I’m generally not a fan of ILPs (Investment-Linked Plans), but over the years, I’ve reviewed several more popular ILPs at the request of my readers. The very first ILP that I wrote about in detail on this blog was Singlife Grow, which was launched in 2021 and was the first digital ILP in the market.

Digital ILPs make for an interesting breed of product, especially given how they were structured to challenge traditional ILPs with some of the following features:

- 100% of premiums are invested upfront

- A fraction of the fees vs. traditional ILPs, since distribution costs and sales agent commissions were being eliminated

- No lock-ins or withdrawal penalties

There are 2 digital ILPs that have since gained traction in the market, namely Singlife Sure Invest (formerly Grow) and Tiq Invest. Many of us in the scene were eager to see if they could beat the big boys.

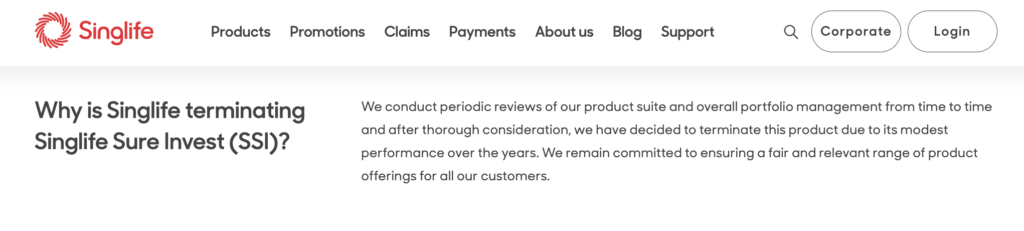

But alas, now that Singlife has announced they’re discontinuing the ILP, we’re now left with only one contender standing.

If you’re a current Singlife Sure Invest / Grow policyholder, this is obviously relevant to you. But even if you’re not, it still makes for quite an interesting case study on the birth and demise of an investment-linked policy (ILP) that tried to solve the criticisms levelled at its predecessors (which are still thriving today).

The birth of Digital ILPs in Singapore

About 8 years ago, I wrote about how I cancelled my ILP after realising how much it was costing me and eating into my investment returns. Later, to avoid having people following my move blindly, I wrote about the pros and cons of ILPs to help readers decide for themselves.

So when Singlife Grow (later restructured as Sure Invest) came out, their product managers designed a plan that could take on the criticisms typically associated with traditional ILPs…while retaining the benefits for consumers. It was a bold vision, with lower fees, no lock-in periods, zero withdrawal penalties and without the need for ongoing premium payments. Shortly after, Etiqa launched their own version of a digital ILP with an even lower fee and managed by 4 fund managers including Dimensional and Lion Global (whereas Singlife’s funds were only via Aberdeen).

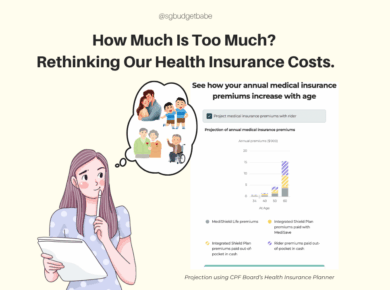

There’s no doubt that digital ILPs are cheaper for the consumer. But in that case, why is Singlife pulling the plug on theirs?

Singlife claims it is because of the product’s “modest performance over the years”. My question is – for who? The insurer or the consumer? My guess is the former.

The thing about ILPs is that they are often sold and not bought. Insurance agents get paid high commissions (see how high here) which incentivizes them to sell ILPs to their clients and ensure they remain committed to the plan and continue to pay for it over the years.

Attempting to cut out the salespeople and go DTC (direct to consumer) is a gallant attempt, but does it pay well enough for the insurer to justify continuing the policy?

Singlife’s cessation of Sure Invest suggests that it may not have been, but we’ll never know. We can now only watch to see what happens with Etiqa’s Tiq Invest to find out more.

What happens to Singlife ILP customers?

In a move that will shake up the industry, Singlife will be giving back all Singlife Sure Invest policyholders their premiums paid, on top of paying a 2.5% interest on the annual management charge that was levied during the ILP term.

This means even if your portfolio is in a loss, all Singlife Sure Invest customers will be able to exit their ILP without incurring any capital losses at all.

You may refer to Singlife’s website here for the details, but here’s a quick summary of the 3 likely scenarios (assuming $10k was the invested starting capital):

- Your policy net asset value (NAV) is in a loss: You will receive a total payment of S$10,147.50 which includes a payment of S$900 by Singlife to bring the policyowner back to the net capital position (at the point of purchase of the SSI ILP policy) and an additional interest payment of S$247.50 by Singlife.

