For the uninitiated, Fave has been around since 2017 and offers an opportunity for you to earn both credit card rewards and cashback every time you pay.

But if you didn’t already know, Fave is more than just QR code payments.

I’ve been using this to triple dip my rewards i.e.

- Earn miles on credit card – even for when the merchant doesn’t accept Mastercard or Visa

- Receive instant cashback – to offset my next transaction

- Get additional discounts and savings through Fave Deals, eCards and Gift Cards

Today, I’ll let you in on this hack and share with you the different ways you can use Fave to save and earn more rewards.

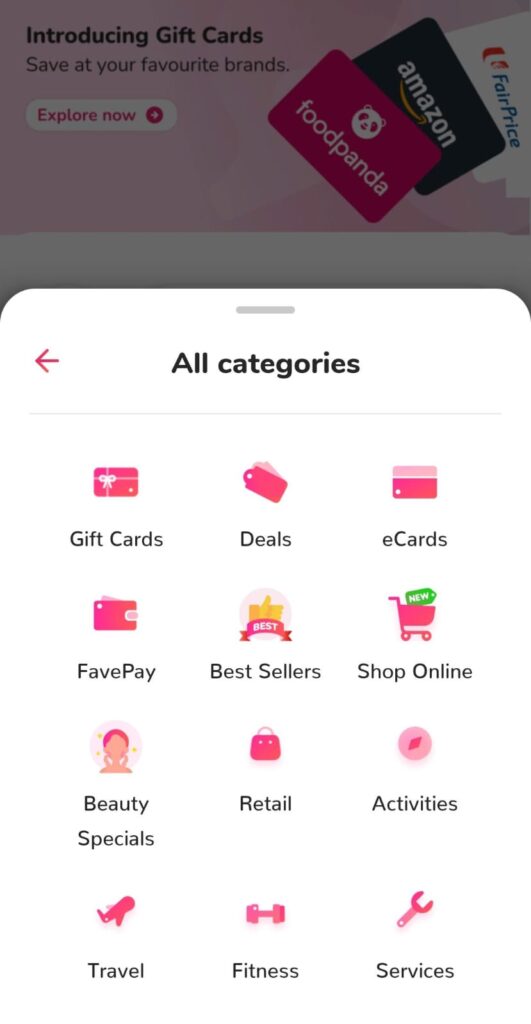

FavePay vs. Deals vs. eCards vs. Gift Cards

The entire Fave ecosystem has grown beyond just QR codes and deals.

Here’s an overview of how you can use Fave today:

- Make in-person QR code payments with FavePay for instant cashback and credit card rewards

- Look for exclusive Fave Deals for online or physical store redemption

- Purchase discounted eCards to reduce your bill

- Buy Fave Gift Cards for yourself or your friends, to be used directly with the respective brand(s)

Here’s how you can make the most out of Fave.

Tip 1: Make QR code payments with FavePay for instant cashback and credit card rewards

Whenever I see people scan the SG QR code to pay for their transaction, I always wonder if they know they can select FavePay instead — as it comes with better benefits.

The SGQR code allows you to use a variety of payment options – DBS PayLah, OCBC, UOB TMRW, Grab, Nets, etc. But not all payment methods will give you credit card rewards, especially since you’re paying via debit, or Grab which counts as an e-wallet top-up (and that’s typically excluded from miles or cashback).

Psst, did you know? If you use DBS PayLah, GooglePay, UOB TMRW or Singtel Dash, you can also get merchant cashback if the merchant accepts Fave! But you will not earn miles that way.

I bet these people probably don’t know that if they pay through Fave instead, they can earn their sweet credit card points. They may not even know the Fave app exists.

That’s because when you link your preferred credit card(s) with FavePay, it allows you to convert an offline spend into an online expense that can concurrently earn your credit card rewards.

Note: Paying through the Fave will code the transaction as an online one, while retaining the underlying merchant category code (MCC). Thus, you can continue to use your favourite category credit card to ensure that you get maximum cashback or miles.

So the next time you see the SGQR code with the Fave logo (refer to image above), use FavePay to make payment instead so that you can earn both instant partner cashback and credit card rewards!

