This is the high-yield savings account we all need because it grows and evolves with us, so we no longer have to keep switching accounts at different stages of our lives. After a while, the time and energy spent opening/closing accounts and moving funds just for a meagre increment in interest no longer becomes worth it…you’ll be better served using your time to invest and grow your money instead.

When news of the revamped DBS Multiplier account was first announced in 2017, it was one of the best high-yield savings account then for the masses. Fast forward to 2020, and DBS still holds the title for this in my view – a truly impressive feat considering what their other competitors have done since.

For a look back into the history of DBS Multiplier, read my past reviews here (November 2017), here (May 2019) and here (February 2020).

What did they do right, and with almost every bank cutting their interest rates, is the DBS Multiplier still the best – or worth staying on? You bet.

Here’s why.

We’ve had enough of constantly needing to switch accounts.

How many of you can relate to having to switch accounts and move your funds each time your bank announces a change? Those of you who have been #adulting long enough should remember some of the high-yield savings accounts have come and gone, as well as the ones that you used to be able to count on for your high interest…but not anymore.

It isn’t fun when you have to keep switching your salary credit and GIRO arrangements. If you’re still in the same job and managed to pull that off without pissing your HR off, good for you.

After a while, the hassle just isn’t worth it for that interest anymore.

No minimum salary credit = still relevant even if you got retrenched / a pay cut

Having to deal with being retrenched or a pay cut in this economic recession is already hard enough. Being told that you no longer qualify for the bonus interest in your bank account as a result is like having someone slap in your face when you’re already down and out.

Unfortunately, that’s exactly what is happening. Most high-yield savings accounts require a salary credit to qualify for higher interest, and they tend to impose a minimum amount for it – usually $2,000 or $2,500 and up.

Luckily for us, the DBS Multiplier doesn’t require any minimum salary credit. In my case, because my salary credit was already locked up with another bank (and I didn’t want my HR to kill me for changing it again…),I got my husband to credit his salary into our joint POSB eEveryday savings account which allows for both of us to earn bonus interest in our individual DBS Multiplier account 😉

No minimum credit card spend

The other common criteria imposed by many other banks is that you’ll need to spend a minimum amount on your credit cards just to get that higher interest. I’ve already repeated myself like a broken recorder on this blog about how financially UNsavvy it is to be spending more just for the sake of slightly more interest, but today, I want to focus on the need to reduce our expenses in these trying times.

The economic impact of Covid-19 is only just beginning. We don’t know how long more the Fed and global governments can artificially prop up the economy by printing money, nor the implications of all that unlimited quantitative easing (inflation, anyone?).

We’ve already seen large names like GNC, Cirque du Soleil, Dean & Deluca and MUJI file for bankruptcy. The retrenchments at Resorts World Singapore. Pratt & Whitney laid off 20% of its Singapore workforce. Even SIA has announced that job cuts could be in the pipeline with air travel battered by the pandemic and no end in sight.

None of us know who’s next, and in these times, it is prudent to ramp up your emergency savings and reduce your discretionary expenses (non-essentials). Our spending patterns have, and must, change. Naturally, our credit card spending will drop. Some of us may no longer meet the requirements for minimum credit card in other high-yield savings accounts.

Tough. Thankfully, the DBS Multiplier doesn’t have this requirement either. What they do have is:

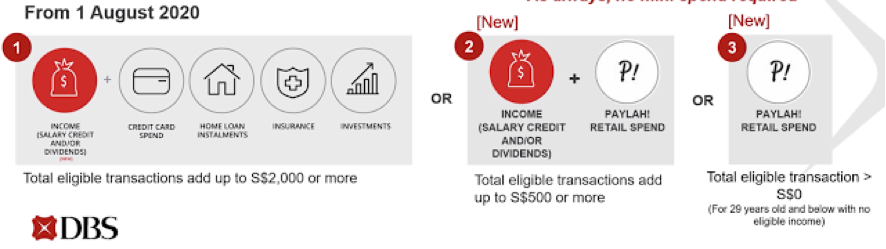

PayLah! retail spend

Our PayLah! retail spend can now count towards our eligible transactions for extra interest on DBS Multiplier. If you’re younger than 29 years old with no income, any dollar spent on PayLah! will qualify. Or, if you meet the Income requirement, your total eligible transactions with PayLah! should add up to $500 or more – this should be relatively easy to hit. For instance, a $400 income from your temporary food delivery gig will mean you just need $100 on PayLah! retail spend to qualify.

Which brings me to my next point,

Suitable for Students & NSFs too

There are very few high-yield savings accounts in Singapore that are as inclusive as DBS Multiplier. Students (without income and/or who do not qualify for a credit card), NS men (income <$2,000) and the Self Employed tend to have inconsistent income – this usually excludes them from most of the qualifying criteria needed for higher bonus interest on other accounts.

DBS Multiplier doesn’t do that – instead, they’ve built in ways for these groups to still earn interest based on their own lifestyle and spending habits. Here are a few examples:

Students

A 20-year-old university student with $3,000 in DBS Multiplier who has spent $100 on PayLah! at retail shops can now qualify for 0.30% p.a. (on her first $10,000 of deposits). If she gets an internship during her summer holidays or start investing to collect dividends, her interest rate level will now increase from 0.30% to 0.50% p.a. once she credits any amount of income into her Multiplier account.

