When DBS launched digiPortfolio in 2019, it shook up the entire market for its low starting capital and management fees (which was almost unheard of among banks at that time). By now, we already know why DBS digiPortfolio is one of the best options for retail investors, and now, there are 2 new portfolios added for us to choose from – SaveUp and Income.

Are these portfolios any good, and how do they stack up against the current other options in the market? Here’s what you need to know before you decide whether to put your money in.

Back in 2019, I said this about DBS’ digiPortfolio offering:

“The DBS digiPortfolio…makes a lot of sense for investors who don’t have time to actively research and manage their portfolios, as well as those who have always wanted to invest but stayed out of the markets because they’ve no clue on how to construct their own well-diversified and balanced portfolio.

Even for DIY investors, for those looking to diversify and add to the index component of your portfolio, this might just be a more cost-effective and productive way to do so. It certainly saves you from all the time and extra fees incurred each time you manually rebalance your portfolio.”

That was when they only had 2 portfolios (Asia and Global) for us to choose from. Today, the pie has since expanded:

With the recent macro uncertainty, it isn’t surprising that DBS has introduced alternative portfolios for investors who are rethinking their appetite for risk, especially in the light of market performance since the pandemic.

I’ll review SaveUp and Income below, to help guide you towards deciding which is more appropriate for your needs.

