Your chance to finally engage a fee-only advisor for a customized financial health check without having to pay thousands for advice. Thanks to MoneyOwl, who has finally launched their Comprehensive Financial Planning tool (the one we’ve been waiting for since 2018). Is it any good? We review it to find out.

We previously tested MoneyOwl’s (free) insurance analysis tool, will-writing services and investment offering, which were all fantastic in their own right. The last piece of the puzzle was for them to launch their Comprehensive Financial Planning (CFP) tool, which is the only one integrating national schemes like CPF to provide you with a holistic picture of your wealth and financial assets.

MoneyOwl recently invited me to review and share feedback to help improve the tool further. Here’s how my experience was like.

Trying Out MoneyOwl’s Comprehensive Financial Planning Tool

I had to first go through the online tool, which covered many sections of my financial life in detail. For those of you who are doing this, I would recommend that you prepare your insurance policies and assets in advance rather than throwing estimate numbers in, so that you can get an accurate picture of where your finances stand.

|

| I’m not sure how long this free offer will last, but in the meantime you can still get your free consultation by clicking on “Get Promo Code”. |

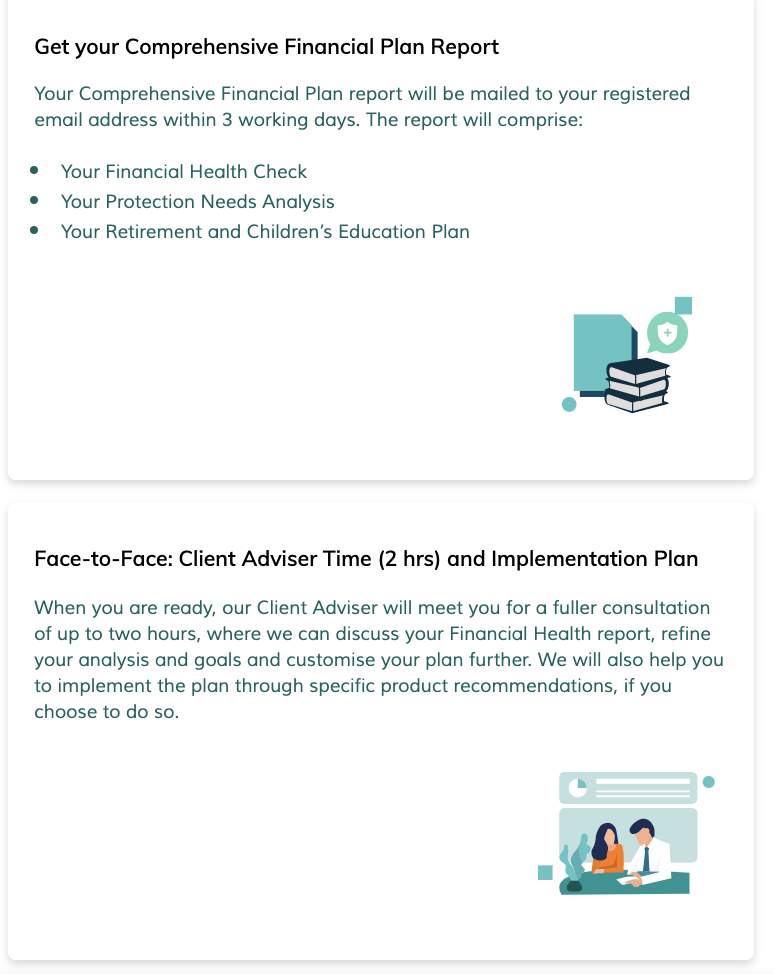

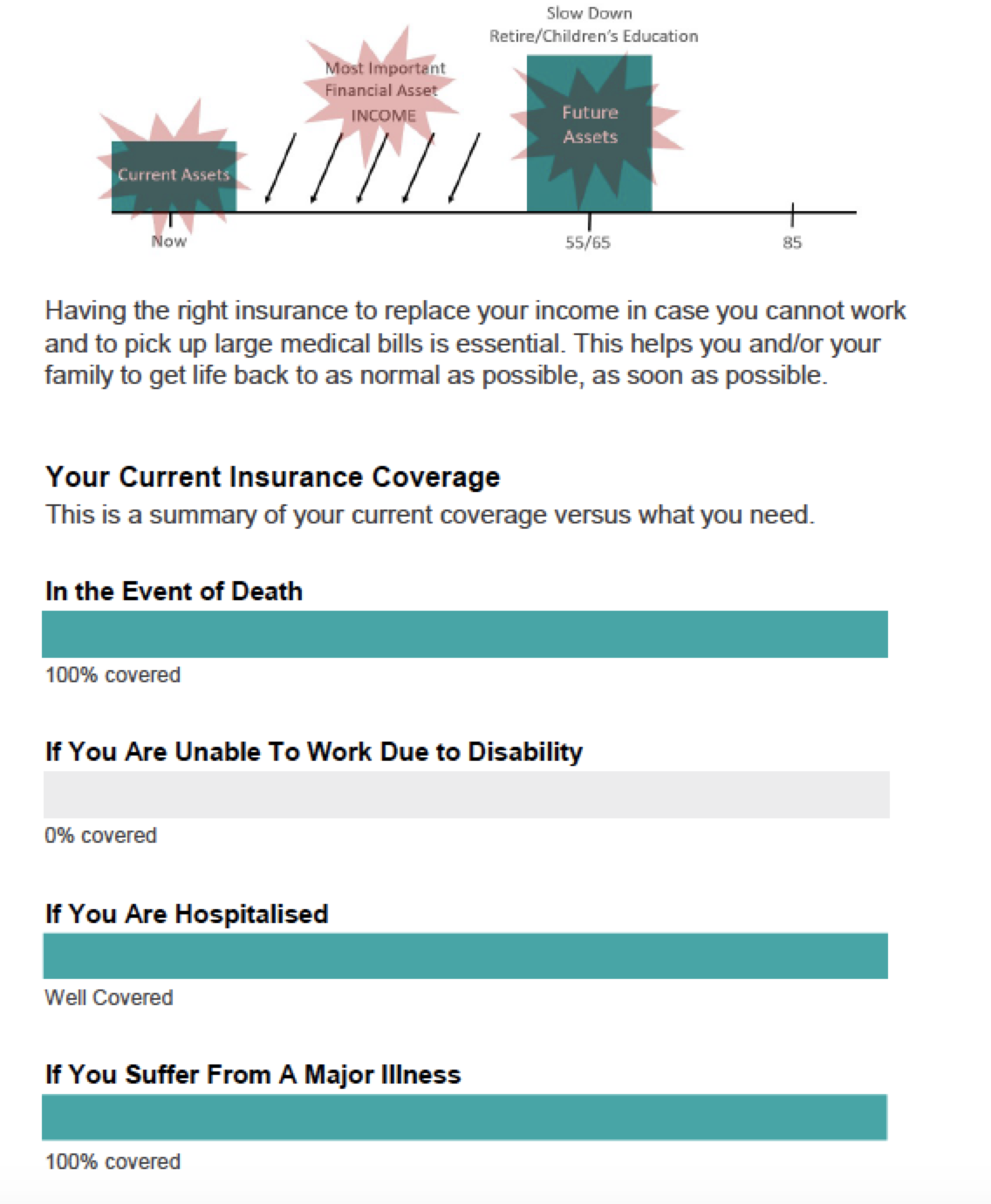

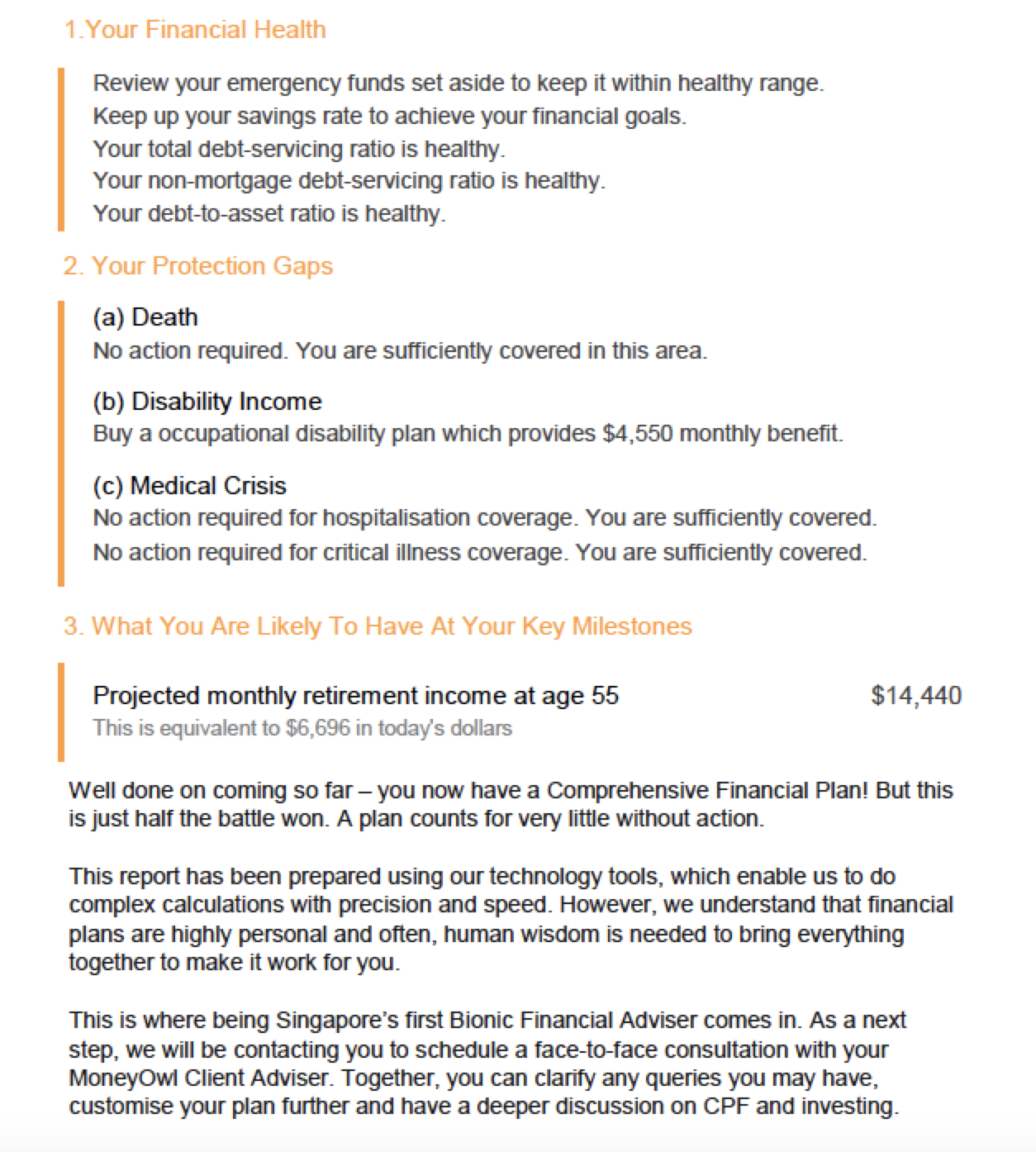

The CFP gives you access to a comprehensive financial health check, looks at the gaps in your protection needs (both present and future, based on your number of dependents) as well as takes into account what you’ll need to prepare for your retirement and children. Aside from the report that their advisors will calculate and generate for you based on your inputs, you can also make use of the 2-hour face-to-face session to discuss your financial needs and goals in detail, to figure out what it takes to get there.

