Rickmers Maritime has officially fallen. I warned readers last year who asked me if this high dividend yielding stock could be good. My answer was a hard one for many of them to stomach – after all, Rickmers dividends have been high for quite some time. You can find the warning article on my blog to stay out (Sept 2016).

Well, the company is now winding up after failing to reach a deal with their lenders. Those who bought their stock? Burnt.

Those who bought their bonds, thinking it'll be safer? Also burnt. It is quite unlikely that they'll even get their capital back.

Sigh. I hope these people were none of you guys here. Feel quite bad for them, buying into something they thought they could make good money from, only to end up losing everything 😪

If you think MAS is gonna protect you, nope. They can't do anything.

Investors have to take personal responsibility for their decisions. In the case of bond investments, they need to look beyond the headline yield offered. (MAS statement, Nov 2016, ST)

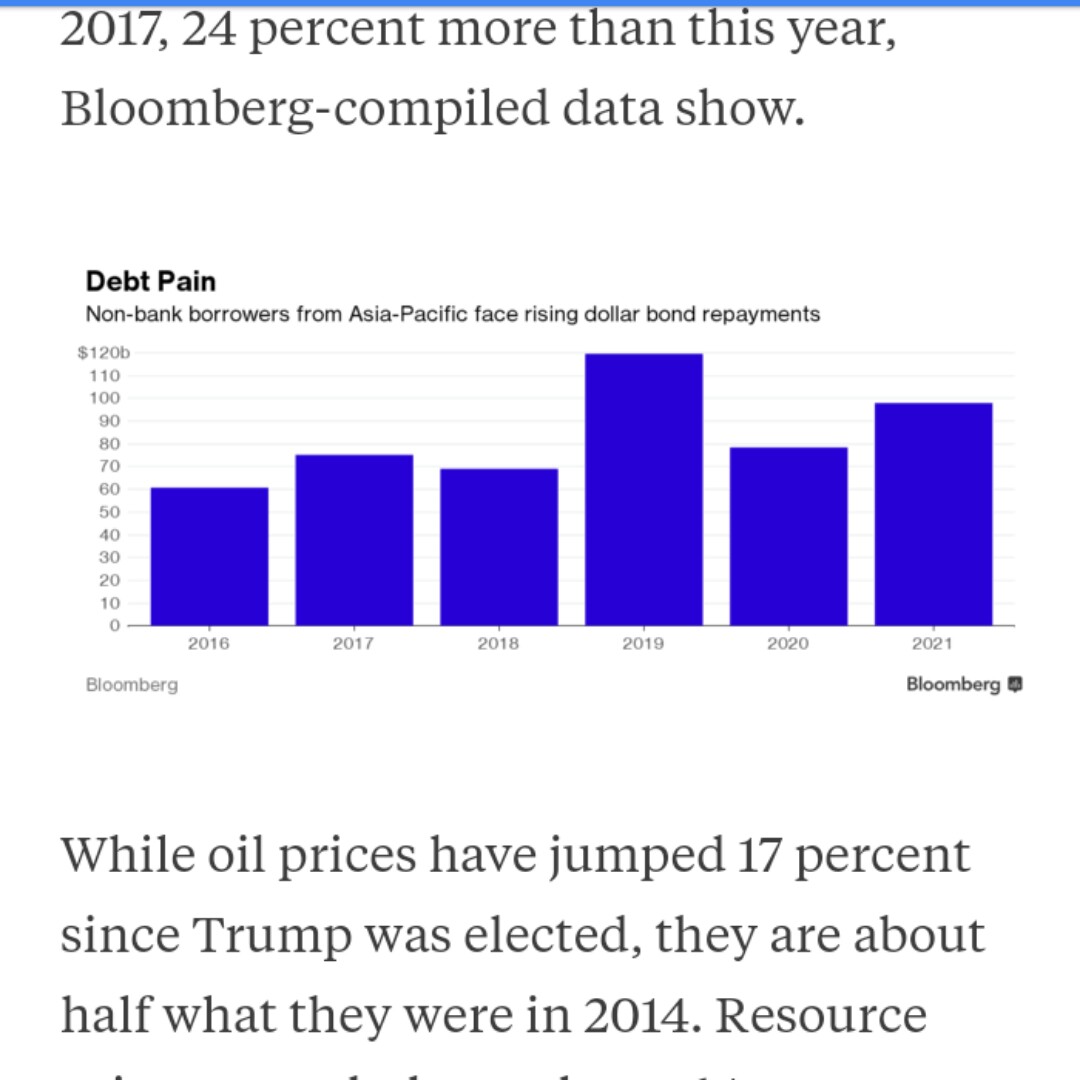

Over $70 billion bond repayments are due this year. Will you be the lucky or unlucky ones?

What are bonds?

See @sgbudgetbabe:051016 on a tutorial covering what bonds are all about, and @sgbudgetbabe:260916 for whether bonds are truly safe to invest in.

What about the bonds sold to me by my banker?

Did you know? Almost half of the $1 billion bond defaults last year were sold by private bankers who earned rebates by doing so. They "advised" their clients on such unrated securities and got money in their pocket for it.

This is why I don't just buy whatever a banker / insurance agent / financial advisor recommends me. The huge conflict of interest makes it extremely difficult for most to stay objective. Yes, there are good ones, but the industry has too many bad eggs too.

💂 Mr Jin invested $50k in Swiber bonds (now defaulted) and this was what he said:

“I was simply following the advice of my relationship manager, who never told me much about the company. I just thought, a bank in Singapore, with this much regulation, would not recommend risky investments”

😪😪 see how important financial literacy is? #adulting

Good luck trying to get your banker to give you the money you thought you would get when the bonds default.

Why you should care about bonds

1. Bonds are relatively safe investments.

You know how an IOU works? Bonds are somewhat that way. Companies raise money from their retail investors for various reasons – expansion, operations, debt repayments etc. In return, they'll give you a high(-er) interest rate than the one you'll get from the banks. However, how "safe" they are depends on who the issuer is as well.

2. Bonds are usually a key part of a well diversified investment portfolio.

That typically consists of cash (held in high-yielding accounts or fixed deposits) / gold + bonds + stocks. Such as the Singapore Permanent Portfolio which I mentioned before as a fairly fail-proof methodology which some people swear by.

(I'm not one of them, but I feel it is a pretty good strategy too.)

3. People invest in bonds as they provide predictable, recurring income and guarantee your capital.

4. Look out for the different types of bonds.

I get quite miffed when I see people or insurance agents recommending bonds carelessly – especially when it comes to corporate bonds! Poor victims who get burnt. Whatever happened to ethics and responsibility?

I tend to go for government bonds > government-linked bonds > banks bonds > corporate bonds > corporate bonds > bonds by companies in cyclical industries.

(From Koreaboo)

NOOOOOOOOOOOOOOO!!!!!!!! #kdramas