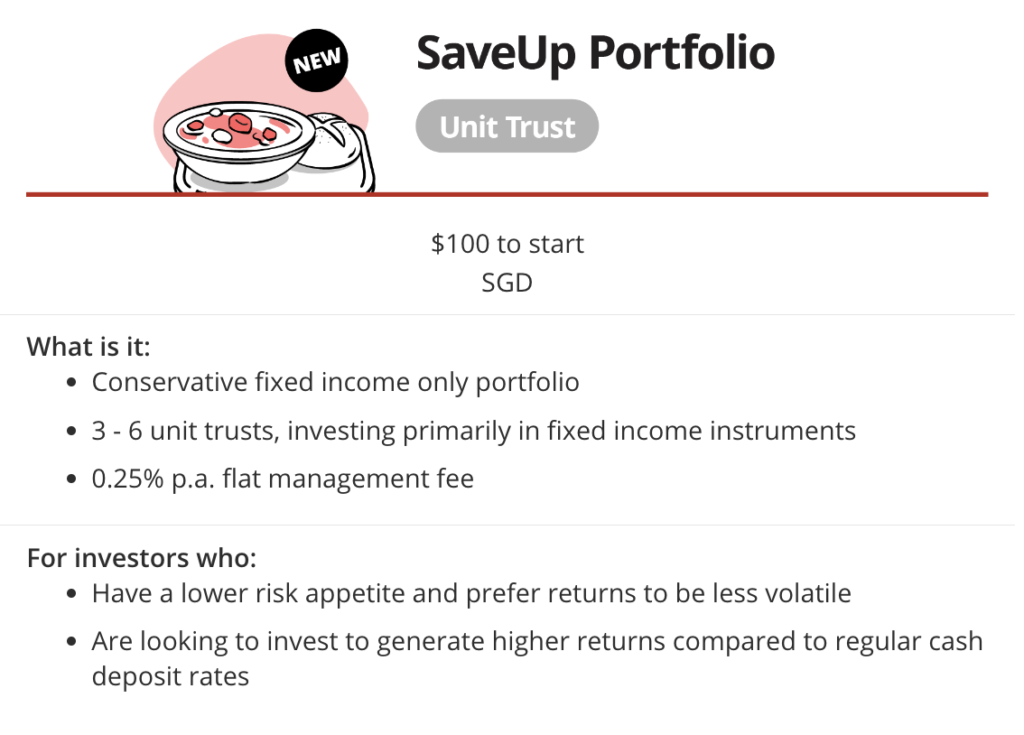

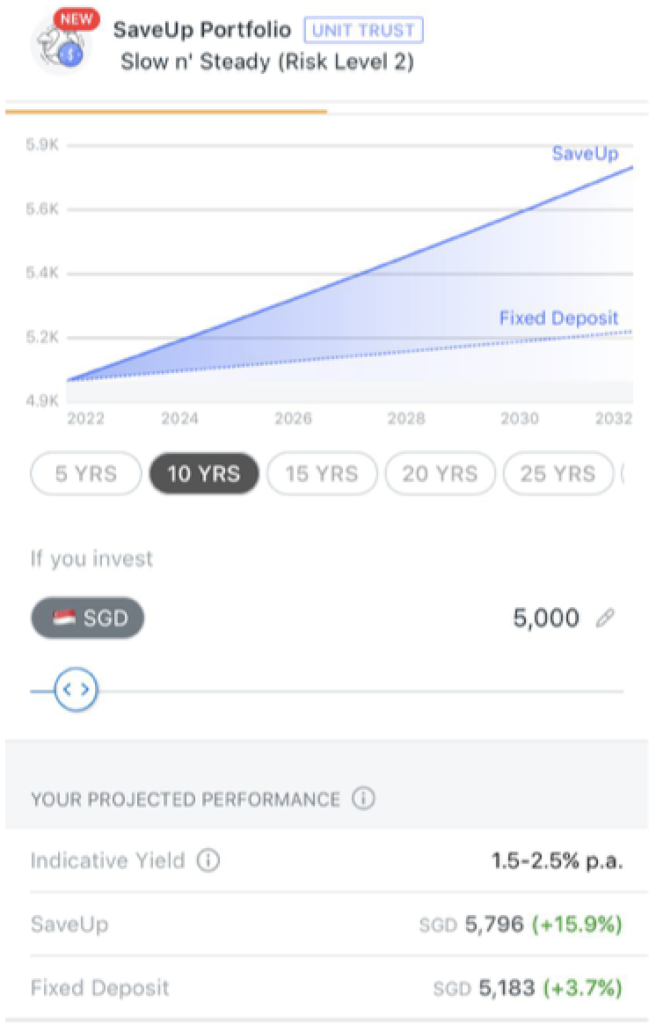

SaveUp – a portfolio of mostly fixed income instruments

If you’re generally quite risk-adverse and have been periodically rotating your money between fixed deposits and government treasury bills, then SaveUp would likely interest you more.

(also read: Is it worth investing in Singapore T-bills now?)

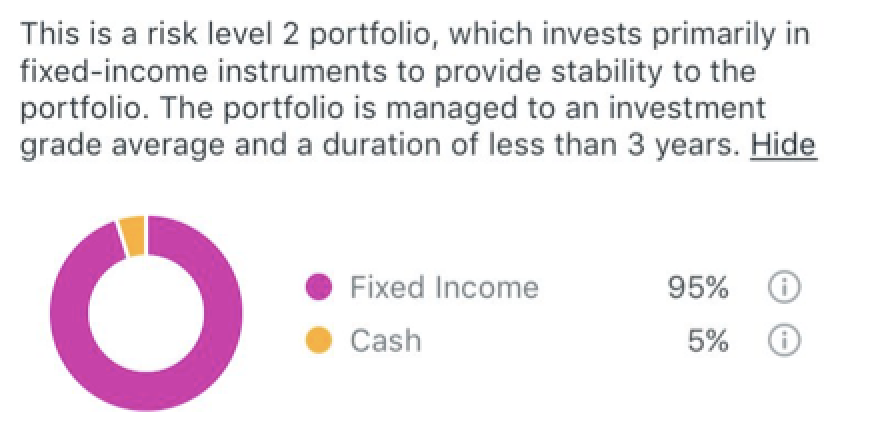

Comprising of 95% fixed income instruments, its long-term yield is projected to be about 1.5% – 2.5% p.a., but is currently yielding closer to 4% due to the higher interest rates environment that we are now in.

If you didn’t already know, prior to this year, interest rates have been muted for many years.

