It is no secret that I was on Team Cashback throughout my 20s. Back then, as a single female who was spending less than $800 each month, cashback cards made the most sense for me because even if I clocked 4 miles for every single dollar, I would only have enough for a 1-way business class flight to Philippines (3 hours) at most after an entire year. Naturally, getting 1 month back in expenses was far more attractive to me!

Now, if you have a similar life profile and prefer to have cold, hard cash back in your pocket for you to spend on other stuff, then cashback cards may still make sense for you.

TLDR: If you spend less than $1,000 a month, then cashback cards may appeal to you. Typically, this would be the fresh grads, or folks in their 20s / 30s who aren’t yet married with kids and keep their spending to a minimum.

How do you choose between miles or cashback?

By now, you clearly understand that when it comes to winning at the credit card game, your spending habits and personal preferences take the front seat.

| Pros | Cons | |

| Cashback | Get a percentage of your spending back in the form of rebates. It is credited back into your credit card account to offset your bill so you pay less. | To earn higher cashback rates, some credit cards require you to spend a minimum amount each month. There could also be a cap to the amount of cashback you can earn. |

| Miles | Earn miles for every dollar you spend. Whether in economy class or first class, these miles can be used to redeem your next flight out of Singapore. | It takes time to accumulate sufficient miles to a destination outside of Southeast Asia, unless you spend big. Your miles might also expire before you have the chance to use them. |

Summary: A cashback card is the most straightforward when it comes to earning rewards for your credit card spend. With a cashback card, you get rewarded with cash credited into your credit card, which helps you pay a lower credit card bill so you have less cash leaving your pocket.

Who should get cashback cards?

- If you think cash is king. You are rewarded with cash in your credit card that can be used immediately, on your next purchase, whatever that might be.

- If you don’t spend much. You still enjoy cashback regardless of the size of your spending, and the cashback cap doesn’t bother you.

- If you prefer immediate gratification. Your cashback is credited into your credit card each month. On the other hand, miles and rewards cards require months or even years of miles/reward points accumulation before you can redeem something substantial.

Downsides of cashback cards include:

- Minimum monthly spend required (usually $500 – $800)

- There’s a limit to the maximum amount you can earn in cashback each month

- Some cards make this even harder by limiting the cap on categories (e.g. 5% cashback but $20 max per category = you can’t spend more than $400 on dining out each month)

- They’re a lot harder to track and manage, because the banks don’t give you visibility in-app on how much you’ve spent per eligible category this month so far. You have to manually track it yourself.

Who should get miles cards?

Miles cards are easier to manage, since you can optimise by simply using specific high (4 mpd) specialised cards for each category of your expense, and putting everything else on a general (1.2 – 3 mpd) card.

You only need to worry about hitting the maximum spending cap each month, which is easy to track because it’ll show on your bank app.

Who should get a miles card?

- If you want cards with NO MINIMUM SPENDING, then miles are the way to go. At this stage of my life, I hate having to think about “hang on, have I spent enough on my Citi Cash Back this month to get my rebates?!”

- If you prefer to track your total spending rather than per-category spending. e.g. I only need to worry about not exceeding S$1,500 online for my DBS Woman’s World card, instead of having to obsessively track to make sure that I don’t exceed $312 for each of my groceries / food / transport on the 8% cashback Maybank Family & Friends card.

- If you love to travel. There’s nothing like redeeming your hard-earned miles for a ‘free’ flight, especially if you’re travelling on non-budget airlines where paying for the actual ticket can cost you more.

- If you want to experience travelling in luxury. Can’t bear to pay for a business class flight but need to be able to lie flat for your long-haul flights due to your aching bones (or epidural-induced hip pain)? That’s me, but I’ve gotten them for free thanks to my miles.

- If you want free lounge access at airports. Instead of sitting around in crowded waiting areas, unlock premium lounge access with your miles credit cards where you get to eat all you want / free massage chairs / shower rooms / free-flow alcohol, and more!

- If you have big-ticket purchases coming up. While you can definitely get cashback on your big-ticket items if they fall into different categories, it can be less effort to put them on miles cards instead especially if you’re doing a hotel banquet where everything is charged to a single vendor.

Downsides of miles cards

- No instant gratification. Since you need to accumulate sufficient miles in order to exchange for free flights or hotel stays (usually at least 20k miles for a start), this could require several months of spending before you’re eligible for a redemption.

