Reviewed this insane new deal on the blog.

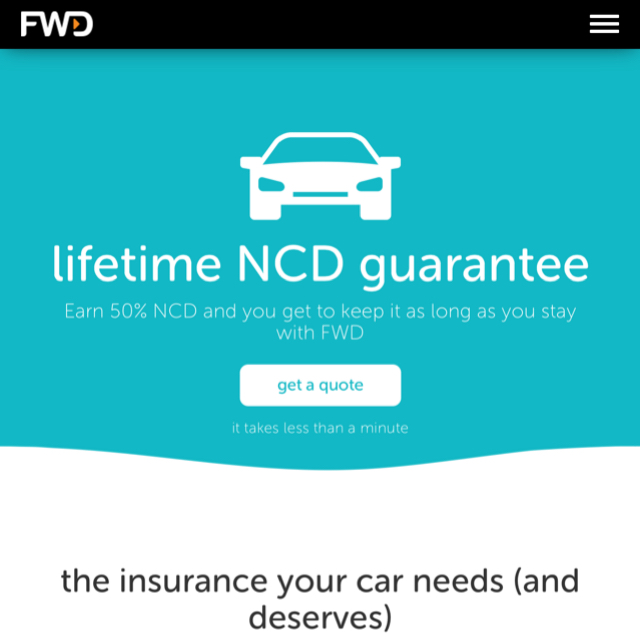

Car insurance: Singaporeans who own cars can get 50% NO Claims Discount FOR LIFE 😱😱

One of the things I never quite liked about owning a car is the fact that there's just so many associated costs pushing your monthly bill higher. We estimate that after you account for your car purchase, taxes, petrol, cleaning and motor insurance, a car can easily set you back by about $2k a month.

(My parents sold our family car a longggggg time ago because it no longer made financial sense to own one after we kids grew up.)

But I can understand that to some folks, owning a car is somewhat like a necessity – especially if they need it for their work / have young kids or elderly parents to ferry around, etc.

Since you can't run away from certain costs – especially car insurance – then might as well make sure you're getting the best deal for it right? That's the same philosophy I wrote regarding income taxes and CPF in Singapore too last week on Dayre.

FWD (a leading insurance company in Hong Kong) has just launched in Singapore a few weeks ago, and their launch offer is LIFETIME 50% NCD for car insurance!!!!!!!!!!!!!!!!!!!!!!!! 😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱😱

(Must emphasise how shocked I am / was when I heard about this deal because it is UNBELIEVABLE LIKE 🍆 vegetable.

You know how I'm super skeptical about insurance companies and insurance agents right? Well, I tried to dig out the dirt and find out loopholes in this policy in the beginning.

Lifetime 50% NCD? Where got so good deal?!? WHAT IS THE CATCH

Not bad right?!?

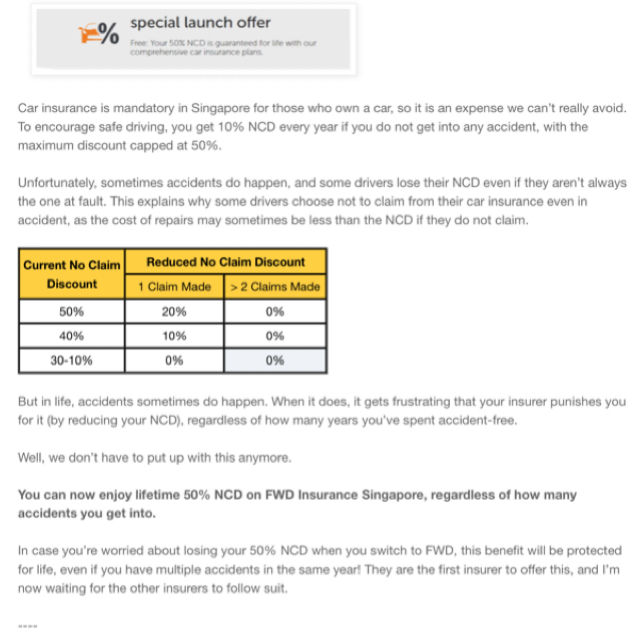

Better than other insurers where you pay your premiums then don't even claim when you get into an accident, because doing so would compromise your NCD and result in higher premiums later on.

