Having not travelled for so long, some of us might have forgotten the usual travel hacks. Here are all your must-haves before you start packing for your next adventure!

When it comes to planning for our next adventure, most of us would go through the usual steps of

- Book flights

- Book accommodation

- Book activities

- Buy transport passes (rail, ferry, etc)

- Buy e-SIM or roaming Wi-Fi

Travel insurance is usually not on that list but take it from a budget babe here: make sure it is on yours.

In the last week alone, two of my good friends had their flights cancelled on them at the last minute while they were already at the boarding gates – one was due to bad weather, whereas another was due to an unexpected downsizing of the scheduled aircraft. Another friend was hit by a typhoon at his farm stay in Taiwan and needed to be sent to another hotel for safety precautions.

As you can imagine, the events that followed included a flurry of new hotel bookings, transport options and new flights – all done within hours under very high stress conditions.

When things go wrong, it helps when you can make decisions without having to worry about expenses like my friends did…because they had travel insurance.

It was a good reminder once more of how essential travel insurance is, and why it should be at the top of your priority list after you’ve booked your holiday.

Which is the BEST travel insurance?

As regular readers of this blog would know by now, there is no such thing as a single best travel insurance policy.

Depending on your needs when you travel, there are different policies to meet each need. For instance, the best travel insurance policy for a solo traveller versus a family holiday won’t be the same. Others might be willing to pay more for a policy that will cover trip cancellations due to their unpredictable work schedules, while others fork out extra for plans covering pre-existing conditions such as cancer or heart disease, where complications can result in hefty medical costs overseas or even the entire trip being cancelled.

Thus, the financially savvy traveller will know that going for the cheapest travel insurance may not necessarily be the best. Instead, start with your needs for the trip and find which insurer or plans cover those.

Your task: find an affordable policy that offers comprehensive coverage for your trip.

What to look out for

Personally, I like travel insurance which meets my following criteria:

- Covers for adventurous activities (including water sports and skiing)

- 24/7 telemedicine access

- Can be purchased instantly online

- Quick and fuss-free online claims process

- COVID-19 related coverage

You can call me kiasi, but as a parent, I still worry about whether we will catch a new variant that might cut short our holiday or even other infectious diseases circulating abroad. This is especially now that PCR tests and masks are not needed indoors, even in the planes where the passengers around us are openly sneezing and coughing into the air.

Having a 24/7 medical and emergency assistance hotline is also important to me, especially one that includes a telemedicine option so that we can talk to a doctor from our hotel. This is super useful when you have young kids like mine who may kick up a fuss about being dragged to a clinic or hospital abroad!

If your criteria are similar, then check out Klook Protect Travel Insurance, which is their latest launch to add further value as a travel booking resource.

For itinerary ideas and bookings, Klook has already been my go-to resource since 2016, especially with their digital vouchers or tickets, which I can claim without having to print out any documents. I use Klook so often that I’ve already hit their highest membership tier – Gold.

If you aren’t already on Klook, you can sign up with my referral code to get $5 here.

You may have also recently noticed their newest feature – Klook Protect Travel Insurance!

