There isn't much information about term insurance plans available to consumers as few insurance agents will sell this type of plan, with most preferring to sell life or investment-linked plans instead.

Why? Because they earn higher commissions if you buy that off them, that's why. Commissions are paid based on the premiums you pay, so if you buy a plan with higher premiums upfront, your agent gets more money in his pocket sooner.

Term insurance, on the other hand, which typically cost just $100+ a year in premiums (for someone in their 20s), pays such a small sum to your agent in that first year that it is quite insignificant. If you were an agent relying on commissions for your monthly income, would you spend all that time and effort on someone just to be paid a few dollars?

I doubt so. Of course, there are good agents out there who sell term insurance, but they're a rare breed because the effort-to-reward ratio just isn't worth it.

And that's why there are more people on ILPs or life insurance (across its different forms). I'm not saying these policies are bad (it depends on whether it is suitable for YOU), but it is true that they give a bigger payout to your agent earlier, rather than in the case of buying term. Hence greater incentive to sell that too.

Hehe. Why are insurance products so difficult to comprehend? (Not gonna tell the answer but it is quite obvious plz)

Term insurance only covers me till age 65, whereas life insurance covers me for my whole life.

This is one of the biggest reasons why people buy whole life policies – because they want to make sure they're covered past their retirement.

When I bought my first insurance policy, this was true. I couldn't find any term insurance plan that covered up to 99 years (or maybe my agent just didn't sell it).

Today, however, more insurers are starting to offer term insurance up till age 99. Speak to your own advisor if you want to get one (sorry I don't sell any!)

Whole life insurance is convenient – I get 3-in-1 benefits of protection, saving and investment at the same time!

As much as I love the convenience of 3-in-1 shampoo which includes hair conditioner and body wash all within a single product, it isn’t something I use on a long-term basis because the results aren’t fantastic. My hair usually ends up dry and tangled, and my skin never quite feels truly clean. Same for #dayremakeup isn't it?

Using separate products, each specialized in their individual function, has yielded me better hair and skin.

This analogy applies to insurance as well. Just because a bundled product is convenient does not necessarily mean it is the best product in the market. More often than not, I think of these products as Jack-of-all-trades, Master of none.

You’ll be better off buying them individually from the best masters in each field. Instead, consider insurance, automating your bank savings, and equities respectively.

Whole life insurance policies give me access to better investment opportunities.

"Better" is subjective when it comes to investing. I may think DBS is a great stock, but someone else may think OCBC is better.

Investment opportunities offered by insurance companies are limited to the types of funds they have access to. If you think they are indeed “better” than the other options available in the market, that’s your own personal view as well.

"I don’t know how to invest, so I’m better off buying an investment-linked policy from my insurer."

If you’ve no time or can't be bothered to pick up just a little bit about investing, then go ahead and pay someone to do it for you. With so many courses and (free) tools on financial literacy available today, “I don’t know” is no longer a good excuse.

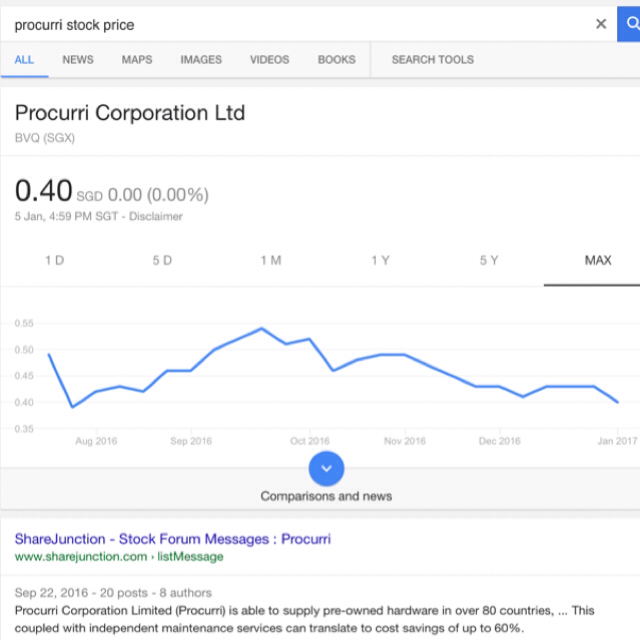

I went from not knowing a single thing about investing to being able to conduct my own analysis today. That's how I "predicted" Procurri's stock price would drop – thus warning my readers not to buy into its IPO hype.

The growth story that Procurri's shared in its IPO prospectus was very pleasing to the ears. Analysts and brokers were talking about this IPO excitedly too back then. Ads for it occupied 2 full pages on major newspapers.

If you had invested $10,000 at their IPO (price was $0.56), you'll be sitting on $2857 of losses today. In other words, your $10k has become only worth $7k+ thanks to this move.

A few readers commented / emailed me after Procurri's share price dropped to thank me for the warning – but really, it wasn't so much being able to see into the future than it was based on hard work and time. It took me over 6 hours to analyse Procurri's stock thesis when they first announced their plans to IPO!

Since more people buy whole-life insurance, then that must mean it is a better product.

Oh, how I love it when insurance agents try to use this tactic! Remember when this was happening for ILPs years ago? Look at how many people are calling it a mistake today, and how many more who wish to terminate / have already terminated it!

This is a super common argument put out by most advisers, and it is WEAK. It is a logical fallacy (GP, heh) to assume that just because a product is popular means it is good. (Google “bandwagon fallacy” or “herd mentality” if you don’t know why).

Insurance is an EXPENSE. I don't expect to get anything back from it.

Found this graphic online that illustrates the great disparity between the two methodologies of buying whole life insurance which gives you back a cash value vs if you buy a cheaper term insurance and invest the difference.

Now you'll understand better why I opted for the latter right? Because losing a few thousands in the grand scheme of things was insignificant compared to the lifetime opportunity cost I would be losing out on if I stayed with my ILP.

Hopefully this post clears up many of the misconceptions that most people have towards term insurance!