Kimly IPO results will be out tonight!

This one will seriously be over-subscribed cos I know of a few high(-er than most of us here) net worth investors who have subscribed to the IPO shares as well at dizzingly large amounts!

Fingers crossed that I get some! I like the business model and the fact that the company is debt free. Might this be the next Jumbo? Let's see!

———————-

Also wanted to share a bit more about our CPF talk last night as requested by some of you! 🙌 I got to meet a few Dayreans so I'm a happy girl! Didn't get to say hi to a few though especially those who got their early bird ticket from me 😞 think cos the talk ended quite late. #dayrefinance

I was honestly quite shocked by how packed the room was yesterday! It was a completely sold-out event and most who attended were between their 20s to 40s with some retirees (probably to learn from Jacob).

While I found the Gen X and Baby Boomers perspectives to be extremely interesting, I still stand by my actions that I've chosen to implement in order to optimise NY own CPF for retirement.

It was a pretty interesting mix of speakers. Regardless of age, those who attended last night got to see:

1) A Gen Y young worker who's making steps now to ensure she'll have a good nest egg in the future. Not interested in leaving CPF aside for children education or other stuffs yet since I don't have any kids at the moment.

2) A Gen Y lawyer-in-training who retired a few years ago (savvy investments and being frugal) but just rejoined the workforce. Earns 8k in CPF interest every year.

3) A Baby Boomer retiree who believes in using his CPF for investment and has lived through the Global Financial Crisis and SARS downturn thus his portfolio has already seen the result of his moves.

It was quite funny yesterday cos I opened my talk with the caveat that I have no results to prove with my CPF "hacks" yet cos I'm still young. If folks want statistical proof, they can ask me again when I'm 40 or 50 years old.

But the reason behind my conviction in each of my moves? Because I've been lucky enough to learn from folks older and wiser than me, so I'm replicating their moves but tweaking it cos many things have now changed for CPF vs the past.

Your CPF amount comprises of monies from 3 sources: yourself (20%), your employer (17%) and the government (2.5% interest rate and up).

The CPF scheme is structured such that more frugal and financially savvy folks are rewarded for their prudent moves in their CPF, in the form of extra government interest.

Since you can't get your employer to give you more CPF contributions unless you get a pay raise, the best way is to increase your own contributions for higher interest monies.

