Did you know that the secret to getting approved for a mortgage / personal loan / new credit card really lies in how good your credit score is?

I didn’t know about this when I first started working and was happily applying for new credit cards. But after learning about the Credit Bureau of Singapore (CBS) and what they do, I realised that m

any life opportunities are enabled only when you have a good credit score, because this gives the banks the reassurance that you will not default on your loan if they lend the money to you.Disclaimer: #notsponsored

However, I recently got my credit report from CBS for free, thanks to SingSaver as they’re currently giving away free credit reports as part of a campaign to help Singaporeans understand their financial health better. The report not only showed me my current score, but even reminded me of a credit card that I had almost completely forgotten about (I had applied for it with my mother over 4 years ago and have barely used it since).

Here’s the breakdown:

Oh no! What if my credit score is less than AA?

I’ll reserve this topic for another day but if you’re interested, SingSaver has invited me as a guest speaker for their upcoming workshop and you can join me by signing up on this link.

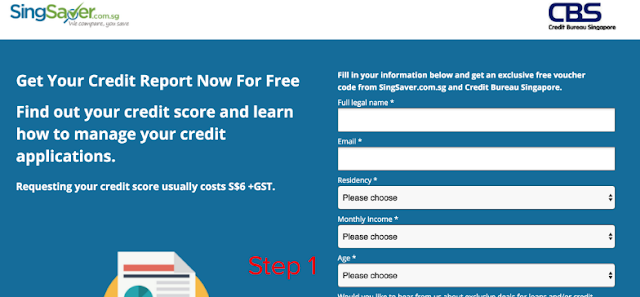

From now until 31 December 2016, SingSaver.com.sg is giving away free credit reports so that consumers can understand the state of their financial health better. You can register on their website here. They’ll then send you a unique code together with a personalised link directly to Credit Bureau’s website to redeem your free report.

In case you’re confused about the figures on your credit report, you can join me at the upcoming FREE workshop held at the Credit Bureau to learn about how to read your report, how to sustain good credit reports and other tips.

They’ll be running 2 workshops this year, but I’ll only be joining them for the 20 December one so do sign up for the correct workshop if you want to meet me 🙂

Disclaimer: I am not paid to write this post or speak at the event, nor do I receive any monetary payments if you click on the link to redeem your free credit reports above. I am also not paid to speak at the guest workshop, so please do not feel afraid to come join me! There’s no selling of any goods or services as much as I know of.

—

We often don’t realise the implications of not clearing our credit card bills on time, or any other actions that unwittingly pulls down our credit score, until we try to take a loan for a car or property. You could be ruining your own chances for future loans without even knowing in.

So join me in December to learn more about how to avoid making such mistakes, or even if you simply just want to meet the person behind Budget Babe!

P.S. There’s only 16 12 7 seats left for the December workshop so do sign up fast!

|

| Still don’t know who’s behind Budget Babe? Try guessing which one is me! |

With love,

Budget Babe

3 comments

neat write-up. That's an eye-watering amount of credit card debt ($46k) in the 50-54 bracket – I wonder why the big jump from the younger brackets?

This comment has been removed by a blog administrator.

I'm also wondering why! I would have thought folks in their 50s would be more financially stable by then and shouldnt be chalking up that much debt.

Comments are closed.