A reader introduced me to "earlyretirementextreme.com" (thanks @sumomuffin !) and CAN I JUST SAY THAT I LOVE THIS GUY'S SARCASM hahaha!

Personal tidbit: some people get their Daily Dose of Humour from puns, jokes or comics… I'm the weird girl who absolutely adores smart sarcasm. Hey, they say sarcasm is the highest form of wit k! Unfortunately I'm not very good at it but Xiaxue is pretty darn awesome in this area!

"I usually go to the mall to perform a kind of anthropological expedition once a year and I see nothing there which interests me. It's mostly mid-range consumer stuff which will tragically end up in a garage or landfill about 10 years down the road." (quote from Jacob of ERE)

😂😂😂

Okay admit it. How many of you have bought clothes / makeup only to sell it off later? Whether new, swatched or preloved?

Seriously Dawn why are you spending money only to throw it away later on 💤 😒

I'm guilty of this too argh. Just threw out a couple of beauty products cos now that I'll be moving into N's place proper after the wedding, there really is no space for all my junk. All that money down the rubbish chute!!

😥

—————-

www.bigscribe.com/cpf

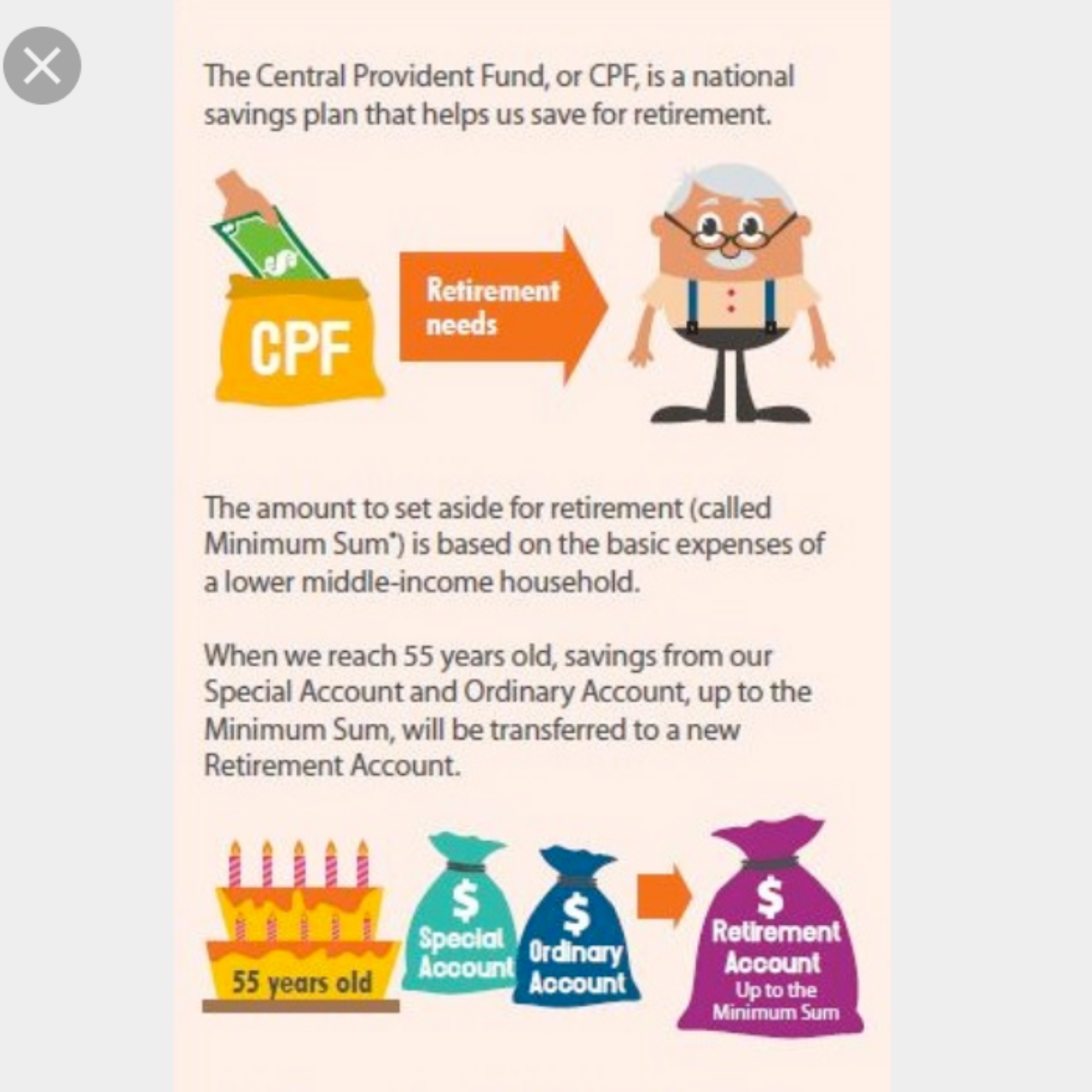

"Think back to your first paycheck. Your relationship with your CPF started the moment 20% of your salary was channelled into your CPF account. Over the next few decades, you would likely use some of these funds for your housing needs, buying insurance and maybe even medical expenses."

Along this journey, it's easy to get distracted and forget the primary purpose of your CPF: helping to fund your retirement.

How to optimise your CPF for retirement!

(Disclaimer: I don't have a stake in BigScribe. They're all males…but they occasionally engage me for their events and sharings!)

What you do in your early 20s in your CPF will have a HUGE impact later on.

