Getting my free credit report // the average Singaporean owes $378k?!?

Hello Dayre! I didn't manage to post anything for the last few days because dance was keeping me really busy! I had a filming session for a video for the National Arts Council + a dance concert over the weekend alone. Really thankful that all those months of intensive rehearsals have finally come to an end!

The last hurdle is next Monday, where my students will sit for their General Paper A Levels exam, and then I'm finally free! Can't wait!

Anyway SingSaver recently informed me about their free credit report promo that they're running with the Credit Bureau, so kiasu me immediately went to sign up to claim my free report.

Save $6 also happy haha 💁🏻 I'll use that for dinner!

You normally have to pay $6+ to get this report, so since it is free then why not right? #dayresavings Some of you might be familiar with it if your employer has asked you for it, or if you've had to submit it for application of a housing loan. #dayrefinance

I've missed some payments before on my credit cards as I forgot to pay during busy work periods, but thankfully those don't happen too often and my credit score is still a perfect AA!

Disclaimer: NOT BEING PAID TO SAY OR PROMOTE THIS CAMPAIGN OKAY. SingSaver did NOT pay me a single cent; I'm sharing this cos it is really a good opportunity to get our credit report for free.

Initially I was quite skeptical about the promo (is it some kind of scam where they take my personal data from the free report!) but my worries were laid to rest when I saw that you can only get the free report through the Credit Bureau directly and not through SingSaver.

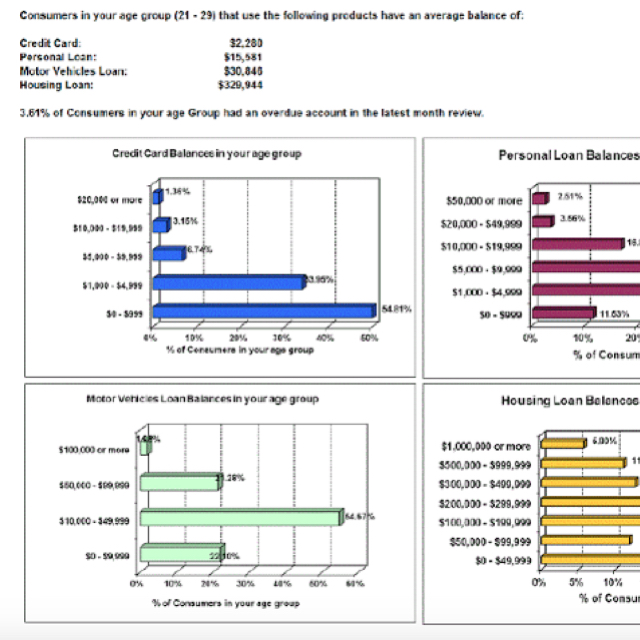

What shocked me most was the amount of debt my generation has!

(I really don't like this square Dayre function…)

The average person in their 20s has a total loan of $378,000?!?

How did we accumulate so much when most of us are still fledging singles?!? Those in their 30s are only slightly higher than us (10k) despite having kids. Still trying to figure that out.

"How come I got rejected for my loan application?!?"

When banks reject you for loans, they don't really tell you the reason except for "not suitable / eligible". What many people don't know is that the banks actually get your credit history from the Credit Bureau and assess your ability to pay them back on time / chances of defaulting on your loan from that report history.

So it is always good to know what your credit report looks like!

You can get your own free credit report directly on the SingSaver website (www.singsaver.com) too!

I was quite intrigued so I met up with some of the team members running SingSaver to learn more about them. Their founder is really nice! We had a blast chatting about my blog and about how I managed my finances while living abroad during my exchange program.

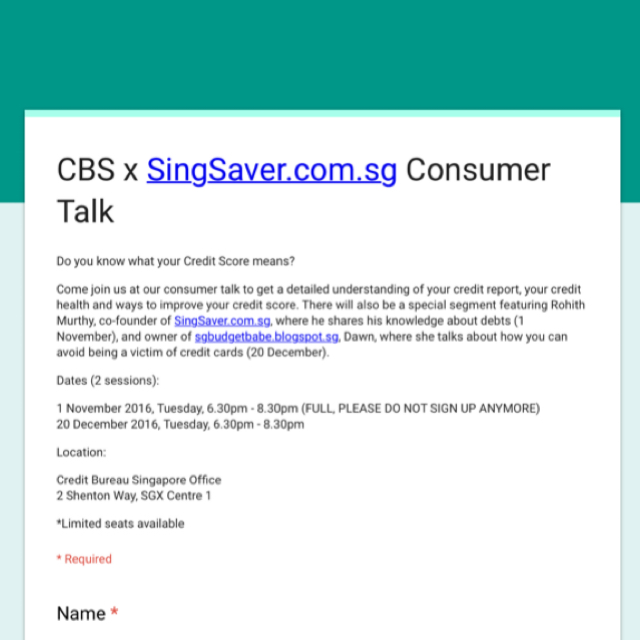

They've invited me to join them as a guest speaker to talk about maximising credit cards benefits while avoiding the usual CC payment traps! (Again, I'm not being paid ok! Very tiring to keep saying this disclaimer lol)

Join me on 20 December Tuesday, 6.30pm at the Credit Bureau to learn more about using credit cards wisely!

I'm quite excited because this will be my first public speaking engagement!

(My last talk at CPF doesn't quite count cos it was a closed-door and by-invitation-only event.)

SingSaver has extended extra tickets so that my readers can attend this free talk too! There'll also be representatives from Credit Bureau there speaking 😊

Omg the folks just updated me that there's only 3 seats left! Hurry hurry!

Go sign up k!

http://bit.ly/2e91fbg

to sign up and reserve your free seat!

Please let me know if you're coming as I'll love to meet you guys in person!