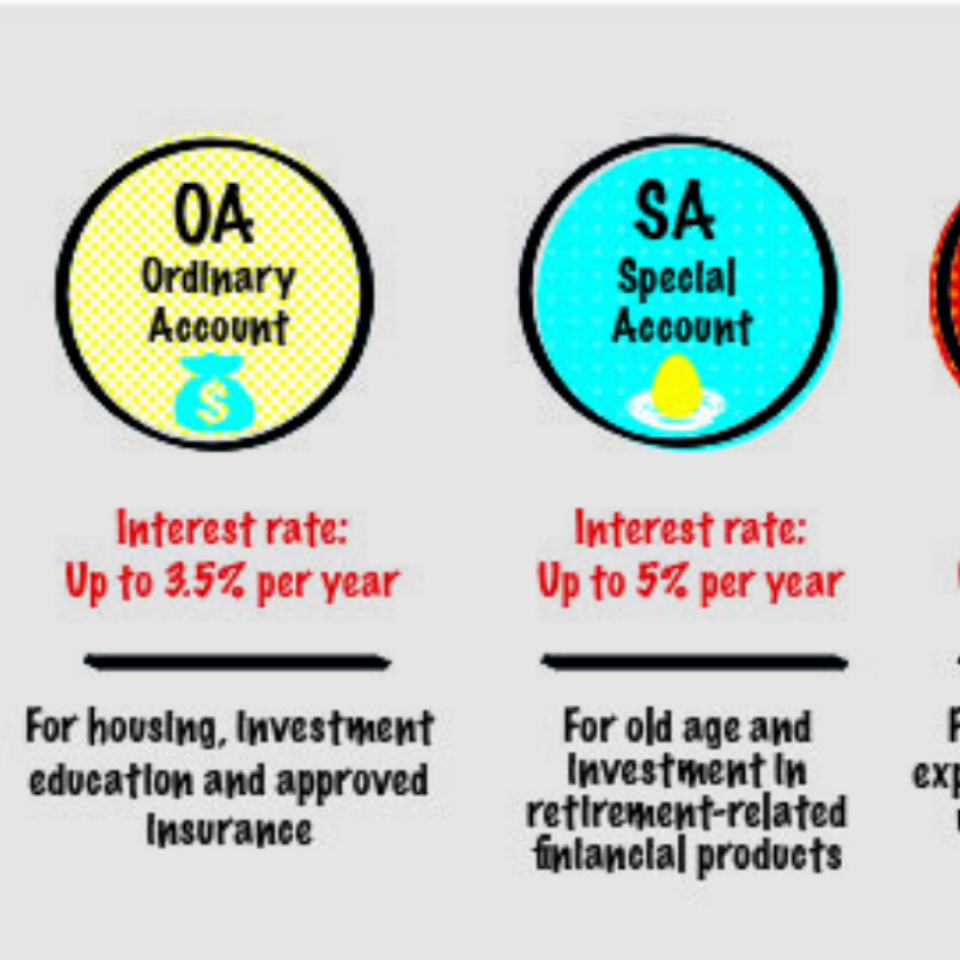

Here's a good graphic from Today illustrating the different functions and interest rates on all your 3 accounts. Dayre cropped out the MA portion, but essentially your MA gets up to 5% interest every year and is meant for your medical and hospitalisation expenses.

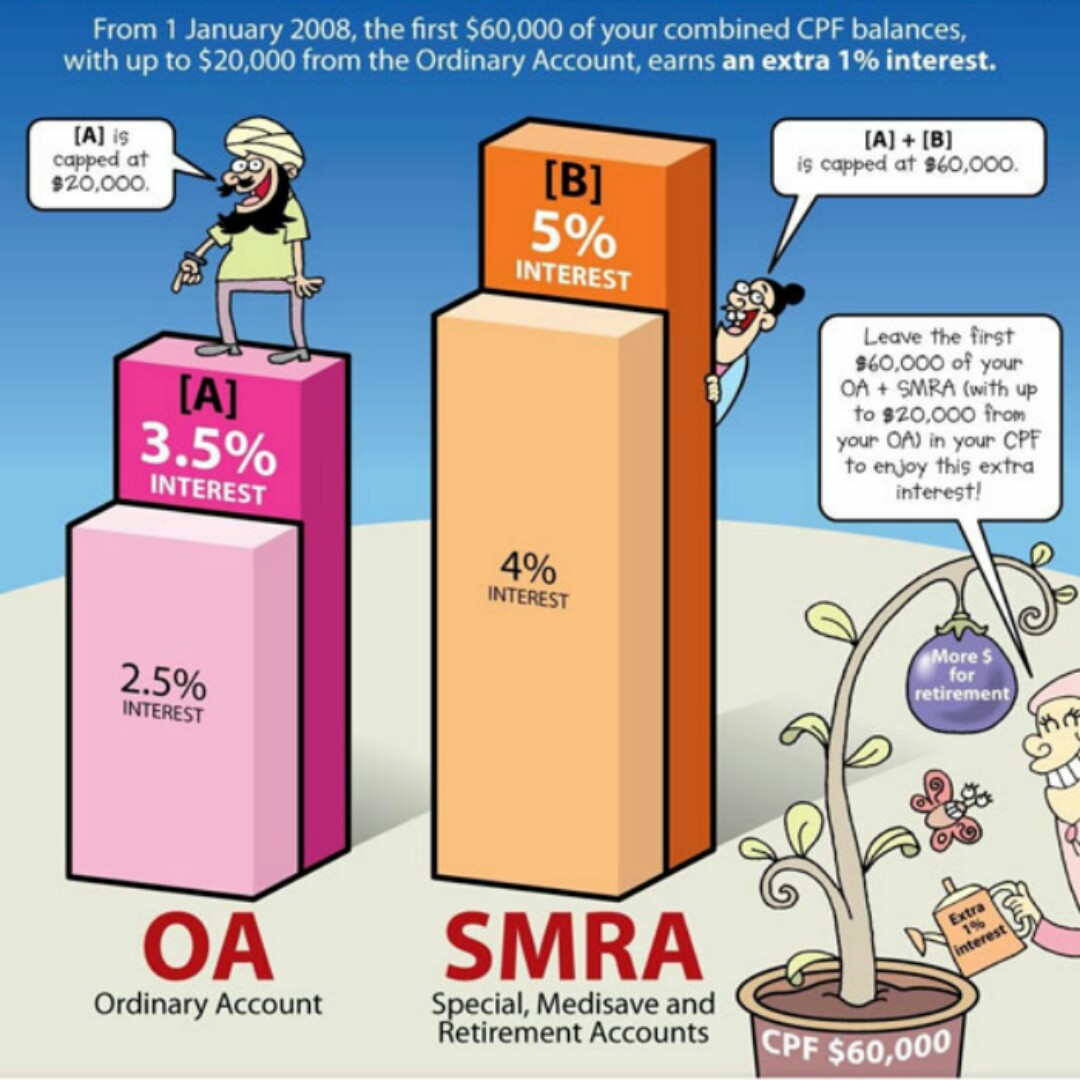

We have the extra 1% bonus interest to thank for the higher payouts. This was introduced almost a decade ago, but not many people are making full use of it yet.

