I’ve been thinking about the state of passive investing as the message “just buy the S&P 500” became the predominant narrative in recent years. This thought was first posed to me by our former GIC chief and Presidential candidate Ng Kok Song a few years ago, and I haven’t been able to shrug it off since.

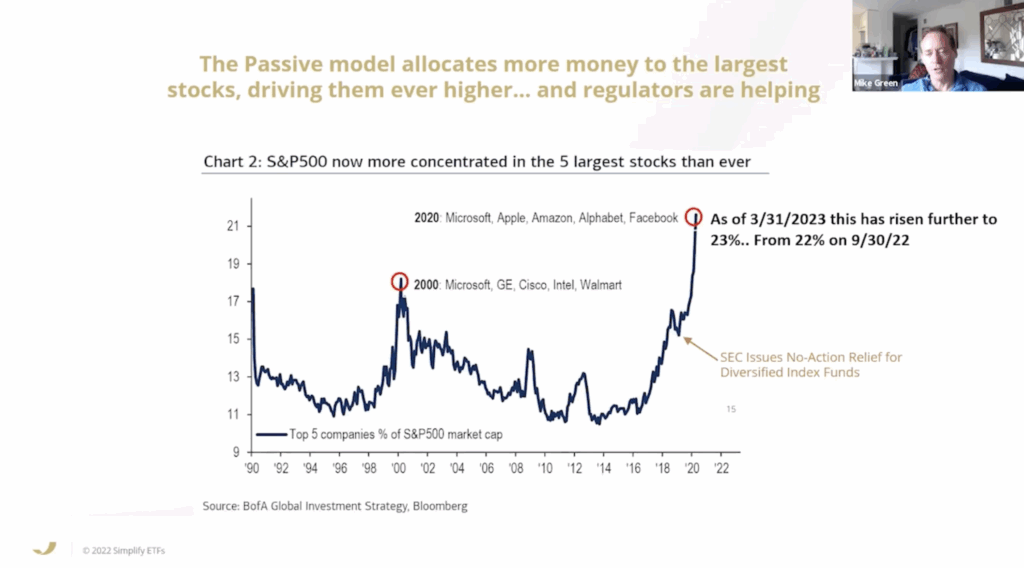

In my recent trip to Omaha for the 2025 Berkshire Hathaway AGM, I had the fortune to meet with many intelligent investors and thought leaders as we talked about stocks and the rising theme of passive investors who simply buy index funds every month without thinking. Is this “buy and forget” strategy enough? How do these shape the markets, and are they causing a bigger valuation gap for companies who aren’t in the large market indices (yet)? Could the new 10X strategy be to find profitable small-cap companies that are rapidly growing and invest in them before they get included in the indices?

