|

Disclaimer: I loved UOB One, but nothing riles me up faster than a badly marketed financial product (okay fine, a badly marketed financial product through lifestyle influencers who mislead their followers for the monetary benefit of a sponsored post come a close second). And because a lot of people have been asking me about UOB Stash, I thought I’ll do a review here so folks know what you’re REALLY signing up for.

|

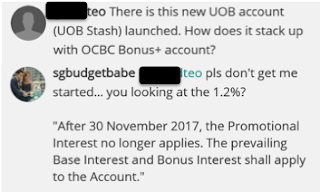

| Err, that’s a lot less than what you’ll earn on the UOB One account, which is a much more superior account to park your money in if you’re using UOB, in my humble opinion. Read on to find out why. |

I’m a huge fan of high-yield saving accounts that give you more bang for your buck. In fact, I’ve openly talked about the various options available on this blog before, including UOB One. But hey, UOB Stash isn’t one of them.

I had hoped UOB (as well as social media influencers working on future UOB campaigns), would have learnt their lesson from the UOB Krisflyer saga on how NOT to market a bank product. In fact, I had even offered to chat with the UOB Stash marketing team directly to share with them my thoughts on how they should manage this round of marketing in order to avoid getting flak for it as well, but was told that my offer got shot down. Oh well, maybe they know better so they don’t need my inputs, I thought.

Apparently not.

If you’re still wondering what on earth happened on the UOB Krisflyer saga, head over here for a quick recap: Does the UOB Krisflyer Influencers’ Campaign Reek of Dishonesty?

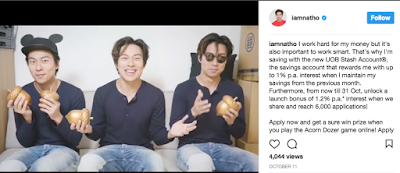

Anyway, I digress. I’m not here to talk about UOB Krisflyer, but about UOB Stash instead. Take a look at one of the campaign posts promoting the account, by one of the same influencers involved in the UOB Krisflyer saga:

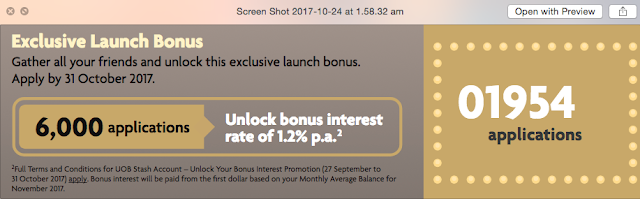

“From now till 31 Oct, we can all unlock a 1.2% p.a. interest

when we all reach 6,000 applications” (Christabel Chua, 2017)

I showed some of my friends this same post and asked them what they understood from the Instagram caption. Most of the conversations sounded somewhat like this:

What do you think of this account? Considering most savings accounts only pay 0.05% p.a. of interest, do you think this is a good product?

I get 1.2% p.a. interest right?

What do you suppose that means? What does per annum mean to you?

I get 1.2% in one year lah, duh.

So if you put in $10,000, how much should you be getting after one year?

(opens the calculator app) $120.

WRONG! If my calculations are correct, you’ll get slightly under $15. For $10k you only get 0.05% of interest for the whole year. That 1.2% that Christabel is telling you about? It lasts only for the month of November. Which means you’ll be getting 0.05% for the remaining 11 months.

WTF?!?!?!?!!?!?

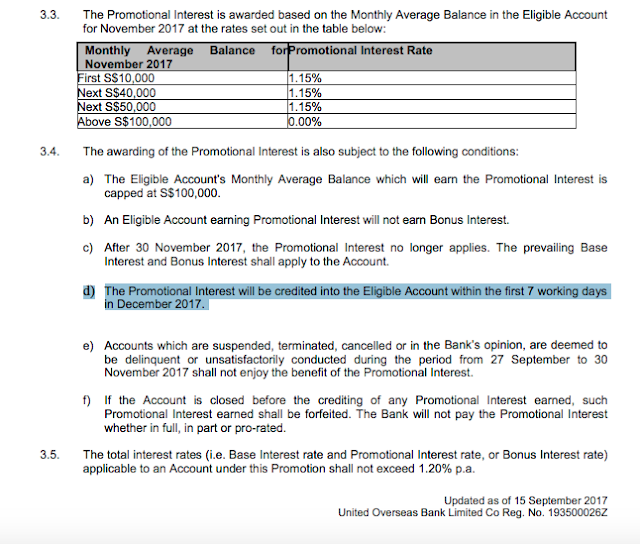

The first thing you need to know about UOB is that their interest rates are often tiered. This is an important caveat, especially for the UOB Stash account, but this was the part which none of the sponsored influencers actually bothered to tell you about. (The only ethical one who did was Dollars & Sense, and that’s the only sponsored post on UOB Stash that you’ll want to read.)

What this means is:

And if you fall below $10,001 anytime, you can expect to get a miserly 0.05%, which is pretty much the same as your POSB Passbook saving account that you’ve had since you were a kid.

|

| Read the full T&Cs here. |

Let’s repeat that, in case you missed it:

After 30 November 2017, the Promotional Interest no longer applies. The prevailing Base Interest and Bonus Interest shall apply to the Account thereafter.

