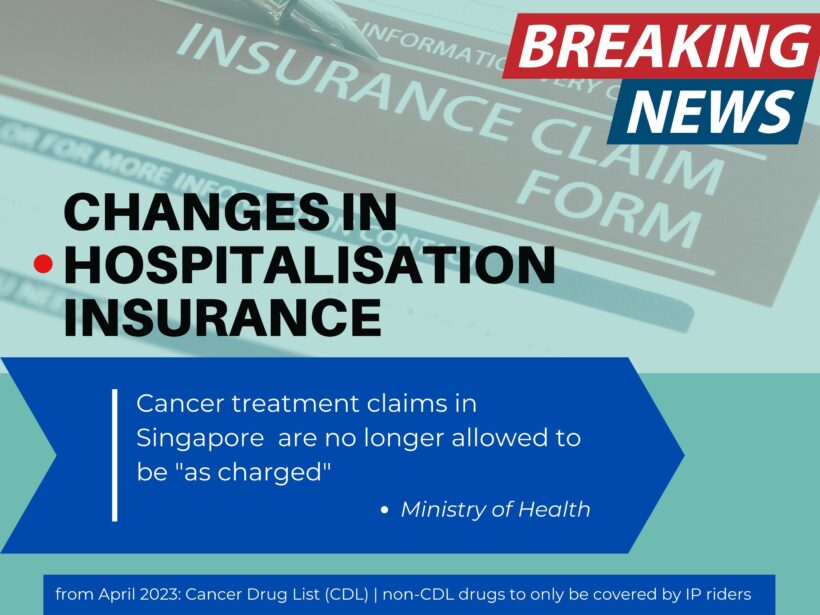

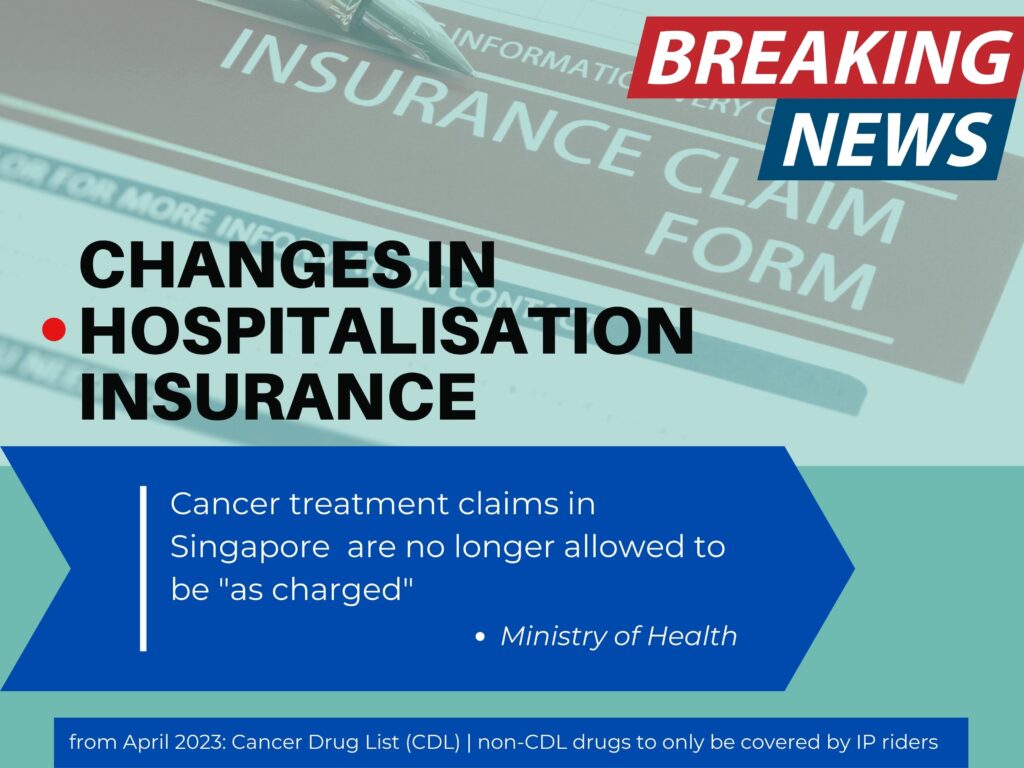

Now that cancer treatment costs will no longer be covered 100% in Singapore, the importance of having a supplementary rider for your hospitalisation plan is more crucial than ever before. But which one should you get?

