If we’re not careful about banking fees, we’ll be losing a lot more than we gain from the bank.

I learnt this first-hand when I didn’t monitor a savings account I had opened during my university days. I always thought just keeping it aside would be safe, but boy, was I wrong.

By the time I realised it, the bank had deducted hundreds of dollars from my account to pay for the “account servicing fee” (in other words, just keeping my money for me), as my deposit amount had dropped to below the required minimum balance.

This was completely new to me as I’ve never experienced this with my POSB account before.

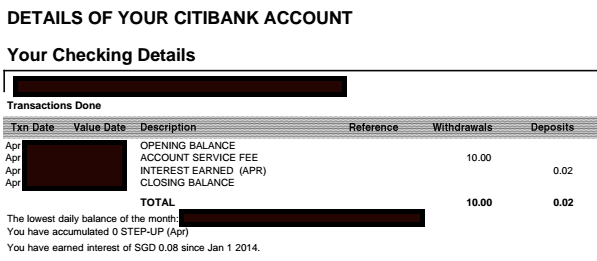

I didn’t manage to pull up all the records, but here’s one of them. The bank paid me a pathetic 2 cents in interest, while they happily deducted $10 from me. That’s almost like the equivalent of the bank getting 49,900% in returns from me just because I was an ignorant customer!

Hundreds of dollars had been taken away from me without my knowing it, all because I didn’t bother checking my monthly banking statements. You can bet that I always opened up every single banking statement and letter from then now. Even so, I never got to earn back the money they had taken away from me when I wasn’t watching.

Look at that pathetic interest paid over 12 months, which pales in comparison to the interest I get from my other savings accounts with other banks.

So ever since I became more financially conscious, I’ve made several moves and changes – such as moving my money into savings accounts that pay out higher interest rates, cancelling my ILP, and being smarter about my credit cards.

What prompted this post? Well, the same bank recently just revised their rates again:

– They’ve TRIPLED their minimum banking amount requirement (for you to be exempted from their hefty account servicing fees)

and

– Increased their account service fee by a whopping 50%!

I’m now considering whether to cancel my account completely, put some money in there, or make my next investment purchases through them so that the total balance will meet their insanely sky-high requirements. Any thoughts?

For those of you wondering whether you’re affected, just check if you’re a customer of the following bank:

If so, you now have about 2.5 months to make a decision / change.

Be smart. Don’t be silly like me to end up paying all that hundreds of dollars to the bank for nothing. It is a dreadful mistake which I still haven’t quite gotten over.

With love,

Budget Babe

12 comments

Banks don't need more deposits now;but when they need it they will lower the minimum. Just commercial decision.

Ask for waivers for the charges if the charges are recent.

LOL I had the same issue with Citi. They were aggressive and had plenty of ATMs at MRT stations amd were convenient. Requirements were low initially, but I cut them loose after the account minimum was raised to freaking $5k. I generally liked their credit card and customer service though, so I kept one card from them.

Kevin

Citibank is like that one lah. They will really suck it until there's nothing left! lol

I like their credit card. Never did like their savings account. Hence, i only keep 1 card from them for the benefit of buying Starbucks with rebates… 😛

Ya man I might be closing the savings account. The newest T&C update is really getting out of hand.

Sadly now there really isn't much of a reason for me to keep my savings account open with them anymore after their stunt this time!

Boy, I remember having to pay a withdrawal fee each time I took money out when I was using their account back in the States. It was crazy. If you thought $5k is 'freaking', then what is $15k now? Haha.

I would, but the charges were already happening for a few years before I discovered it. Too late to waive it off now.

Personal decision now to shut the account then. Haha. Why give up on the whole forest when there are plenty of other banks around to jump ship too?

"The bank paid me a pathetic 2 cents in interest, while they happily deducted $10 from me. That's almost like the equivalent of the bank getting 500% returns from me"

So now I have to correct your calculations too? 🙂 If we follow your 2 cents to 10$ story, the 'return' that the bank is making from you is 49,900%, not 500%! It takes away some credibility from your article when your own calculations are so wrong.

Thanks for highlighting! You're right, I computed 10/0.02 when it technically ought to be (10-0.02)/0.02 x 100 since I wrote returns. Will edit the miscalculation!

Comments are closed.