In other words, you’re NOT really getting 1.2% for the whole year, but for ONLY one month (don’t ask me why it was still marketed as p.a. lah, because per annum = per year to me as well).

You know that 1.2% interest that all the lifestyle influencers were hyping about this campaign? Yup, it lasts only for ONE month, which all of them conveniently left out while trying to influence you into opening an account.

But wait, unlike Melissackoh who claimed she ticked Sydney off her bucket list all thanks to #Krisflyer UOB the debit card (I’ve no words if you genuinely believed she spent $60k just to redeem a flight to Sydney, which you can get for just $500 on Scoot LOL), I shall refrain from jumping to conclusions and assuming the remaining influencers didn’t know about this point. Take a look at what they captioned instead.

|

| I was actually really confused by this post. Perhaps Leia and Lauren must be flush with cash if they’re opening a UOB Stash at this age? Hey mama Amber! I’ve got a better lobang for you. Check out the CIMB Junior Saver account instead, which gives you 0.8% immediately from your first $1000 onwards (instead of $10k!) |

Let’s play a game of Spot The Difference! Do you see it?

Eden, Roz, Nat, Amber and Zoe Raymond all said 1.2%*, but I’m wondering why Christabel was the only one who didn’t put an asterisk behind the 1.2 p.a. Just like how she didn’t declare the post was sponsored in the UOB Krisflyer campaign, then later quietly added the #ad hashtag after Aaron and I called them out on their bluff here. I don’t know what to make of this, but it does explain why more consumers are losing faith in influencer marketing today.

These are very important conditions to be met.

Are you disappointed by now? So am I, but let me try to help. If you’re looking for somewhere to park your cash, here’s what I’ll recommend instead.

Other High-Yield Savings Account

For starters, I’d recommend you look into DBS Be Your Own Boss, OCBC 360, UOB One, Bank of China SmartSaver and POSB Cashback. I’ve reviewed each of them at length, so you can just click to read on how to maximise the interest under each scheme.

Or, if you just want a plain vanilla bank account, how about CIMB FastSaver, which gives you 1% (capped at $50k) with no frills? If you already have that, other options could be CIMB StarSaver (0.8% p.a.) or RHB (1% p.a. after your first $10k, please check out their tiered interest table here).

If you don’t need cash liquidity, try these fixed deposits instead (I compared across some really awesome ones here).

Short-term Endowment Plans

You can now get short-term endowment plans from the various insurers which offer capital and interest guarantee on your monies.

Take the FWD endowment plan for instance, which allows you to start from just $1,000 and guarantees 2.02% interest on your deposits. (To avoid exploiting the scheme, there’s a cap of $15,000 per person.) This would be great for if you’re looking to park your emergency funds somewhere or you’re saving up for a big-ticket item in the future, as you’ll need to leave it there for 3 years.

You can read my review on FWD’s endowment plan here. Just note that this needs to be money you don’t have to use in the next 3 years, because early termination of endowment plans generally incur charges, and the same applies here.

Aside from FWD, the other insurers – Great Eastern, Prudential, Etiqa, etc – have also run their endowment offerings quite recently. However, most of them have since closed, and Etiqa requires you to put in a minimum of $10k+$5k and lock it up for 6 years instead of 2.

Did you get misled by the 1.2% p.a. when you saw those posts? So did I. But at least now we know better.

So where should you park your money? Well, when you compare these alternatives to UOB Stash like I have, I think the answer is pretty obvious. Or, if you’re at a UOB branch already, then just open the UOB One account instead and its tagged credit card. (UOB calls it the most generous rebate card in Singapore.)

Hey, at least it’ll give you a lot more bang for your buck than UOB Stash.

With love,

Budget Babe

Budget Babe has a passion for helping her fellow Singaporeans get more out of their savings. No gimmicks and no marketing fluff. Oh, and always full disclosure. I don’t believe in misleading my readers just because I’m paid for a sponsored post.

Note: If you can’t tell by now, this is NOT a sponsored post, and neither is it an ad for UOB One, although my previous review here was. 2 years on, I still think no other UOB savings account comes close to being as good.

6 comments

usually, i tend to avoid those that are overhyped by so-called social influencers. UOB is extremely bad at this. and thats why i dont even have any banking relationship with them. not even their uob one card/acct.

personally, i use the cimb (1% – totally effortless. dump and forget) and the dbs multiplier (2.68% for 3 catergories). thats a quota of 100k already. more than enough for the average working adult to max out the high yielding acct for spare cash currently

Woah.. Great job Budget Babe! Need people like you to police the finance industry and prevent consumers from being misled.

btw, there is a new multiplier programe wef 1st Nov.

perhaps, something you can do a write up on? =)

I will!

Actually, that sounds like the job for MAS! I don't work there! But I will point out stuff I find along the way for sure (as long as I have the resources to investigate and verify)

You're one of the savvier ones! But considering the audience this campaign was targeted at, there were so many who misunderstood the 1.2% cos it was marketed on such a misleading manner. UOB's website was very clear and transparent, but not the posts on Instagram! I've gotten a few DMs already from folks asking what they should do if they've already opened an account. Still haven't replied them yet…what on earth am I supposed to say?!? Tough luck? Closing the account isn't really an option either considering you'll have to pay $30 if done in the first six months. Haiyo.

Comments are closed.