Disclaimer: My bias towards CardUp is real, especially given how it has been a fail-proof solution for me for the last 8 years. But here’s how the other options to get miles while paying your taxes to IRAS currently stack up anyway, and how you can decide for yourself.

When it comes to paying your income taxes, the default method is for IRAS to deduct these payments via GIRO through your bank account. However, this default method isn’t going to get you miles. So if you have a sizeable tax bill (at least 4 digits) and want to get a significant amount of miles for paying your income taxes, you’d want to be smarter and route it through a third-party payment processor.

You can either use an independent service such as CardUp, or a bank payment facility i.e. Citi PayAll, SC EasyBill or UOB Payment Facility. This post compares these options so you can decide what works best for you.

Here’s a bit of history: In the past, there was no way you could earn miles on your income taxes as payments to government institutions were explicitly excluded from earning rewards in the T&Cs of your credit cards. CardUp disrupted that when they launched in 2016 with a MAS license, and allowed Singapore residents to earn miles or cashback on previously-excluded payments for the first time!

As the banks watched CardUp’s popularity and usage grow, some banks decided joined in to offer their own payment processing facility – Citibank, Standard Chartered and UOB. In the beginning, these banks offered promotional rates to entice customers to switch away from CardUp to their own bank payment facility, but over the years, these promotional rates have come down significantly, while standard fee rates and minimum spend requirements have all but gone up.

2025 Comparison

| Cardup | Citi PayAll | SC EasyBill | UOB Payment Facility | |

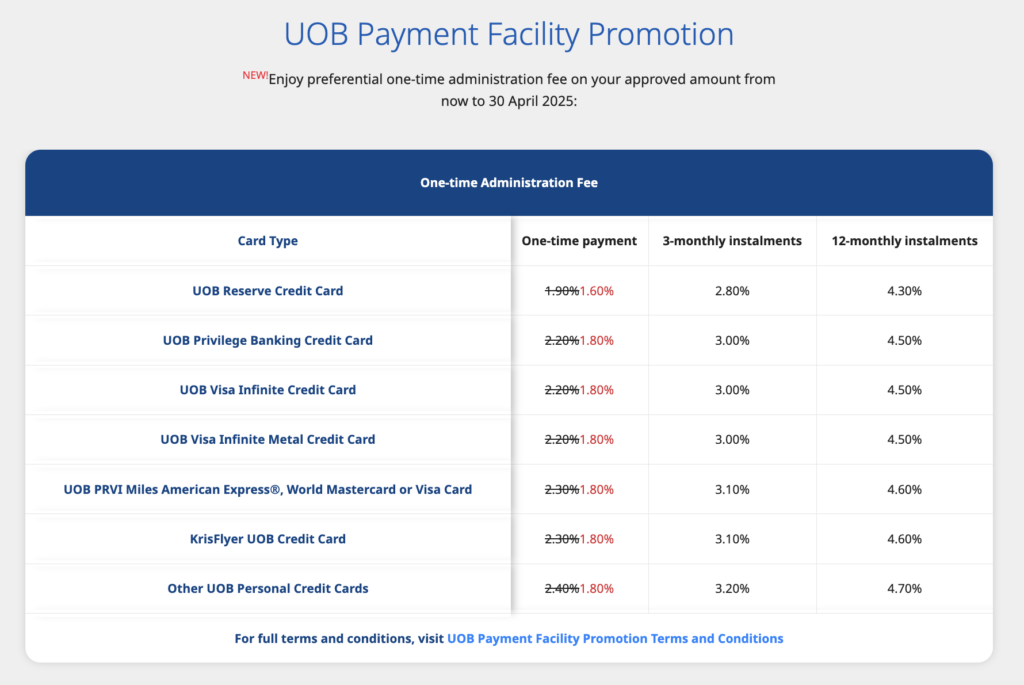

| Admin Fee | 1.73% (OCBC VOYAGE & Premier Visa Infinite Cards) 1.75% (Visa, UnionPay) | 2.6% (previously 2.2%) | 1.9% | 1.6% – 4.7% (varies by cards and instalments) 1.8% for non-HNW UOB cardholders |

