A key part of successful investing lies in being clear about your own risk appetite, and how to manage it in line with your investment decisions. But not only are most people often shy when it comes to talking about money with others, fewer are willing to admit their risk appetite – or even acknowledge that they might not have the risk tolerance that their peers do.

Not to fret, there’s a solution now. Singapore’s first digital advisory tool is not only free to use, but also helps to empower its users and provide personalized investment guidance for everyone (especially if you’re totally clueless on how to make your money work harder for you). With their latest upgrade, you can now also use the DBS NAV Planner to not only find out your risk profile, but also get customized suggestions to help you find your ideal investments. Here’s how.

Investing is a very personal journey, which explains why what works for your friend (or that YouTube guru you follow) may not necessarily work for you.

That is why the process of understanding yourself – including your risk levels, how much loss you’re able to stomach without giving up, and how you generally react to market volatility – will determine the type of tools suitable for you, such as:

- Regular shares savings plans – (see my list here)

- Robo-advisors – such as DBS digiPortfolio which combines human expertise (by portfolio managers) with technology (for scale and efficiency)

- Unit trusts

- Exchange-traded funds (ETFs)

- Equities

But how do you decide what to invest in?

Financial planners or wealth managers can help you with this, but if you’re someone who gets uncomfortable at the thought of being transparent with a financial or wealth planner in person, I get it that it can be hard to open up in real life and talk to someone about the actual state of your finances.

In that case, fully digitalised journeys like this, that can still give you guidance based on your personal data, would help to remove that barrier.

For instance, let’s say you have $10,000 to invest right now, but you don’t feel like disclosing that information to someone in real life.

