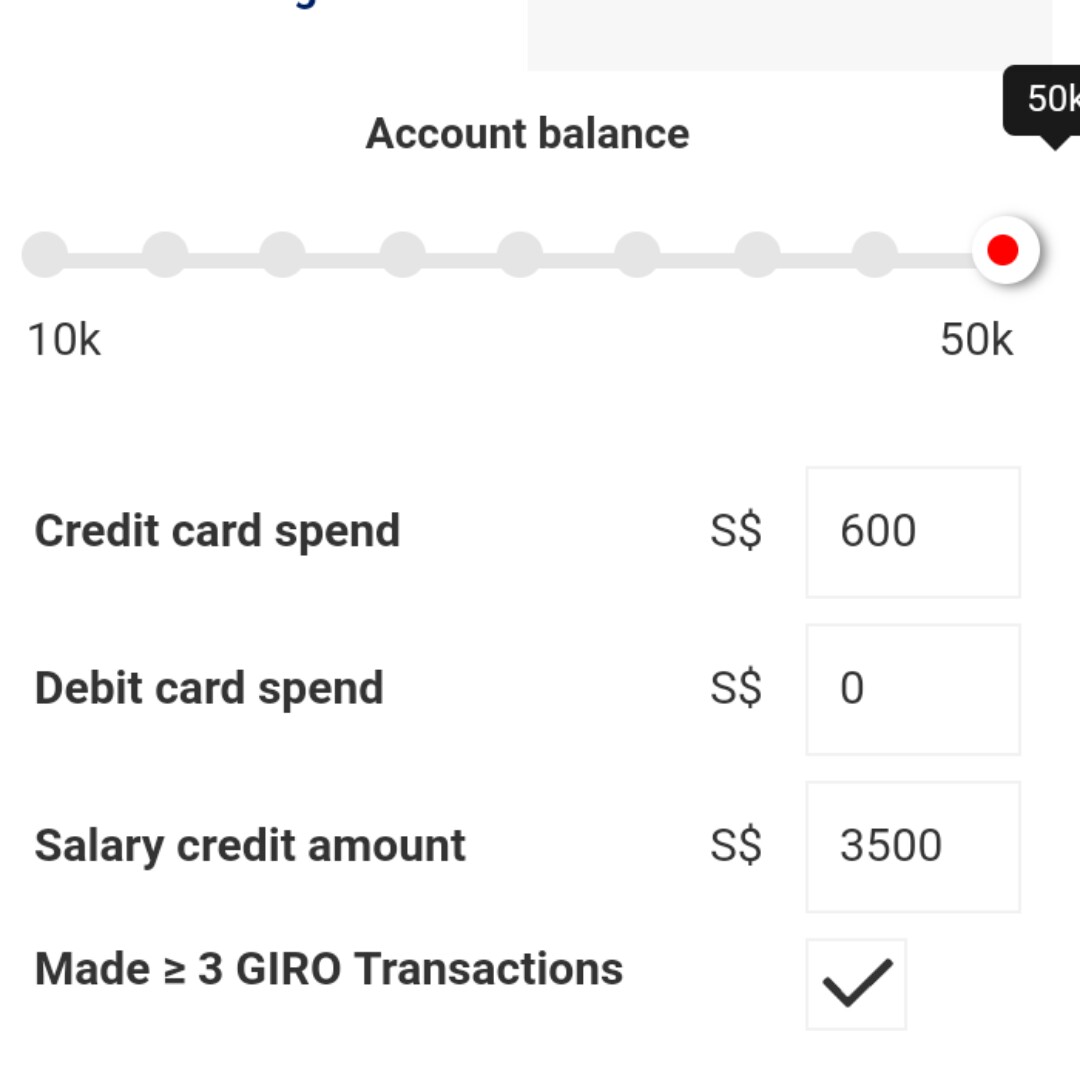

Using their calculator would be easiest if you're still confused!

Assuming you start with 35k. Not too bad, and their bonus interest is now officially higher than OCBC 360 after the changes..

Analysis of POSB cashback scheme on my blog post! $1000 would be realistically the amount you can earn based on my assumptions laid out in the post.

POSB Cashback

Other lower yielding bank accounts but with lesser criteria

Citibank MaxiGain

This offers 80% of the one-month SIBOR rate, and is pretty fuss-free. No need go credit salary, spend on credit cards or clear bill payments. All you need to do is to put an initial deposit of $15,000, then let your money sit and churn. Easy peasy!

CIMB FastSaver

Offers a flat 1% interest rate for banking with them online. Also very easy!