- Poor conversion value on budget airlines. So please don’t make this mistake, you should also redeem your miles on national and international carriers such as Singapore Airlines, Cathay Pacific, Emirates, etc.

- You usually need to hold multiple cards to get optimal miles rewards. If you’re someone who just wants ONE card, a generic miles card will only give you 1+ mpd which means you’ll take forever to qualify for a free redemption. Oh but FYI, the same applies to cashback cards where you also get a miserable 1+% unlimited cashback…so this definitely cuts both ways!

My personal experience

Fast forward to today (a decade later) where I’m now a mother of 2 and CFO of my household. Unfortunately, that also means I can no longer keep my credit card expenses low, since I’m the main person paying (upfront) for the bulk of our family’s expenses, which adds up to a cool $7,000+ every month.

For the first 2 years, I tried to continue my cashback cards game strategy…but failed miserably as the cashback limits kept slapping me across the face.

Eventually, I realized it was time I switched over to Team Airmiles.

Which was why 2 years ago, I made peace with my former online nemesis The Milelion when I told him I finally gave up on cashback cards and was now accumulating miles. The funniest thing is, he thought I was joking – I was not.

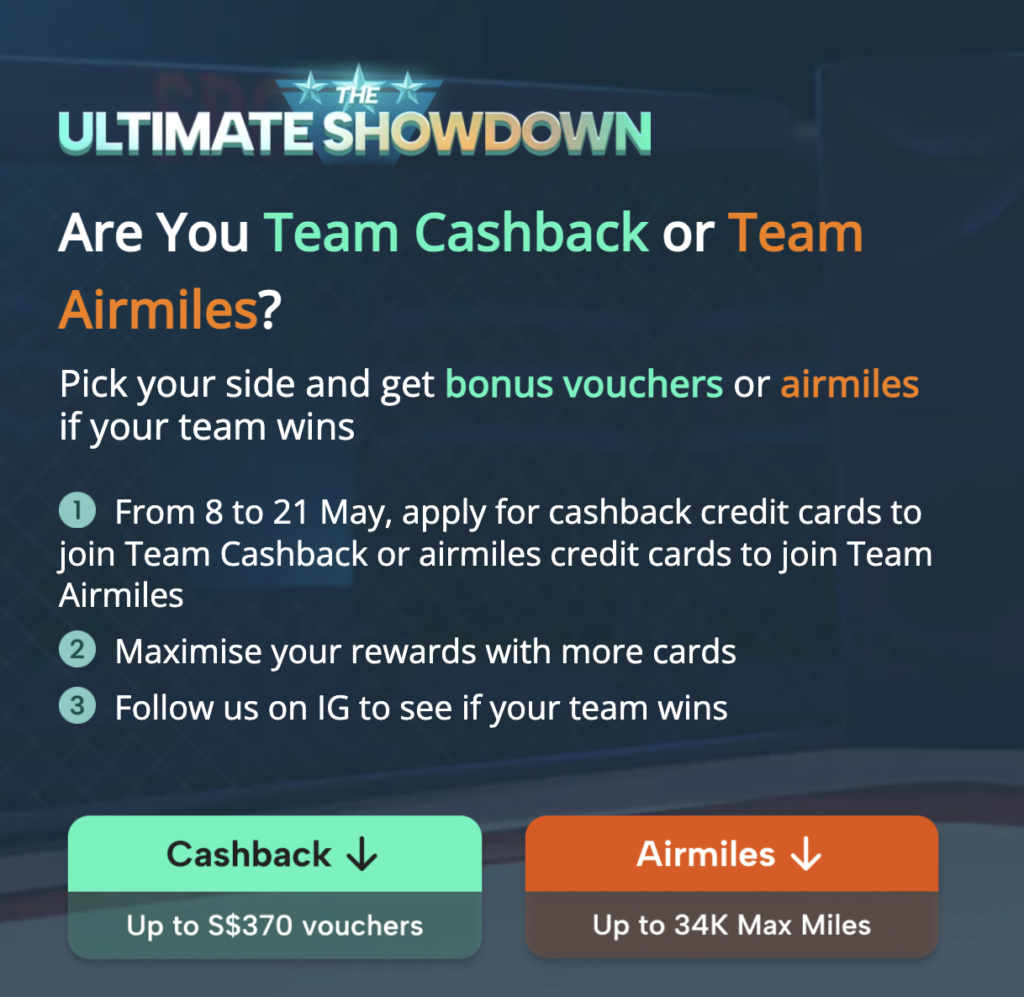

Which is why today, we’re combining forces in SingSaver’s Ultimate Showdown between cashback and miles. This is a nationwide digital campaign to see if Singapore consumers are more towards miles or cashback, which is all the more reason you should participate by getting the best credit card for you this month.

