Bad news for the cashback folks – several cashback cards have changed their terms in the last few months, and what used to be attractive is barely so anymore.

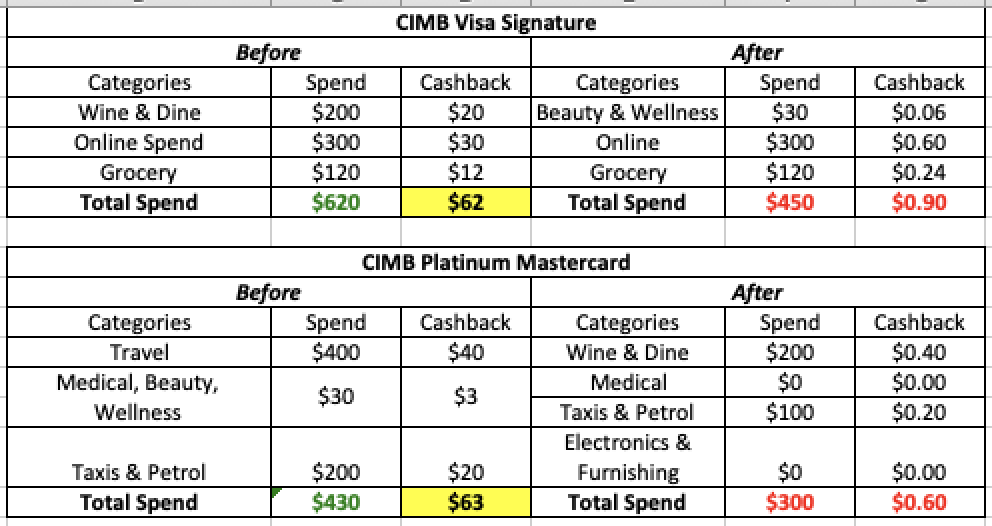

Yes, I’m referring to the OCBC 365 card, CIMB Visa Signature and CIMB Platinum Mastercard. I’ve written about the first change before last year (read it here), so I’ll zoom into what CIMB has done recently, and why their cards have gone from stuff I was actively recommending to something I’m gonna ditch now.

Notable changes in the respective cards T&Cs come 5 June 2019:

- CIMB Visa Signature

- Definition of “Online shopping” has been furthered narrowed to merchants whose main business activity involves selling clothes, accessories, shoes, bags and electronics.

- Movie tickets and F&B orders no longer included

- Shifted categories

- “Cruises” was previously lumped together under “travel” in their Platinum Mastercard

- “Beauty and wellness” was previously lumped together with “Health” in the other card

- Definition of “Online shopping” has been furthered narrowed to merchants whose main business activity involves selling clothes, accessories, shoes, bags and electronics.

- CIMB Platinum Mastercard

- Definition of “Transport and Petrol” now specifically excludes GrabPay top-ups

- Definition of “Travel” now specifically excludes cruises

- Introduction of 2 new categories i.e. “Electronics & Furnishing” and “Foreign Spend”

- Shifted categories

- “Wine & Dine” used to be under Visa Signature

None of the cards now give you 10% for booking of flights and hotels, as it seems like CIMB has almost eliminated that category completely.

The minimum spend for BOTH cards has been raised from $600 to $800 (following the footsteps of OCBC 365 perhaps?). Now, this is a biggggggg problem for folks like me because as you can see from my expense table above, I can no longer hit the minimum on either cards and my cashback rate drops from 10% to 0.2%.

Houston, we’ve got a problem.

Looks like I’ll be retiring these two cards and as a result, it’s time for a review of our cashback credit cards strategy.

Some other key changes I’ve made recently include:

- I’ve retired my Citi SMRT Platinum Visa card because the 2% no longer makes sense now that we have SimplyGo (read this PSA to learn about SimplyGo and why it’s the best thing ever for us folks on public transport)

- I’ve semi-retired my OCBC 365 card because with their latest revision, I can no longer hit the minimum $800 monthly spend consistently. Previously I used it most for its 6% on dining, but now with a new card offering 10%, I’ve switched loyalties.

- I’ve been largely varying between my CIMB Visa Signature + CIMB Platinum Mastercard, but this will become a thing of the past come 5 June 2019.

I’ll be reviewing some other cards that I think look interesting for now.

Get 5% cashback across major categories, min. $500 monthly.

Unlike CIMB, Maybank recently improved their card by increasing their max. cashback cap from $50 to $80 (w.e.f. 1 May 2019) and this card doesn’t limit you to per category spending either!

This means that you can get 5% cashback if you spend on any of the following with a minimum of $500 monthly:

- Groceries: Cold Storage / NTUC

- Transport: Bus and trains (via ABT), taxis, Grab

- Personal care and health: Unity, Guardian, Watsons

- Children: POPULAR, Toys R Us

The other plus point would be for drivers who frequently travel between Singapore and Malaysia, especially if you go across the causeway to top up your petrol, because now you can get 5% (or 8%) cashback on that too!

Minimum spend: $500

If you spend >$1000 in a month on this card, your cashback rate gets revised to 8% across these qualifying merchants and categories.