If you don’t already know, a massive change for ALL Integrated Shield plans (IP) in Singapore has just taken effect from 1 April 2023 onwards. Patients will no longer be able to claim for the full costs of their cancer treatment coverage “as charged”, and claims will now be limited to the drugs on the Ministry of Health’s Cancer Drug List (CDL) (view it here) – up to a maximum of 5 times the coverage of the basic MediShield Life.

Being treated for cancer is already a stressful affair. Now, that’s going to get worse, as you have to start worrying about having enough cash to pay until you complete your cancer treatments.

And should your doctor assess the best treatment for your condition to be non-CDL drugs or maybe even a combination of CDL and non-CDL drugs, then you may feel the financial strain as non-CDL drugs are not covered under your IP anymore. Even if it is under the CDL, you may still need to pay cash if treatment cost exceeds MediShield Life’s coverage limits.

What if you still want to be able to claim from your insurer for outpatient cancer treatment costs on non-CDL drugs?

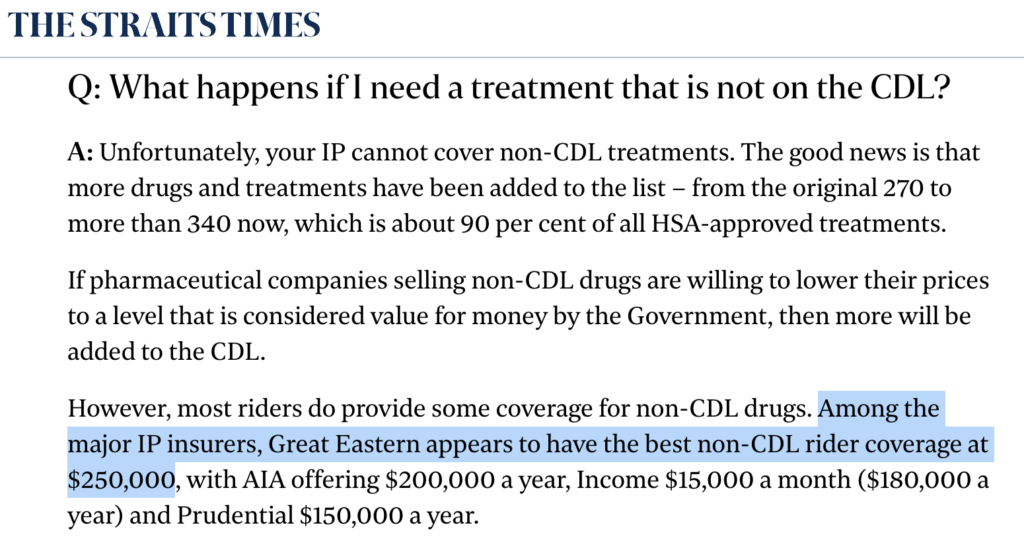

Well, only your supplementary riders will cover you from here, and your choice of insurer for the private IP plan and its supplementary rider will determine how much you can claim.

How will MOH’s Cancer Drug List affect us?

With this change, you can no longer assume that as long as you seek treatment for cancer in a public or restructured hospital, your insurance will cover it. Instead, you will now need to check whether the treatment your doctor prescribes is under the Cancer Drug List. Even if it is under the Cancer Drug List, you may still need to pay cash if treatment cost exceeds MediShield Life’s coverage limits.

But will we get to control what cancer drugs are suitable for our condition, or even get to ask our doctor to recommend only drugs from the Cancer Drug List?

The reality is, no one knows until you get diagnosed. It is estimated that 10% of patients treated in the public sector will not have their current treatment covered by drugs in the Cancer Drug List, with a higher percentage for those being treated in private hospitals.