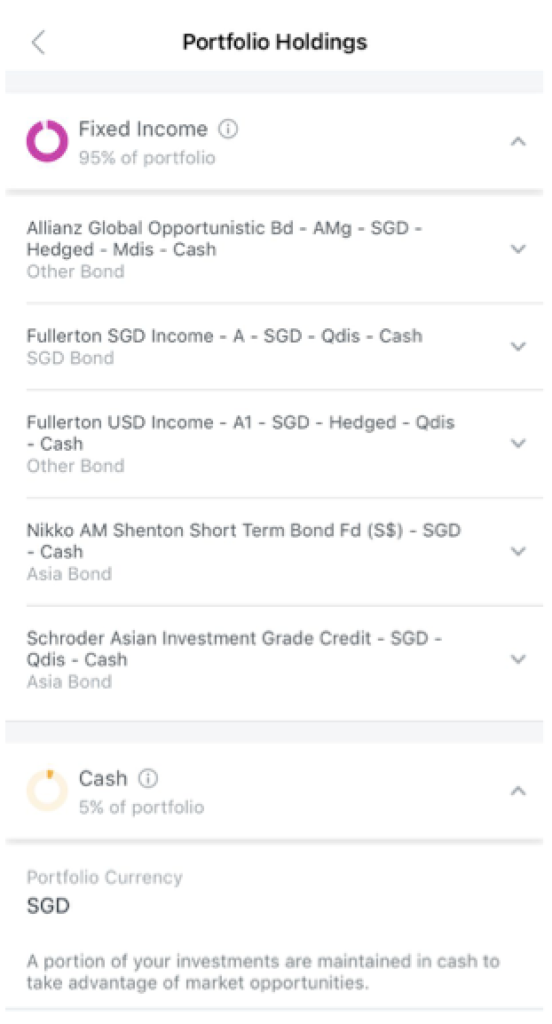

You can also view the portfolio holdings and the rationale when you click on it in your DBS app:

How does SaveUp compare against other options now?

If you’re looking at SaveUp, then your other comparable options would be fixed deposits, the Singapore Savings Bonds (SSBs), treasury bills and cash management portfolios offered by the other robos or brokerages.

Let’s compare against the cash management solutions offered by other robos / platforms first – if you zoom in carefully into the investment breakdown, you’ll realize that most of them allocate to 2 – 3 funds in equal (or almost static) weightage. On the other hand, SaveUp allocates into 5.

But is more the better?

Remember, digiPortfolio has had a unique proposition since Day 1, which is for retail investors to be able to access a portfolio constructed with views from the DBS CIO office. In this case, SaveUp’s portfolio at launch already reflects this, with the 5 funds being of the following different profiles:

- Defensive global bond

- Asian short duration

- Asia investment-grade bonds

If you resonate with that, then you’ll probably like digiPortfolio’s offering better.

As for the bonds and treasury bills, in terms of yields, the rates differ each time based on when you’re doing the comparison. For instance, T-bills were yielding less than 1% for the last 3 years until things changed earlier this year. As for fixed deposits, you’ll need to lock your money in for at least 1 – 2 years if you’re aiming to get anything more than 2% p.a.

So if you’re someone who is constantly monitoring the market and actively rotating your money around the best-yielding option at any one given point, then there’s a chance that you can still beat the rates on SaveUp, even though it requires more of your time and energy.

But if you’re someone who just wants:

- A low minimum capital (S$100),

- No lock-up period,

- Yields higher than what you can earn on your savings accounts,

- Without much work needed on your part,

then in this case, SaveUp would be a good option.