Even better would be the below ideal scenario:

| Partner cashback | Up to 20% |

| Credit card rewards | 4 miles per dollar or 8 – 10% cashback |

That’s because each time you pay with Fave, you also get an instant partner cashback (of up to 20%) which can be utilised to offset future transactions at the same store. If you frequent the merchant fairly often, this should not be a problem for you as most of the partner cashback are valid for 90 days.

Here are some popular FavePay merchants you can start using FavePay with:

- Breadtalk (3% Cashback)

- Gongcha (8% Cashback)

- Jolibee (5% Cashback)

- Sakae Sushi (5% Cashback)

- Nan Yang Dao (3% Cashback)

- Dian Xiao Er (3% Cashback)

- Fei Fei Wanton Noodles (10% Cashback)

- Gain City (1% Cashback)

- Harvey Norman (1% Cashback)

- Marks and Spencer (2% Cashback)

- Poke Theory (5% Cashback)

If you frequent any of the above merchants, you’d want to download the app onto your phone now so you’ll no longer miss out on the cashback (which you should have gotten all this while)!

Get $5 off your first transaction (min. spend: S$15) with the code FAVENEWBB5 (click here) from now until 31 October 2024.

Tip 2: Check out exclusive Fave Deals for online or physical store redemption

Everyone loves lobangs, especially exclusive ones that you can’t find elsewhere.