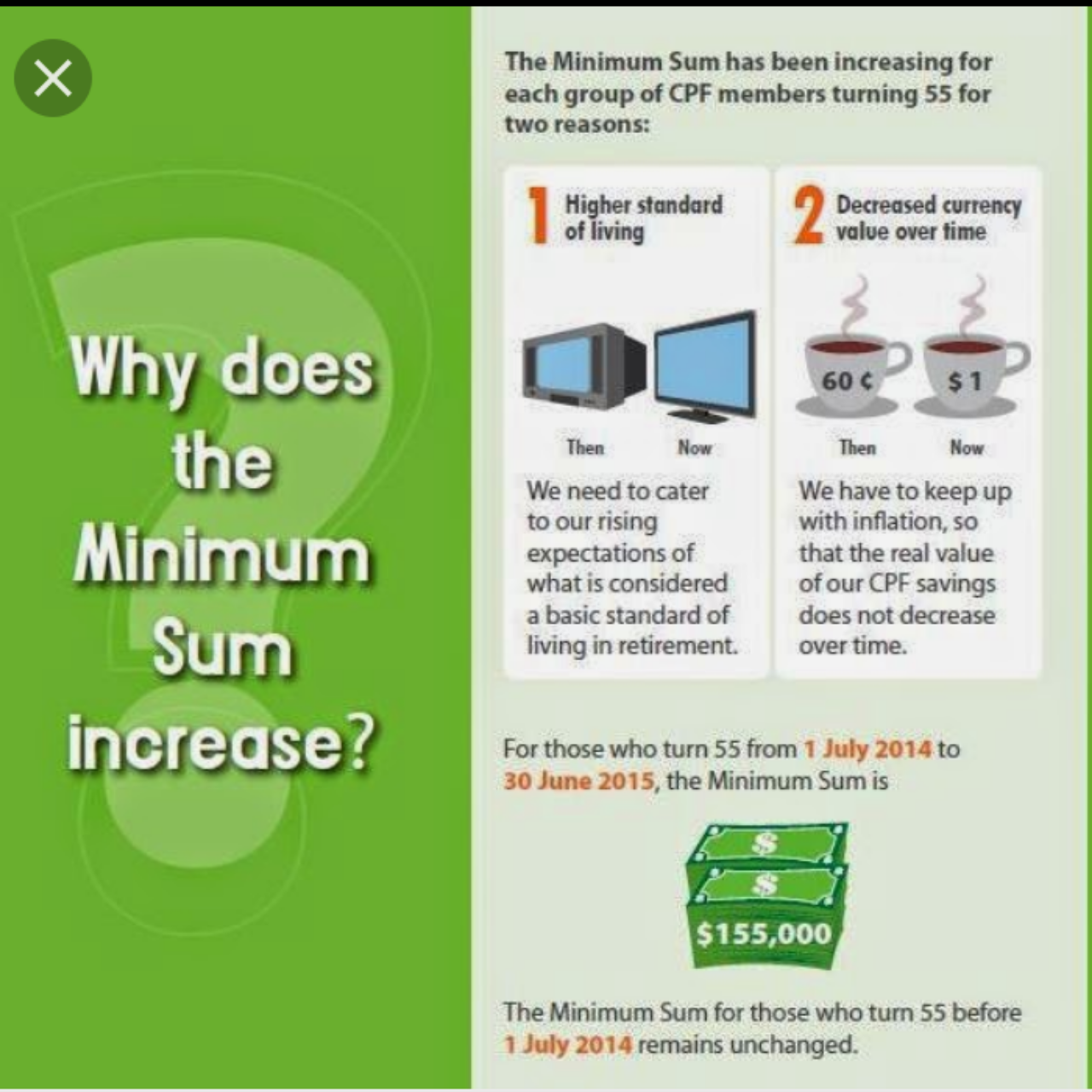

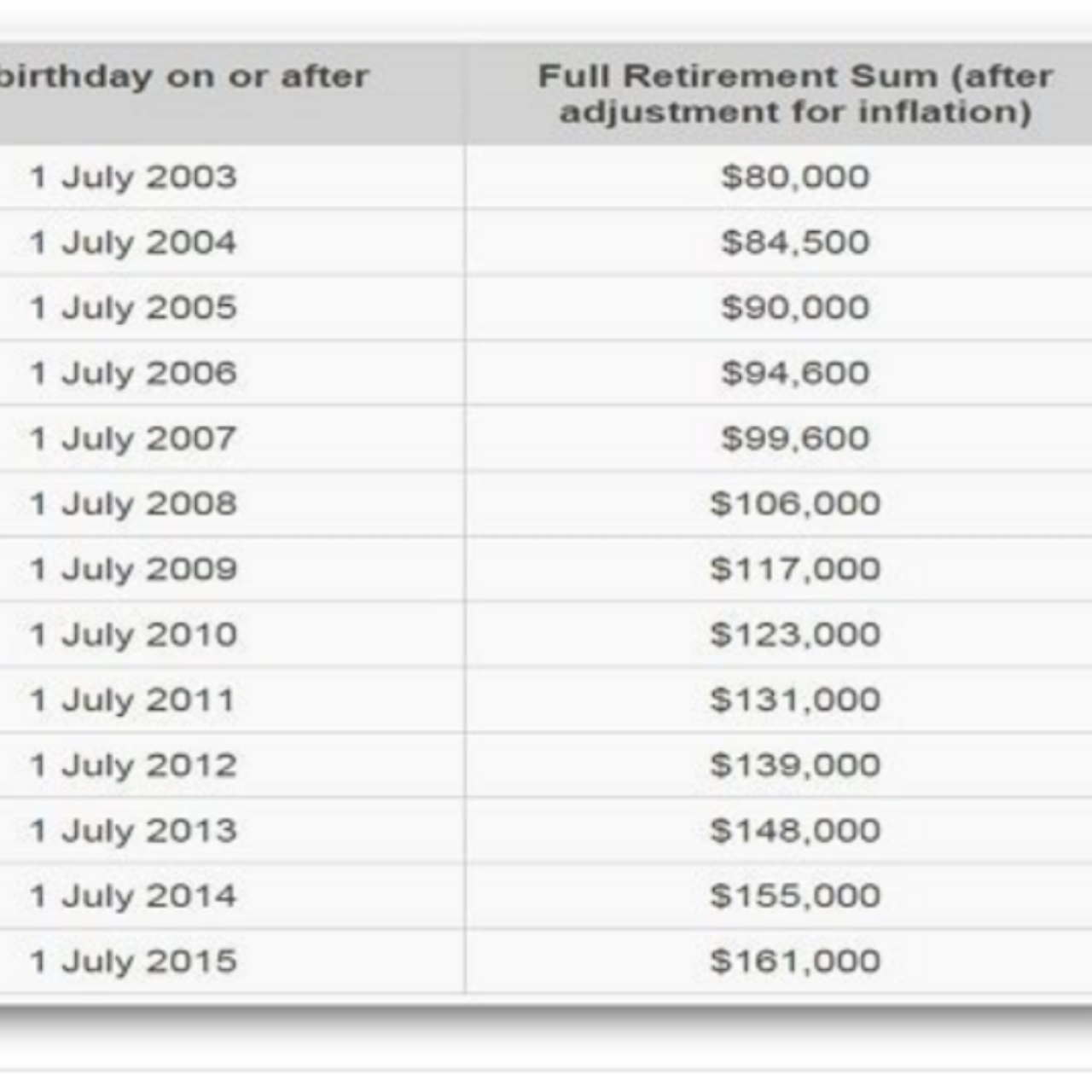

One of the reasons why many people complain about not being able to meet the (ever-changing) Minimum Sum is because they just don't have enough in their CPF for it.

Think about it logically.

Credits to Ivan Guan (I dunno who) or more like I just koped this from Google Image la.

The CPF is meant for your retirement! Not to help you buy your house okay.

But there's nothing that says you can't use it for buying houses. Will explain more during my talk! #dayrefinance

Before you complain about the Minimum Sum always increasing, let's stop to think also about how the standard of living has gone up drastically over the years.

I'm not in a position to judge whether or not the increase is proportional to higher living costs, for that you guys can ask political candidates Han Hui Hui and Roy Ngerng ya cos that's what they fight for.

I don't see a point in fighting for "return us our CPF!" cos I don't like to fight a losing battle. I rather game the system.

If you don't wanna worry about not having enough to meet the Minimum Sum in the future, I'll share with you my tips on what you can do during the event!

Here's what I'll be covering during my talk:

1. How to get more free money from the government in my CPF

2. Should I use my CPF for housing? Or should I take a loan, then let my money grow? (since the interest on my loan is only 2% plus whereas CPF pays me more than that in interest..)

3. Should I do voluntary top ups?

4. Plus! An exclusive SECRET TIP that no other financial blogger has written about before! I promise this is gonna be GOLD haha I only found this hack last year and confirmed it with CPF themselves!!! 😍😍😍

Okay end of shameless self-promotion plug YAY I'm so happy that a number of you have emailed me about coming! Can't wait to meet you fellow Dayreans in real life after all those conversations online!

—————————-

Back to ERE

—————

According to Jacob, he named two financial independence killers on credit:

1) Buy "more house than you need"

2) Buy "more car then you need"

I like the way he puts it 😁

SO TRUE. Especially here in Singapore where property prices and car ownership are really no joke. But a lot of people still want to live in a big / private house and drive a cool car because, you know, gotta show everyone that I've made it in life right?

*rolls eyes*

WHO. FREAKING. CARES.

I told my fiance I don't want a condo or big house because 1) I don't see the point in us slogging to pay the mortgage and 2) the less space there is for me to clean, the better.

If I had my way, I would just buy a 3 room HDB but unfortunately that isn't practical cos we need to house the following people in our flat:

👵👴 his parents

👴 my dad

👧 a domestic helper to take care of our ailing parents (my dad is in a dangerous position…)

👫 me and hubby

👶👶 1 or 2 kids later on

(Backstory: my sister and my dad are estranged. Haven't really talked in a decade. So I'm the only one supporting him 😩)

So the smallest we can go for will be a 4-room HDB. 1 room for his parents, 1 room for us, 1 room for my dad and…I really have no idea where the domestic helper will sleep in the future. We'll cross that bridge when we come to it.

Jacob writes about how he lives on just $7000 a year (including as a single and a married spouse). Sounds extreme?

I know I definitely can't live on just $583 a month. Transport alone is already $200+, usually more because I've been spending on cabs for work. Food is between $3 to $10 a day, more if I'm on a date or hanging out with friends. My average monthly food expenditure is about $250.

But I admire his determination and frugality!