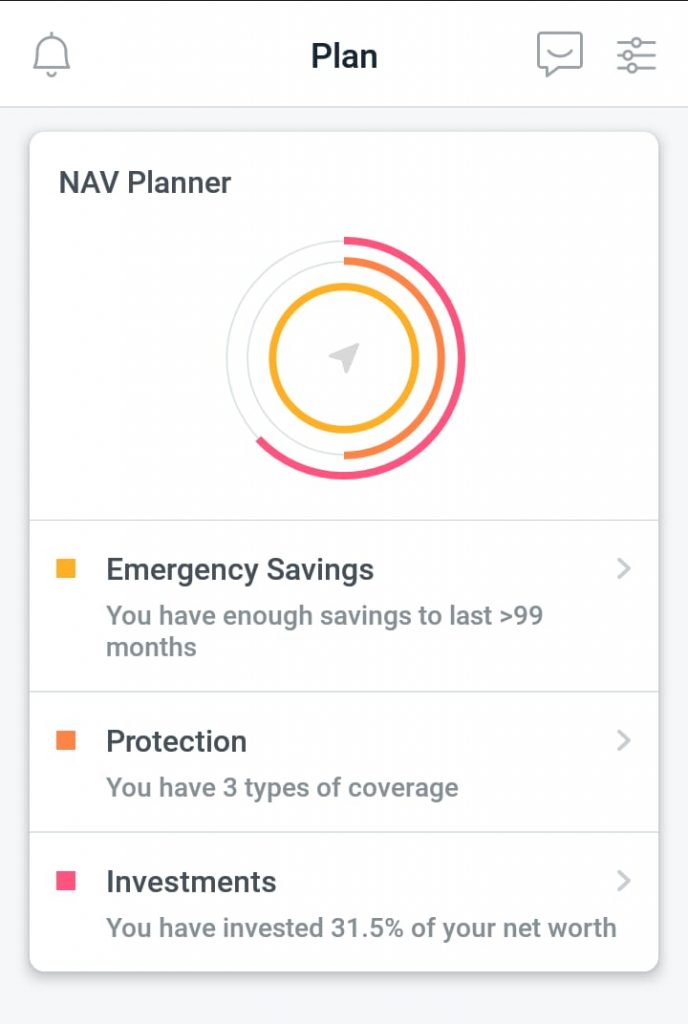

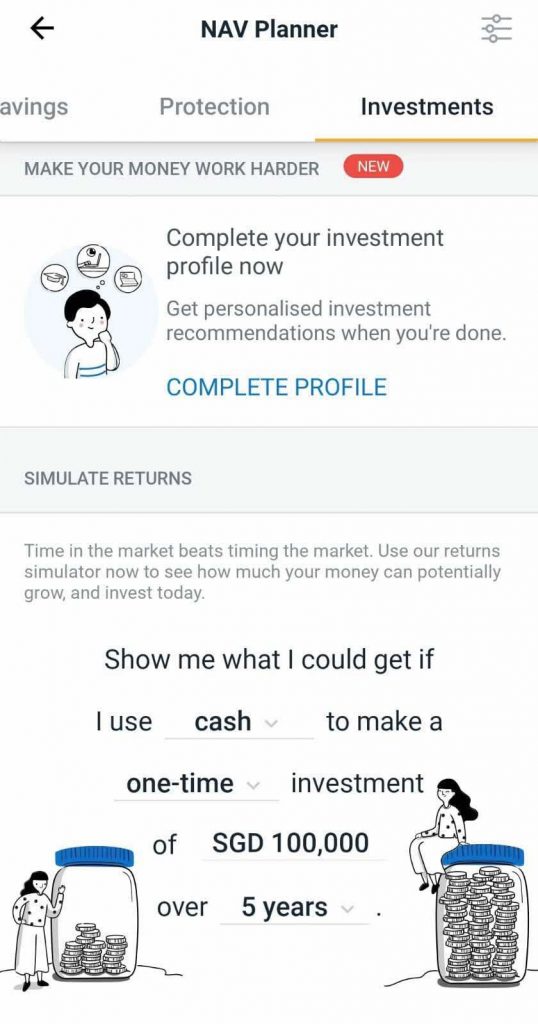

You can also ask DBS NAV Planner the question instead by tapping on “Plan” –> “Investments”:

I was then prompted to complete my profile, which included going through a Risk Profiling Questionnaire and Customer Knowledge Assessment to confirm my personal investment profile and style.

This is where you’ll be asked questions that help you understand your risk profile, investment goals, level of investment knowledge, etc. Pretty much similar to what a wealth manager would also ask you in real life in order to get a sense of where you are now and where you hope to be in the (near) future…except that this is now done via entirely digital means.

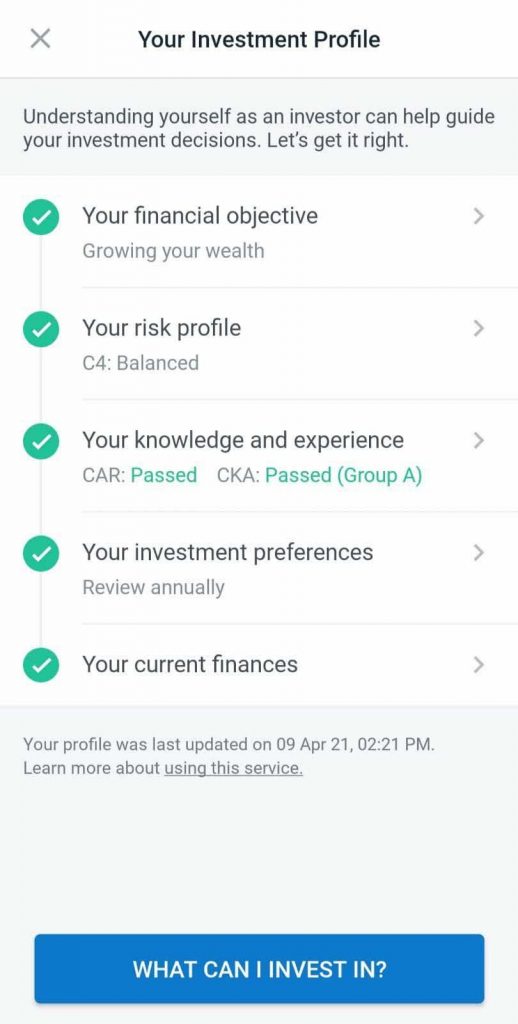

In order to recommend suitable investment products for me, DBS NAV Planner had to first assess my risk level, my investment objective (mine is currently laser-focused on growing my wealth), investment preference (to review my portfolio annually), knowledge level when it comes to investments, and more.