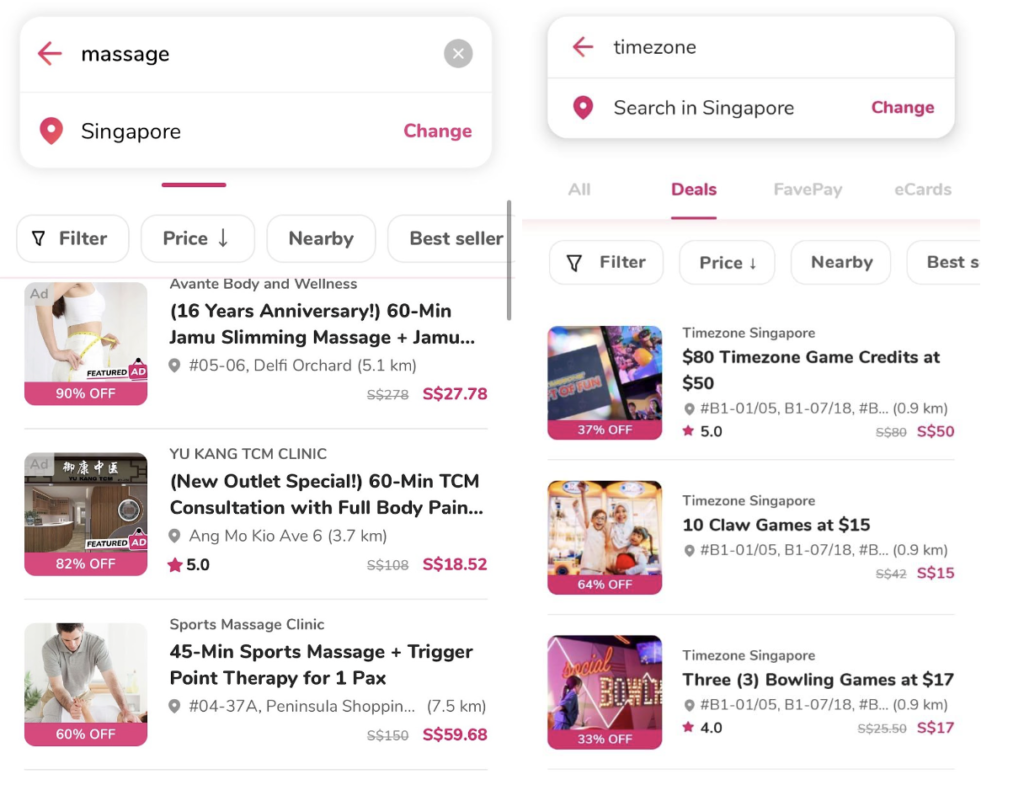

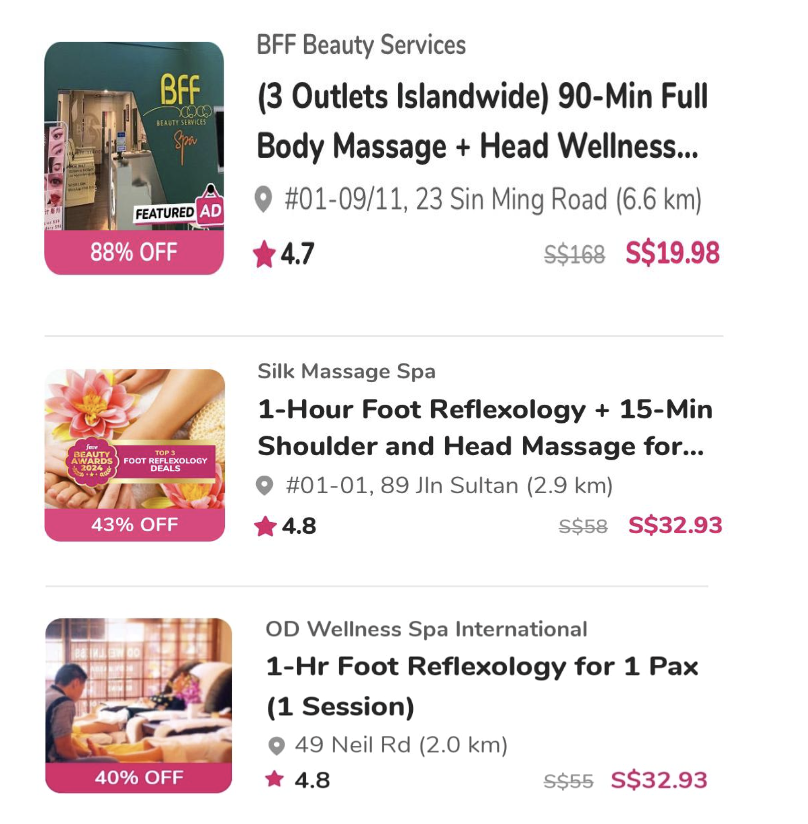

You’ll find that in Fave Deals, which is exclusive to the Fave platform for you to purchase for online or physical store redemptions. This needs a little scrolling (or you can just search for your favourite merchants), but for what it’s worth, you can save up to 90% off on certain deals across food and beverages, beauty and wellness, activities or other retail merchants.

For instance, parents would probably appreciate the Timezone deal, where we get to save $30 and get $80 worth of Timezone credits (enough to keep my kids happy for at least 3 visits). I also spotted deals for beauty and massage services on the app. Since I don’t have a regular massage place or therapist that I frequent, I appreciate these deals that allow me to ease my body aches (sigh, I’m getting old liao) at a trial price.

You can even snag deals such as 1-for-1 drinks at Gong Cha and Coconut Queen, or even a 1-Day Gym and Yoga Pass (2 Pax) going for a steal at just $9!