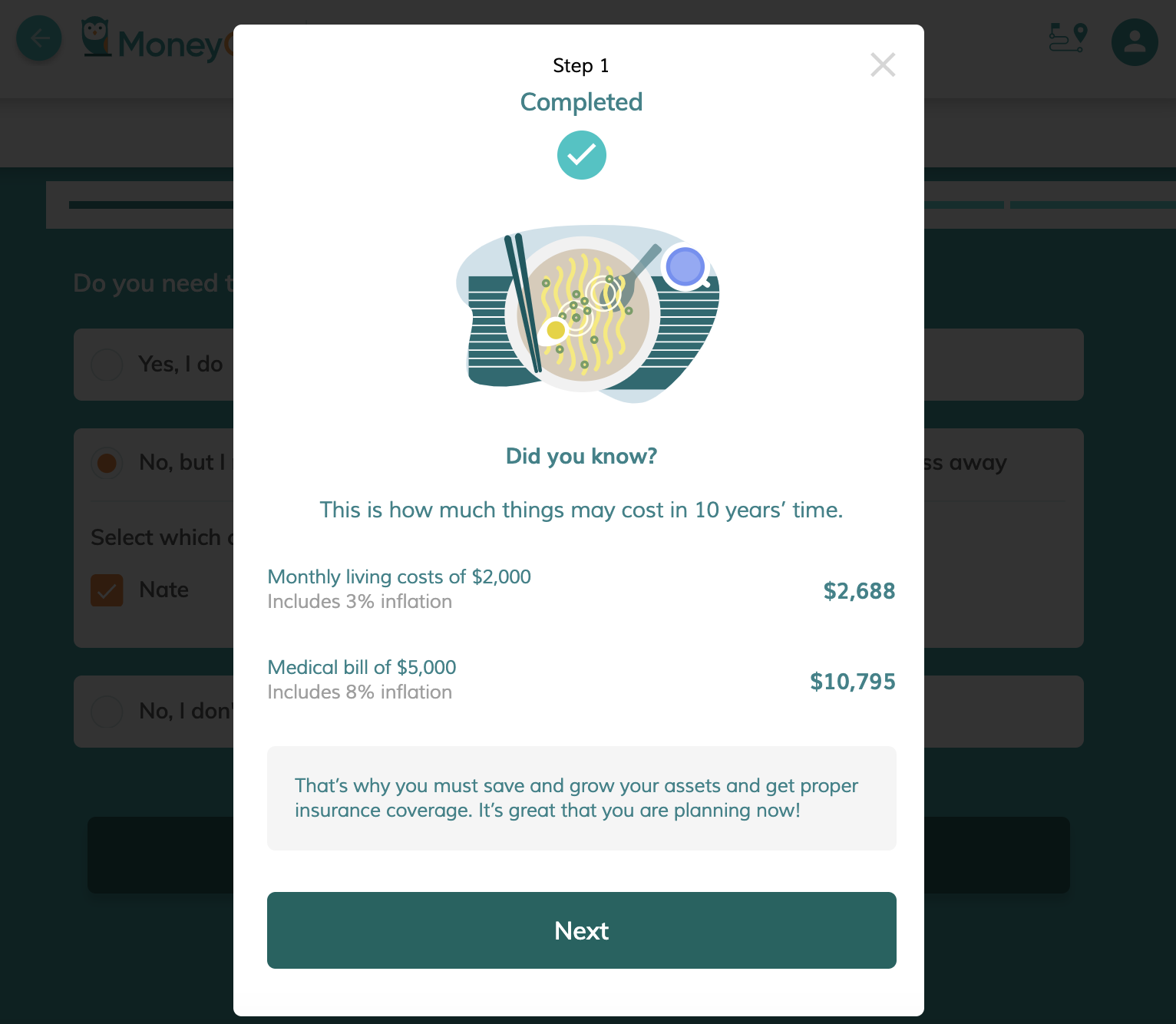

Along the way, I was given useful nuggets of information such as how much my expenses will translate to in the future (due to inflation), or what I needed to make sure I had covered during retirement.