With the newest change, even patients on Integrated Shield Plans (IPs) will only be covered up to 5 times of the prevailing MediShield Life drug limit+ i.e. currently $200 – $9,600 a month. With today’s high medical costs for cancer treatment, this means should your treatment costs exceed this amount, you will have to be prepared to fork out a higher cash portion.

Note: Cancer treatment is usually 2 – 6 weeks per cycle, and depending on the type and severity of your condition, you may need more than just one cycle to kill off the cancerous cells.

+ MediShield Life Limit is dependent on cancer drug treatment as it ranges from S$200 to S$9,600. Refer to the Cancer Drug List (CDL) on the Ministry of Health’s website for the latest MediShield Life limits.

Even MOH has acknowledged that affected patients who are facing this dilemma have a few options:

- Switch to a treatment on the Cancer Drug List

- Get coverage through supplementary riders or standalone critical illness plans

- Apply for subsidised care and support from MediFund via a medical social worker

As it stands, more than 70% of people here do not currently have supplementary IP riders.

So if you’re among the 70%, you might want to think seriously about adding a rider to your hospitalisation coverage to address any gaps while you still can.

How will a supplementary IP rider help?

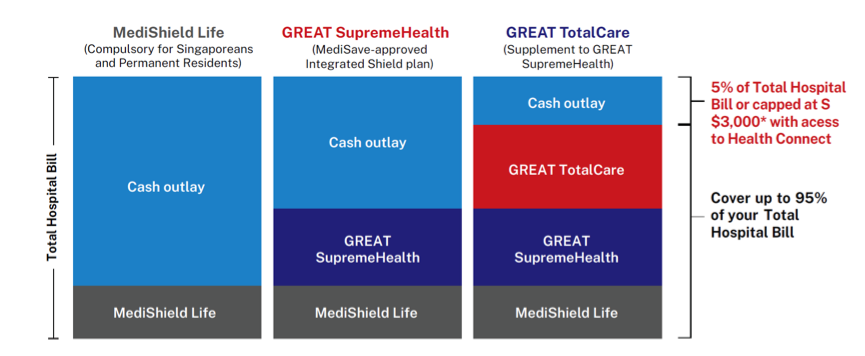

To understand how riders can help, you first need to understand how the different coverage for hospital bills work here in Singapore. The below shows how the Integrated Shield Plan and supplementary rider from Great Eastern can complement your MediShield Life coverage:

With each added layer of coverage, you reduce your out-of-pocket expenses. So if you’re concerned about not having enough cash to pay for your hospitalisation or cancer treatments, then having a supplementary rider can significantly reduce your out-of-pocket payment and prevent you from running into a scenario where you have to wipe out your entire emergency funds, or worse, resort to borrowing money just to get treated.

But before you rush into getting a supplementary IP rider, you should also note that premiums for it must be paid for in cash.

Since we cannot use our MediSave account to pay for it, we have to plan for and make sure that the supplementary riders fit our budget (of course, should your financial circumstances change, you can also contact your insurer to understand your different options available, such as downgrading your coverage).

Without a supplementary rider, patients will need to pay the deductible (which is cumulative over the year if you have multiple hospital visits) and 10% of the rest of your bills. But with a supplementary rider, you’ll only pay 5% of your bills, as long as medical treatments/consultations are being sought through one of the panel specialists.

