A project that I've been working on since December has finally come to fruition, and I'm super excited to share this with you guys!!!!!!

When I was working on the Cashback Guidebook and reviewing all the different cashback credit cards in December, I also concurrently spoke on a panel on how to maximise cashback returns from our credit cards.

One of the questions from the audience was how to MANAGE them, especially given there are different credit cards which give varying cashback rates across different categories.

For instance,

💳 OCBC 365 gives 6% on weekend dining, but this falls to 3% if you swipe for the same dining places on weekdays

💳 Citi Cashback, on the other hand, gives 8% for dining all days of the week.

But if you're topping up for petrol, you'll be better off using your OCBC 365 card which gives you 23.8% savings, while your Citi Cashback card gives slightly lesser at 20.88%.

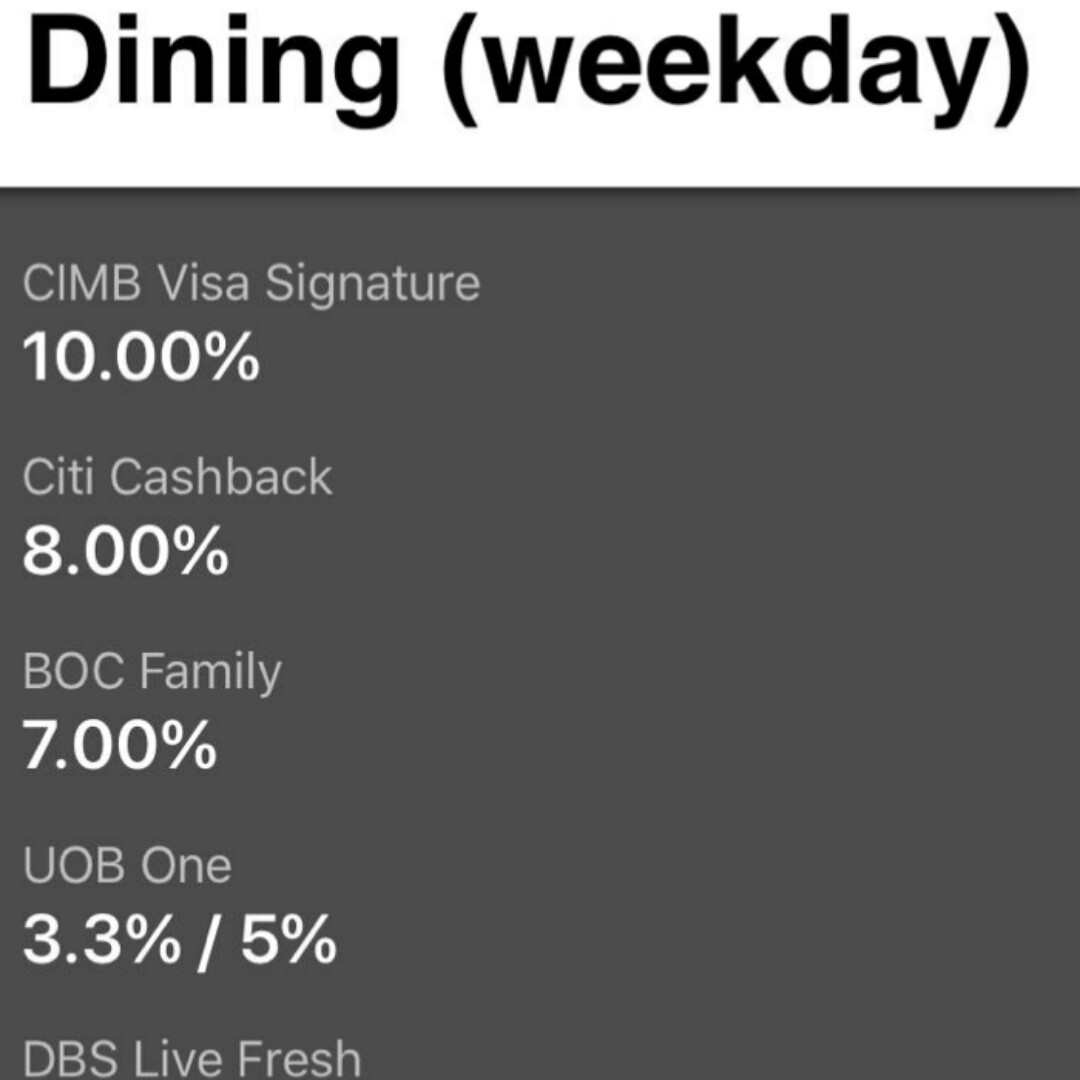

Let's review another combination – DBS Live Fresh and CIMB Visa Signature.

💳 DBS Live Fresh gives 5% for dining and entertainment

whereas

💳 CIMB Visa Signature gives 10% for dining and only 0.2% cashback if you use it for your movies

So there's a very real problem and pain point for consumers who are trying to game the cashback rewards system:

How do we keep track and manage across our different credit cards?

Credit cards have made it extremely difficult and TEDIOUS for us consumers with their various terms and conditions too. It isn't always as simple as a flat % cashback on all your spend – there are cards like the SCB Unlimited Cashback Card which gives you 1.5% across all categories (there's a readers promo on my blog now if any of you are thinking of getting it), but the trade-off for this convenience is a lower cashback rate (remember 10% by CIMB Visa Signature?)

So I got thinking…WHAT IF I could make it easy for consumers like myself?

And then the solution hit me.

A mobile app!

Easily accessible, in your pocket anytime, captures the different categories, allows you to toggle between cards, can be updated when the credit card companies change their rates…

It seemed so obvious to me that I wondered why no one else ever built it.

I tried building the solution myself initially, and got pretty far (all the tabs and pages designed and done!!) before I realised the program I was using hadn't been very transparent about subsequent costs that would be needed after the app goes live. Moreover, the data I had built would be owned by that company (the program) and I didn't think that was right.

So I spoke with an app developer, Elliot Koh, and paid him a sum to build what I had in mind.

I gave him all my materials and the mock-up of the one I built so he'll understand what I envisioned.

After two months of hard work, I'm proud to unveil…

The SGBB Cashback App !

You can find it on the App Store (search for "SGBB Cashback") today for free downloads.

Unfortunately I only had the budget and bandwidth to do an iOS version (the developer I worked with isn't trained in Android) so that means…even I myself can't use this app for now 😅 if any of you knows an Android developer who won't rip me off please let me know!!

But for all of you iPhone users, I hope this helps!

I'm so proud of this baby!!! Really hope you guys like it!!