| Downsides | Promo rates last until Aug 2024. No promo rates for MasterCard or AMEX cards. | Only for limited Citi cards: Citi ULTIMA Card Citi Prestige Card Citi PremierMiles Card Citi Rewards Card. Customers without an existing Citi banking relationship must first spend min. S$6,000 on non-tax payments (at 1.6 mpd) in order to unlock promo rates (2 mpd) for tax payments. | No option for recurring payments i.e. you have to pay your entire income tax in full at once. | Earns only 1 mpd with all UOB cards. Promo rates end the earliest i.e. on 30 April 2025. Charges and rewards (mpd) varies between UOB cards (check here). |

As a consumer who has been using CardUp to pay for my income taxes (and more) all this while, I’ve been monitoring this scene for the last 8 years and have noticed that while some of the banks have hopped onto this bandwagon to compete, their promotions and flexibility are still not as great as CardUp’s.

The biggest trade-off with using most of the banks’ payment facility is that they either require you to make your tax payment in full for the lowest processing rates, or limit your rewards to a small handful of credit cards.

UOB Payment Facility

If you’re a UOB cardholder, the only card that gives you lower fees than CardUp’s 1.75% is the UOB Reserve Credit Card, provided that you can pay off your entire income tax bill in full all at once.

Otherwise, if you’re using any other UOB credit cards, then CardUp will be a better choice as you’ll pay lower fees (1.75% vs. 2.3%) and you earn a higher 1.4 mpd rather than just 1 mpd.

What’s more, you should note that any amounts charged to the UOB Payment Facility do not count towards the bank’s minimum spend for redeeming your welcome offers, nor are they generally counted towards the requirements for an annual fee waiver.

UOB Payment Facility is not the cheapest way of buying miles, so if you have a legitimate bill to pay, you could almost certainly earn higher rewards for less through a platform like CardUp.

SC EasyBill

If you’re a Standard Chartered cardholder who can pay off your entire income tax in full all at once and don’t mind paying slightly higher processing fees (1.9%).

However, the earn rates aren’t fantastic:

- StanChart Beyond Card: 1.5 (Standard) to 2mpd (PB/PP)

- StanChart Visa Infinite: 1 to 1.4 mpd (if min. monthly spend of S$2,000 is hit)

- StanChart Journey Card: 1.2 mpd

Other SC cards earn less than 1 mpd, so don’t bother. Considering the best card on this list is also eligible to pair with CardUp at a lower fee (1.75%), I feel it is a no-brainer to use CardUp instead.

Do note that SC EasyBill only supports one-time payment requests, so you cannot use it to pay your monthly instalments for IRAS.

Citi PayAll

There was once a time when Citibank used to run more aggressive promotions to fight for CardUp’s share of the market vs. its own Citi PayAll facility, but these days seem to be over.

Not only have they increased their rates from 2.2% to 2.6% today, they have also limited the rewards to just 4 miles cards: Citi ULTIMA Card (by-invitation only, high net-worth individuals), Citi Prestige Card, Citi PremierMiles and the Card Citi Rewards Card.

Last year, for customers without an existing and active Citi banking relationship, Citi imposed a minimum spend of S$5,000 on non-tax transactions on a single card in order for cardholders before they could get rewarded for income tax payments, but that has since been hiked to $6,000 this year. This is bad news for you guys who are just hoping to pay their taxes and nothing else.

According to The Milelion, a leak suggests that Citi might be bumping up the miles earn rate to 2 mpd on tax payments made 18 April – 31 August 2025. Back in 2022, the promotional rate was 2.5 mpd.

Unlike UOB, Citi PayAll transactions will count towards the qualifying spend required for your welcome offers and card-related benefits.

For HSBC cardholders

If you didn’t already know, HSBC already discontinued its Income Tax Payment Programme a few years ago, and have specifically excludes CardUp payments from earning rewards.

So if you’re a HSBC cardholder, you’d be silly to use your HSBC card to pay your income taxes. Opt for a different card instead.