- Your policy net asset value (NAV) is in profit: You will receive a total payment of S$11,247.50 which includes an interest payment of S$247.50 by Singlife.

- Your policy net asset value (NAV) = net capital: You will receive a total payment of S$10,147.50 which includes an additional interest payment of S$247.50 by Singlife.

In case you’re confused by the “Net Capital” term used by Singlife, it refers to your Initial Premium + Top-ups – Withdrawals/Refunds – Fees.

This is wild, and extremely generous of Singlife to do so. Instead of simply reimbursing the annual management charges, they’ve gone one step further to pay a 2.5% p.a. interest on top of it. Their move will definitely go down in history books as one for other insurers to learn from.

This is the first time I’ve seen a local insurer offer to bear any investment losses by the customer!

What Happens Next?

If you currently hold the Singlife ILP, then you can expect to be paid on the following 2 dates:

- Net Asset Value is refunded to policyholders by 30th September 2024

- 2.5% p.a. interest on Net Capital is given to policyholders by 18th October 2024

Singlife has said that they will send a final statement by 18 Oct 2024 to confirm the termination and a summary of the net payments to be credited to you.

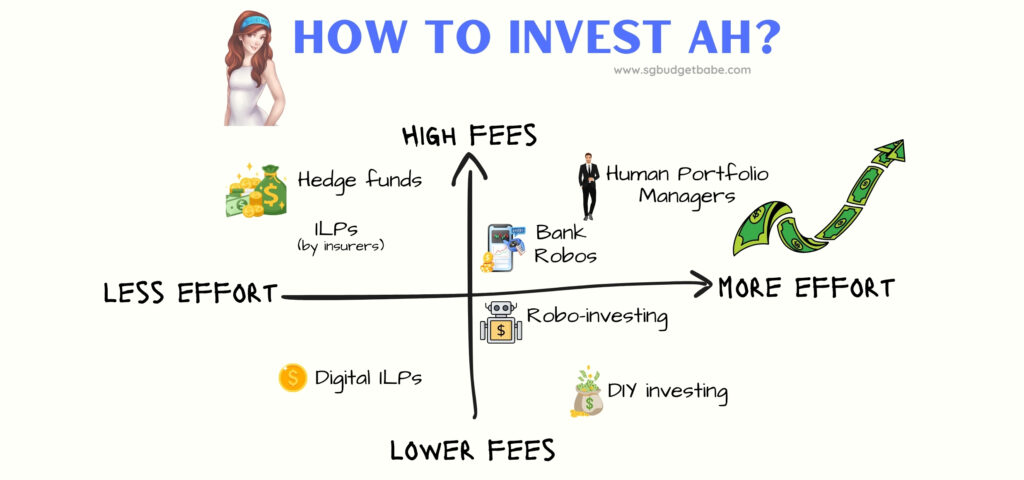

What should you do to invest the money that you get back? Well, there are several options (ranked from lowest fees):

- Learn how to invest by yourself via a brokerage

- Invest via a robo-advisor’s packaged portfolios

- Invest via a bank’s robo portfolios

- Invest in Singapore’s other digital ILP: Tiq Invest

- Invest via a traditional ILP (be prepared to pay higher fees)

- or, if you’re rich, you can also invest directly into hedge funds and portfolio managers.

Will Digital ILPs survive?

It is no secret that the high fees associated with ILPs erode into the investment returns for policyholders, but that’s how the nature of traditional ILPs work anyway – tacked with high agent upfront commissions, insurer distribution fees and the fund manager’s ongoing fees. So it was refreshing to see digital insurers Singlife and Etiqa try and tackle this problem by launching a lower-fee, single-premium ILP to compete with the big boys, but today, Singlife’s decision to shut it down only makes us wonder why.

As much as we want digital ILPs to work, the reality might just be that customers are not buying enough of them to justify the work and money involved on the insurers’ end. And when that happens, the hard decision of closing it for good will have to be made. After all, you can’t save the world without first ensuring your own livelihood.

I bet more traditional ILPs have been sold in the past 1 year vs. the combined sales of Singlife Sure Invest and Etiqa Tiq Invest. Amidst that backdrop, how can we then expect digital ILPs to survive?

All eyes on Etiqa now to see how the scene develops from here.

With love,

Budget Babe