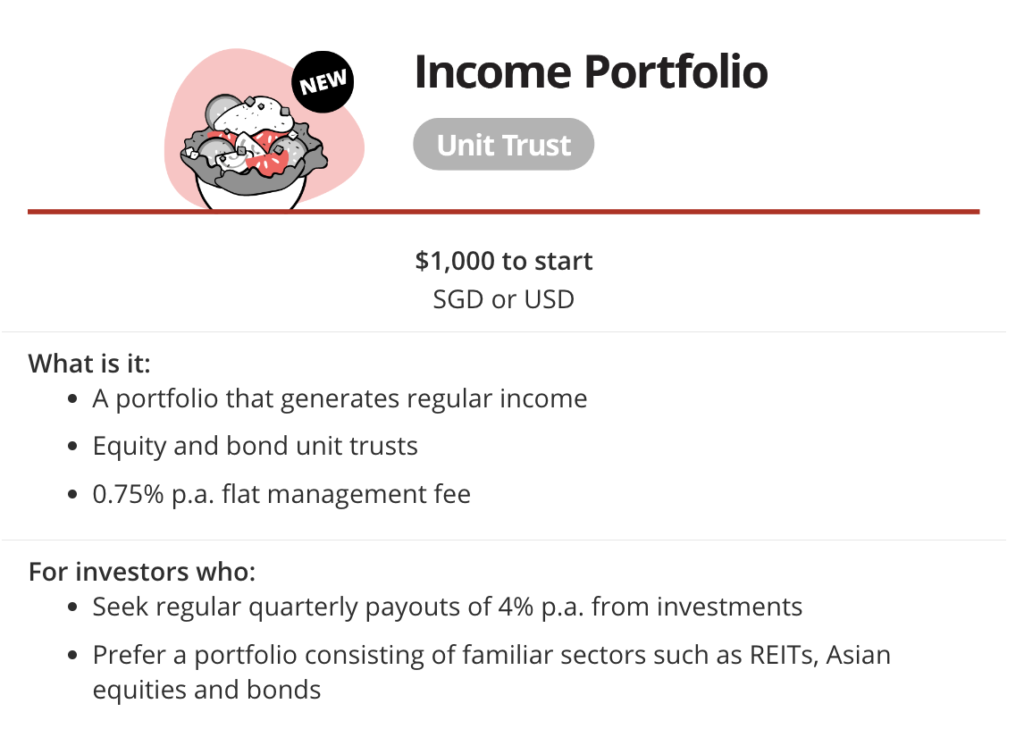

Income – seek regular payouts of 4% p.a.

What if you wanted returns higher than what SaveUp could potentially offer?

