Saddled with a tuition fee loan from university?

Decided to write on this topic as I just received an email from an NTU student today. She shared a little bit about her life and asked if I had any advice for her on how to become financially free #dayrefinance

Well, first things first, focus on paying off your tuition fee loan.

That's right, don't invest yet. Pay off your debts first. Let me explain why.

If you're studying in a local university, you're probably on either the DBS TFL scheme or OCBC. As of now, these are the only two MOE approved and supported loans.

My sister got the OCBC Frank loan. Both DBS and OCBC are great in the sense that they allow us to study in peace without worrying about repayments yet. 0% interest during your study years thanks to MOE.

Upon graduation, the minimum monthly repayment required is merely $100, which means you can get away with paying just $100 a month for as long as over 20 years. So not to worry if you don't earn a lot in your first job (like me!).

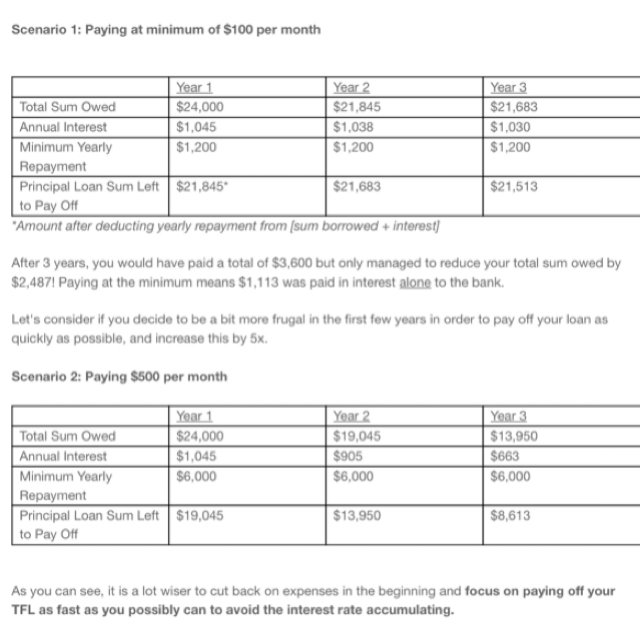

I know of some friends who are "taking advantage" of this and only pay the minimum sum every month, but what they do not realize is that the bank actually gains more money when they do so. Here's why:

I did up a calculation based on today's prevailing bank interest rate of 4.75%.

Which is the better option?

Let me put that into context. Assuming a total loan of $24k, paying $600 vs $155 a month can save you $11k in interest paid to the bank.

The more you pay each month, the less your total sum paid to the bank.

If you pay only $100 a month, you'll make the bank very happy, because they stand to earn 5 figures of interest payments from your procrastination!!!!

I'm actually using very simplistic calculations to illustrate this hard truth that most people don't realise.

In reality, the interest rates are calculated every month, not every year. Also, these rates are not fixed. In a rising interest rate environment, good luck to you if you have any outstanding debt.

Don't believe me? Google "Rickmers Maritime" or "Marco Polo" in today's stock news. These companies are facing the likelihood of winding up soon because they can't pay back their debts.

Happy graduates! Welcome to the real world of paying back your massive #tuitionfeeloan! 🙊

No one probably told them about the pains of #adulting yet.

Shucks so how should I pay off my tuition fee loan now?!?

I have a few solutions. Pick what works best for your situation, or come up with your own? Or leave a comment with your situation and I'll try to see what else I can come up with?

Solution 1: Borrow money from your parents to pay off the loan.

👀 eh mai siao, my parents no money so I had to take TFL, how to borrow from them sia?!?

Okayyyy I recognise that this solution may not work for everyone. But SERIOUSLY if you're lucky enough to have this option, use it!

This was the solution I gave my sister. She was making only slightly over $2k a month in the beginning but didn't want to let the bank earn so much interest from her.

So I suggested for her to either faster pay off, or borrow from someone to pay.

My mum stepped in and loaned her 14k. She was thus debt-free after less than a year. (Okay not really, she still owes my mom!)

If you feel bad about making your parents pay, then pay them the interest on this loan! After all, might as well let your own parents earn interest than to give it to the bank right?