CIMB StarSaver

Get 0.8% interest with this checking account. You'll need to have a minimum of $5000. No other requirements or monthly actions needed either.

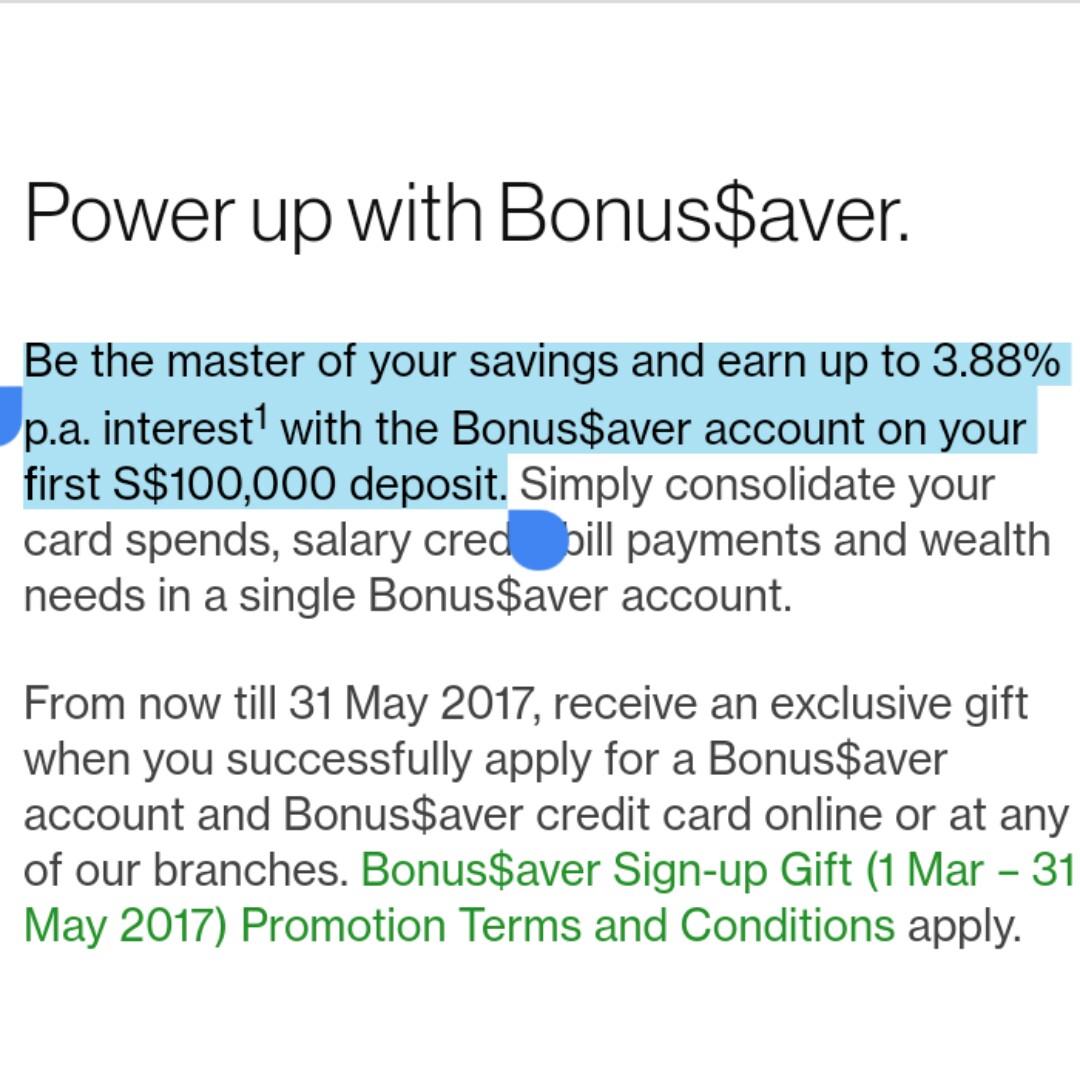

What I don't like: Standard Chartered Bonus Saver

3.88%!!!!!!!

Sounds very high right? WAIT LA THERE'S A CATCH.

I digress but their free sign up gift is really tempting me. I want this levitating speaker!!!!! Any reader who gives me this (if you open an account with them), I'll gladly do a full financial analysis of your life in return!!!!!

Just kidding. I don't think MAS allows that. Haha but if you're my friend… 😌

Using their bonus interest calculator I only got $63.31 on an initial deposit of $35,000 and a minimum salary credit of $3000. Oh, and yes to paying 3 bills and $500 credit card spend, no to insure or invest.