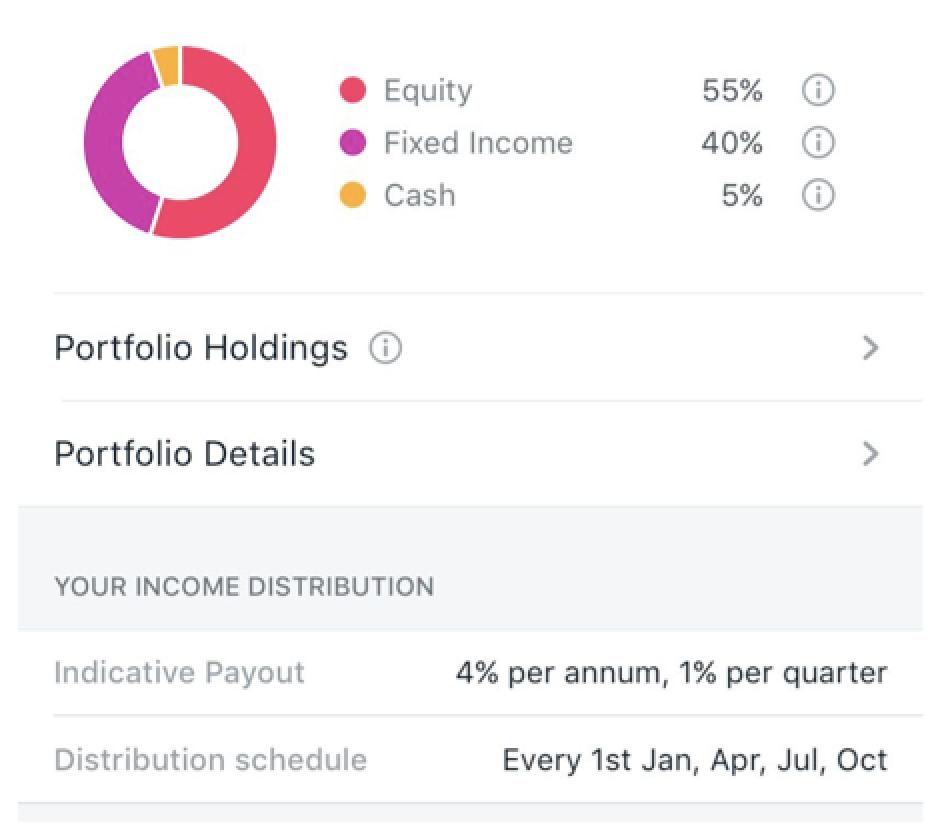

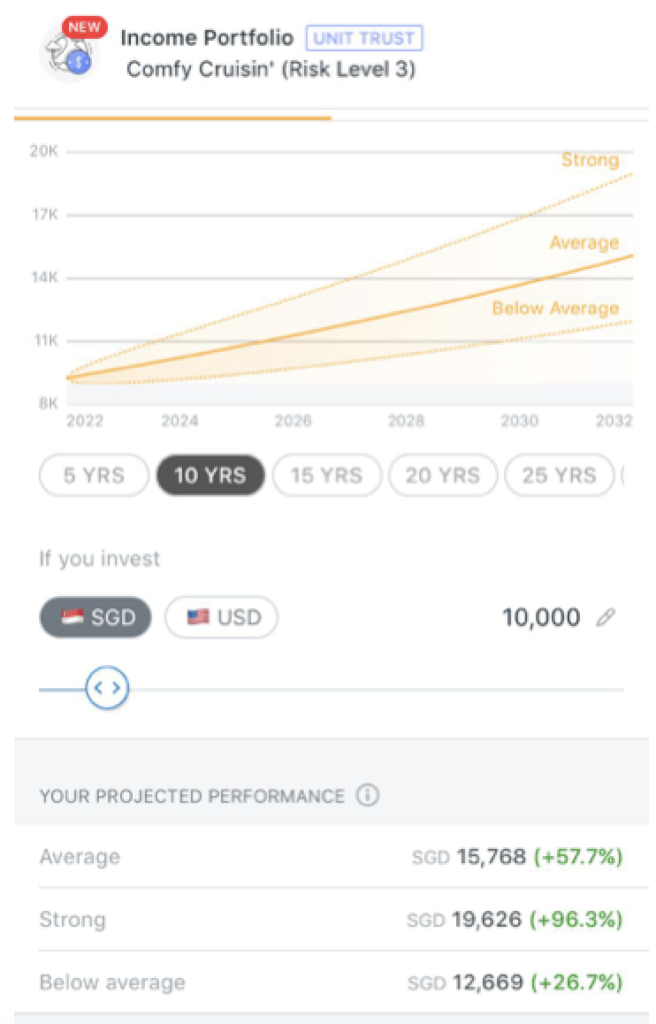

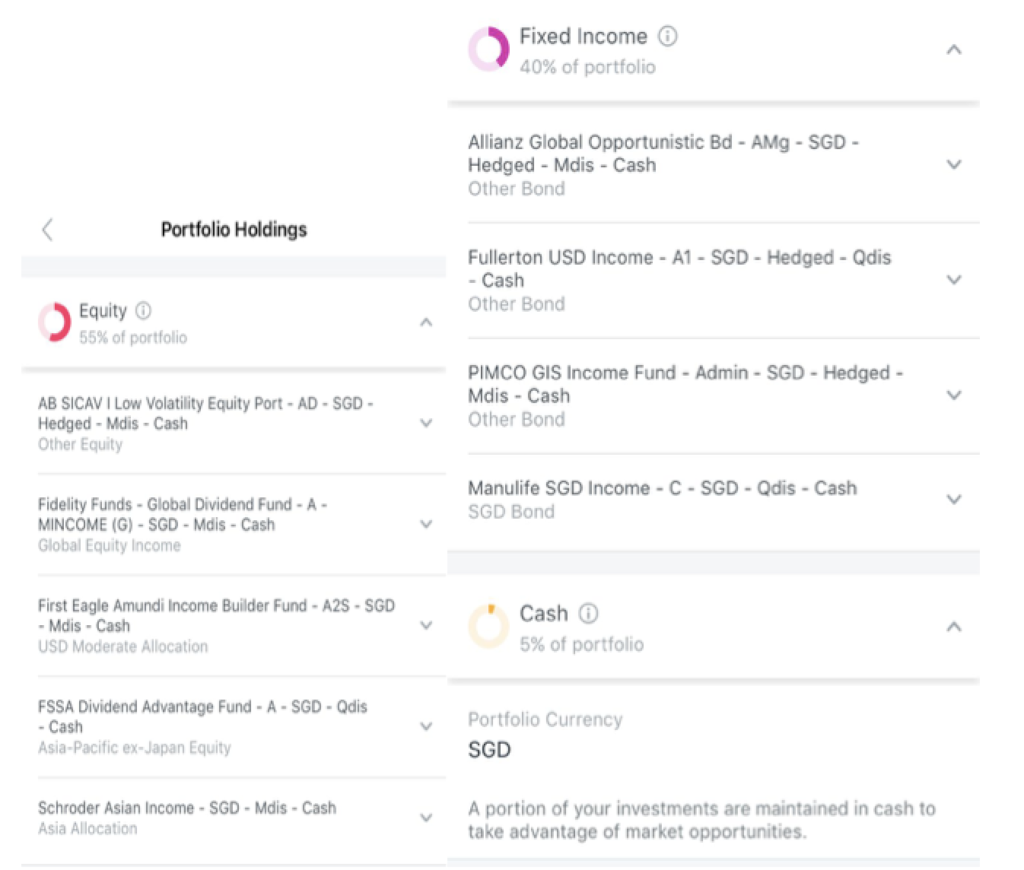

In that case, start looking beyond just fixed income instruments and dial up your equities exposure as well. In this case, the Income portfolio might be a more appropriate pick:

With a 55% equities exposure, this portfolio will be taking on more risk than SaveUp, but is still less volatile than most portfolios that come with higher equity allocations.

Tap to view the portfolio holdings, which will reveal exposure to mostly high-quality bonds (both global and Asia), dividend stocks, REITs and other blue-chip companies that generally have a history of paying stable dividends:

How does Income compare against other options now?

If you’re looking at Income, then your closest comparable options would be the low to medium risk portfolios offered on other banks or robo-advisory platforms.

