If you’re on Chocolate Finance, you may have seen the latest news that using your Chocolate Visa card can now earn you a sweet 2 Max Miles per dollar, and there’s an additional USD option for your managed cash account with higher interest payouts.

I’ll talk about the USD option first, since that comes in the aftermath of their SGD rates drop, which shouldn’t come as a surprise to anyone by now if you understand the interest rates environment and the underlying performance of its bond funds.

But how does it work, and is it worth signing up for?

Quick Introduction:

Chocolate Finance is a licensed fund management company with a CMS license by MAS and a digital adviser serving retail investors focusing on giving you better returns on your cash. Founded by the Founder of SingLife (yes, that big insurer we all know who now manages MINDEF insurance), Chocolate Finance was designed to compete with banks as a high return cash account using a managed account construct. It is not protected by SDIC insurance, just like how your investments have no such protection.

Unlike the banks, which generate returns by investing customer deposits mainly in mortgages and credit, Chocolate Finance’s managed account primarily invests in short-duration fixed-income funds and money market funds, giving them greater flexibility to make your money work hard for you.

P.S. If this is the first time you’ve heard of Chocolate Finance, I recommend reading these 2 articles first:

As a customer, you can now choose to either have all of your cash being managed for you in a SGD account, or to add on the USD portfolio as well.

Here’s how the rates stack up:

| SGD Account | USD Account | |

| First S$20k | 3.3% p.a. | 4.6% p.a. |

| Next S$30k | 3% p.a. | 4.2% p.a. |

| Above S$50k | Target 3% p.a. | Target 4.2% p.a. |

This means that your returns for the first S$50,000 is guaranteed by Chocolate Finance. If you opt to add on the USD managed account, you will then be able to get double of their guarantee up to ~S$135,000* i.e. on your first S$50,000 in SGD and your first US$50,000.

*Note that this is based on the prevailing exchange rates, which is currently about 1.36 (USD-SGD).

How does Chocolate Finance earn money?

As a fund manager, they earn when the performance is above the rates given out and take a fee of between 0-2%, depending on the level of outperformance. There is no fee if they meet (or fail to meet) the stated and target rates.

If you’ve already studied their underlying SGD funds before putting your money in (like I always emphasize), then their choice of USD funds should not come as a surprise to you. The majority consists of similar funds with the same issuers, except that it is denominated in USD.

Even if your money is being managed by Chocolate Finance, it is important that you at least know what are the underlying funds in each portfolio as it is where your money goes into:

| SGD Portfolio | USD Portfolio |

| Dimensional Short-Term Investment Grade SGD Fund (DSF) | Dimensional Short Term Investment Grade USD Fund (DSF) |

| Fullerton Short Term interest rate SGD Fund (FST) | Fullerton Short Term interest rate USD Fund (FST) |

| LionGlobal Short Duration Bond SGD Fund (LGF) | LionGlobal Short Duration Bond USD Fund (LGF) |

| Nikko AM Shenton Short Term Bond Fund (NST) | abrdn SICAV I Short Dated Enhanced Income USD Fund (ASF) |

| UOBAM United SGD Fund (USF) |

These are fixed-income funds that have been carefully selected to optimise risk-adjusted returns based on factors like duration, yield to maturity, credit quality and currency. The funds may change at the sole discretion of the portfolio manager; in your app, you will be able to see the information on each fund and the percentage of money allocated to them.

Is it worth getting the USD account?

While the higher rates are attractive, you need to remember that putting your money in a USD account will inevitably subject you to USD-SGD forex fluctuations. If the USD weakens against the SGD, then the higher rates may not end up flat after all. Hence, whether to go for it will depend on you. Here are some guiding questions you can use to help you decide:

- Are you satisfied with returns on your first S$50,000 in Chocolate Finance?

- If you prefer to put your money in a bank, are the current USD fixed deposits – which range from 3.09% – 4.25% with a 6 to 12 months lock-up and have minimum amounts of US$5k to US$100k (the highest is from UOB) – attractive enough for you?

If you answered no to the above questions, then perhaps the USD managed account is worth looking deeper into. Join the waitlist here or in-app in order to get early access when it opens!

In case this reminds you of the last Astrea (8) bonds offer that was open to the public last year in July 2024, you’re not alone. The difference? A lower rate, but without any lock-ups (the Astrea bonds required 5 – 6 years of your money being locked up in exchange for 4.35% p.a. SGD or 6.35% p.a. USD). The USD offer was oversubscribed by 3.9 times vs. the SGD offer at 2.9 times.

