Inspired by Avengers: Endgame, SingSaver is currently running a Battle of the Cards campaign to find out what’s the best travel, cashback and rewards card in Singapore. Here’s my take.

The current battle (till 12th May) is for the travel category, where they’ve pitted the following favourites up against one another:

Frankly, I’m really only a fan of two of the above cards, so I’m not gonna shout out for the other two cards just for the sake of this campaign. So I’ll let you know why my vote is on the UOB PRVI Miles Card, and why I think the Citi PremierMiles is a good dark horse, whereas the other two are…not worth my time mentioning because I don’t like them, period.

If you’ve followed my writings closely over the past few years, you might also remember that 2 years ago when I criticised the UOB Krisflyer Debit card which many lifestyle influencers were gushing about (with the #sponsored / #sp tag noticeably missing from their posts too – click here to read about the whole saga lol), I also did a follow-up post here where I suggested better alternatives if you wanted to earn miles.

The CitiPremier Miles and UOB PRVI Miles Card were specifically flagged out in that post. My opinion hasn’t changed since then.

What’s qualifies as the “best” travel credit card, in SGBB’s books? Simple:

- High miles per dollar (mpd) earn rate

- Expiry of miles

- Ease of redemption

Perks like lounge access and airport transfers may sound fancy but frankly, I don’t care much for them because I don’t use it anyway.

My vote (out of the four) goes to the UOB PRVI Miles Card, which I use for lots of stuff – basically anywhere that my cashback card doesn’t give me a good return, or where I’ve reached the maximum limit for bonus cashback on a card but don’t foresee myself spending enough to hit the minimum criteria for another card.

Hey, I may be known as Cashback Girl, but I’ve always said that it would still be good to hold one or two miles card as well for all the cases where using your cashback card wouldn’t make much sense.

Here’s why.