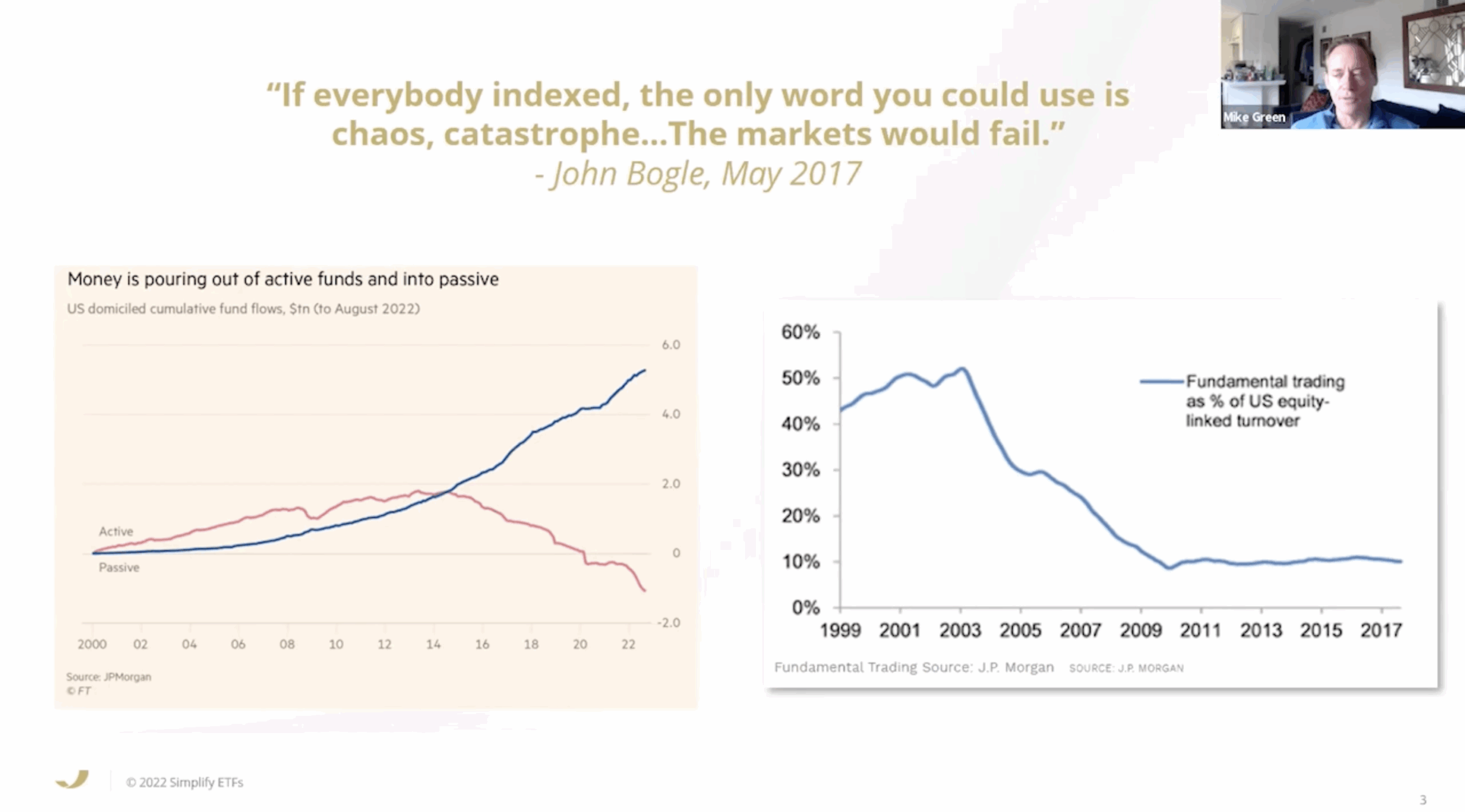

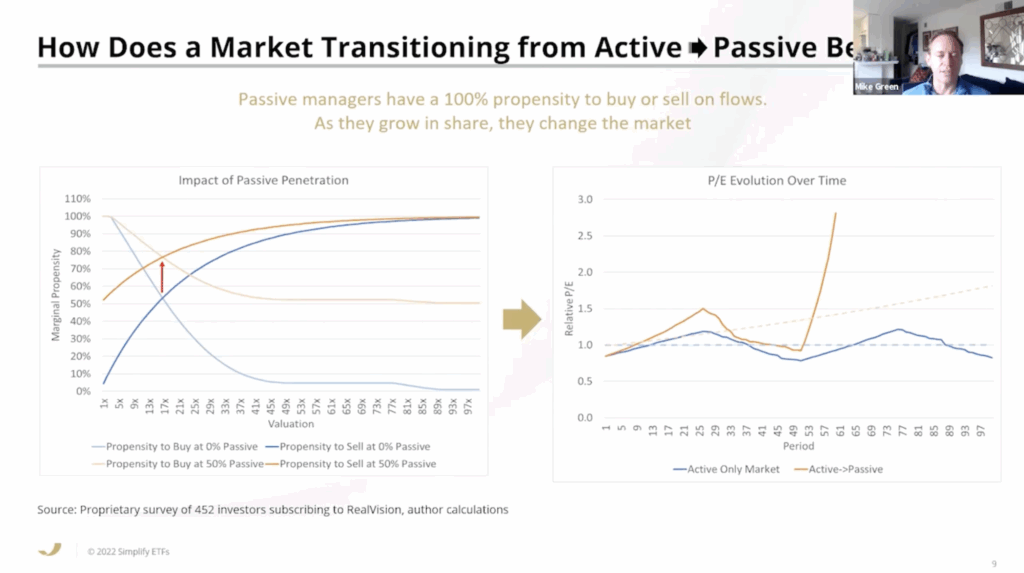

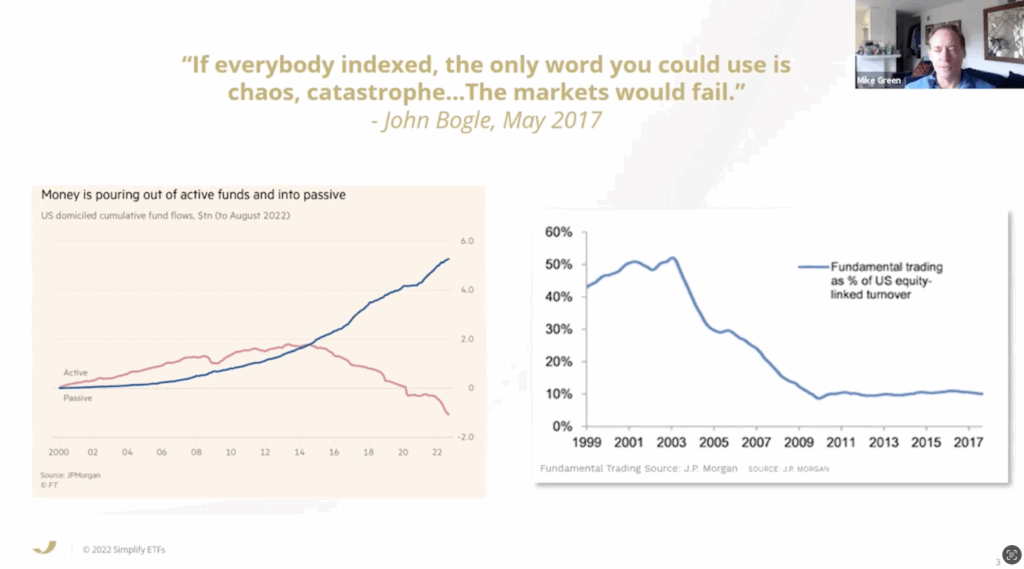

I spoke with Michael Green, chief strategist of Simplify Asset Management at the VALUExBRK conference the day before, who calls passive index investing “The Greatest Story Ever Sold”. He argues that passive is not passive and is instead the greatest con ever pulled on investors. The below slides are snippets I’ve cut from an earlier version of his presentation, which can be found here.

The argument that the rise of passive investing not only distorts the markets, but will lead to chaos is not exactly new, but we finally have more statistics to back this hypothesis up. Interestingly, this sentiment was also echoed by Warren Buffett in an earlier 1982 letter to shareholders where he expressed concerns about the detachment from underlying business valuations that the rise of index funds could bring.

Howard Marks also wrote a memo on this earlier this year, and I quote some noteworthy sections from it that got me thinking:

“The greatest bubbles usually originate in connection with innovations, mostly technological or financial, and they initially affect a small group of stocks. But sometimes they extend to whole markets, as the fervor for a bubble group spreads to everything.

In a similar vein, heated buying spurred by the observation that stocks had never performed poorly for a long period caused stock prices to rise to a point from which they were destined to do just that.