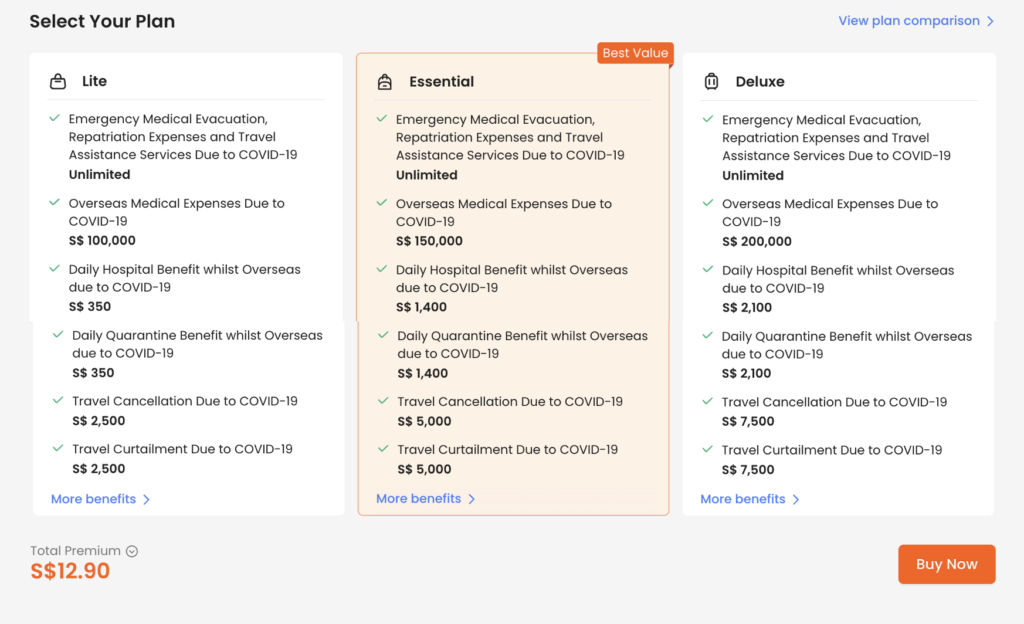

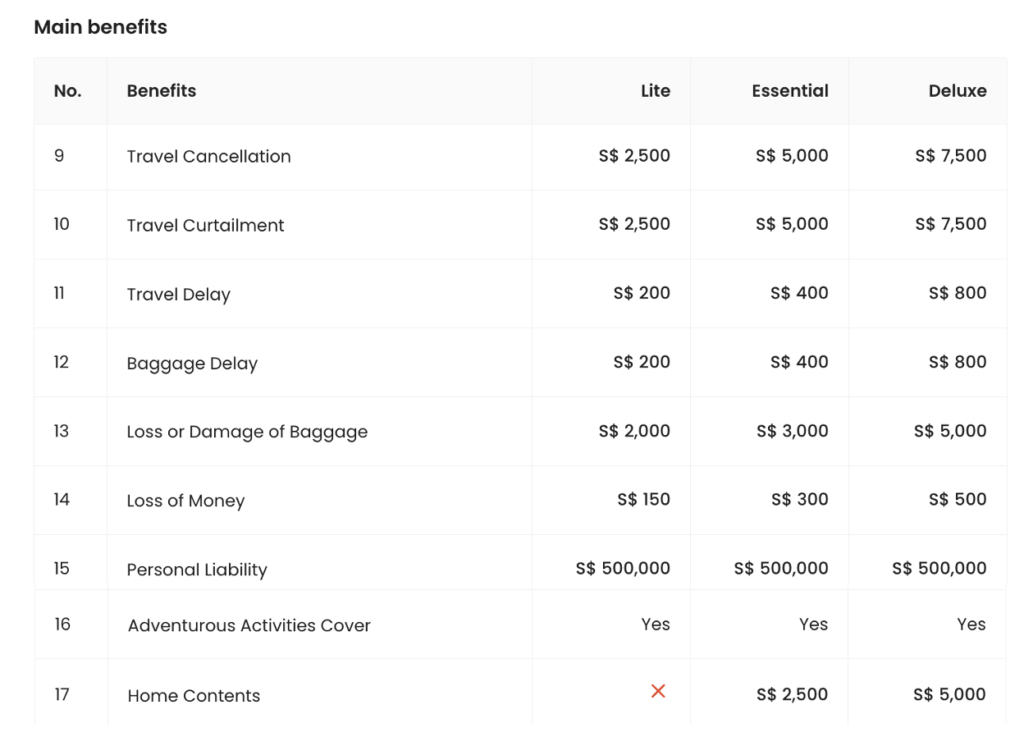

Travel insurance should be simple and fuss-free, so Klook has divided it into 3 easy options to help you decide what to get: Lite, Essential and Deluxe.

Personally, I’d tend to go for Lite if I’m travelling within Southeast Asia without the kids, while I’d prefer Essential for further countries due to the difference in the cost of travel, overseas cost of living and foreign currency exchange rates.

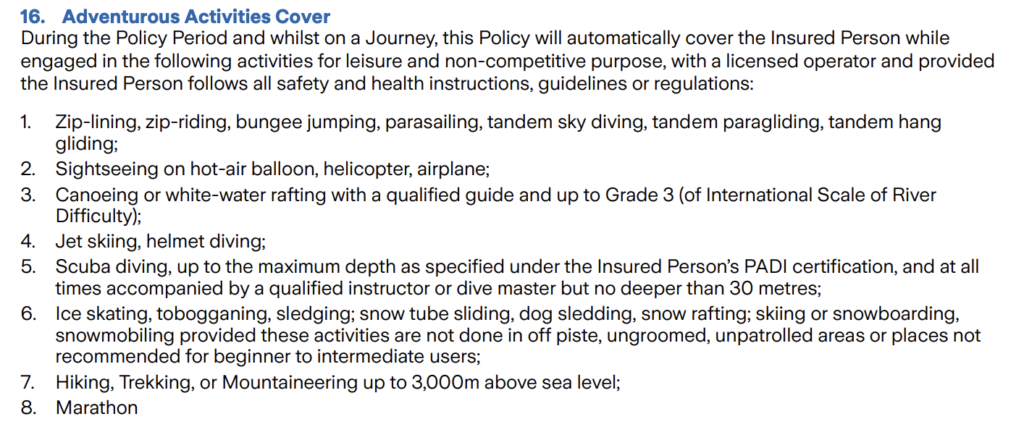

One key policy feature unique to Klook includes coverage for adventurous activities, which will come in handy if you intend to go for any water, winter, air and/or extreme sports:

Traditionally, the savvy ones had to either (i) pay more to obtain such coverage or (ii) get it covered under a separate, worldwide personal accident plan.