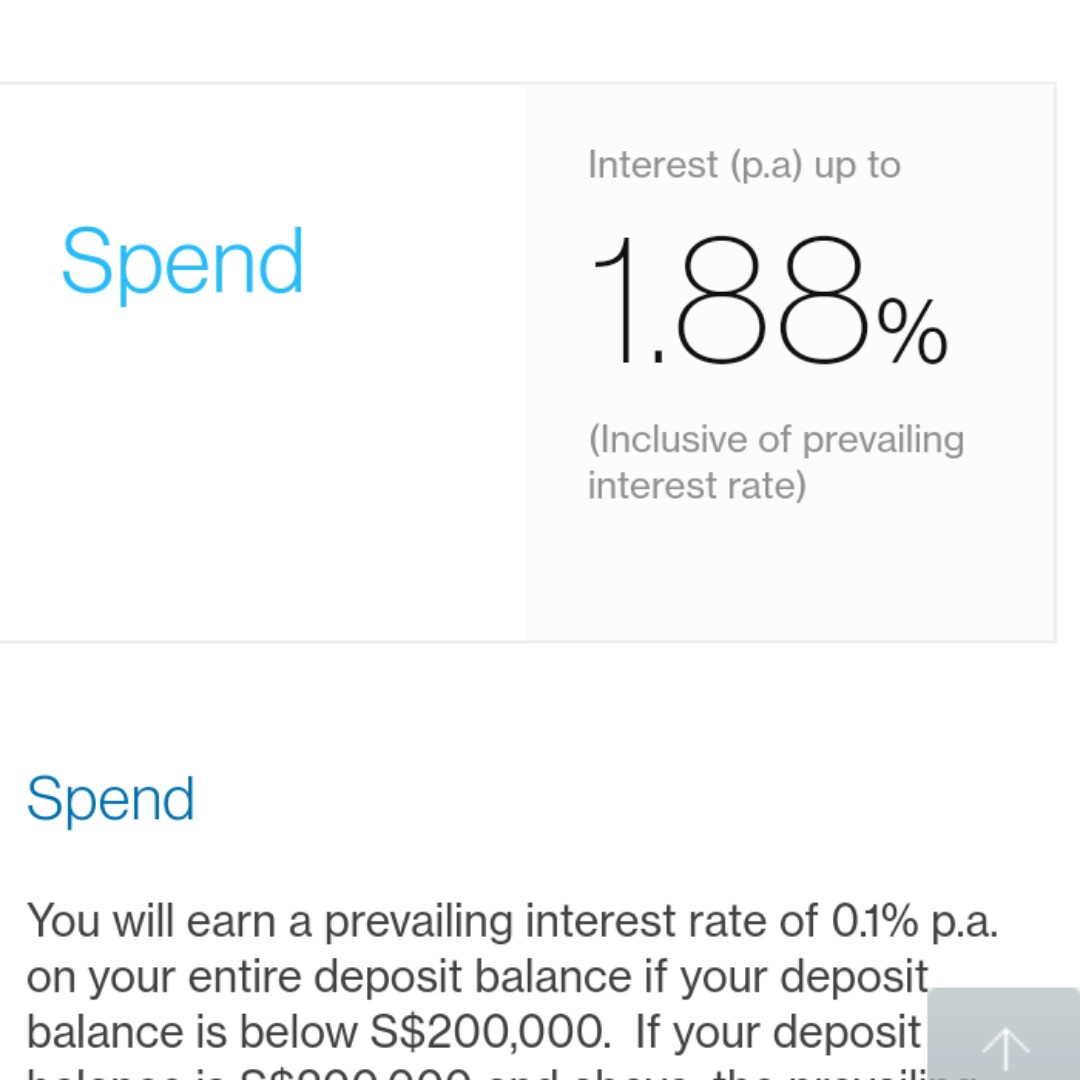

They claim their credit card spending category will give you up to 1.88% but THE KEY HERE IS "UP TO".

Cos you will earn a prevailing interest rate of ONLY 0.1% p.a. on your entire deposit balance IF your deposit balance is below S$200,000.

Jeng jeng jeng.

So realistically, us mortals can only achieve 0.88% CC spend + 1% salary credit + 0.25% bill payments.

Eh, who said 3.88% ah?

You'll only earn the publicised 1.88% if you spend $2000 a month on your credit cards 💳. Mai siao 😩😲😡😤 why you cheat my feelings…

So that rounds up the changes in OCBC 360 account, as well as some other high yielding saving accounts that you guys can consider if you wanna shift your money over.

Have fun!