Understanding the Report

Within a few days, I received the report in my email inbox, which was a very comprehensive look into my finances, the gaps and what I needed to do to start preparing for my future.

For those of you who might not be financially savvy enough to understand the report, please make sure you utilize the 2-hour face-to-face session for their advisor to walk you through it.

In terms of insurance, the only gap they spotted was my lack of a disability income cover, which was one that I disagreed with – more on this later.

The Consultation

I was then assigned to one of their advisors, who walked me through the contents of my reports, covered my gaps in detail and discussed their recommendations. You can choose to forgo the session if you want, but I went ahead because I wanted to see if anyone would hard-sell me (especially to get a disability income policy) given the “gap” spotted.

Thankfully, that didn’t happen. I attribute this to the fact that MoneyOwl’s advisors are salaried staff who do not receive any commissions, which makes them operate in a very different manner than the average insurance agent who earns based on the commissions of what they successfully sell you. This objectivity goes a long way in allowing you to plan without fear of conflict or hard-selling.

There was also no pressure at all to purchase anything from them, and they respected my preference in stock-picking instead of investing in a broad-market index fund. However, what I liked was that they clearly explained the pros and cons of each method, then left it up to me to make my own decision.

Investing with MoneyOwl

If you decide to invest in Dimensional Funds via MoneyOwl, they will direct you to a page where you have to take a risk profile assessment in order for them to recommend you suitable fund allocations.

You can even set up multiple investment profiles of varying risk levels, if you have different goals that you’re working towards (eg. longer term horizon with more exposure to equities). The process is quite straightforward, as you can sign up for your investment account via MyInfo, and then top up the sum you would like to invest via bank transfer or PayNow (to iFast).

For more details, you can read my review on their investment approach here.

Note: If you choose to invest with MoneyOwl after completing your CFP, the cost will be rebated back into your investment account.

Who is this suitable for?

If you’re a young working adult, you will find this tool extremely helpful and probably save yourself from having to pay “tuition fees” to insurance agents or the stock market (like how many of us did – read why I cancelled my ILP and 10 ways to fail at stock investing here).

If you’re already past your 30s, then this tool serves as a great financial health check-up to assess how you are currently faring, and what more you need to do (if any) to get to your financial goals. You can even bring all of your existing insurance policies to the review and get MoneyOwl’s advisors to help you take a look, knowing that they will not be advising you to switch or purchase any new policies unless there really is a severe gap in your protection.

What I liked best was that there was no hard-selling and that their recommendations were extremely catered to each customer’s journey and needs. For instance, those who do not have emergency funds would have a discussion centred on the necessity of building that first, instead of being advised to start an investment portfolio right away (that’s a big mistake, by the way. Never invest until you at least have 6 months of expenses stashed aside.)

MoneyOwl’s philosophy is to promote low-cost term insurance and low-expense ratio market-based investment funds, while helping you to optimise your CPF at the same time (which should form an integral part of your financial planning anyway).

Comparison with Providend

Considering how Providend’s advisory services for its high net-worth clients have generally been out of reach for the common man on the street, this is a good middle ground that MoneyOwl has managed to achieve.

So if you’ve ever wanted to seek advice from a fee-only advisor but yet couldn’t afford one previously, this is a good time to try out MoneyOwl’s Comprehensive Financial Planning tool and sit down with their advisor(s) for a personalized consultation, without worrying that anyone is going to try and sell you a financial product that you don’t want.

Further reading:

- Find out your insurance gaps here with MoneyOwl’s free tool

- Writing a will with MoneyOwl

- The latest robo-advisor – investing with MoneyOwl and Dimensional Fund

Disclosure: This post was written in collaboration with MoneyOwl.