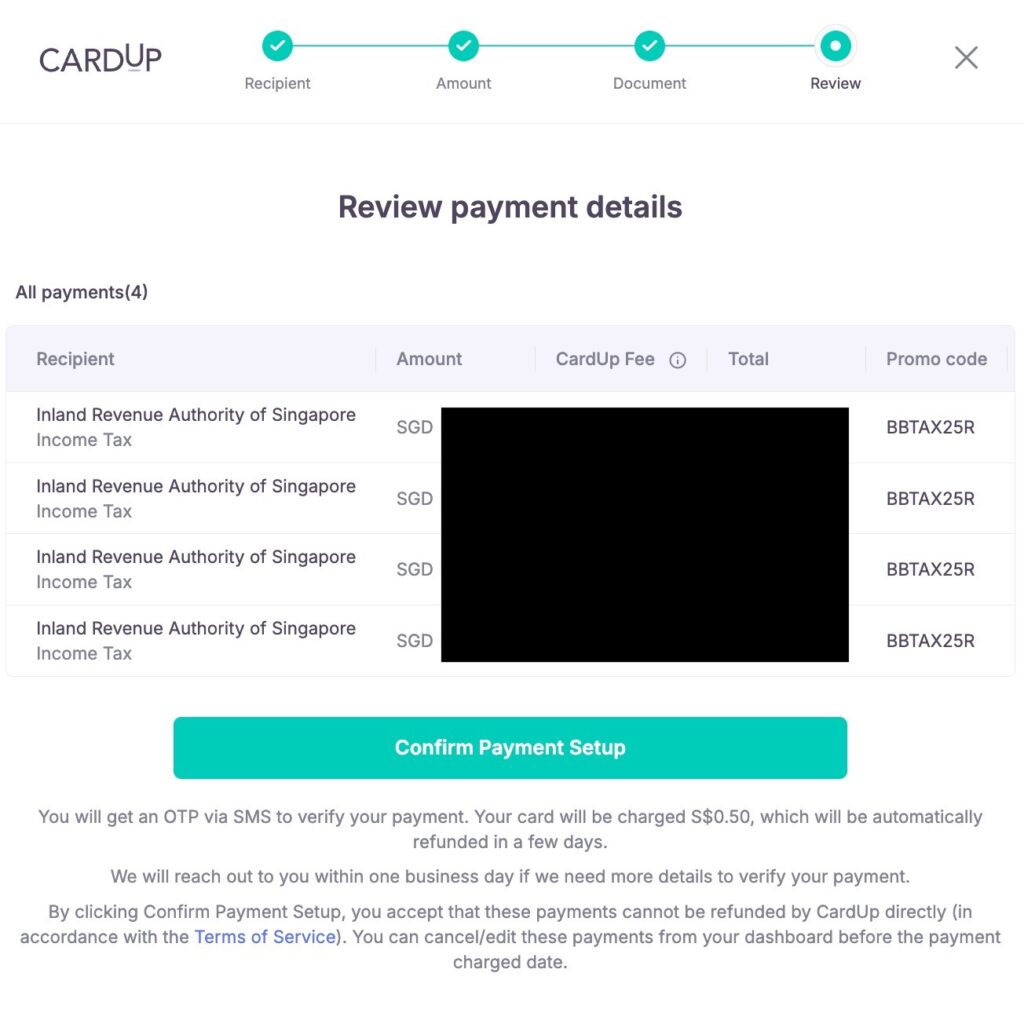

Use CardUp if you need recurring payments

If you’re paying your income tax in monthly instalments, CardUp is the best choice among all of the above options, because you can set up recurring payments every month and still enjoy the promotional rates as long as you’re using a Visa or UnionPay card:

| For monthly instalments | For one-off payments | |

| Promo code | BBTAX25R | VTAX25ONE |

| Fee charge | 1.75% | 1.75% |

| Payment type | One-off and recurring | One-off and recurring |

| Expiry date | Must be scheduled before 31 August 2025. See T&Cs here. | Last payment on 23 May 2025 |

Most of the other options mandate that you pay off your tax bill in a single sitting instead.