Tip 3: Purchase discounted eCards to reduce your bill

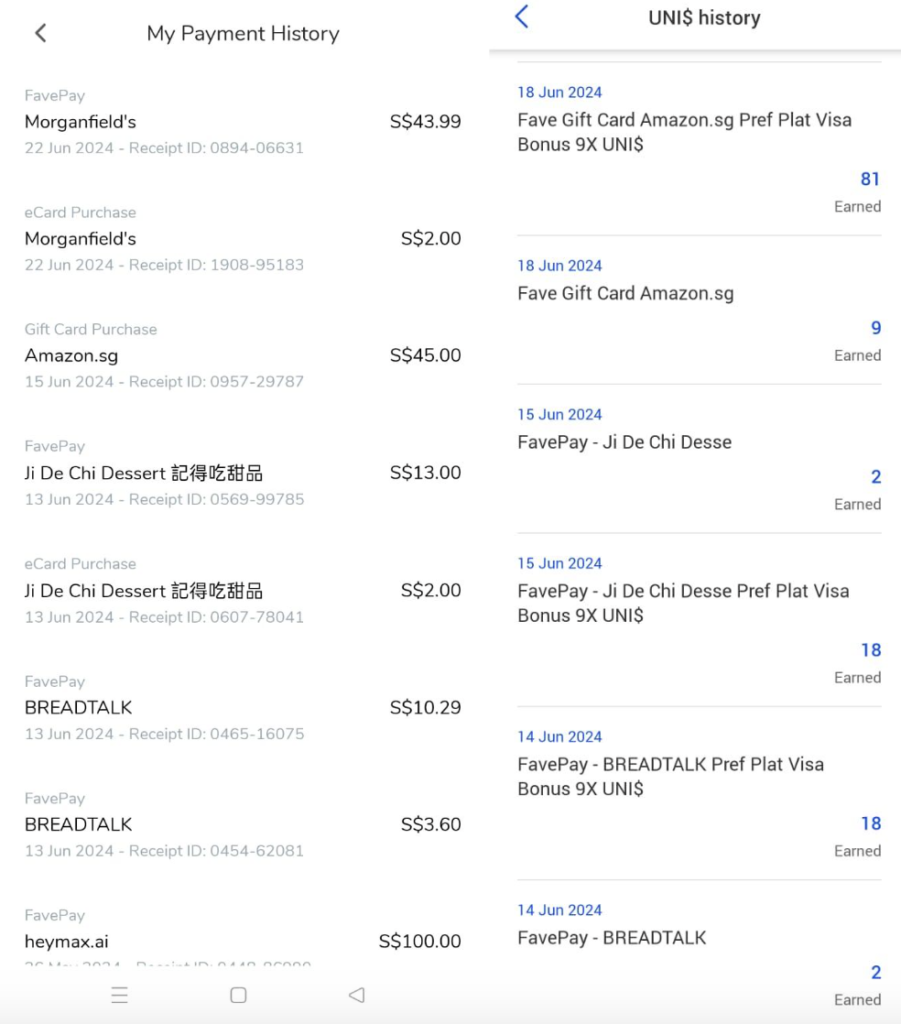

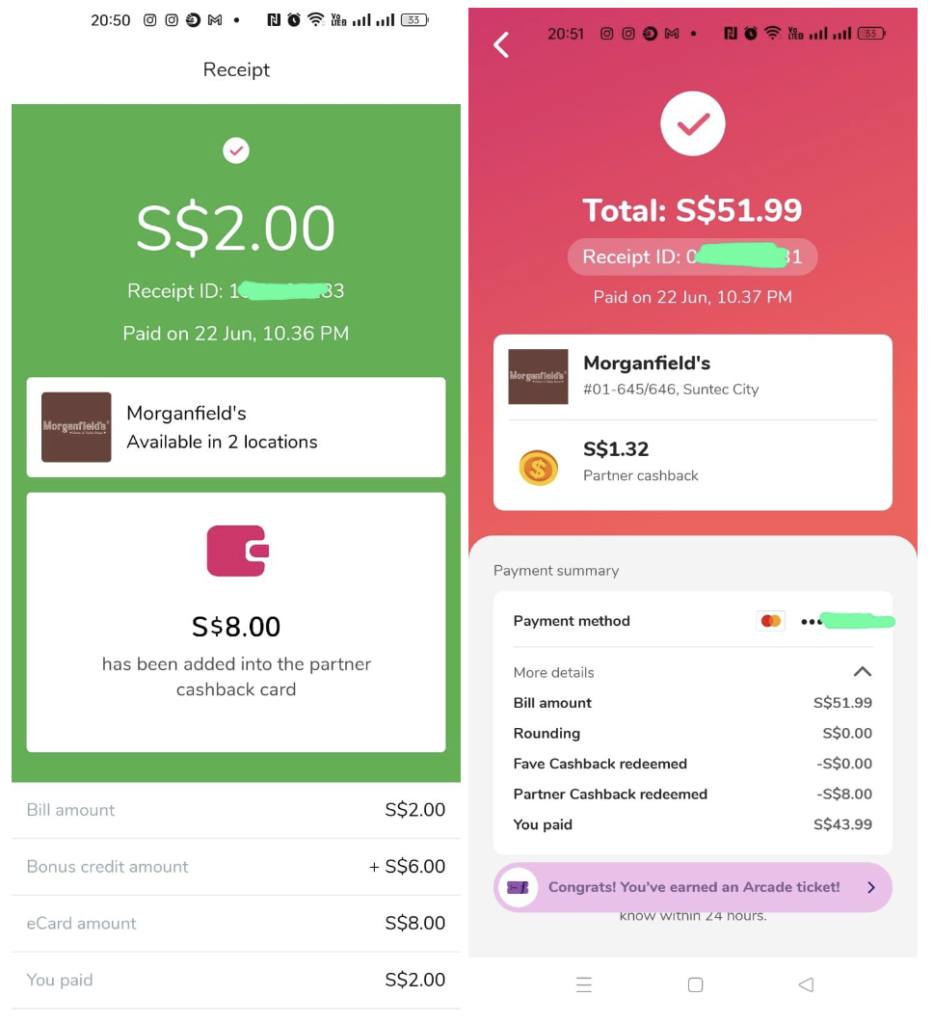

I had a few recent encounters with Fave that showed me the power of these discounted eCards.

The first time it happened was when I was dining at Morganfield’s. I noticed there was an option to pay via FavePay, so I went to scan the QR code and the app immediately prompted me that there was a $2 Morganfield’s eCard for $8 value that I could purchase. This then reduced my bill from $51.99 down to $45.99 i.e. an instant $6 savings for very little effort!

Fave eCards are discounted vouchers available at over 1,400 stores islandwide. These can be used concurrently during your FavePay checkout for maximum savings.

Some popular eCards trending on the app right now include:

- WELCIA-BHG – Pay $95, Get $100

- BHG – Pay $77, Get $88

- Kei Kaisendon – Pay $27, Get $30

- Lovet – Pay $140, Get $150

- Teo Heng KTV Studio – Pay $92, Get $100

Start making it a habit to pay with FavePay whenever you see the QR code, and you might be surprised by the savings you can get!

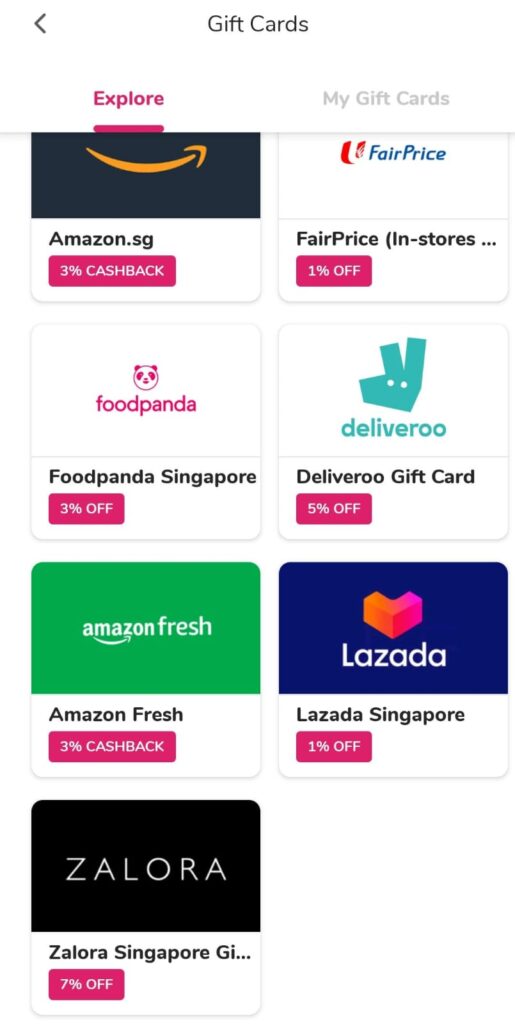

Tip 4: Buy Fave Gift Cards strategically!

If you shop at Amazon Singapore, FairPrice, Foodpanda, Deliveroo, Lazada or Zalora, you might want to start buying gift cards on Fave to offset your spending.

That’s because Fave provides Gift Cards that are often sold at a discount, allowing you to save instantly on everyday expenses with minimal effort. Or, for some brands, Fave awards you with Fave Cashback just from purchasing a Gift Card.