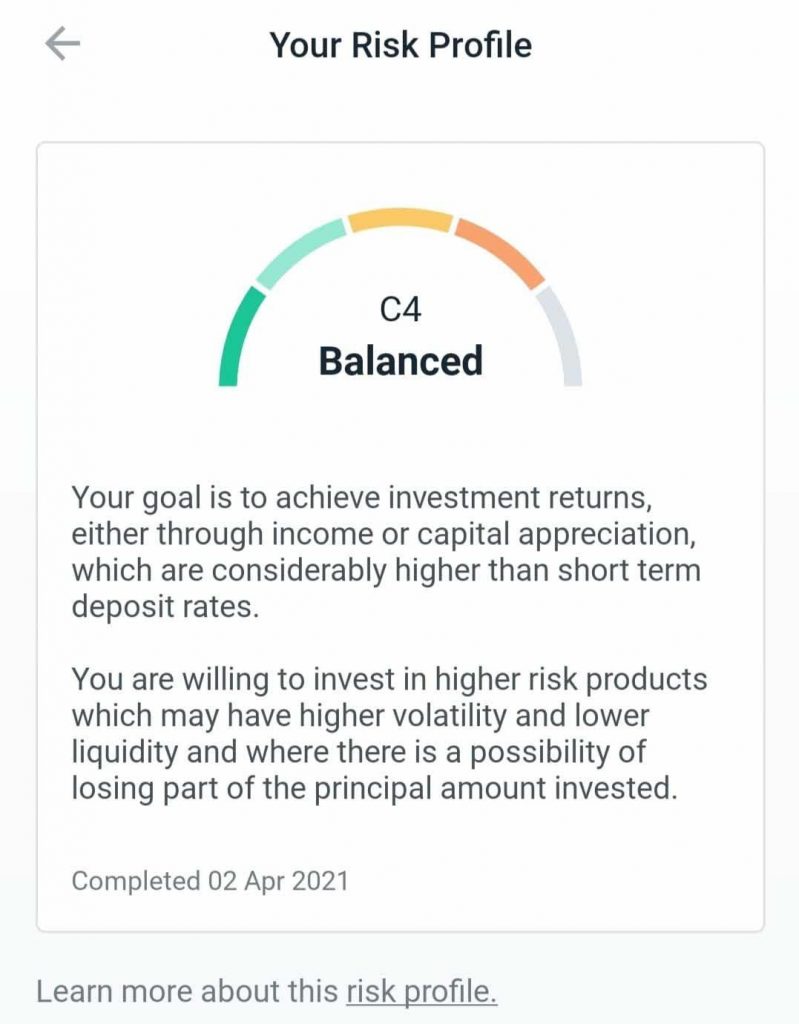

With all of my answers, it then confirmed my risk level as Level 4. Sharp-eyed readers should be able to spot that DBS NAV Planner’s analysis of my risk level is pretty spot on, given that I’ve been talking about how I do NOT believe in using leverage or investment loans due to the risks involved.