In the meantime, if you’re a parent like me, you might find the below to be similar to your own household spending habits:

Limits of cashback cards

(especially if you’re a parent)

Let’s talk about how cashback cards reallllly hold you back when your expenses are easily 4 to 5 digits a month.

For instance, the Maybank Family & Friends card can give 8% cashback for your groceries, food, transport, telco bill, Netflix and even concert tickets (among others) – these typically cover the majority of my spending categories. The only problem? This is capped at S$25 cashback each for 5 categories (S$312 spending), and you can get no more than S$125 in total per calendar month even if you cross the $800 monthly minimum spend. But hey, check out how much my expenses are in these categories:

| Category | Monthly Spend | 8% Cashback |

| Groceries | $600 | $48 (max $25) |

| Food | $800 | $64 (max $25) |

| Transport | $200 | $16 |

| Telco & Internet | $70 | $6 |

| Netflix | $19.98 | $2 |

| Total | $1,690 spent | $74 cashback (instead of $136 so = $62 “lost”!) |

I could, of course, shift my groceries over to my UOB One card to try for up to 10% cashback to combine with my online shopping, since the card gives the highest rebates only when we spend $2,000 a month on it. But here’s the problem – we shop more frequently on FairPrice rather than Cold Storage! The cashback is also given out quarterly, and is capped at $50 / $100 / $200 (for $500 / $1k / $2k monthly spend respectively). I’m not the only one who has been having trouble managing this card after all the bank changes (check out this Reddit thread), and the only reason why I’m still keeping it in my wardrobe (where it doesn’t see the light of day anymore) is because we still have some cash in our high-yield UOB One savings account.

Otherwise, I could also keep my groceries on Maybank and shift my dining over to the UOB EVOL card for 8% when I pay via mobile contactless, but with the cashback capped at $20 per category and requiring $600 minimum spend on the card per month, that means I’m limited to $250 for online shopping and dining respectively each month, and having to find a way to spend at least $100 elsewhere every, single month somehow.

If all of that talk is already giving you a headache, just imagine the frustration I faced in actually executing it. After tracking for a few months and receiving paltry cashback, I was close to giving up.

The final kicker came when I realized there was almost no way for me to earn decent cashback on my income taxes, family insurance premiums and children’s education fees ever since many of the banks nerfed the cashback benefits on CardUp. This leaves just Bank of China Family and Maybank Platinum Visa as the last remaining contenders (but capped at $2,400 spend monthly i.e. $28.8k a year). And guess what? Last year alone, these 3 categories already added up to a cool $75,000 for us.

No matter how I worked within my arsenal of cashback cards, the capped category cashback limits ($250 – $300) per month made it almost impossible for me to match every dollar to at least some form of acceptable cashback yield.

So after trying for a year, I finally gave up and switched over to miles credit cards instead.

The moment I switched to Team Miles, my financial life suddenly became a lot less stressful! I was finally freed from the silly category spending caps that are a mainstay in most cashback cards, and only needed to watch:

(i) which categories,+

(ii) the maximum spend

that I put on each miles card every month.

No kidding, take a look at how these the categories and max monthly spend looks like on these 4 mpd cards:

Is it any wonder why I switched?! In fact, I should have done it sooner – from as early as 2018 once I became a parent.

Earn up to 34,000 bonus miles plus gifts when you apply for miles cards this month

Now, if you’ve been thinking of applying for any credit card to up your miles game, I suggest you do it from now between 8 May to 4 June 2024 via SingSaver. That’s because not only do you get incredibly generous sign-up rewards, you also get to vote (with your card applications) to determine whether Team Miles or Team Cashback will win.

Many of you ask which cards I personally use and would recommend, so I would suggest that you first get these 3 cards to start earning 4 miles for every dollar across the following categories:

| UOB Lady’s | Dining, Transport (includes petrol and public transport), Beauty, Entertainment, Travel (choose any 2) | max $1,000 spend per month (or $2,000 for Solitaire) |

| HSBC Revolution | Shopping, Ride-hailing, Air Tickets, Cruises | max $1,000 spend per month |

| Citi Rewards | Online (includes subscriptions), Medical, Travel (paired with amaze) | max $1,000 spend per month |

But of course, if you want to truly earn maximum miles by putting even your kids’ education fees, family insurance premiums and income taxes on your credit card, then I would recommend that you read my article here to see the complete miles credit card stack to get.