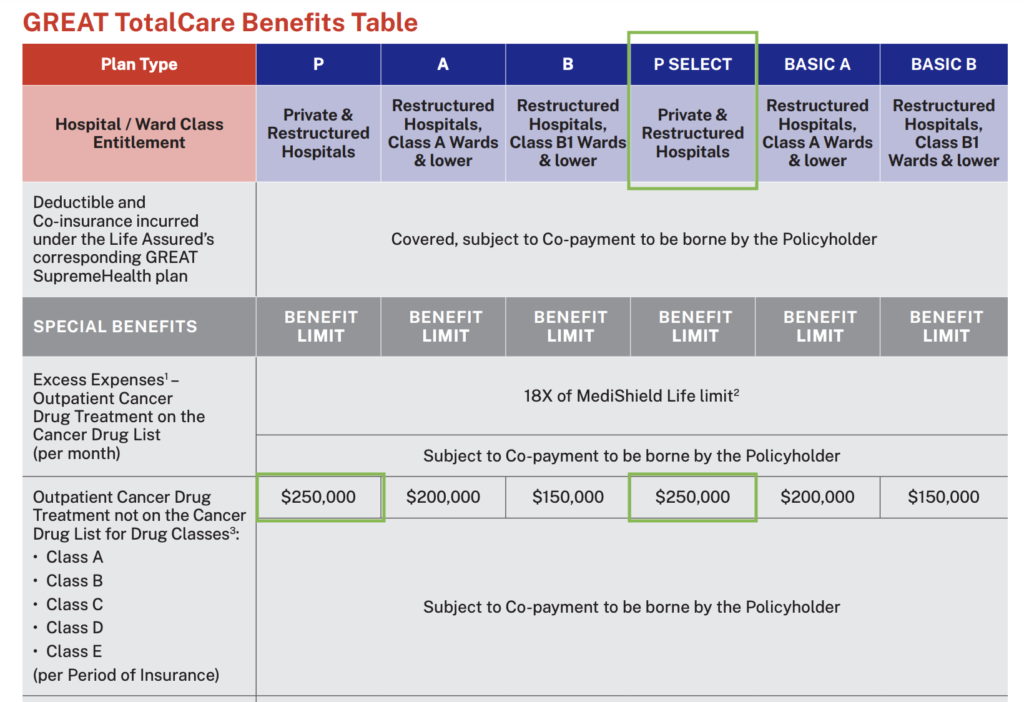

And among all the IP insurers in Singapore right now, Great Eastern has the highest non-CDL rider coverage at S$250,000 – yearly.

The best part? Great Eastern’s premiums are also among one of the most affordable.

So if you asked me, going for an Integrated Shield plan like GREAT SupremeHealth and bundling it with a supplementary plan like GREAT TotalCare will be generally sufficient for most of us as we can be covered for up to 95% of our total hospitalisation bill.

As for the portion that you’ll need to pay? Most of it will now be capped at S$3,000*.

*This cash outlay of S$3,000 per policy year only applies with GREAT TotalCare provided expenses were incurred under panel providers or at restructured hospitals. As a good practice, I recommend always checking with your insurer if the doctor or hospital you’re getting treated at is on their panel so that you avoid any bill shocks later on.

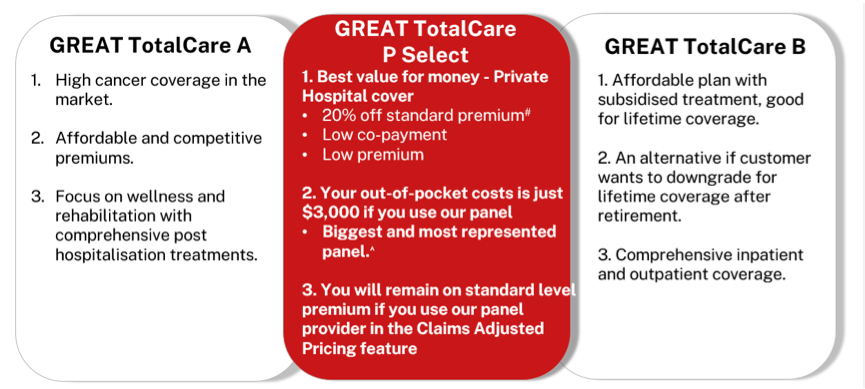

According to Great Eastern, their GREAT TotalCare P Select has one of the most comprehensive list of benefits at an affordable premium, possibly making it one of the most value-for-money hospitalisation plans offering coverage across both private and restructured hospitals.

