Apart from the missing plane on international news, here in Singapore, another drama has unfolded for retail investors.

Technics Oil & Gas (SGX: 5CQ) was founded in 1990 and headquartered in Singapore. It has 350 employees and largely serves the oil and gas companies among its customers for repair and maintenance, leasing of equipment, and other various contract engineering projects. A part of its business also manufactures medical equipment.

Yesterday, it was announced to be caught in a legal tussle between 3 separate companies – Soilbuild REIT, Hup Seng Offshore Engineering, and its former director Ting Tiong Ching who had served the company for 17 years. Hup Seng also happens to be owned by his relatives.

The legal cases:

– $1.9 million repayment of loans, by Ting Tiong Ching

– $3 million repayment of loans, by Hup Seng.

– $2.19 million repayment of defaulted rent owed to Soilbuild REIT, and $11.8 million for continuing arrears in rent and security deposit for the second year

Now, here’s the interesting drama:

|

| All 3 have since left. |

In end Feb, Ting Yew Sue resigned as Chairman of the Group, a position he has held for almost 15 years. He claimed it was due to medical reasons that required him to be absent from work for an extended period of time.

Shortly after, he also sold off almost 6% of his voting shares (he originally had 10.68%) for a total of $2.077 million, claiming that it was a “forced sale transaction performed by financial institutions” and that he “was not immediately aware of the transaction”. Since the shares were sold in batches, this works out to be an average of $0.153 cents each

His son, Group Managing Director Ting Tiong Ching (yes, the same person who filed the lawsuit), also resigned thereafter. The most interesting part is that Ting Tiong Ching has been with the Group since 2002 as well, the same year his father was appointed Group Chairman.

Other resignations in 2016

Tan Kia Teck Thomas resigned as Executive Director

Tan Liam Beng resigned as Independent Director

Ong Siew Peng resigned as Lead Independent Director

Tay Mian Cheo took over momentarily as Executive Chairman, but later resigned as Executive Director

What happened? Was the Group in financial trouble?

2016 was evidently not a good year for the company. Their results so far are:

2Q2016: Revenue $14.2 million. Net loss $4.4 million

1Q2016: Revenue $15.2 million. Net loss $1.1 million

However, this does not come as a surprise since we already know the huge drop in oil prices since last year. Furthermore, due to their nature of business, the Group is susceptible to cyclical headwinds in the sector, as can be seen from their lumpy profits over the past 12 years.

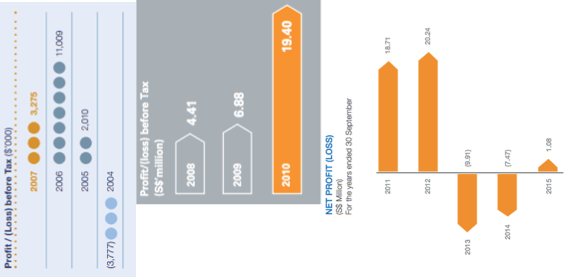

Take a look at their revenue and profits which I’ve (hastily) put together below and judge for yourself.

|

| Revenue |

|

| Profits |

Shares Movement

In late Feb, Eversendai Corporation Berhad (an existing major shareholder) spent $2.95 million to buy almost 23.5 million shares of Technics, thus raising their ownership stake in the Group from 19.62% to 29.87%

In March, two significant directors sold a majority of their stakes on the open market. Executive Director Tay Mian Cheo sold 5.65 million shares for a total of $748,000 (about $0.1325 each), claiming that this was because he was interested in 5 million shares held by his spouse. This does not make sense to me.

Ting Tiong Ching also sold 14 million shares at $0.20 each for a total of $2.8 million.

Stock Price

Back in January when oil prices were at its lowest ($33.62 per barrel compared to today’s $48), a lot of oil and gas companies were trading near historical lows in terms of their valuations. That was when local darling Keppel dropped to under $5, but Technics was still trading at about $0.60 per share.

Later, in early Feb, the group was apparently involved in negotiations with potential parties regarding its assets and a major transaction that could lead to its reverse takeover. The discussions did not go reach a satisfactory conclusion in the end and were called off, leading its stock to drop drastically to $0.119.

Even when they had released their poor quarterly earnings, the stock price did not perform that badly.

After the series of bad news that were just released yesterday, Technics’ stock price has plummeted to $0.11 again.

Are you starting to see what I see now?

Let’s sit back and watch the show unfold. It’ll be interesting to see what happens from here, and how the share price reacts accordingly. Looks like we don’t have to always tune into MediaCorp to watch drama!

Update 26 May: Technics Oil & Gas lost the case, and SoilBuild has successfully gotten the company’s bank guarantee for a sum of S$11.8 million.

That’s all for now 😛

7 comments

Hi BB,

This is not uncommon in business because perhaps this is really the first time a major or more sustained crisis has hit Sg (oil co). So that now more people is talking. Having in the business of oil and gas, I have heard sonny stories which retailer prolly unaware.

The biggest problem to Singaporeans is the last real crisis happened almost 20 yrs ago and everything has been too smooth sailing for the country that the pple tend to be overconfident.

In last 13 yrs SARS, GFC crisis I had experienced but while companies struggled for a short while, they recovered fast.

So now the oil crisis had already last for 1.5 yrs, getting painful. If a sustained economic crisis come the next time… oh dear!

Jason holdings is in bigger trouble…

As much drama in Jason Holdings too? 😛

Nice summary and nice graphics.

Agree with Rolf, Jason Holdings is in bigger trouble and has creditors chasing them.

The current oil situation is quite bad. Being an active reader of the SGX announcement page, you can see that many oil related companies are experiencing cancellation of orders (Nam Cheong, Penguin) or squabbling over contracts (Semb Marine Mermaid). On the p2p scene, there is a company whose customers are in the O&G field who had defaulted (Scan Tech Marine), not sure how did Moolahsense resolve this crowd funding default

Before this saga happened. Me and one of my colleague already smell rats on this company beginning of last year.

Tech O&G company juz located two buildg away fr the firm we work. Every morning we walk pass their company whenever we go for our meal.

The buildg whc own by Soilbuild now has bn vacanted till today. It even took god knows how many years to complete the still vacanted buildg.

The strange part is thier last year share price was still resilient while other more reputable o&g firm share price have already drop like flies.

Thinkg of shortg this company share since last year.

I'm definitely staying out of O&G stocks for now!

Woah, you mean the building has been empty for some time already? So Tech O&G were essentially paying rent for a place they did not use? Not quite sure I understand…

Comments are closed.