In the meantime, here’s a quick overview of what I personally use for the below categories (in my capacity as the household CFO) every month:

The best part is that unlike cashback cards, miles cards do not require you to hit a minimum monthly spend before you’re eligible to start earning rewards. That allows you to start earning miles from your very first dollar.

My dear nemesis-turned-ally Milelion insisted that I needed to publicly explain why I had switched sides, so I hope this post helps you to understand why.

TLDR: Budget Babe grew up, had kids and hence spends 4-digits every month for her household and dependents…so cashback cards no longer fit her spending needs.

At the end of the day, the choice between miles vs. cashback cards really comes down to an individual’s lifestyle profile and preferences. I said this same line before in 2017 so nothing has changed…other than my life stage spending habits.

It was nice to have been able to keep my credit card bills below $1,000 a month when I was a young, unmarried female with no kids to be financially responsible for…but hey, we all grow up someday 🙂

Of course, if you’re young and frugal (like I was!), miles cards may not necessarily serve you well because it’ll take a long time before you clock enough for your first free flight; but if you’re a parent paying for more than 1 person’s financial dues (i.e. your kids or the elderly), then cashback cards will only hold you back. Need I even remind you how stressful it can be trying to manage your cashback cards while juggling your job and young kids who don’t always listen?! 🤣

Your choice between a miles and cashback credit card should align with your spending habits and lifestyle. Nothing has changed.

Apply now for the best miles (or cashback) cards for you here + vote with your card applications on SingSaver before June!

You’ll also get up to 34,000 bonus miles plus gifts like Apple iPad, Dyson, Samsonite luggages, among other gifts and lucky draws (which might just see you win a free return Business Class trip to Switzerland)!

Singapore, let’s see whether it’ll be Team Airmiles or Team Cashback to emerge champion when the results are out next month.

With love,

Budget Babe

4 comments

feels like sgbudgetbabe can be renamed to sghighexpenditurebabe

Hi,

Thank you for the simple to read article.

One question remains in my mind.

Is it worth paying bank’s FCY (3.25-3.5%) – Amaze (Mastercard +1%) to earn those extra miles of 1-2 mpd?

UOB Krisflyer is the hidden gem here for large overseas transactions since it is an uncapped 3mpd, albeit with a fairly low $800 requirement spent on SQ. If there is a single overseas transaction of >$2000, then this is the card to go? Is this good for local SGD purchases or for overseas purchases only?

In what scenarios will the amaze + credit card combination not worth out in favour ?

It all boils down to how much you value a mile. If you want to be mathematical about it, you can look at it this way. Which would you rather pay?

Option A – 3.25% fees and get 2.2 mpd

Option B – 1-2% amaze and get 4 mpd (or 3 mpd once busted)

I think it’s quite clear isn’t it? Of course, there will always be folks who prefer paying higher fees and getting less miles…but I’m certainly not one of them lol.

And yes, I would put that $2k overseas transaction on UOB Krisflyer for 3 mpd – provided your $2k is in one of the categories I’ve highlighted! You can also use it in Singapore locally, since KrisFlyer miles are given per S$1 spend on dining, food delivery, online shopping and travel, and transport spend – including for Agoda, Airbnb, Booking, Expedia, Hotels.com, Kaligo, Traveloka, Trip and UOB Travel. So that makes it a pretty good catch-all card.

The amaze + credit card combo doesn’t work out if you’re blur enough (like many people are) to link a DBS Mastercard to it (e.g. DBS WW) thinking you’re earning 4 mpd when DBS has explicitly excluded amaze since 2022.

Amaze + credit card combo may also not work out if you are only using 4 mpd linked cards and you’ve busted the limits. That’s why I said pair it with UOB Krisflyer or UOB PRVI Miles for after your caps have been crossed.

Seth / Kelvin, your joke repeat so many times until old liao leh. Haha. Don’t think anonymous means I dunno who 😛

My expenses still quite ok bah? $1+k for my recent Korea trip for so many things that will last me a year (or more!) vs. my friends who spent $3k – $6k (each). So still living up to my Budget Babe name 😛 I was more excited about the wholesale place rather than hip areas like Soonsu-dong (where I found the same ring I saw at wholesale for 9,000 KRW being sold for 30,000 KRW wow).

Comments are closed.