NSFs

A full-time NSF receives $650 monthly and spends $100 on PayLah! retail. With $5,000 savings in his DBS Multiplier Account and total eligible transactions of $750, he can earn 0.50% (on his first $10,000 of deposits). When he completes his NS and gets his first job that pays him $30k a year (meaning he’s now eligible for a credit card), crediting that into his account and using his credit card can raise his interest rate from 0.50% to 0.90% p.a. (on his first $25,000 of deposits).

Expand Income Category

Investors like myself were celebrating earlier this year when DBS Multiplier announced that dividends would now count towards the Income category. Considering the amount of dividends I’ve accumulated from my stocks (including DBS aka SGX:D05, lol!), this was a huge game-changer in the industry.

Today, DBS has expanded that even more to recognise investments in your Invest Saver, CPF-IS and SRS. I’ve always talked about how DBS Invest Saver is awesome for beginners in the stock market who are looking to start up a fuss-free regular savings plan (see my article here), and it is awesome that DBS is now counting this as part of their eligibility criteria too.

This really shows that they’re listening to consumer feedback, because there has been many requests on Facebook for DBS to add this in. I like that they’re taking our feedback seriously and implementing it, to the benefit of consumers.

Track and see how much more interest you can earn on mobile

Open your DBS digibank app. Under Deposits, tap to access your DBS Multiplier Account and view your Bank & Earn summary.

The mobile interface is quite intuitive and allows you to know how much interest you’ve earned this month, as well as the current bonus interest rate that you’re eligible for. What’s more, it also shows you how much more you need to transact to reach the next level of bonus interest, which helps you to ensure you don’t miss out unnecessarily especially if you’re close to unlocking the next level!

This helps us to track and maximise your interest. Awesome!

DBS Multiplier: an account that grows with us

As a user of the DBS Multiplier Account myself, I really like the fact that DBS continues to improve their account features and evolves with us across our different life stages.

During the years where I was earning under $3,000 a month, I was obsessed about high-yield savings accounts and would keep chasing all the bonus interest, hardly hesitating to switch accounts if one no longer worked for me. Those of you who have followed me on this blog since my earlier years may remember this *sheepish grin*

But today, I’ve reached a stage of my life where my work keeps me busy + I hustle on weekday evenings and even weekends teaching tuition + ever since becoming a mom, I have to spend more time with my young son to teach and nurture him.

The most valuable thing to me now is TIME.

And any spare time that I have, I’d rather be spending that with loved ones, or studying the stock markets to improve my investments, or learn a new skill.

So my advice is, if you’re like me, it may be worth using your time meaningfully instead of obsessing over changing bank accounts all the time. Invest in yourself and your loved ones. And as you up-skill and upgrade, you’re also boosting your earning ability over time.

With the DBS Multiplier, I no longer have to fuss over changing bank accounts all the time, and I’ve come to really appreciate that.

Psst, need a credit card recommendation to help you earn your extra interest on DBS Multiplier? My pick goes to the DBS Live Fresh card, because in these times where we’re spending more online rather than offline, this card is close to being the best for my type of spending patterns. Read more in my detailed review here!

Disclosure: This post was written in collaboration with DBS. All views are that of my own.

7 comments

Haha, the circus animals have rebelled & refuse to jump thru any more hoops.

Yeah, don't miss the forest for the trees.

"Open your DBS digibank app. Under Deposits, tap to access your DBS Multiplier Account and view your Bank & Earn summary."

– i dont see this on my mobile app. there is not update required as well. so not sure whats happening.

"I got my husband to credit his salary into our joint POSB eEveryday savings account which allows for both of us to earn bonus interest in our individual DBS Multiplier account ;)"

– my wife is a homemaker, so no salary. we have a joint account.

so my salary has to go into this joint acct (instd of purely my acct?). and we both need to have this multiplier acct (indivd)

– does she also need to hit the other category on her own? ie insurance/dividends/etc?

This comment has been removed by a blog administrator.

It should be under your Bank & Earn summary! Try going to the Play store to update to the latest version if you haven't yet done so?

Salary –> credited into joint account. Both of you need to have your own Multiplier accounts, it will recognise the salary credit. (disclaimer: this "hack" is still valid as we speak but I cannot confirm when DBS may nerf it!)

Dividends –> credit into joint account so both parties' Multiplier get recognised for it.

Home Loan –> if both of you are on the DBS Home Loan, then this should already be recognised.

Insurance –> I can't confirm cos we don't get our insurance through DBS, so need to double check with them. My guess is that it depends on the policy owner's name though.

PayLah / credit card spend –> cannot hack this one, must be ownself's. Haha

When I was younger the incremental interest amount earned was worth it, but as I grew older and my earning + investing power increased, it was barely worth all that time anymore!

just went to playstore to check. its already the latest version. maybe coz its iwealth app. hmmm, idk. will drop them an email.

ah, okok, divd needs to be creditted to joint account. (not sure how easy to change crediting from own acct to joint acct. )

-salary can be changed into joint account.

-no home loan.

-i got the cancercare insurance.

BB, do you know how to change divd crediting account? in order to change to the joint account

Comments are closed.