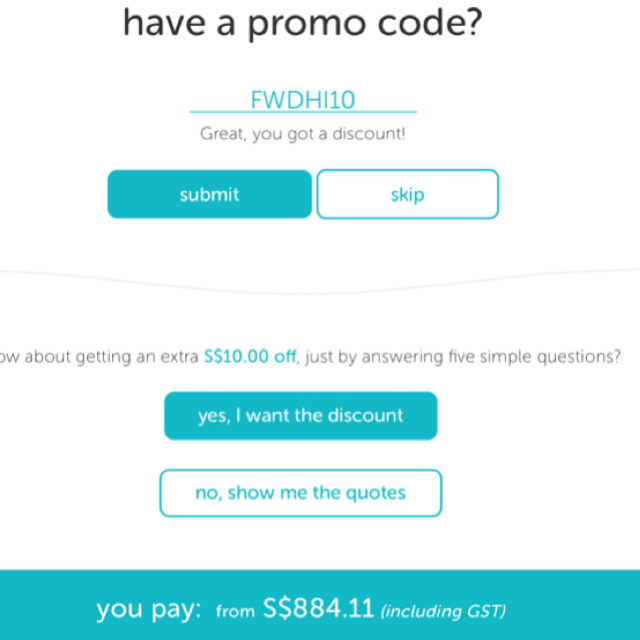

Remember to use the promo code if you're gonna buy! (Not my promo code sorry no readers privilege here cos I not #lifestyleblogger lol) #insurance

At first I thought,

💡Higher premiums? But nope not really.

💡50% only for first year of policy, then after that back to normal? Again, nope it is seriously for lifetime like WHATTTTTT.

💡not MAS regulated? But nope it is!

I seriously still can't find any loophole after studying the product for so long. If you guys find any please let me know okay!

For the uninitiated, here is how car insurance and NCDs in Singapore work.

If you wanna buy or read about the technical stuff and find out more, head over to my analysis on the blog www.sgbudgetbabe.com !

N is thinking of buying a car in December so we are gonna get this insurance for ourselves then. Don't say good things I never share!

The blog article is a sponsored post but FWD did not pay me nor edit any of my content. And I can assure you that even if they didn't pay me to write about it, I would have still reviewed it on the blog anyway because it is seriously too good a deal 👯 I'm also sharing here on Dayre on my own accord because I believe in it.

NOT PAID to promote this here ok!!

Term insurance : also super affordable.

On this part, I currently have one term insurance which I bought directly myself after terminating the stupid ILP I bought from an agent when I was a naive fresh grad.

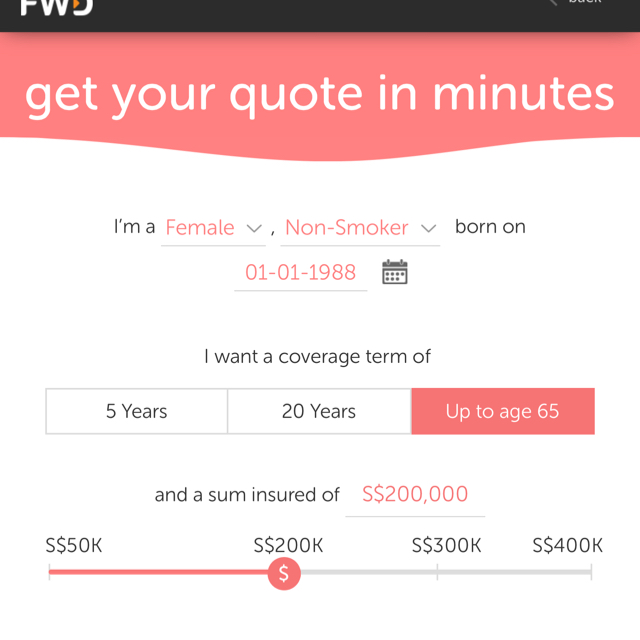

I replicated the same policy here on FWD to get a quote (they don't ask for your name or contact if you just want a quote, which I like because no agent can call me up to hard sell me the policy after!).

Except for the birth date, everything else is exactly the same as my current plan.

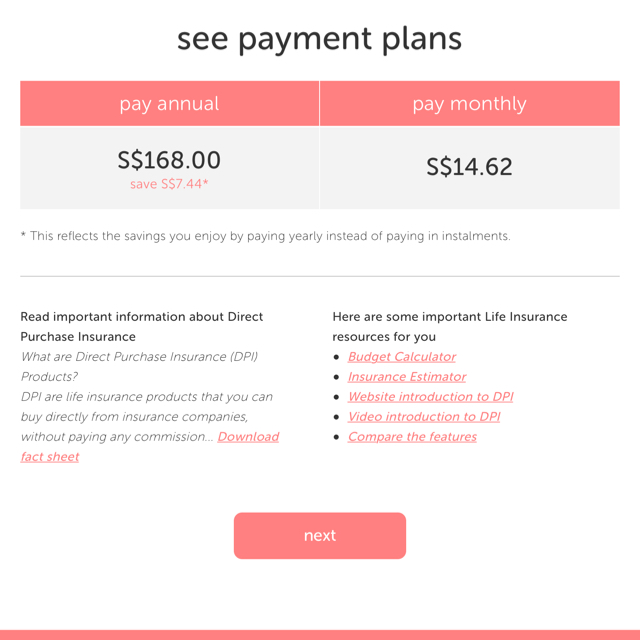

AND IT IS….about the same price! Cos mine really dirt cheap 😅 I pay less than 50 cents a day hehe.