Gift Cards differ from Fave eCards as you do not have to use them through FavePay; instead, you can use them on the merchant’s own website or store!

If you’re as budget-conscious as I am, you may have also noticed that many of these merchants concurrently offer gift cards or vouchers on other platforms such as ShopBack or HeyMax.

So how do you decide where to purchase from?

That really boils down to what you value more.

I’ll use Amazon.sg’s gift card as an example:

| Fave | HeyMax | ShopBack | |

| Savings | No (or up to 10% discounts during certain promo periods) | No | No |

| Cashback | 3% cashback (up to 6% cashback during promo period) | 3-4 Max Miles on Mondays | Yes |

| Credit card rewards | Yes | Yes | Yes |

Miles chasers may prefer to get Amazon gift vouchers off HeyMax, since that gives you more mileage (pun intended). But if you care more about the absolute dollars you’re paying, then buying it through Fave would likely be your top choice.

During double-digit campaigns, you can also expect upsized cashback on Amazon Gift Cards. For instance, I snagged a 10% off Amazon gift card last month and shared about it on my Instagram here.

It all adds up!

From 8 to 11 September 2024, enjoy an exclusive 6% Fave Cashback on purchases of Amazon Fresh or Amazon.sg gift cards by using the code AMAZONFAVESEPDD.

If you didn’t snag that, fret not because from now to 30 September (or while supplies last), you can receive an instant 3% Fave Cashback with the code, AMAZONFAVE.

Psst, I’ve heard from the Fave team that more gift card brands will be added later this month. So, for all your end-of-year shopping, you’ll know just where to go!

What are the best cards to use with Fave?

Ok, now that you know the secrets of how to maximise the app, let’s talk about which cards to use strategically with Fave so that we can earn even more from our credit cards.

As a reminder, Fave converts your offline spending into online ones, but retains the underlying MCC. Hence, the best miles cards to use would be:

| All Fave transactions | Citi Rewards (4 mpd for online) |

| Fave – Dining | UOB Lady’s (4 mpd, Food) UOB PPV (4 mpd for online contactless) Krisflyer UOB (3 mpd) |

| Fave – Department Stores / Retail | OCBC Rewards (6 mpd – until 31 Dec 2024) HSBC Revolution (4 mpd) UOB Lady’s (4 mpd, Fashion) UOB PPV (4 mpd) |

| Fave – Beauty, Wellness & Spas | UOB Lady’s (4 mpd, Beauty) |

Important note: do NOT make the mistake of using your DBS Woman’s World card with Fave, as Fave is excluded by DBS and will not earn you the 4 mpd rate despite it being an online spend!

For you cashback lovers, the best cashback cards to pair with Fave would be:

| Card | Category |

| UOB EVOL (10% cashback) | Online spend |

| HSBC Live+ (8% cashback until 31 Dec 2024) | Dining and shopping |

| DBS Live Fresh (6% cashback) | Shopping |

| UOB Absolute Cashback (1.7% cashback) | All |

| Citi Cashback+ (1.6% cashback) | All |

| Standard Chartered Simply Cash (1.5% cashback) | All |

TLDR: Use Fave to triple dip your rewards

Even as we grapple with inflation and rising cost of living, there are still ways to get more out of your everyday spending when you learn to be strategic about using solutions like Fave.

Now that we’re living in an era where we no longer have to settle for just earning credit card points alone, what’s stopping you from triple dipping your rewards?

Miles + cashback + discounts = that sounds like a good combination to me.

That’s why I’ll be using Fave whenever the opportunity arises.

How about you?

Sponsored Message

If you’ve never used Fave before (or haven’t opened up your app in a long while), here’s a special reader perk that the Fave team is offering to all Budget Babe readers!

Get $5 off your first transaction (min. spend: S$15) with the code FAVENEWBB5 from now until 31 October 2024.

Limited to the first 1,000 BB readers only.

This offer is applicable for both new and existing Fave customers who have yet to transact on the app before.

Grab it here while it lasts!

Disclosure: This article was written in collaboration with Fave, whose team fact-checked to ensure accuracy in all the rewards I’ve written about.

1 comment

Does citi smrt card work with fave?

Comments are closed.