One of the most underrated cards in the market with 5% cashback.

It’s an open secret that I’m always on the lookout for the best cashback cards, so when a reader who has recently switched to the DBS Multiplier account recently messaged me to ask which credit card I would recommend for her to pair with the account, and when she told me she preferred cashback over miles, I immediately suggested that she look into the DBS Live Fresh Card.

“DBS Live Fresh? Is that a new card?” was her response.

I’m actually surprised more people aren’t talking about this card, and if you don’t already know of this card, then you might want to take notice.

The DBS Live Fresh Card : Yay or Nay?

Short answer: Yay!

|

| Source |

I’m not much of a fan of cashback cards that require you to spend at least $800 every month, and I recently found myself needing to switch to another more suitable credit card based on my monthly expenses of $700. After all, I can’t win at the cashback game if I’m not even spending enough to qualify for the bonus cashback.

That’s when the DBS Live Fresh Card caught my eye, and it’ll work together perfectly with our DBS Multiplier account as well – that’s cashback AND bonus interest i.e. a double win in my books!

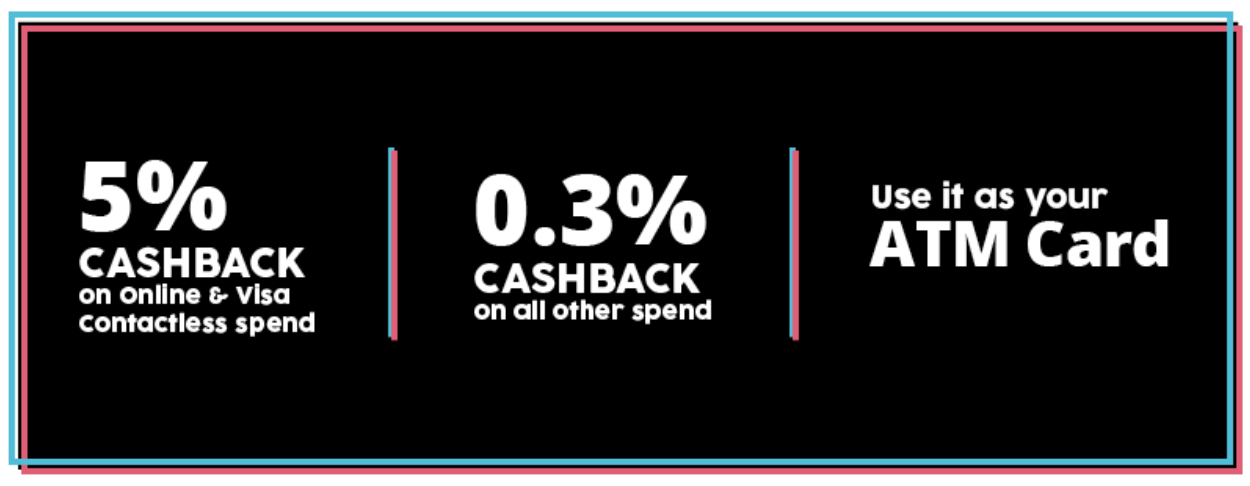

One of the biggest merits of the DBS Live Fresh Card is that I find it to be a super convenient and fuss-free way to earn 5% cashback easily. Unlike many other cashback cards which have pretty strict spending requirements (e.g. X% on dining, entertainment, travel, petrol), the two categories are broad enough to cover almost everything in our lives today.

Key features:

- 5% cashback for online shopping / Visa contactless spend

- Visa contactless i.e. transactions through a contactless terminal via the Card or mobile wallets on Apple Pay, Samsung Pay, Google Pay

- FavePay counts as an online transaction if used at retail outlets

- Minimum monthly spend of $600

It can be quite easy to hit the minimum monthly spend, given how the qualifying categories are fairly broad – almost everything in our life today can be done via online or contactless payments these days! Groceries? Retail? Fashion? Dining? Travel? All checked!

And if you’re a parent, you’ll probably benefit from this card as well, especially if you spend often on online platforms such as Fave, Shopee, Lazada or Qoo10 like I do a.k.a. shopping havens for baby essentials, diaper sales and wet wipes!

The card also comes with several notable merchant privileges, and the ones that I use more frequently would be Chope, Expedia and Zalora.

Here’s an example of how DBS Live Fresh Card fits into my own regular spending:

|

Category

|

Monthly Expenses

|

Cashback Earned

|

|

|

Grab rides

|

Online

|

$100

|

$20

|

|

Milk powder and (heavy) groceries via RedMart

|

Online

|

$200

|

|

|

Diapers via Qoo10

|

Online

|

$60

|

|

|

Baby essentials or clothes via Shopee

|

Online

|

$40

|

|

|

Dining

|

Visa contactless

|

$100

|

$18

|

|

Movies

|

Visa contactless

|

$40

|

|

|

Groceries at NTUC Fairprice

|

Visa contactless

|

$220

|

Some months we dine out less frequently, or don’t even get the chance to watch a movie in cinemas, depending on our baby’s schedule!

It is, after all, DBS’ best cashback card.

Conclusion

Given that the DBS Multiplier is one of the easiest high-yield savings account in the market to use right now, your next question will probably be on which credit card to pair it with. The DBS Live Fresh Card might just be your answer if you spend at least $600 a month on online shopping and Visa contactless spend (which is essentially almost everything today, except smaller merchants or hawker centres).

This will give you at least $30 back every month (or $360 in a year) assuming you’re savvy in getting the 5% cashback on the two broad categories and hit the minimum spend.

What should you do with that money? Treat yourself to something nice, or even better, put it into your DBS Multiplier account and earn that extra bonus on it so your money keeps growing!

Disclosure: This post contains a sponsored message by DBS below. All opinions above are that of my own.

Plus, get 5% cashback on overseas spend* when you travel and charge a min. of S$700 in a calendar month during your next vacation! The cashback will be awarded for all payments made in person abroad, and excludes contactless and online transactions made overseas in foreign currencies. If you’re booking a trip to Europe, Greece or New Zealand, DBS Live Fresh Cardmembers get 10% off and more on Contiki. Don’t forget to activate your card for overseas usage before you fly!

- 15% off at Zalora for existing users (use promo code “DBS2019”),

- an extra $4 off Chope vouchers (promo code “411911DBS) for existing users,

- additional 10% off eligible hotel bookings with Expedia (promo code DBSEXPSG)

- 10% off when you book a trip to Greece (promo code “LIVEFRESHMS10”) and New Zealand (promo code “LIVEFRESHSS10”) with Contiki,

- 20% off mini golf fees at Holey Moley Golf Club,

- 10% off at Puma (promo code “LFXPUMA”)

- Over 50 1-for-1 dining deals