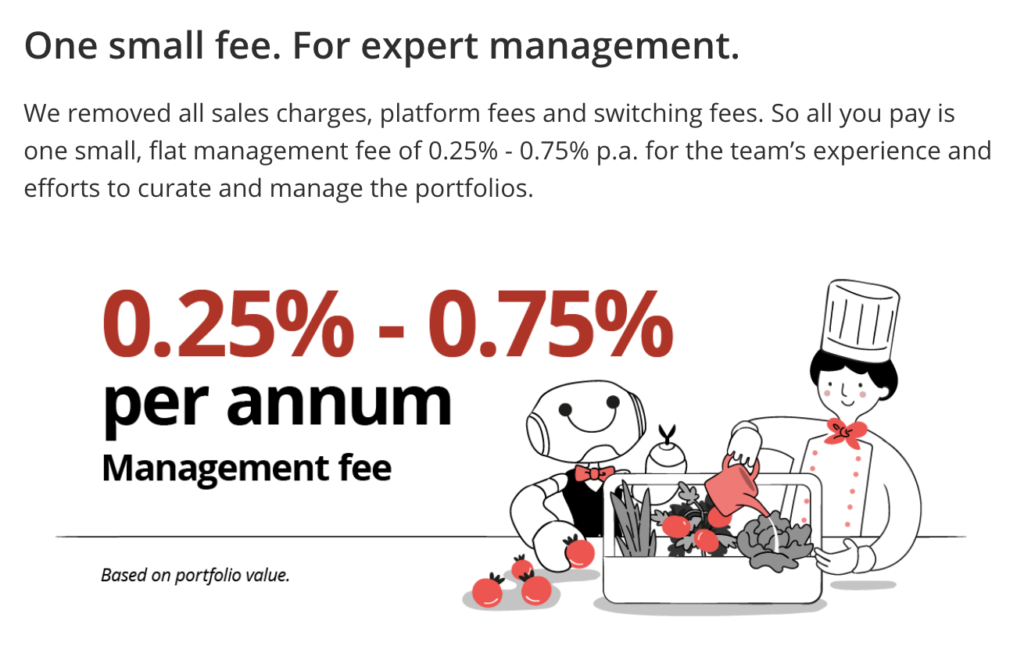

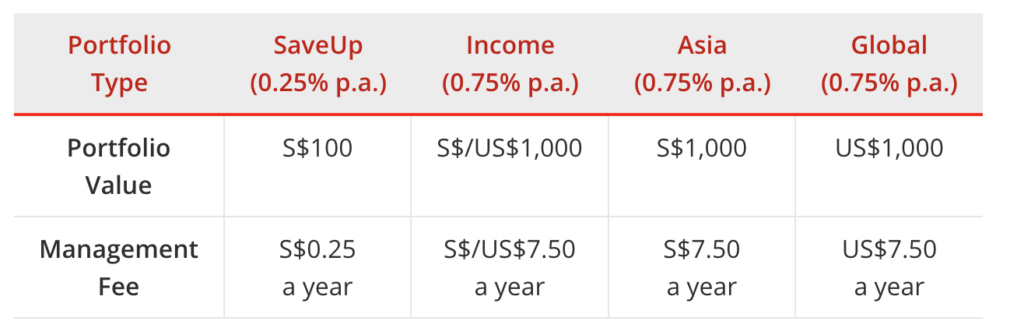

Among the banks, DBS definitely has the lowest fees right now:

| Provider | Rates (p.a.) | Minimum investment |

| DBS digiPortfolio | 0.75% | S$1,000 |

| OCBC RoboInvest | 0.88% | US$100 |

| UOBAM Robo-Invest | 0.8% | S$500 |

What’s more, your investment in digiPortfolio also qualifies for higher bonus interest on your Multiplier account, so you’ll end up killing two birds with one stone.

What’s stopping me from DIY?

Nothing.

DBS digiPortfolio was never meant to be a complete replacement; and from a cost perspective, DIY almost always wins.

But when you calculate your costs based on the time and energy needed to research, execute, monitor and rebalance your portfolio periodically…then the digiPortfolio becomes a no-brainer, especially when you’re paying for fees this low.

Conclusion

Perhaps you’re one of those who started looking into digiPortfolio because you’re trying to maximise the bonus interest earned on your Multiplier savings account.

Or perhaps you were among the many who started investing during the pandemic – only to realise you weren’t as skilled as you thought you would be – and you’re now looking to move your investments to a robo-advisory instead.

Whatever your reason, there’s no doubt that digiPortfolio can help, especially now that it has been enhanced to offer 4 ready-made portfolios built and managed by the DBS investment team for you. I like how DBS has moved along with the times and introduced SaveUp and Income now, especially in an era where more investors who went in big during the pandemic are now starting to realise that they took on too much risk than what they bargained for.

I hope this article helps you to better understand what SaveUp and Income offer, and how to read the portfolio allocations accordingly. If you’re considering the Asia or Global portfolio instead, check out my previous review here.

For a hassle-free investment experience, all you need to do is to choose which portfolio suits your needs better, set the amount and frequency at which you’ll like to invest, submit, and you’re done!

Check out which digiPortfolio offering will suit you best here.

Sponsored Message from DBS Each portfolio on digiPortfolio is curated and managed by our elite team of portfolio managers, whose expertise was previously accessible only to investment sums of S$500,000 and above. Besides carefully selecting exchange traded funds (ETFs) and unit trusts to create quality portfolios, our team monitors the market regularly, aligning digiPortfolio with our Chief Investment Office’s views to ensure optimal asset allocation and portfolio resilience, and initiating rebalancing whenever necessary. digiPortfolio is coded to automate processes such as back-testing, rebalancing and monitoring. In doing so, we can deliver scale and efficiency, while giving every investor full transparency of trade activities. This is our way of making investing easier and more accessible to the masses.

Disclosure: This post is brought to you by DBS. All opinions are that of my own.

Disclaimers and Important Notice • This article is for general information only and should not be relied upon as financial advice. Any views, opinions or recommendation expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability. • This advertisement has not been reviewed by the Monetary Authority of Singapore. • It is provided in Singapore by DBS Bank Ltd (Company Registration. No.: 196800306E), an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore • The information and opinions contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. • This article is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.