Finally got finished transcribing my interview with Lauren Templeton!

This took me much longer to write because I was so worried about not doing it justice! The number of drafts and cancellations I made…aye.

Hopefully it inspires you as much as she inspired me in real life!

I also added a few tidbits from her talk on stage, for those of you who didn't get to attend the Value Investing Summit over the weekend either because you didn't know of the event…or maybe you thought the tickets were too expensive?

Honestly I may never be able to understand how some people can spend on branded stuff or makeup but say they've no money to invest. But maybe that's just me.

Was invited to Yale-NUS last night to talk to the students about being a female in finance (you should see me when I hang out with fellow finance writers…they always joke that it'll be a sausage party if I don't turn up!). They were all so young! Each aged 17 to 22 as the oldest I think? It made me really happy to see folks starting early to want to take charge of their own personal finance!

One of them said she saw me on Dayre too haha but I forgot to ask for her username so 👋🏻

Some of the questions they asked last night were great for beginners so I thought I'll reproduce some of them here!

Given credit card debts and high interest rates, should we use credit or debit cards?

Choose based on your own financial habits. What's best for me may not be best for someone who doesn't pay off his bills on time, for instance.

Definitely credit cards! I try to go cashless whenever I can because there are tons of benefits for doing so. For instance, I'll usually offer to pay for the bill first when I dine out with my friends, and they'll either pay me back in cash on the spot or do a bank transfer after! The cashback rewards all go to me though 😎 and sometimes we get discounts off our bill for using a certain credit card too!

The key trick is to make sure you transfer money into your spending account so you have enough money to pay off your credit card bills right away at the end of the month. You can either transfer in a lump sum, or in small amounts each time right after a payment swiped on your card.

If you're someone who lacks self-discipline, then maybe debit cards will be better for you as they stop you from spending money that you don't have. The only downside is that you're missing out on CC rewards!

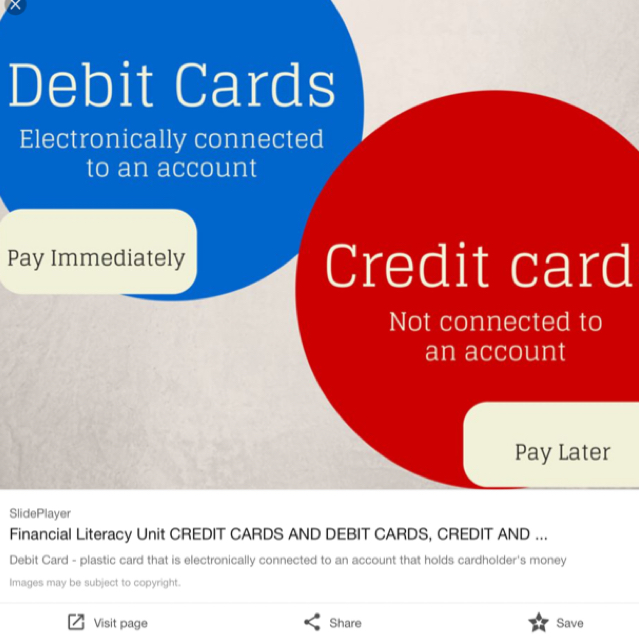

Found this really cute and useful sketch for those of you who aren't familiar with the differences between debit and credit!

What's the best debit card out there?

In Singapore, the best debit card I've found so far is the DBS Visa Debit card, which offers 5% cashback. That's the highest among any other debit cards I know, because they usually don't give much benefits at all.

This is how it looks like!

I did a review on this card not too long ago on my blog, and concluded that it is a pretty good deal for those who aren't as inclined towards using CCs.

The funny thing was how the DBS team emailed me after this post went up. Haha!! 😅 I didn't know them btw. Maybe they weren't expecting a review especially when they didn't pay for any sponsored posts online…other than MRT ads?

Good things must share lah 😂

What's the minimum sum I need to buy stocks?

Ever since SGX revised their lots to 100 stocks per lot (it used to be 1000), investing has become a lot more accessible to the average person on the street.

For instance, if you wanted to buy a small-cap stock that traded at 30 cents, then you just need $30 for 1 lot!!

There are stocks trading at 7 cents even (I think there are cheaper ones too) so please don't tell me things like you've no money to invest k. If you've money to eat at cafes, you certainly have money to buy stocks.

The only thing is that of course, no one in their right mind will pay $30 for 1 lot when your brokerage fee is at least $10 to $25 per trade. It just doesn't really make sense.

And remember that "shopping" on the stock market works the same as shopping in real life – cheap stocks are often cheap for a reason. Few great companies trade at cheap prices on the stock markets.

DBS, for instance, is about $18 today (thanks for the huge profits! But I'm not cashing in yet…). SIA is about $10.

Are miles or cashback rewards on credit cards better?

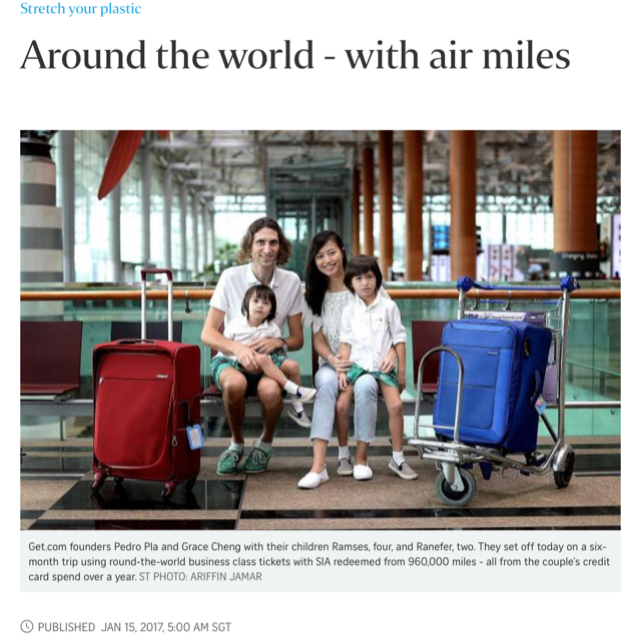

Over the weekend, there was a feature about a couple who managed to clock up close to a million miles on their credit cards which they exchanged to travel around the world for free.

If you love travelling, and would never splurge on non-budget airlines type of tickets, then miles credit cards may be a great option for you. A little travel hacking can help you accumulate lots of miles FAST which gives you free trips to quite a few countries in exchange! However, you'll need to be good at what we term as travel hacking la in order to maximise your miles earned.

(Omg so many campers! If there are stuff I haven't covered yet feel free to let me know in the comments k!)

Note that some miles also have expiry dates so not all of them will allow you to keep accumulating, such as Amex Krisflyer.

If you just want cash back in your pocket to spend on stuff that you want, be it budget air tickets or anything else you desire, then cashback cards are the most practical as you get to choose how you want to spend the money!

Use credit cards linked to high-yield bank accounts to kill two birds with one stone!

If you're on a UOB account, then you should use the UOB One card which has some pretty good cashback rewards AND concurrently gives you a higher interest rate on your bank savings if you hit their minimum spending! Quite achievable.

I reviewed the UOB one savings account in my blog before so you can check that out for more info!

Our wedding photo book is here! Pretty proud of how it turned out! #dayrebrides #budgetbride