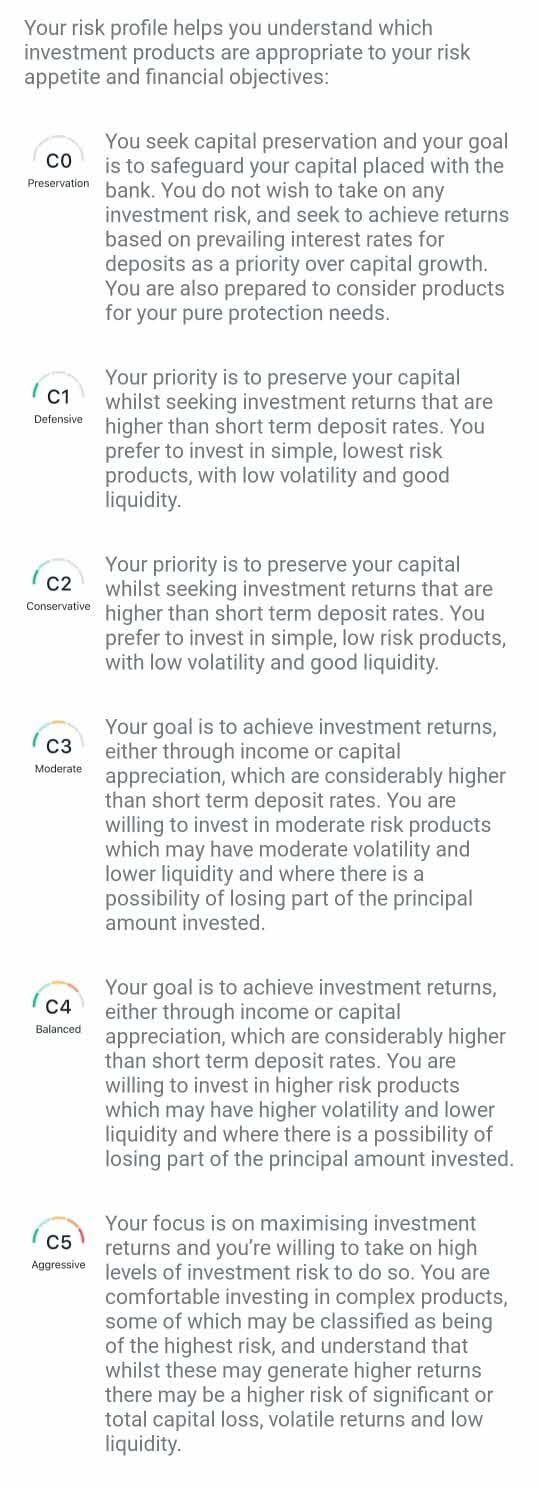

The 5 risk ratings presented:

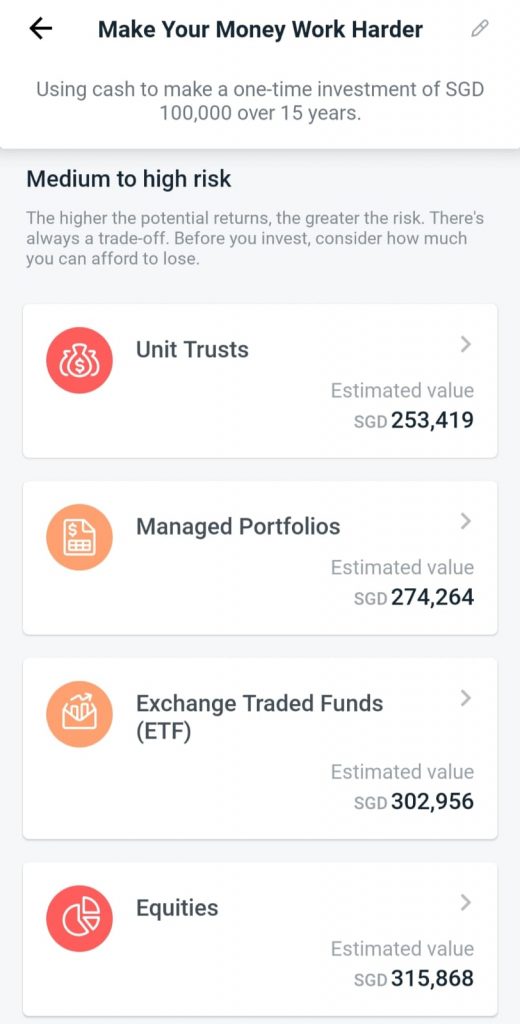

Now, if you’re a low risk-taker and get emotional when you lose money, you should note that investing in products like ETFs and equities could in fact work against you – because you’re likely to run for the hills and liquidate to “cut loss” when the market undergoes a correction or a crash.

On the other hand, if you can stomach market volatility (like me), then the low rates from low-risk products like bonds and endowment plans don’t make much sense either, since you could be getting a lot more bang for your buck.