Why be so silly? My goal is for maximise that 1% as early on as I can, so that my money can compound over a longer period of time into a bigger pot of gold.

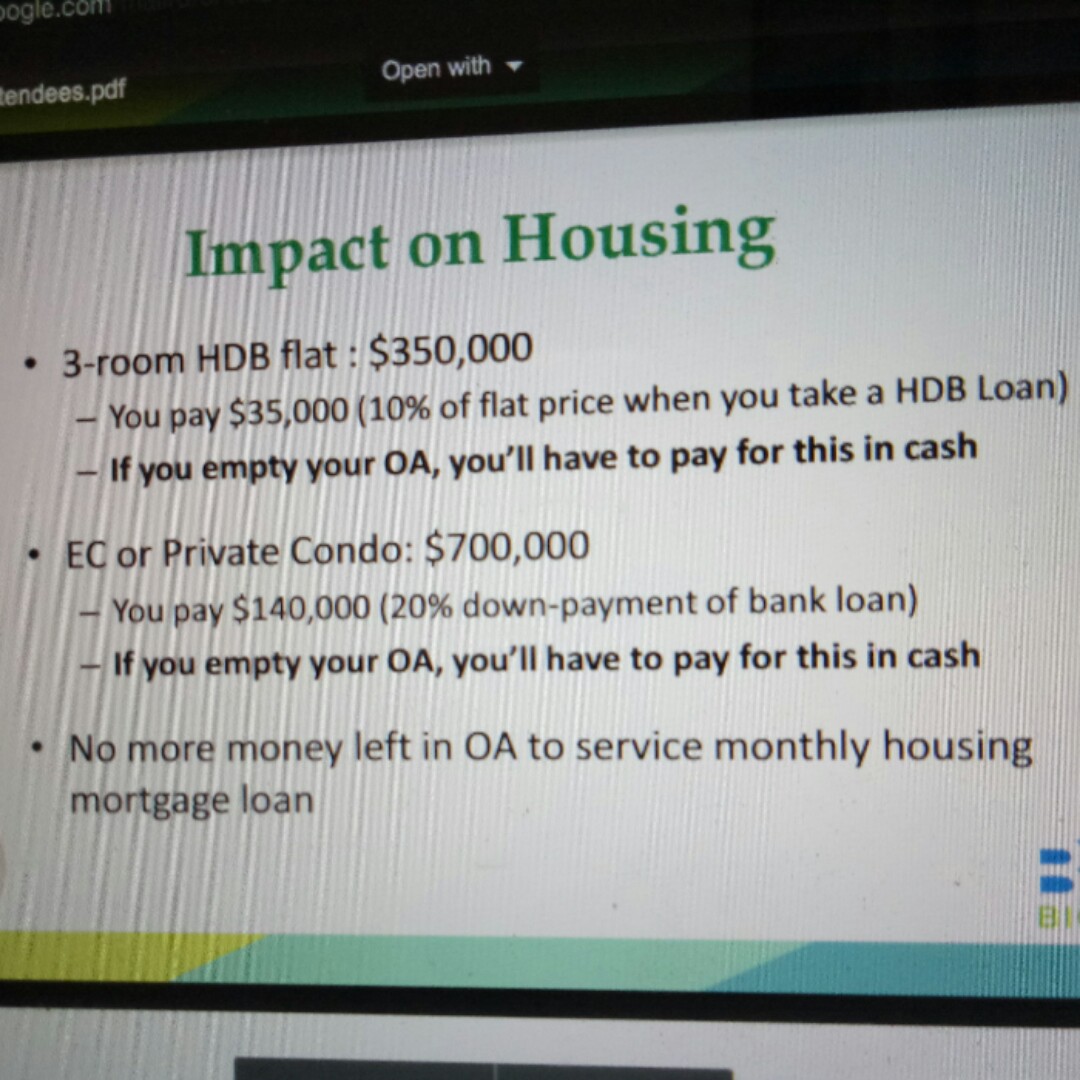

You must be prepared to accept the huge trade-off if you make this move.

Speaker Chris likened the CPF to a seven-headed Hydra : because it tries to do so many things at the same time, some people might feel that it does not fulfill all of its roles adequately.

Like my famous 3-in-1 shampoo analogy lah. Obviously you'll be a Jack of all trades but Master of none right?