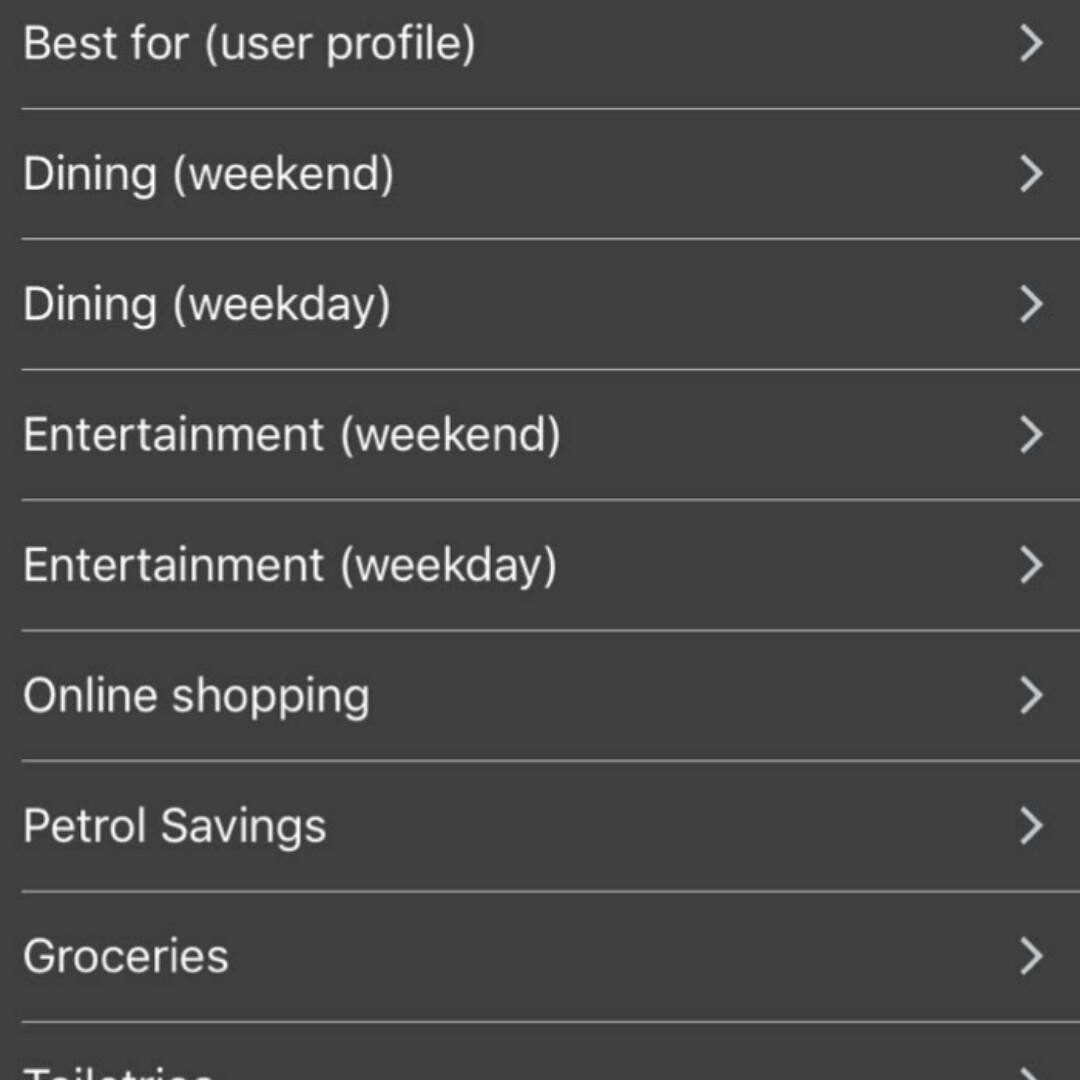

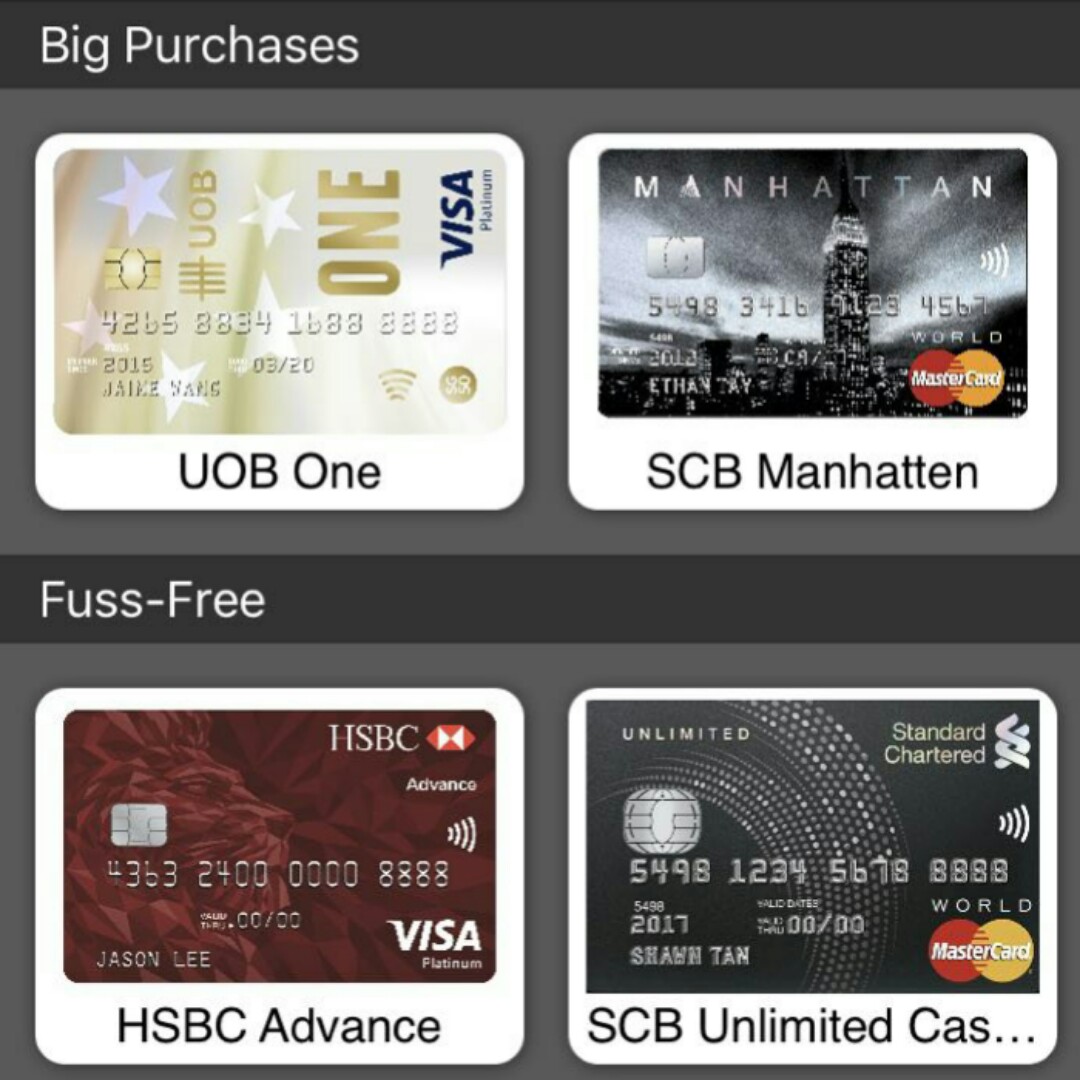

How to make use of the app

You can filter by category to find out the different cashback rates across the different credit cards. For instance, you're out dining at Fish & Co on Sunday and can't remember whether it's better to swipe your OCBC 365 or CIMB Visa Signature. Open the app and click on "Dining (weekend)", and you will immediately be able to compare which one gives you the higher cashback.

The app will show you that it makes more sense to swipe your CIMB Visa Signature 🙂

You can also toggle between the different cards! Say you own three credit cards in your wallet but you're going out with just a clutch so you only want to bring your smaller wallet with just one card.