If you intend to do any of the above activities while on your holiday, you will appreciate how Klook’s insurance policy explicitly covers you for them.

Note: Many people may not realize that most travel insurer providers tend to exclude these from your coverage benefits. You can find it by either searching under “Dangerous Sports and Leisure Activities”, or a clause (usually under general exclusions) wordings like “taking part in flying or other aerial activities / taking part in any kind of speed contest or racing / extreme sports”. Some other insurers offer it only as a payable add-on under “winter sports” or “adventurous water sports”.

A few other benefit areas you might want to take note of are:

- Travel delay – at least 6 hours

- Baggage delay – at least 6 hours

- Loss or damage to baggage – $2k / $3k / $5k

- 24/7 assistance emergency hotline +65 6260 0122 (by Zurich)

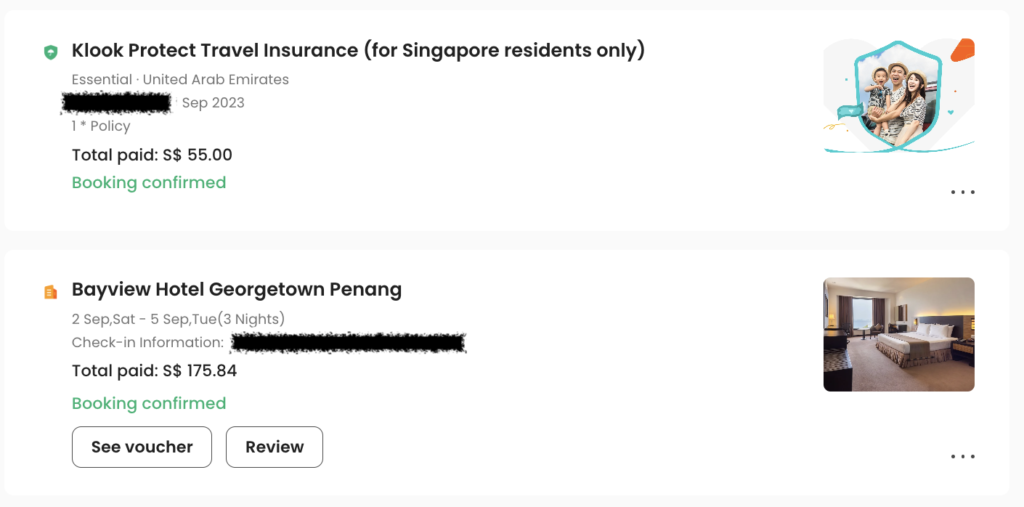

I tested it out for my upcoming Dubai trip, and Klook in fact came in as the lowest-cost online plan among those with similar coverage. Of course, your exact quote will vary depending on the details of your trip.

In terms of convenience, I really like how I now have the option to keep all my travel documents in one place – on Klook – specifically my accommodation bookings, activity tickets, and insurance!

It is essential to note that Klook Protect Travel Insurance is only available to Singapore residents and cannot be extended to overseas travellers visiting Singapore (which means you cannot book it for your overseas boyfriend who’s travelling to Singapore and taking a trip to Malaysia / Thailand with you).

However, for solo travellers and even families residing in Singapore, Klook’s insurance offering is a much-needed welcome to the scene for sure.

TLDR Conclusion

Klook’s newest travel insurance, underwritten by Zurich, is not only affordable and super price-competitive but also comes with various benefits that are seldom found in other typical insurance plans.

Those who value convenience (like me) will also appreciate the fact that your policy will be issued immediately and is available for retrieval within your Klook app. With all your travel bookings and key documents in one place, this greatly reduces the administrative and logistical headache that we have to deal with otherwise.

If you’re getting Klook travel insurance for yourself, here’s a promo code to make it even sweeter.

Use BUDGETBABE20 at checkout to get 20% off!

For those of you looking to travel during the upcoming year end holidays or getting ready for your 2024 trips, don’t miss out on Klook’s special 11.11 deals here! Klook’s 11 days of 1-for-1 deals runs from now until 15 November.

Disclosure: This post is brought to you in collaboration with Klook. All opinions and reviews are that of my own.

Klook is Asia’s leading platform for experiences and travel services. We curate quality experiences ranging from attractions, tours to local transport and accommodation all around the world. Founded in 2014, we are here to inspire and enable more moments of joy for travelers anytime, anywhere.

Sponsored Message

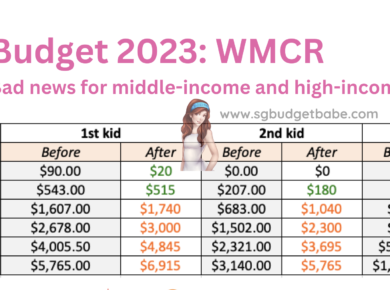

Information accurate as of 21 September 2023, and promo details updated 10 November 2023. This advertisement has not been reviewed by the Monetary Authority of Singapore.