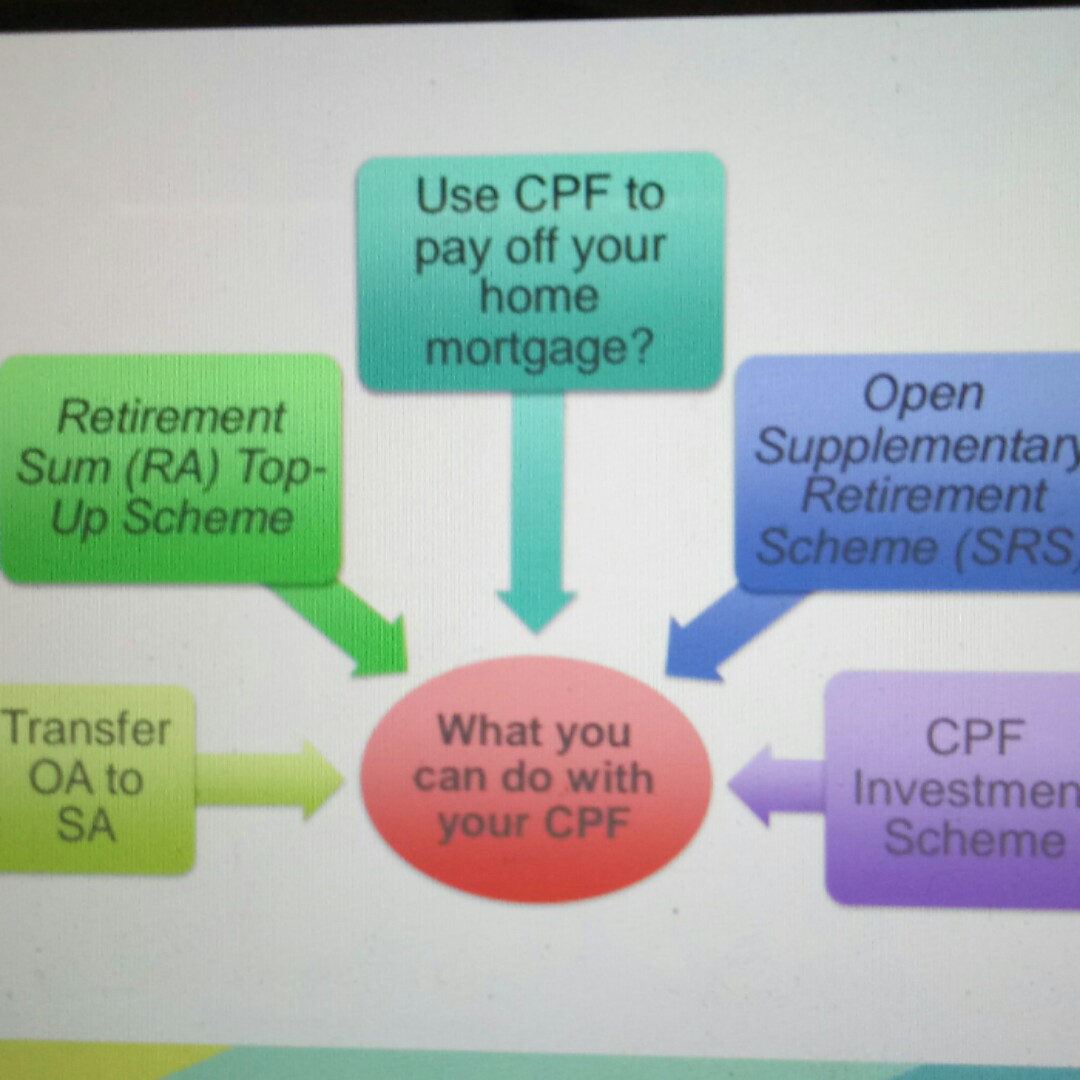

For those who missed my talk yesterday, this formed the content of my entire sharing for moves you can make in your 20s.

There were quite a few sensitive data shared by the speakers yesterday such as their own yields and CPF returns, so to respect their privacy and also be fair to those who paid to attend, I will not be disclosing that here. Sorry!

Maximise your OA transfer to SA early so you get a longer time horizon for your interest to compound

This is why I've been transferring my OA to SA early on.

BUT!!!!!!!!!

OA to SA transfers are IRREVERSIBLE

I hear some folks saying, "I transfer first, get the higher interest rate, then transfer back to OA to pay my housing / child education lah!"

Sorry ah but our government smarter than that…they already built in methods to STOP people from abusing / gaming the CPF system (or whatever term you wanna call it).

Pros:

✔ Get higher interest rate

✔ Compounds into a bigger sum

Cons :

❌ Irreversible

❌ Lesser (or no) money left to pay for housing / child edu next time in the future

❌ No tax rebates

I give you the two scenarios I shared yesterday (with less exact figures, so those who paid to attend at least get bonus info) :

Scenario 1: Pay with OA for monthly housing mortgage. Wipe out using OA, zero dollars in cash upfront or even every month. After 20 years, $0 left in OA. When you sell the house, you need to return back the full sum PLUS accrued interest. (hah! But plz lah it's a good thing if you remember CPF is primarily meant for your retirement)

Scenario 2: Pay in cash fully every month, leave CPF untouched so interest accumulates. After 20 years, you'll have $400k in your account vs the family in Scenario 1 who has zero! Also, any profits from selling your house next time will be all yours since you didn't touch CPF for it.