Sponsored Message

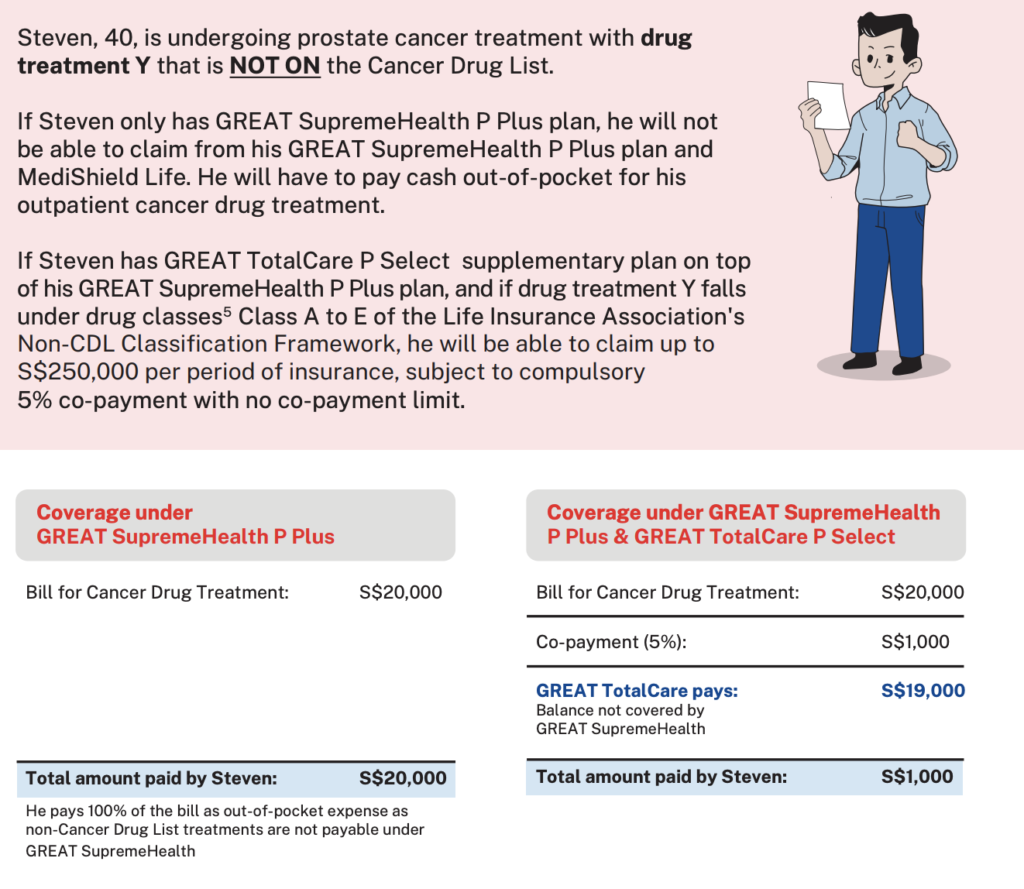

Here’s how a claims illustration on Great Eastern’s IP and supplementary riders for a non-CDL cancer drug treatment will now look like:

| MediShield Claim Limit | GREAT SupremeHealth | GREAT TotalCare P Select | GREAT TotalCare P | |

| Cancer drug treatment (non-CDL) (yearly limit) | Not covered | No longer covered | $250,000 | $250,000 |

| Cancer drug services (yearly limit) | $3,600 | $18,000 (5 x MSHL) | As charged, subject to 5% co-payment^ | As charged, subject to 5% co-payment |

5 The Non-Cancer Drug List Classification Framework provides greater clarity and facilitates a common understanding of non‐CDL treatments covered by supplementary plan. Under the framework, cancer drug treatments are grouped according to regulatory approvals and clinical guidelines

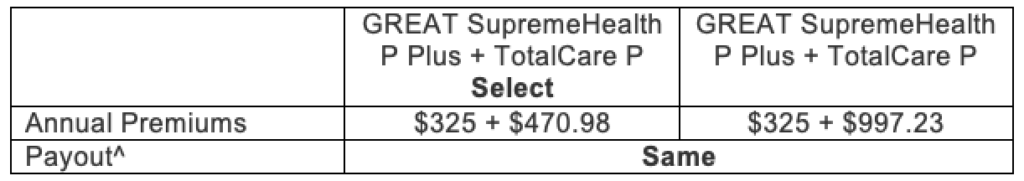

Since premiums rise with age, let’s look at how much the premiums vs payouts for “Steven” (age 40, non-smoker) would have been in the above scenario:

^ Interestingly, even if Steven had gone for the higher-tier rider (TotalCare P), he would still have received the same coverage as if he had been under the TotalCare P Select rider instead – despite paying lesser premiums.