TLDR: The best way to earn miles on your income tax payments? CardUp.

If you’re using DBS / OCBC / HSBC / BOC / Standard Chartered / Maybank / UOB cards to pay your income taxes, CardUp is a no-brainer option so you can earn miles.

How to calculate your cost per mile?

A $5,000 tax bill put through CardUp, for instance, can earn 8,000 miles on a 1.6 mpd card at a cost of $87.50 processing fees. That’s equivalent to buying miles at ~1.09 cents each, which is the lowest among all its competitors.

See the eligible cards to pair with CardUp here. It’s a long list – much longer than any of the banks’ payment facilities.

I started with CardUp because they were the first to make it possible for me to earn miles on my income tax payments, but over the years, those of you who monitored the scene like I did would have noticed that while CardUp mostly kept their fees the same (1.75%) throughout the years, the banks have been fickle and gotten less generous over time.

If you have a OCBC VOYAGE or Premier Visa Infinite card, the bank has an ongoing promotion with CardUp at an even lower 1.73% fees. Enter OCBCTAX173 in the promo code.

Citi cardholders with an existing banking relationship might still find the 2 mpd offer compelling (provided that the leak proves to be true), but for the rest of us cardholders, CardUp is a no-brainer option this year in 2025.

See this guide on how to set up your income tax payments with CardUp here.

If you’re wondering why I’ve not included iPayMy in this list, that’s because they’re almost similar to CardUp (which I personally use). Also, the card I use for income tax payments is a UOB card, which specifically excludes iPayMy so I cannot earn rewards and have not been able to use it there.

Which credit card should you use on CardUp?

Personally, I’ve used my UOB PRVI Miles with CardUp since 2017 because it has been earning me a sweet 1.4 mpd throughout all these years. The same card gets me only 1 mpd if I put it through the UOB Payment Facility. However, as the promotional rate for income tax via MasterCard on CardUp this year is much higher at 2.25%, I will be switching to my Visa card for my IRAS payments to get 1.75% instead using the BBTAX25R promo code.

For most of us, 1.4 mpd is the sweet spot with many cards offering that earn rate on CardUp, including but not limited to:

- UOB PRVI Miles

- UOB Visa Infinite Metal

- Standard Chartered Visa Infinite (on local spend >S$2k a month)

Otherwise, the 1.2 mpd category also has the widest range of mass-market cards that can be paired with CardUp:

- Citi PremierMiles

- DBS Altitude

- Maybank Visa Infinite

- UOB Krisflyer

If you’re privileged enough to own a by-invite-only high-end card like the DBS Vantage, DBS Insignia, Citi ULTIMA or UOB Reserve, then you can potentially earn a higher 1.6 mpd on your CardUp payments.

If this is your first time using CardUp, use the code BUDGETBABE to get a discounted 1.79% on your first payment (vs. 2.6% fees).

Or use BBTAX25R to get the lowest 1.75% fees for your income tax payments.

Like this hack? Remember to share it with your loved ones so they can stop shortchanging themselves of miles they could have otherwise earned! 😉

Save on your CardUp payments when you use my affiliate promo codes BBTAX25R (for your income tax) or BUDGETBABE (for every other payment types).

Full Disclosure: The links embedded here in this post are not affiliate links, but simply to make it easier for you to check out more information on the different payment websites. I may earn a small affiliate fee if you are new to CardUp and use my promo code. I earn absolutely nothing if you are already an existing user and use my code - especially if you signed up anytime prior to 2024 (between 2017 to 2024 when I've been actively recommending CardUp, I was not paid any affiliate fees or referral benefits other than the same referral next-fee-payment-waiver which normal consumers got.

With love,

Budget Babe

2 comments

DBS Vantage is not an invite-only card. Just need to hit the minimum income and if you spend $60k+ (even on Cardup), the annual fee is waived.

you’re right, I should have rephrased that better perhaps as cards for higher-income or the more privileged, as it is the other cards in that sentence that are invite-only, but not DBS Vantage.

Comments are closed.