Which scenario is better for you? Aiyo how I know sia, you must decide for yourself!

Are you prepared to pay in cash every month? Do you have money to pay? What if you suddenly lose your job? Then how to cover your mortgage? If this worries you, maybe you should go for Scenario 1 for peace of mind.

But the CPF interest quite high for risk-free rate leh I want to accumulate interest and be a power saver! I have enough emergency funds and income to cover my monthly mortgage payments.

Then go for Scenario 2 lo 🙂

Wearing Colourpop Solow out today, and I feel so cheated by the colour?!? It's so much darker than the shade shown on the outside. Also, this is so drying that I really don't think I'll be using it as often as I thought I would. My lips feel super dried out now. Why's the #dayrebeauty so obsessed with these lippies? I'm trying to understand but I really can't leh my lips feel so terrible now.

Also, no makeup except my eyebrow pencil, lip colour and brown eyeshadow on my lids. No concealer 😬

Obviously you have to think hard whether you can afford this move. Maybe you can today, but what about in the near future, especially as most Singaporeans take about 20 to 25 years to clear off their mortgages?

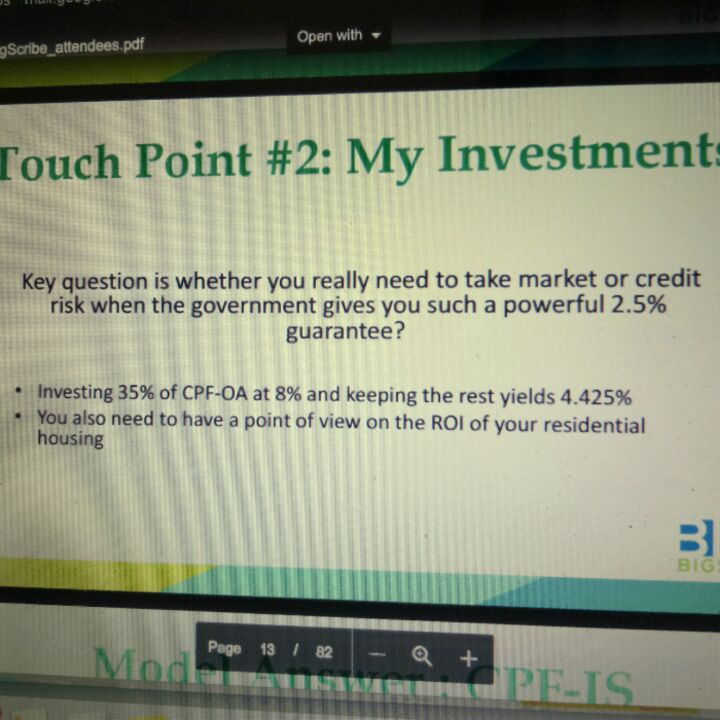

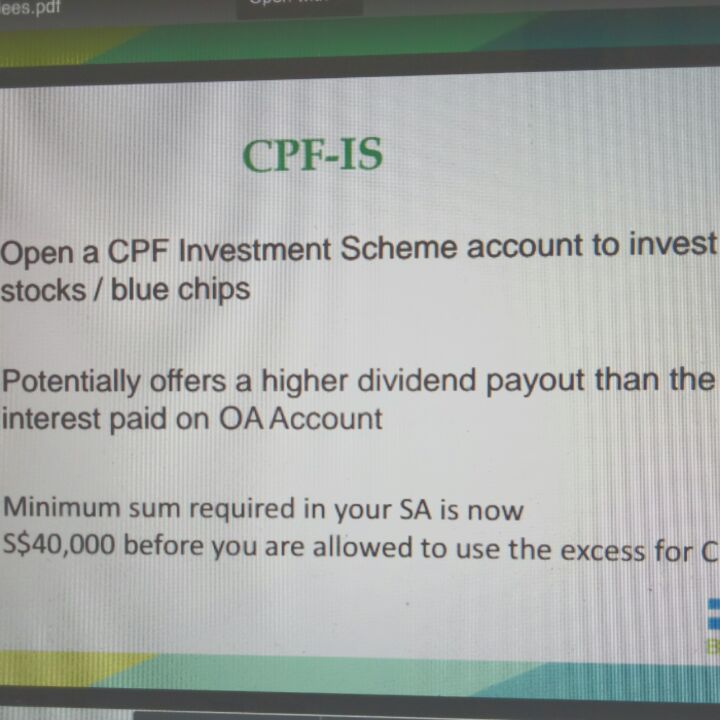

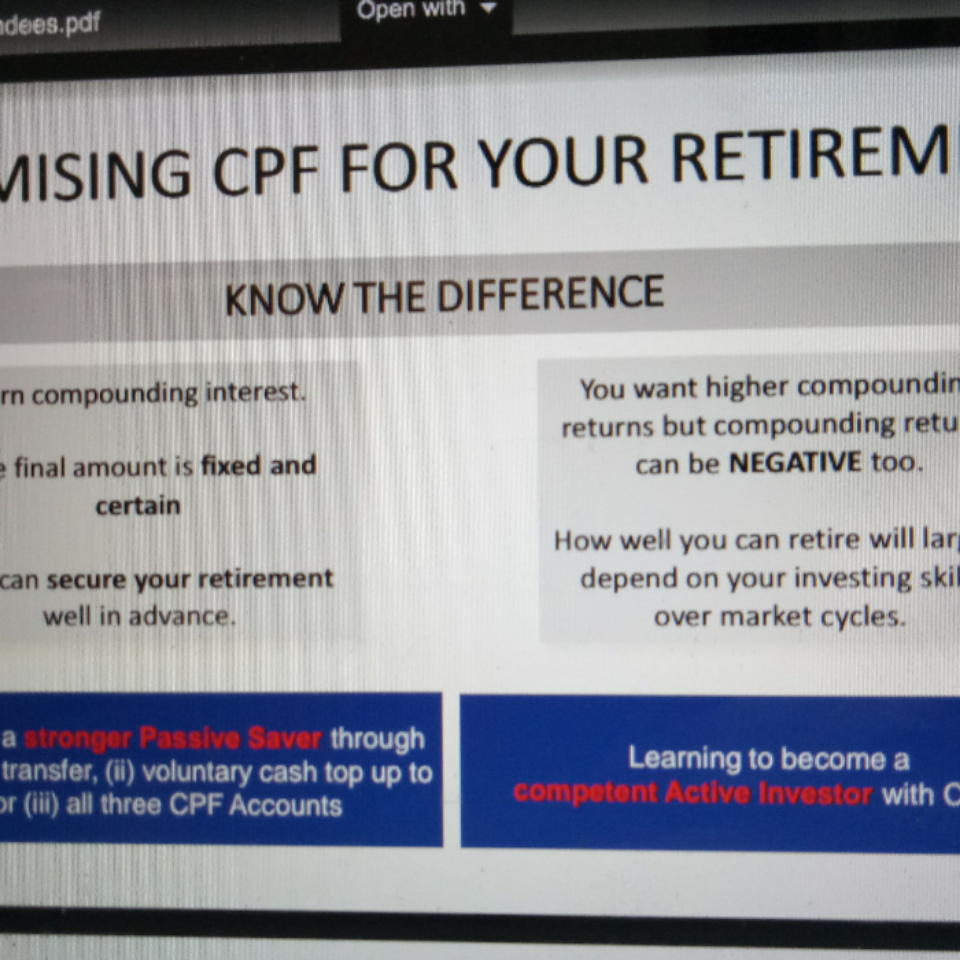

Open up CPF-IS to get a higher interest rate than what the govt is paying – either into dividend yielding stocks for for market crash

Another area all 3 speakers talked about was on using the CPF-IS.

For those who are uncertain of your investing skills, note that you could potentially lose your monies and have barely much left for retirement. This happened to my dad, and to many others in the Baby Boomers era as shared by Jacob. That's why many of them do not have enough to retire on.

But if you're good, you could potentially earn a much higher return than just the 2.5%.

Do you want to take that risk?

How greedy are you for yield? Is the risk worth it?