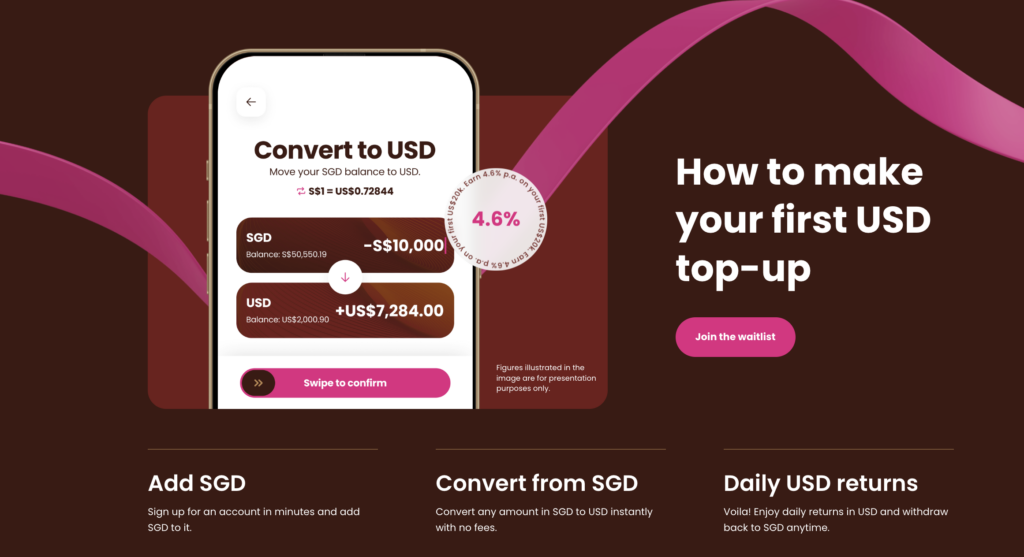

Just like the majority of USD funds in Singapore, you cannot deposit USD directly into your account to start; instead, you will need to transfer SGD first and let them do the conversion.

Note that the exchange rates in the Chocolate Finance app are based on wholesale market rates with a small margin to cover currency fluctuations as follows:

• 0.3% adjustment from Monday 5:00 AM SGT to Friday 12:59 PM SGT

• 0.6% adjustment from Friday 1:00 PM SGT to Monday 4:59 AM SGT

Since your USD will be given a 4.6% p.a. on your first US$20k, 4.2% p.a on your next US$30k and a target 4.2% p.a. on any balances above US$50k, this means that with a US$50k balance, customers can expect to receive US$5.80 daily, US$178 monthly and US$2,132 annually in their app.

Once you have your cash working for you in Chocolate Finance, the next question most of you would naturally have is whether you should click on that “Apply now” button on your app to get the Chocolate Visa debit card.

Up until last week, my answer had always been “no” because there was little reason to get a debit card with zero FX fees when other options like Trust and Youtrip already exist. However, that has now changed because Chocolate Finance has just announced their partnership with Heymax to reward customers with Max Miles each time you spend!

If you were among the 3,000 lucky folks who got to attend my free Credit Cards workshop last year, you would be familiar with HeyMax, which is a miles-hacking tool I use to get extra Max Miles on top of my credit card miles rewards.

Why you should get the Chocolate Visa Debit Card

Having a card that earns you a sweet 2 Max Miles per dollar with zero FX fees, no silly $5 award blocks and no minimum spend with very little exclusions on merchant categories is a card that deserves to be a mainstay in any savvy miles collector wallet.

I say this even though I’m already an avid credit card user who earns anywhere between 1.4 – 10 miles per dollar on my spend. Specialised credit cards give a higher earn rate of 3 to 10 mpd, but only on specific categories of spend. General credit cards make it easier to spend anywhere else, but the trade-off is a lot fewer miles being given (1.2 to 1.4 mpd for most people).

So to have a card that gives 2 Max Miles on almost everything? That’s a game-changer for sure.

Earn 2 Max Miles on almost everything

I foresee this revamped card to become a worthy contender in the near future, because there is simply no other card that gives you such a high earn rate on almost everything in the market right now.

- There is no minimum spend required before you start earning, and no silly blocks of S$5 awarded (you get it per S$1).