Solution 2: Check if your parents might have bought an endowment or savings plan in the past which they forgot all about.

This was what my cousin did! Her mom had bought an endowment fund for her kids many years ago. It matured a year after my cousin graduated from NTU and so she took that lump sum to pay off her TFL. So the bank didn't really have a chance to earn much interest from her hehe.

Solution 3: Pay off as much as you can, FAST!

Live frugally for the first few years of your working life. Take a little hardship. Save as much as you can. Pack sandwiches to work so you don't have to spend $10+ every day for CBD lunches. Avoid the morning Starbucks coffee and use your office coffee maker, or buy instant coffee powder and make your own. Stop clubbing and spending on alcohol for the time being. Eat out less at restaurants; more at home or at hawker centres. Resist the temptation to buy branded or #taobao #dayrebeauty loots.

Save as much money as you possibly can and use that to pay off your TFL. #dayresavings Put that as your ultimate priority!

Paying $1.2k every month will make you debt free in just 2 years.

Solution 4: Take another loan (at a lower interest rate) to pay back your TFL.

I left this method for the last because it isn't a solution I will recommend off the bat to anyone. Word of warning first: you need to be VERY SAVVY and do all your calculations + timeline planning right in order to execute this well.

But it isn't that hard either. So basically, go look for a loan with low interest rate. Credit cards and banks occasionally offer loans with super low interest rate as a promo eg. BalanceTransfer promotions.

If your TFL is 4.75%, any loan that offers you a lower interest rate can work. The bigger the difference, the more you save.

HOWEVER this method is potentially dangerous and could backfire if you're not careful. The trick is to please read the T&Cs very carefully on promo period and balance your payment timeline very well. If you take a loan that is 0% for the first 3 months then 18% thereafter, obviously that's gonna leave you worse off la.

Ok if you're lost then just ignore this fourth solution because it is a double edged sword. The concept is basically to use leverage to pay off debt. It is an investing concept that rich people use to make even more money. If you don't understand it, then don't do it. Simple rule of thumb.

Why should I pay back my loan first before I invest? Why can't I do both at the same time?

If your TFL interest rate is 4.75%, how much returns do you need to make in your investments to beat that?

Are you confident enough of your investing skills that you can beat 4.75%?

Most average investors can't. We're happy enough to get 3 to 8%. Anything more than that means you're either a genius investor, or just a very lucky one.

If you're getting anything less than 4.75% returns on your investments, you're basically still in deficit. So why bother?

Let me illustrate.

Jane owes $20k for her TFL. Every month, she manages to save $1k. She decides to put $100 to debt repayments and $900 to investments.

Jane is an average investor. She invests in blue chips because she's not very savvy yet as a beginner, and gets 3% in yearly returns. After a year, her investments gives her $380 profits.

Scroll back up to my computed loan scenario table earlier. Remember that when Jane pays only $100 a month, she ends up paying $1k+ in interest to the bank

Therefore Jane has effectively lost $600+ in a year if she pays back her TFL and invests at the same time.

Nadia, on the other hand, is much smarter. She decides to channel all $1000 to repaying her TFL each month. By the end of her first year, she only needs to pay <$500 in interest for the next year. Once she pays off her loan in 2+ years, every return she makes on her investments after that is hers to keep 🎉🎉🎉

So if you're a student or a fresh graduate, please do the smart thing and focus on paying off your loan first before you think of anything else.

This is a piece of advice that your bank or relationship manager probably won't tell you! Try walking into the bank tomorrow and ask them. I bet most of the RMs will recommend you to repay and invest at the same time. Plus I'll bet they'll ask you to invest in unit trusts.

But didn't you say the best time to invest is now?

Yessssss I did. But when I say invest, it includes reading and learning about investments to get yourself ready. I don't literally mean go take your money and buy an investment today!

(fyi I was stupid enough to think that when I first started and received this piece of advice to start asap. I followed a popular male blogger and bought a construction stock. Lost 50% of my money after. Luckily the sum I put in is only $1k! My recent $2k gains on another stock helped to mitigate this losses.)

So pay off your tuition fee loans first, so everything you make in your investments after that will be truly yours to keep 😋💪🏻 #dayreinvest

#financialfreedom #tuitionfeeloan