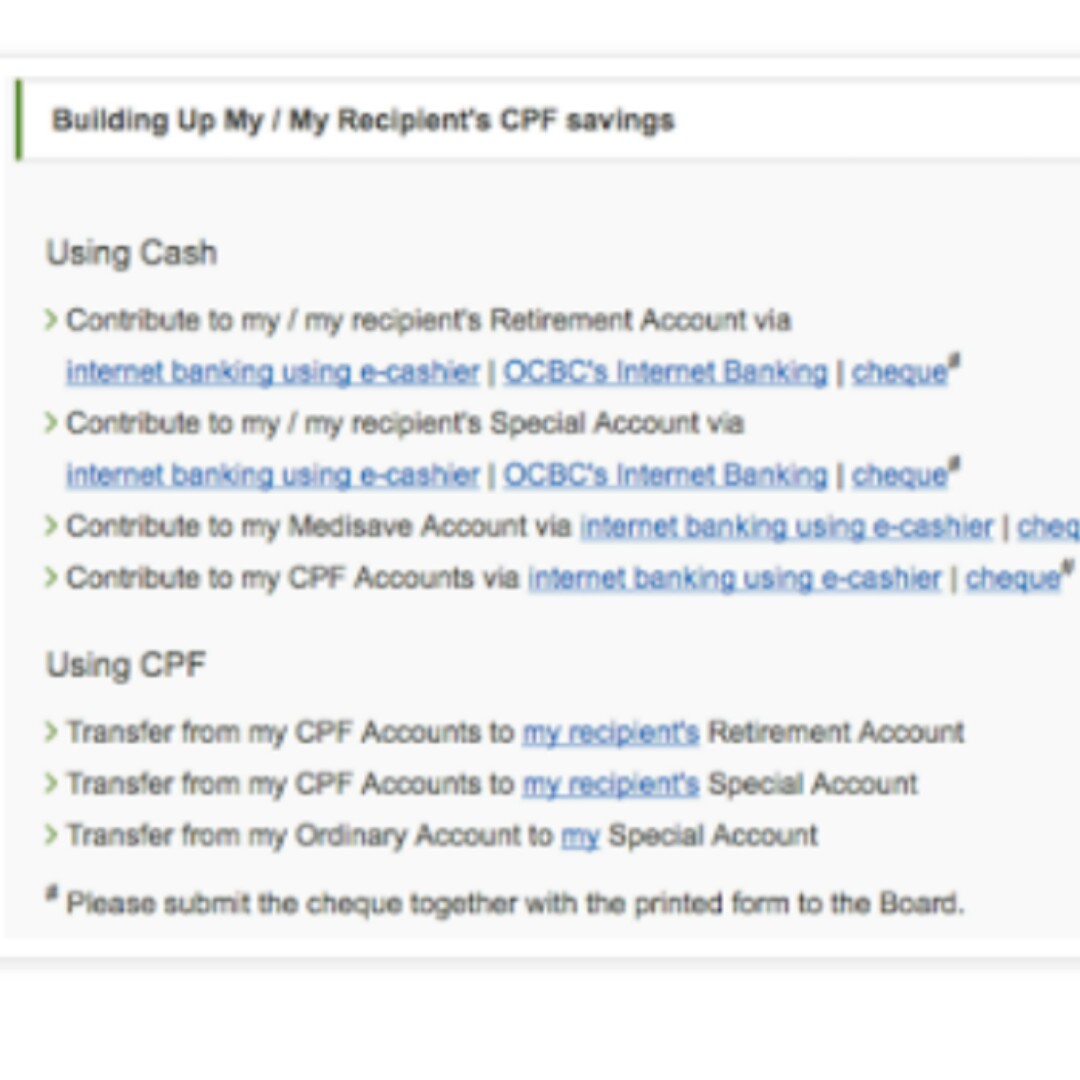

Do VC early when you're young and have surplus cash

Going back to my first point under the top picture – you can increase your contributions to get more interest paid to you by the government. This is called Voluntary Contributions (VC) using cash to deposit into your account.

I have a step-by-step guide with screenshots on the HOW to do this if you're interested so go search on the blog. Don't be lazy la 😝

VC also helps to reduce your income tax to a maximum of $7000 deductible, so if you want to optimise that you can top up $7000 every year into your own account! But note that only VC monies that go into MA will enjoy this benefit k.

Eh BB can I do VC to my SA? Cos got higher interest rate mah

If you do generic VC, it gets channelled automatically into all your 3 accounts – OA, SA and MA. Same as your monthly employment contributions.

BUT you can always transfer the sum that went into OA (in excess of your $20k) into SA separately later on to still arrive at (almost) the same goal (minus the sums that were put in MA but interest rate there is same as SA anyway!)

Alternatively, you've to go through the RS scheme in order to top up your SA directly.

Look for this page on your CPF account!

RA top up scheme

Also more for tax rebates rather than you getting more money for your own retirement… This involves you either transferring your own CPF monies into your parents' account or top it up using cash.

I won't talk too much about this point cos already elaborated in detail during my session for those who came but in summary, the interest rate for your parents RA also quite high, so why not.

Eh BB I don't want to top up my parents RA can I top up my own RA?

😱😱😱 you unfillial selfish child!!