Thus, for those of you who are more budget-conscious, it seems pretty apparent that TotalCare P Select is a more value-for-money option.

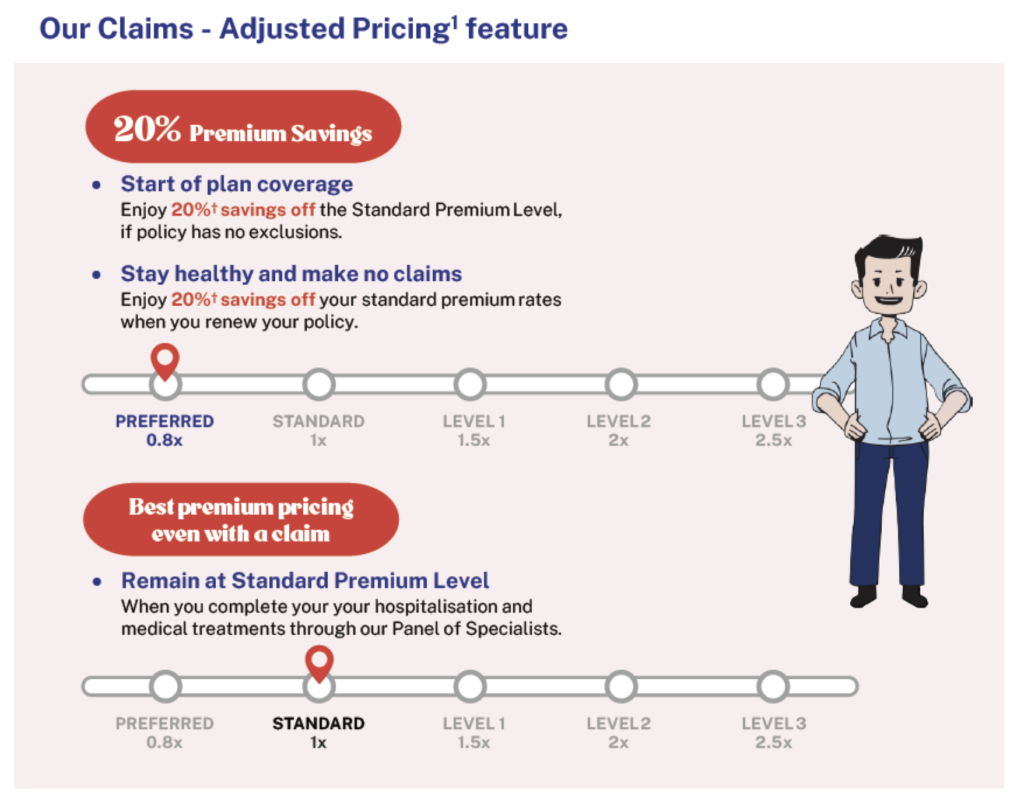

– you are healthy at the time of application.

– If you do not have any claims during your coverage period, the 20% off the Standard Premium Level for each policy renewal year applies too.

^ Co-payment cap is subject to exceptions

Considering GREAT TotalCare P Select?

As someone who’s still in good health and aiming to secure a comprehensive coverage without breaking the bank, if you asked me, GREAT TotalCare P Select certainly ticks both that criteria.

In comparison with other insurers, at ~$300 – $450 for those aged 20 – 39, the premiums are almost half of what it’ll cost for other similar supplementary riders with private healthcare coverage, but offers similar privileges when it comes to what matters to me.

2 The benefit limit for outpatient cancer drug treatment varies in accordance with the MediShield Life limit per month (pursuant to the Cancer Drug List found on the Ministry of Health’s website (go.gov.sg/moh-cancerdruglist)). The Ministry of Health may update this from time to time. For the purposes of assessing the MediShield Life limit, “per month” shall mean the particular calendar month in which the outpatient cancer drug treatment was administered and/or received.