UOB PRVI Miles Card

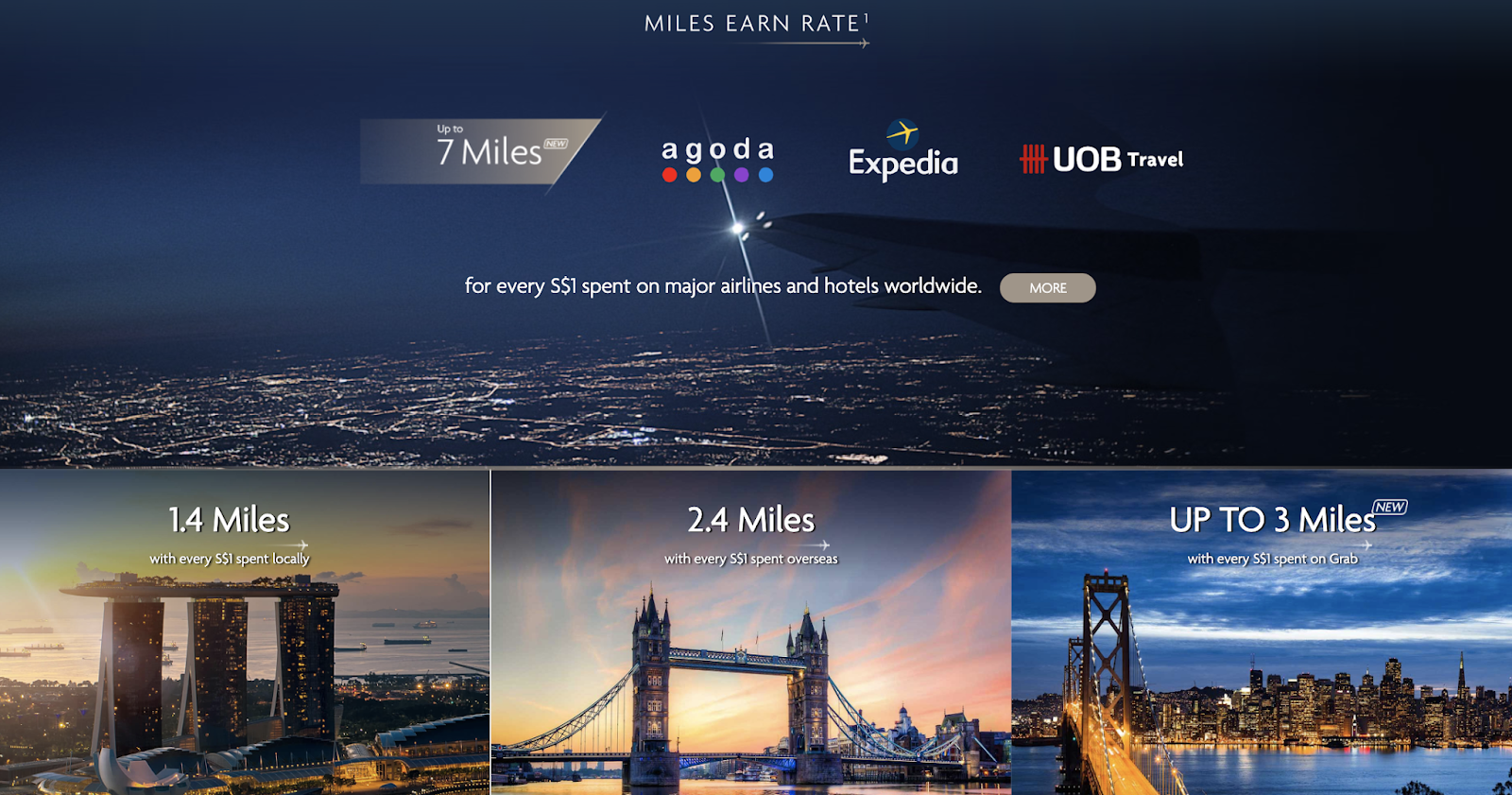

Hands down the best card giving you the highest rate of:

- 1.4 mpd for local spend

- 2.4 mpd for overseas spending

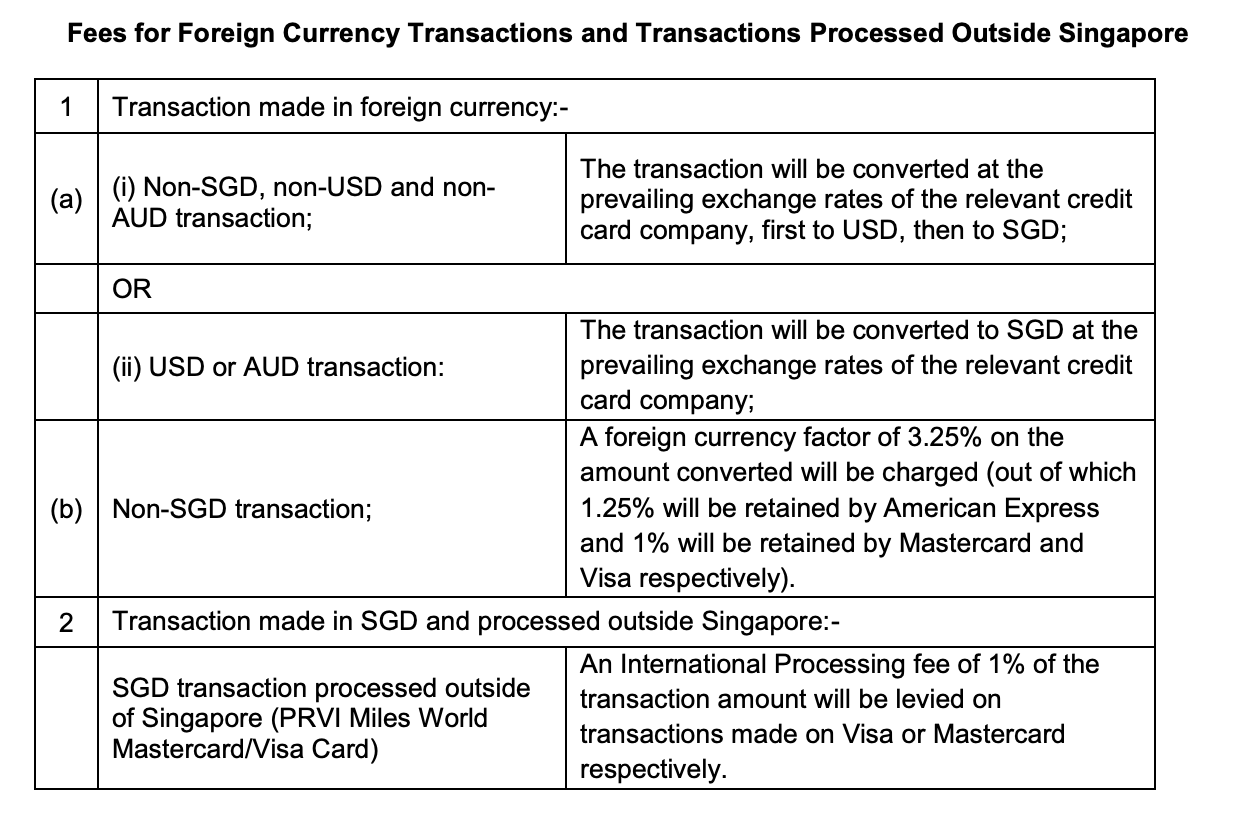

Before you use your credit card overseas, bear in mind the DCC and forex fees though:

There’s no minimum spending requirement nor maximum cap to the number of miles you can earn (given in the form of UNI$), so this is a great card to keep in your wallet. The best part? You can also currently earn 7 mpd on Agoda and Expedia, or a fantastic 10 mpd on hotels booked through Kaligo.

If you define “best” in terms of the highest earn rate + you don’t have to worry about what category to swipe it for (of course, the usual exclusions apply – AXS, ez-link, brokerages, etc), then the UOB PRVI Miles Card is your answer. Just make sure you remember to transfer the UNI$ to your Krisflyer account before 2 years are up, so you extend your miles lifespan by another 3 years. That’ll make 5 years in total for you to use them before they expire.

My vote is on this card for the winner, and so far, it looks like it might just win.

The only problem is…I can’t take part because I already have it -.- but you certainly can!

Click here to apply.

Citi PremierMiles Visa Card

I’m betting on this one as the dark horse. It might just win, or lose to the above contender. Let’s see.

Reasons to love this card:

- 1.2 mpd on local spend

- 2 mpd on overseas spending

Cardholders also get 3 mpd for Expedia, 7 miles for Agoda, and 10 mpd for Kaligo bookings. With the exception of Expedia, the other two merchant tie-ups are on-par with UOB’s.

The Citi PremierMiles Card also has one advantage that I will concede to over the UOB PRVI Mies – the miles never expire.

If you’re new to the miles earning game and worry that you can’t spend enough to redeem a great flight anytime soon, then this might be your solution because you have all the time in the world to earn and redeem it (until Citi changes their T&Cs, which is hopefully never).

Another thing to love about this card is that it has the widest selection of airline partners, which means you have more options and flexibility when it comes to exchanging your miles for flights.

But I’m betting this card won’t win the battle because most Singaporeans I know who are on the miles bandwagon already own this card. And since I like to look for the HIGHEST earn rate, Citi PremierMiles can’t contend with UOB PRVI Miles for now, but both are still great cards to own.

What happens when I apply?

Regular readers will know about how I always apply for my cards through SingSaver wherever possible, because I love the fact that I can get cash while signing for a card that I want anyway.

If you’re applying for a card during this campaign (till 9th June), here’s what you can expect.

- The usual sign-up rewards up to $200

- varies according to the card you choose and your relationship with the issuing bank

- Get up to $150 bonus cash if you correctly pick the winners of each battle

- i.e. if you picked the best card out of 4 for travel, cashback and rewards

- Successful applicants of the winning card for each category will get a bonus $50 cash gift (regardless of whether you’re new-to-bank or an existing customer)

- A chance to win one of three prizes of 50,000 Krisflyer miles

Note: I won’t be inserting my affiliate links for the other two cards in the campaign because as I’ve always maintained, I will never recommend anything I don’t personally believe in or find of value to my readers. You can read more about my collaboration criteria here. And in this regard, my vote is so strongly biased towards UOB and Citi’s offering that I honestly cannot bring myself to recommend the other cards for the title in this battle.

But nonetheless, if you still wanna apply for the American Express Krisflyer Ascend Card or the Standard Chartered Visa Infinite because they fit into your lifestyle better, then you can head over to SingSaver’s campaign page here to apply.

Disclosure: This post contains affiliate links. If you choose to apply through my link, I will get a small affiliate fee that goes towards the running of this blog, at no cost to you. All opinions are that of my own.