The S&P 500 declined in 2000, 2001, and 2002 for the first three-year decline since 1939, during the Great Depression. As a consequence of this poor performance, investors deserted stocks en masse, causing the S&P 500 to have a cumulative return of zero for the more than eleven years from the bubble peak in mid-2000 until December 2011.

The point is that when stocks rise too fast – out of proportion to the growth in the underlying companies’ earnings – they’re unlikely to keep on appreciating. Michael Cembalest has another chart that makes this point. It shows that prior to two years ago, there were only four times in the history of the S&P 500 when it returned 20% or more for two years in a row. In the last two years, it’s happened for the fifth time. The S&P 500 was up 26% in 2023 and 25% in 2024, for the best two-year stretch since 1997-98. That brings us to 2025. What lies ahead?”

This is an observation I’ve repeatedly expressed on my social media channels. The recent market movements are anything but normal. I’m not smart enough to know all the answers, but Howard Marks offers a clue by looking back into history:

“There’s a strong relationship between starting valuations and subsequent annualized ten-year returns. Higher starting valuations consistently lead to lower returns, and vice versa.

Today’s P/E ratio is clearly well into the top decile of observations. In that 27-year period, when people bought the S&P at P/E ratios in line with today’s multiple of 22, they always earned ten-year returns between plus 2% and minus 2%.”

Unfortunately, I didn’t get a chance to ask Warren Buffett about this during the 2025 Berkshire Hathaway AGM at the microphones, so I thought I’d ask the next best person: Markel’s CEO Tom Gayner. His track record is impeccable, and he’s an investor whom I greatly respect for both his track record and life wisdom. His response?

“It might well be that this era we’ve been through (of outperformance by the S&P 500) might be very difficult for the S&P to keep up with.

It may look very different than what it has achieved in the last 5, 10 or 20 years.

I spend my time to think about each individual business and can I count on them to relentlessly compound our capital, and I try to think of that as independently to the S&P as I possibly can.”

I often get asked by readers whether simply buying the S&P 500 every month and doing dollar-cost averaging will be sufficient. My stance is pretty clear, and I will say this: you have to make – and accept – the decision for yourself that will determine your future investing outcomes.

I’ve found these memos and insights to be useful for me, and hope it gives you something to think about as you make a decision on the path you want to take with your money.

As an investor myself, I don’t believe that the path to wealth lies in doing what everyone else is doing. I’ve never been a believer of simply buying the indexes – instead, I prefer to find the highest-quality companies within it and buy them when they are trading at undervalued prices on the market.

The S&P500 may have historically returned 10 – 11% over the last 40 years, but past performance is not a guarantee for future performance and there’s no telling how the future will look like.

I’ve no doubt that many US-listed companies will continue to grow and dominate. I’m personally invested in several of them – including Alphabet, Amazon and Palantir. But I bought them only at strategic timings, and not through an index fund.

One thing is for sure – my portfolio didn’t cross $1M by buying the index every month, and even if I could turn back time to change my strategies and buy the S&P 500 every month instead, there’s no way it would have gotten me to $1M either.

Of course, just because I couldn't do it with the S&P500 doesn't mean you can't. After all, the S&P500 returned 300% gains in the last decade, so anyone who had $330k to start with then might have yielded a completely different result.

For the record, I started investing with $20k in 2014. It wasn't until 2017 when I hit $100k, and even if I had the foresight (and guts) to invest all of it in the S&P500 then, my returns still wouldn't be anywhere close to $1M.

Instead, I prefer to be thoughtful about what is more likely to beat the markets in the long-run. I’d much rather follow the playbook of legendary investors I respect – including Buffett, Gayner and more – and invest in undervalued companies that will compound faster and higher than the market indexes.

While I have no idea where the S&P500 will go from here, I shall listen to Gayner’s advice and operate “independently of the S&P500”.

How about you guys?

With love,

Dawn

Budget Babe