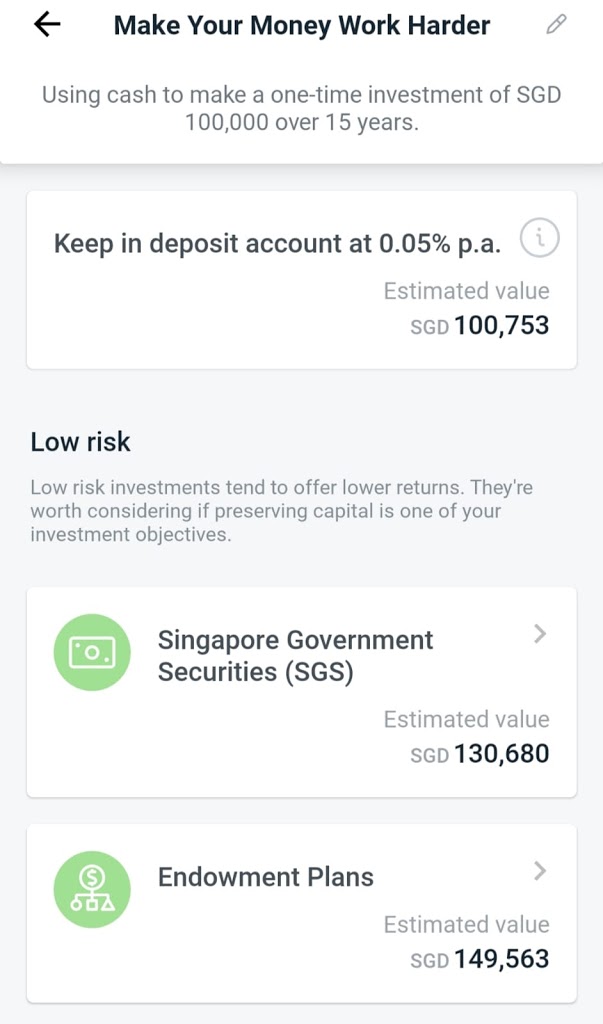

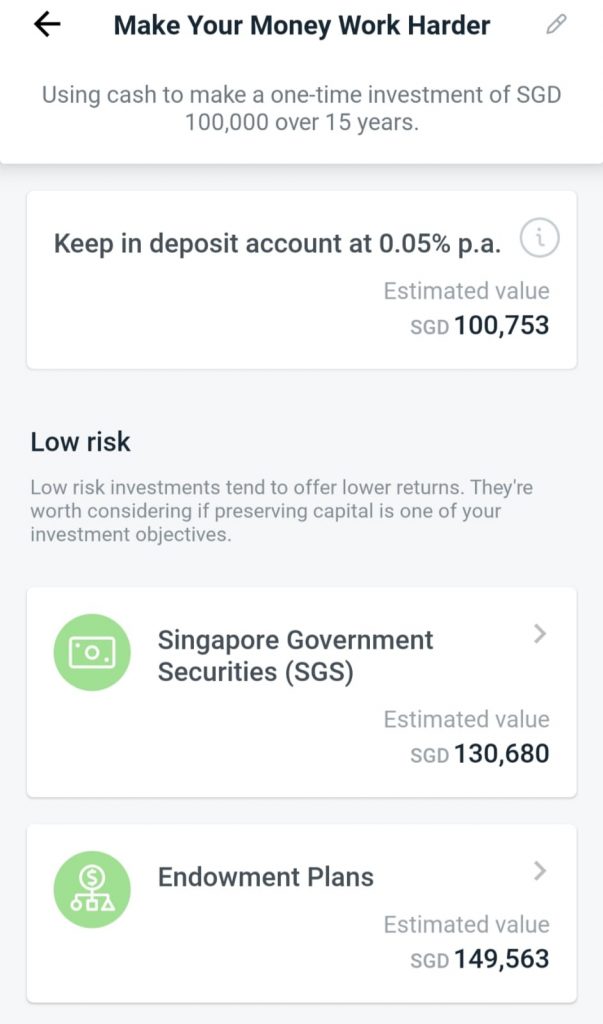

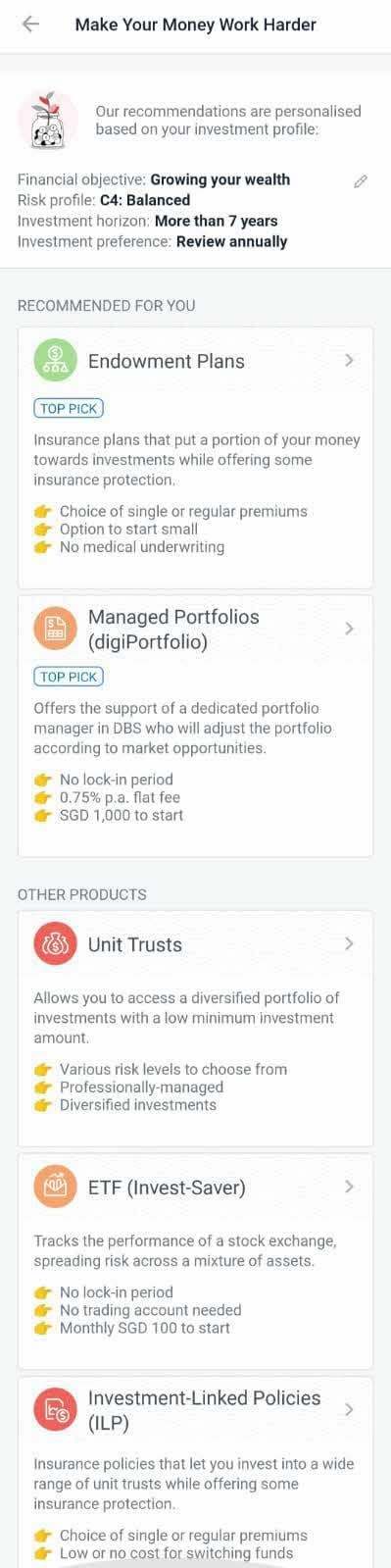

Once DBS NAV Planner knows who you are and what you hope to achieve with your money, it can now show you a variety of different products which you can use to Make Your Money Work Harder. Mine, for instance, looked like this:

Note: if your risk appetite changes later on, you can always edit your risk profile (click on the pencil icon in the image above) to get more relevant solutions recommended for you. For instance, this might happen as you may be more conservative now, but as you get the hang of the markets, your risk tolerance appetite may grow.

If you’ve enabled SGFinDex on your app, the data can also be integrated with your consolidated assets, debts and cashflow across your different banks.

The app will also customize and show you its entire library of funds available which suit your investment profile. Truth be told, I was impressed by the wide range of products available, given that this is on a digital platform rather than in-person with the bank’s wealth planning manager.

For instance, if I were use my CPF or SRS to invest, it showed me some of the recommended funds available based on my profile:

Now, if you’ve ever been through an in-person wealth planning process, this should not look too foreign to you.

So imagine having your own wealth planning manager on your phone, who’ll not only walk you through what investing is all about, but also help to customize and recommend suitable options for you. The best part? The entire journey is fully digital, so you can take your own sweet time to browse through the different product solutions, without feeling pressured to make a decision right there and then.

Should you choose to invest with DBS thereafter, don’t forget that eligible investments can also help you clock up higher interest on your DBS Multiplier account (such as the above lump-sum cash investments into unit trusts).

Remember that it is also equally important for you to review your investments at each different life stage to see what’s working for you and what’s not. With DBS NAV Planner, you can easily track all your finances in one place, including getting an overview of your savings, insurance, investments and tracking your net worth within seconds.

So why not check out DBS NAV Planner‘s Digital Advisory today to learn more about your own investment profile, and see how it can help you find the right investments tied back to your own needs and objectives? Using your own unique data, it’ll be able to make some suggestions which you might find useful for your own wealth-building journey.

Sponsored Message

Start investing today with confidence using your DBS NAV Planner. DBS has not only built Singapore’s first digital advisory tool, but also put the widest range of products available on a digital platform here. Download the DBS NAV Planner now and take control of your own finances.

Disclosure: This post is written in collaboration with DBS. All opinions are that of my own.

This advertisement has not been reviewed by the Monetary Authority of Singapore.