Okay but wait look at the next one.

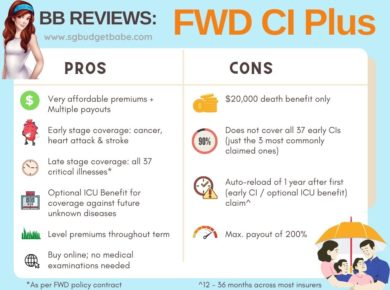

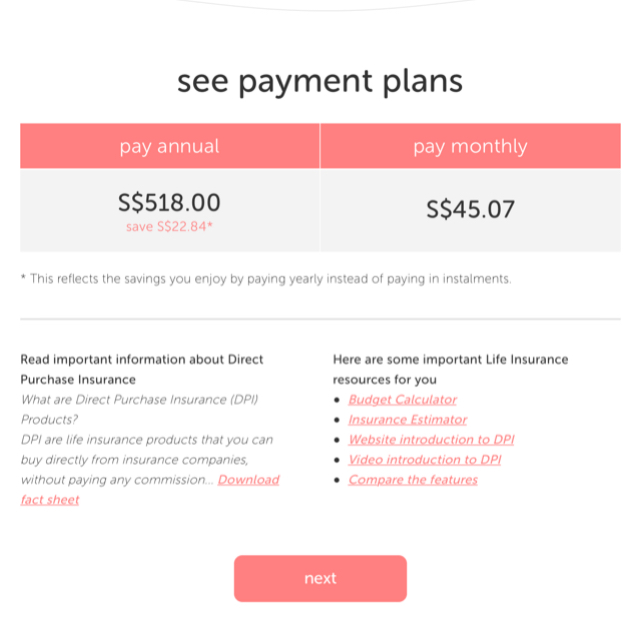

My current plan under the DPI scheme doesn't include critical illness coverage. I've been intending to add this on later this year or sometime next year.

FWD's quote for this is CHEAP goodness gracious me.

(Writing to them now to ask if they got promo code for me to use here before I buy cos I want more #dayresavings HAHAHA)

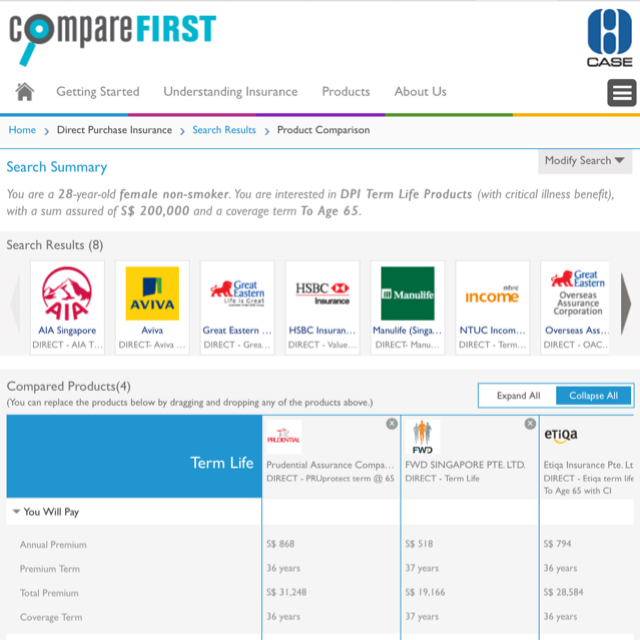

Using MAS tool for objectivity in comparing across the insurers.

You'll see that FWD is seriously cheap in terms of market offerings. You can go and compare the rest yourself but $700 to $800 plus is siaooooooo no thanks.

If you really want cheapest, AXA is slightly cheaper but the claims process is a bit more troublesome. For FWD everything is online and digital so it is super seamless!

I'm buying mine soon! Once they give me a promo code, that is HAHAHA

Why so cheap? Because they don't hire agents! They save on commissions so they can give consumers cheaper premiums.

Have fun shopping! 😎