2. DBS Live Fresh

3. Maybank Platinum Visa

Provided you can hit $300 for consecutive quarters (eg. Jan – Mar), you can get 3.3% cashback on your local spend and $3 off movie tickets at Shaw Theatres.Not too shabby at all.

There’s another card in the market that offers you 1.6% with no minimum spend or cap, and that’s the ICBC Chinese Zodiac Credit Card, which also currently gives you 20% cashback on your public transport expenses till 30 June 2019 via SimplyGo. Unfortunately, I hesitate to recommend this card due to the bad feedback on its application process and customer interface. You can search online for those reviews and decide for yourself if it’s worth all that hassle… Between that and Maybank’s, I would opt for the latter.

5. CIMB World Mastercard

Let’s just hope CIMB doesn’t pull another major change on this one to us like they did on the other two cards…

Even if you’re predominantly a cashback person like me, you might still want to add at least one miles card into your wallet for the times where cashback may not be as compelling eg. when the category you’re spending on doesn’t qualify under your cashback rewards.Here are 3 of my favourite picks at the moment:

6. UOB PRVI Miles

This is, without doubt, my favourite miles credit card from UOB thus far.

The general miles earn rate for this card is 1.4 miles per dollar for local spend, so I use it to swipe for all categories of spending that my cashback cards don’t give me bonus cashback on, or in cases where I’ve reached the max. cashback rate on my other cards.

The best part of this card right now is its 7 miles per dollar rate for travel on Agoda and Expedia. Yes, you read that right, that’s 7 mpd! Any seasoned miles hacker worth his salt will tell you that’s a insanely good rate, and not one that’s often seen. The catch? This attractive offer ends 30 June 2019, so you have two months to quickly book your travels and take advantage of this.

6. UOB’s Lady Card

- $30 off a $120 bill at Haidilao Hotpot

- $30 off $140 on Zalora

- UOB One Card: A must-have if you’re on the UOB One savings account and/or you have an upcoming big purchase to fund. Most recommended for couples who wanna get cashback on their wedding expenses. Do a search on my blog to find out more about this card.

- Citi Cash Back Visa: 8% if you drive and dine out (or take Grab) often, provided you can hit $888 a month. Read more here.

- UOB YOLO: If you find that food, entertainment and Grab are your biggest expenses each month, then this card offers you up to 8% for these categories, which is the highest headline rate for this particular (and potent) combination. Read more here.

- Citi Premiermiles: Breakdown in this post. The welcome offer this time is 30,000 miles which can get you an economy ticket to Hong Kong or a business class seat to Bali (+8k more miles – take it from another miles card!) via SIA. Its 2017 welcome gift was better though. Singaporeans love this card for the fact that Citi miles never expire.

| Card | Best for (Profile) |

| CIMB Visa Signature / CIMB Platinum Mastercard | Parents / Those who spend largely on dining, travel, groceries and/or online shopping. |

| Maybank Platinum Visa | Those who can only hit $300 minimum. Gives you 3.3% cashback. |

| UOB One Card | Folks with UOB One account / upcoming big spend eg. wedding couples |

| UOB YOLO Card | Those who Grab, dine and spend on entertainment often (eg. movies / clubs / karaokes). |

| Citi Cash Back Visa Card | Those who drive and dine out often. |

| Maybank Family & Friends Platinum MasterCard | Those who travel between SG and Malaysia frequently (even if it’s just to top up petrol). |

| UOB PRVI Miles | Best for general spending (miles) + If you need to book travels this year |

| Citi PremierMiles Visa Card | If you want free miles that won’t expire, but don’t have the time to enforce a detailed miles-hacking strategy |

| CIMB World Mastercard | Fuss free or big spenders. Unlimited cashback. |

| Maybank FC Barcelona Visa Signature Card |

CIMB Platinum Mastercard (SIA, 10% cashback) + UOB PRVI Miles (Agoda, 7 mpd). Unfortunately, the former offer is no longer valid, so it was good while it lasted.

I always sign up for new credit cards via SingSaver due to the attractive welcome bonuses offered, which are often more than the bank online rewards or even at roadshows.

Not all the cards I’ve shortlisted in this post qualify for a sign-up bonus from SingSaver, but since this article is all about the best credit cards for 2019, I’ve included a comprehensive list of the ones I love and/or already using this year. If you’re applying for any card recommended in this list but which is not part of SingSaver’s current campaign, I will not get a single cent 🙂

6 comments

Yea disappointed by the drastic change by CIMB as an early adopted of their card many years ago. I spent heavily on healthcare especially supplements and medical. Probably will change to MayBank soon.

AFAIK, topup Grabpay from DBS live fresh card no longer entitle 5% cashback.

How about Standard Chartered Unlimited cashback card with 1.5% on all spend (with some caveats) ?

right?! I was so happy when I saw there was finally a cashback card giving 10% for medical / hospital which I could actually achieve based on spending requirements. not a fan of the new changes :((

oh yes you're right! dear me. let me make that correction, thanks man!

I used to love it (maybe I still do), and we still have it! but that was last year before the 1.6% cards came out, so it's not quite right for me to recommend that anymore I feel? even though I get paid affiliate fees for SCB Unlimited if readers sign up through my link, and none for any of the other cashback cards I highlighted as best in this post lol.

Comments are closed.