Also, 😂😂😂. You not 55 yet where got RA? Joke sia 😂😂

(lol OK I'm weird for laughing at my own jokes don't judge leh wahlau this was a legit reader question last time)

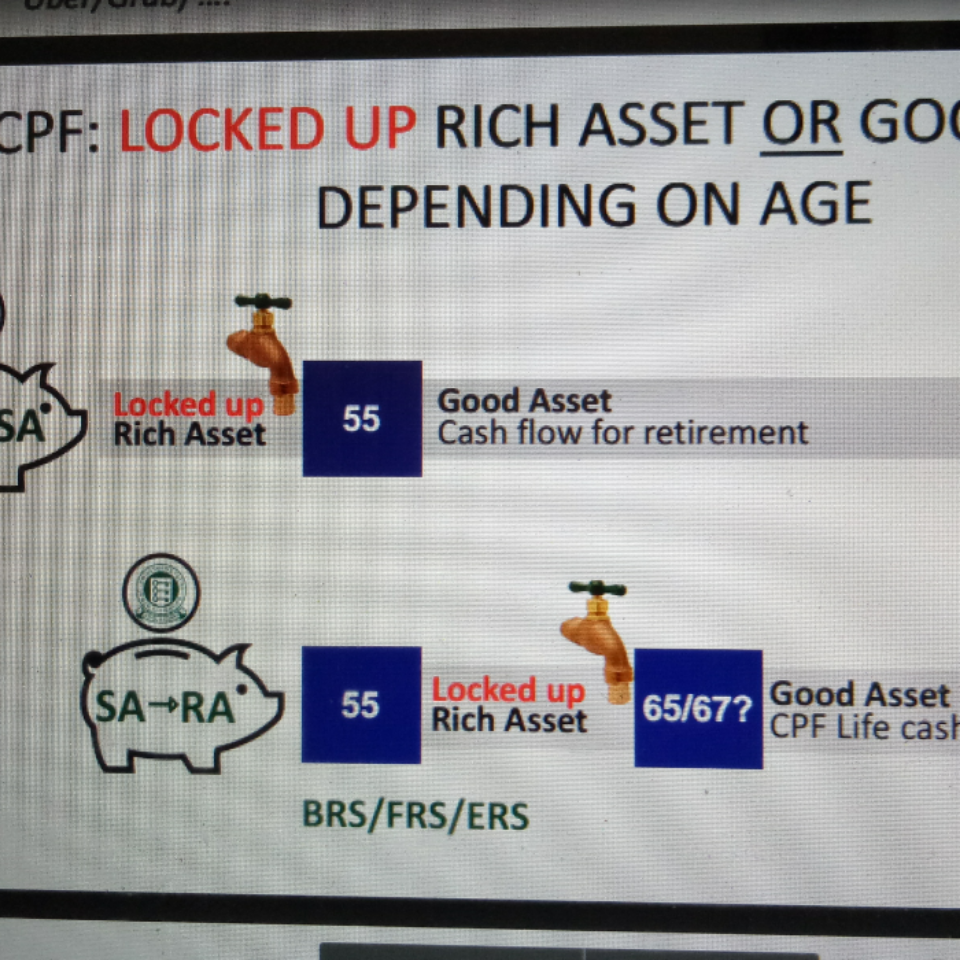

One of my favourite slides from Jacob's segment : whether you hate the CPF cos your money is locked up or see it as a cash flow asset really depends / changes with your age.

My approach is easier la. I pick the battles that I can win. Since no amount of complaining or hating the system will remove it, why fight it? I might as well make lemons out of lemonade.

Before you touch your CPF monies for investments, you need to understand the trade off that you are making.

Jacob is unique cos he came from a time where the government did not "protect" the reckless citizens from themselves. Folks then could empty their CPF into investments, get burnt, end up being left with not enough money for retirement, which then calls for the government to support them. Thus higher taxes on the general population.

Jacob said because of the GFC and all the crises that happened, the government finally woke up and implemented a cap of 35% of your monies that you can use for buying stocks.

As Chris sarcastically calls it, the CPF is an insurance. It insures the smarter / more prudent folks from the stupid and reckless ones who don't bother saving beyond the minimum.

By forcing people to save, when things go bad, you'll have a sum of money to rely on before you go to the government for help.

That way, the government can focus its money on helping the lower income groups and those who really need it most. They also reward those who are prudent with their CPF.

Let's be the ones who get rewarded, shall we?

Decided not to cover the debate of whether or not to use CPF today cos I'm tired + there's too much details to elaborate on so I'll leave it for another day.

I just wanted to share one last perspective of the CPF which a wise friend once taught me:

Treat your CPF as a bond

I've had some investors ask me, eh why you want to do VC and lock up your cash for 4 to 5% returns if you can invest well and get higher returns of maybe 6 to 10%?

That's a valid viewpoint. Why not? Personally I believe in asset allocation – bonds, insurance, stocks, property.

I see the CPF as the bond component of my portfolio. Government bond. Like SSBs, only with less liquidity but with a higher return.

Doesn't the fact that your CPF money is locked up bother you?

No. CPF can be used for many things, but it was designed first and foremost for our retirement. So I will keep it for that function.

Similar to insurance, which was primarily designed to protect. Today, there are all sorts of insurance plans that also help you to save and invest. And you guys know my stance on those types of insurance by now, don't you?

Told you I'm a simple girl 😂