- Note that the 2 mmpd reward rate is only given up to your first S$1,000 spend each month, regardless of whether you spend this in Singapore or overseas. Be careful to watch for anything above S$1,000, which will only earn you a (sad) 0.4 Max Miles per S$1, in which case you’ll be better off putting your spend on one of these credit cards for overseas use instead.

- At zero FX fees, this makes it a better card to use overseas than your Trust or Youtrip card (neither gives you any miles).

- The best feature about the card is that most MCCs are included by Chocolate Finance, which includes your rare Pokemons like insurance premiums, bills, charity donations, education school fees and even AXS payments (which are normally exempt from card reward programmes). This thus makes it a good alternative for those of you who weren’t a fan of routing it through CardUp for a fee to earn 1.2 mpd – 1.8 mpd.

- The Chocolate Visa Card has no minimum income requirement and zero annual fees, making it a great option for students to start earning miles with.

The only exclusions stated are for cash top-ups and financial institutions, as below:

| MCC | Merchant Category Name |

| 4829 | Money Transfers |

| 6010 | Financial Institutions – Manual Cash |

| 6011 | Financial Institutions – Automated Cash |

| 6012 | Financial Institutions – Merchandise, Services and Debt Repayment |

| 6050 | Quasi Cash – Financial Institutions, Merchandise, Services |

| 6051 | Non-Financial Institutions – Foreign Currency, Money Orders (Not Wire Transfer), Stored Value Card/Load, Travelers Cheques, and Debt Repayment |

| 6529 | Quasi Cash – Remote Stored Value Load – Financial |

| 6530 | Quasi Cash – Remote Stored Value Load – Merchant |

| 6540 | Non-Financial Institutions – Stored Value Card |

Max Miles never expire and can be converted at a 1:1 ratio to 27 airline and hotel partners, with no fees. This makes it arguably more valuable than Krisflyer miles, which most of you would be more familiar with.

To put things into perspective, if you wanted to travel in business class to Tokyo, you only need 40,000 Max Miles to redeem with Japan Airlines, in contrast to 120,000 Krisflyer miles on Singapore Airlines!

You can apply here to get your Chocolate Visa Card and add it to your mobile wallets (Google / Samsung / Apple Pay) to start earning 2 Max Miles per dollar instantly, even before your physical card arrives in the mail!

Your investment units will be sold to fund your card spend, while your remaining cash in the account continues to earn the 3% – 4.6% p.a. accordingly.

Important: Link to HeyMax to get and track your miles earned

If you don’t already have a HeyMax account, then you will need to sign up for one here and pair your Chocolate Visa card with Heymax under the Your Cards > Add Card menu tab. A test transaction will be charged and later refunded.

Pro tip: Make sure you click to join HeyMax’s public transport campaign here so you get 5 Max Miles per dollar when you travel via MRT, bus or even bike sharing! (3 Max Miles from HeyMax Visa giveaway + 2 Max Miles from Chocolate Finance’s earn rate.) The campaign runs until 28 February 2025.

TL:DR Conclusion

The Chocolate Visa Debit Card has undergone a revamp and (finally) gives you rewards for your spend now, at 2 Max Miles per dollar up to your first S$1,000 anytime, anywhere. With most MCCs included, this makes it an attractive option for anyone who wants to earn miles on usual excluded spend such as their bills, insurance premiums, charity donations or even education payments.

As for your cash in Chocolate Finance, there will soon be a USD managed account option released later this month, which has higher rates of 4% to 4.6% p.a. on your funds. If you choose to go for it, you will now enjoy rates guaranteed by Chocolate Finance on your first S$50,000 and US$50,000 (vs. just S$50,000 previously).

Would you be signing up for their USD account waitlist or activating your Chocolate Visa Debit card in lieu of these offers?

Want to start earning daily returns on your money, or get 2 Max Miles for most excluded MCCs on your Chocolate Visa card?

Get your rewards on Chocolate Finance here.

Disclaimer: This post was written in response to my readers who have DM-ed me to ask about Chocolate Finance's latest USD offer. While it is NOT sponsored by Chocolate Finance, however, I've included my own referral link as a customer of Chocolate Finance (which gives the same rewards as all of your friends').

If you appreciated my work on this article to help make Chocolate Finance's offerings easier for you to understand and make a decision on, you may sign up here using my referral link.

With love,

Budget Babe