CPF sharing!

Not too long ago, the folks at CPF invited me to be their guest panelist for an internal talk and share about my finance tips using CPF to maximise my returns.

So I thought I'll document it here for those who couldn't be at the talk to learn!

When I first started working, I used to resent the CPF system. For someone earning a meagre $2,500 a month, getting less than $2k back was quite pathetic (later I found out after quitting that my employer didn't give me my correct CPF amount every month wtf).

But then I figured if I can't change the system, I might as well learn how to hack it for my own benefit!

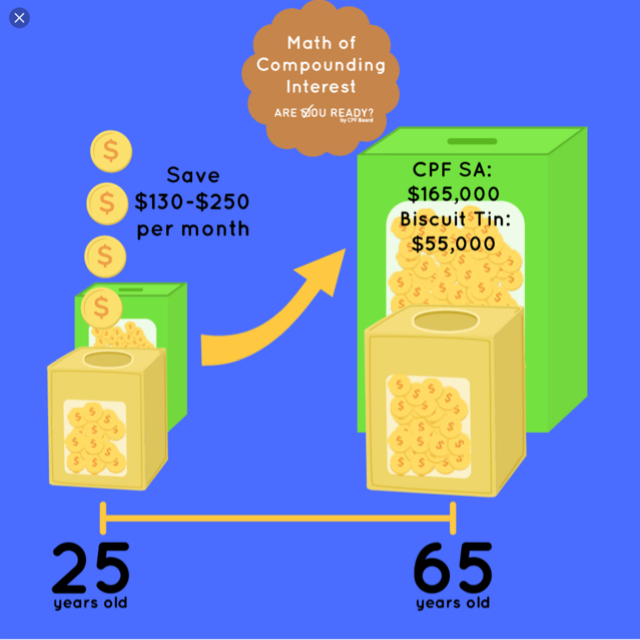

The compounded effect of CPF interest rates over the long term is amazing! I've yet to experience it myself, but I've older folks who have shared their journey with me and also their CPF statements with all that rollover interest so that's something I want for myself.

One major move I made recently was to transfer part of my OA (Ordinary Account) money into my SA (Special Account), where it gets a much higher interest rate. Compounded over time, this should help me reach the MS (Minimum Sum) faster and much easily.

When I shared this during the talk, there were quite a few questions raised from the audience, among which consisted of some of my fellow financial writers themselves.

1) "Won't this leave you with less money for your house when you eventually buy one later?"

(Omg so many campers today! Sorry to have made you guys wait! Was at rehearsal and only just came back…)

Leaving your money in OA for housing is not a bad idea, but it is costing us opportunity costs as well. So why not take the middle ground, and transfer part of the sum over to allow it to compound earlier first?

Yes, if you transfer OA to SA it'll leave you with less money for your home. But hey you don't have to transfer ALL the money laaaa. Also remember that your house should be paid by BOTH your spouse and you! Plus, you should be looking at getting a house within your means instead of overpaying for one (will anyone be interested if I break down the math on this in a subsequent post? It is too complex for a single paragraph…)

So I transferred about 1/3 of my OA to SA 😎

2) "But the transfer is irreversible! What if you regret it?"

Don't do things that you'll regret. For me, I don't see what's there to regret when I transfer my money into a place with more interest-earning power.

If I fall short of funds in OA for future items, there's also this thing called VC (Voluntary Contribution) to top up your funds!

3) "But you can't touch that money until 55!"

I'm happy to not touch it – and neither can anyone else! The CPF is my safety net for my retirement so I at least have a decent sum to survive even if the government doesn't support me with enough welfare, or if my children aren't filial, etc.

4) "Considering your young age, instead of VCs to your CPF, why not play with stocks or other instruments that can give you a higher returns rate?"

I believe in a diversified portfolio of bonds, stocks and cash savings. The CPF as I see it is the "bond" element of my portfolio, and with a 5 to 6% interest rate that is almost risk-free, I've nothing to complain about!

Plus, stocks go up and down, but my CPF monies can only go up, up and up.

When you learn how to "hack" the CPF system for your own benefit, it feels really good!

With my strategies, I'm actually killing two birds with one stone (helping my parents and myself!)

Another tip I shared was that of using the CPF to minimise my taxes.

I've shared previously on one way to do it last month so I shall not nag again, but what I shared specifically during the talk was the idea of giving my parents their monthly allowance through their CPF.

I'll do cash top-ups to their account, and since they're both already over 55, they'll be able to use the money already / very soon!

I have to give my parents monthly allowance anyway, so might as well get some tax benefits out of it if the government wants to reward citizens for their filial piety? 😎

I wish more people knew about this, because I'm certain that the cost of living in Singapore is going to go up, up and up.

If people only save and do not invest, they'll be seeing the value of their money erode over time. While Singaporeans complain about the government raising the MS every few years, why not do more during our younger years to let the government help us meet that sum with their interest payments?

I think it's the obvious approach, but too many aren't aware.

That's it for my CPF sharing and what I spoke about during my guest talk! Hope you guys found this useful.

A sidenote – SingSaver has just asked me to be their guest speaker for a workshop on credit cards usage in December, and I'm drafting the blog post now, so do head over to www.sgbudgetbabe.com to book your slots!

(I'm NOT PAID TO SPEAK and it is a free event! Let me know here if you're coming? ☺️ I wanna meet the fellow Dayreans!)