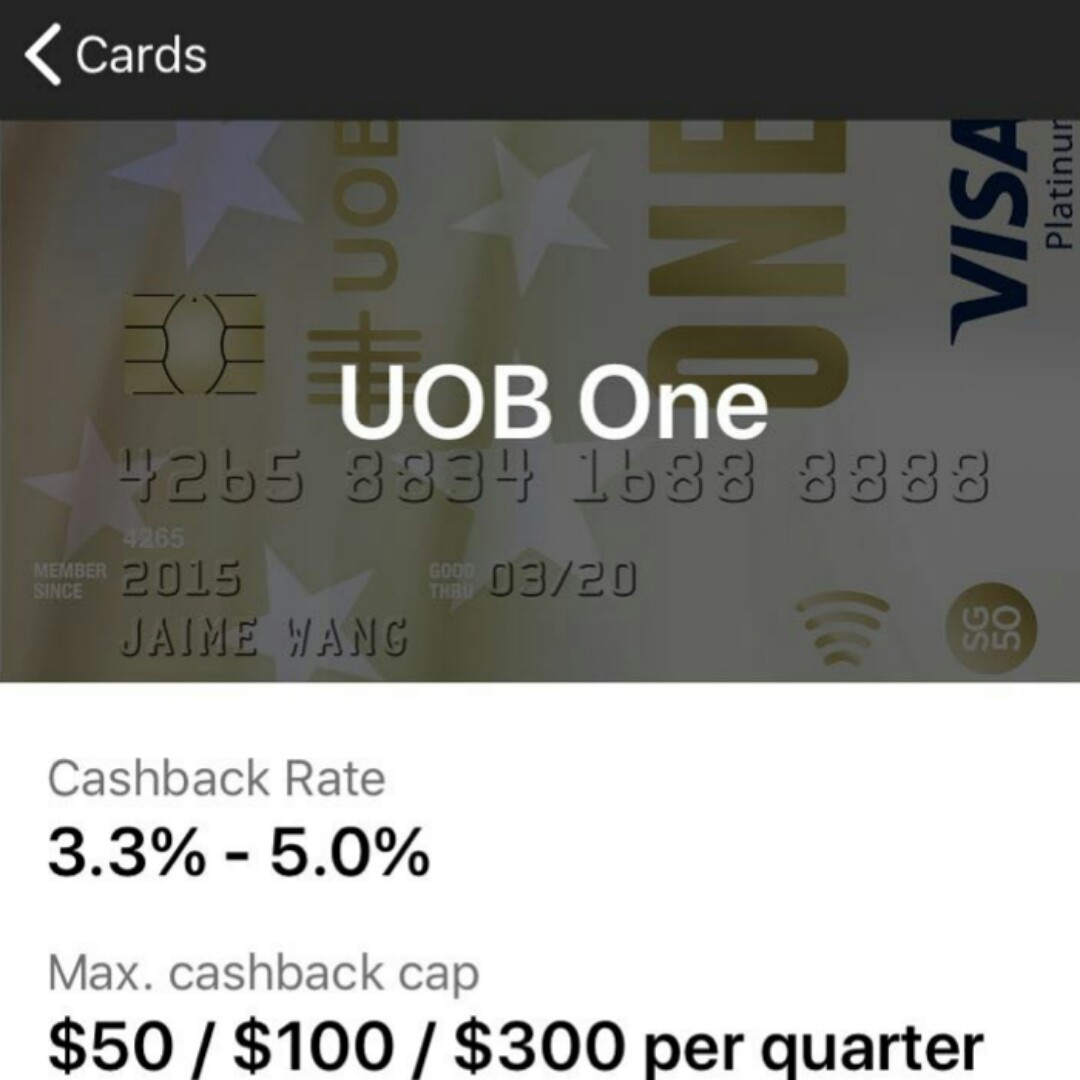

Tap on the card you wish to view.

And you'll be able to see all the benefits of that card across the different categories!

Also, don't worry because there's really no catch to this app (well, except my branding…please visit my blog often at www.sgbudgetbabe.com and contribute to my meagre Google Adwords earnings so I can upgrade my cai png and add meat 😂 thanks 😝).

You're not even required to key in your personal data, or what cards you have. You don't even need to create an account to use the app.

There are no ads on the app and it doesn't do annoying things like a pop up to tell you to sign up for this new credit card promo, etc.

Because this is a one-woman effort, if you spot any errors in the app (such as if the cards change their rates, etc) please let me know so I can get the changes made! It is hard for me to keep track of all the cards otherwise (esp if it isn't cards I personally own).

I know cards like SCB SingPost (and more recently even SCB Manhattan) have been discontinued for new sign ups, but I've kept them in the app because there are people I know who are still using the cards now.

So there you go guys, I hope you like this!

I started out wanting to build this for myself (Android), finished 80% of it before running into a major roadblock, and had no luck finding a decent Android mobile app developer. I still hope that eventually I'll be able to launch an Android version, so if any of you can help (or knows someone who can) please let me know!

Not sure if I still have budget leftover to pay an Android developer but yes please send reasonable ones my way 😊

————————————————-

also, on #saveDayre updates : I'll be meeting another investor tomorrow to hopefully finalize their bid for the app! Fingers crossed!