3 Refer to the “Non-CDL Classification Framework” by Life Insurance Association for the classification of cancer drug treatments that are not on the Cancer Drug List (https://www.lia.org.sg/media/3553/non-cdl-classification-framework.pdf). The Life Insurance Association may update this from time to time.

Not only are its premiums one of the most affordable in the market, it also offers comprehensive coverage that can help ease your financial worries in times of hospitalisation.

What’s more, you can get 20% off the Standard Premium Level as long as you are healthy at the time of application. And if you do not make any claims during your coverage period, you will continue to enjoy the 20% off (the Standard Premium Level) each policy renewal year.

And for those of us who do intend to seek treatment at public or private panel specialists, then GREAT TotalCare P Select does appear to be more value-for-money instead.

Sponsored Message: Get access to Health Connect

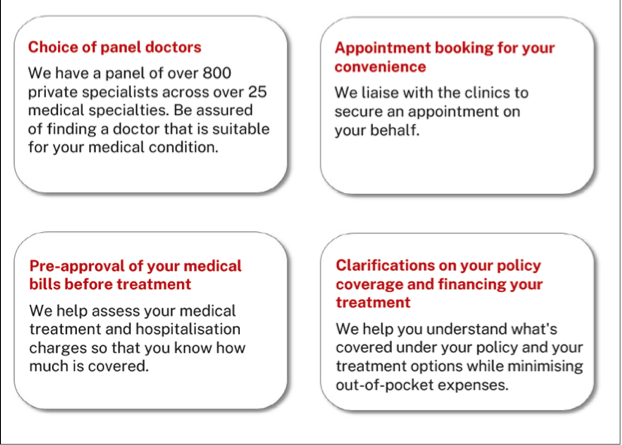

As a Great Eastern SupremeHealth policyholder, did you know that you also get access to Health Connect?

With one of the largest panels of over 800 private medical specialists across 25 specialities in Singapore, you can choose your preferred medical specialist and get treated with full certainty on what your policy covers. That way, you can avoid any bill shocks and focus on recuperating instead.

Call Health Connect at 6563 2233 to help you with:

What’s more, don’t forget that going through Health Connect also gets you recommendations on the most suitable medical treatment options so that your premium rate for your next year’s policy renewal will remain at standard premium level. This way, you can get quality healthcare with your preferred panel specialist, whether in a restructured or private hospital, and still prevent your premiums from increasing by 1.5 – 2.5 times due to a claim.

Conclusion: Get a supplementary rider if you can afford it

With the latest changes, having a supplementary rider is now becoming a non-negotiable for those of us who do not wish to bear the burden of huge out-of-pocket hospitalisation bills.

And as part of my financial planning, the last thing I’d want is to have my entire emergency funds and life savings wiped out by an unexpected condition or hospitalisation.

This is why I continue to keep my Integrated Shield Plan and rider (supplementary plan) to avoid such a scenario, but because I need to ration my budget to pay for other types of insurance as well, I choose to forgo the highest level of riders, overseas coverage and daily hospital allowance. These are nice to have, but ultimately not something that I really need.

If you too, are concerned about the financial impact that the latest Cancer Drug List might have on you, please speak with a financial representative to understand the different options available that you can look at, as well as what they’ll cost you.

And if you’re looking for Integrated Shield plans and/or riders that provide comprehensive coverage, while rewarding you for healthier living, you may want to check out Great Eastern’s plans here.

Disclosure: This post is a sponsored collaboration with the Great Eastern Life Assurance Company ("Great Eastern"). All opinions are that of my own, and information accurate as of June 2023.

Disclaimers: All premium rates are inclusive of 8% GST. Premium rates are not guaranteed and may be adjusted based on future experience. All ages specified refer to age next birthday. GREAT TotalCare is not a MediSave-approved Integrated Shield plan and premiums are not payable using MediSave. GREAT TotalCare is designed to complement the benefits offered under GREAT SupremeHealth. This advertisement has not been reviewed by the Monetary Authority of Singapore. The information presented is for general information only and does not have regard to the specific investment objectives, financial situation or particular needs of any particular person. Protected up to specified limits by SDIC. Information correct as at 21 June 2023.