I’ve been seeing a lot of recent ads on Facebook selling the idea that HDB owners who earn as little as $6k – $8k combined monthly income can:

– Upgrade to a private condominium AND

– Own a second property AND

– Get a 5 to 6-digit lump sum of capital

all WITHOUT forking out any additional cash.

For many of you who have been targeted by these ads and are wondering what the catch really is, I’ll be debunking this today and sharing with you why I think such a message is completely unrealistic and misleading.

Got such a good deal meh? How does it work?

To be fair, the situation isn’t completely impossible. Here’s how:

1. Sell your HDB flat at a higher price than what you bought it at previously

2. Use the cash profits from your HDB sale to pay for the minimum downpayment of 2 condos (1 to stay in, 1 to rent out).

3. The remaining cash forms your emergency fund.

4. Rent out your second property for $XXXX a month and use that to pay off your mortgage loan on that same property, ideally with excess to spare.

Unfortunately, for a family whose combined income is $6,000 a month, I feel that agents who recommend such a strategy aren’t being financially responsible.

What’s the catch?

There are many downsides that these agents aren’t telling you about. I spoke with an honest property agent whom I’d trust with my life (aka my husband lah #biased) in order to clarify this, and here’s a backward projection we came up with.

We tried very hard to work out a backward projection that meets the claims purported in these ads, and I struggled to come up with scenarios where the above marketing claims were met in full. It eventually only worked out after we assumed a 1-bedder condo (for $800k) was purchased, and used overly optimistic figures for rental yield and excluded all other reasonable expenses.

But there are many glaring issues that make these assumptions problematic, and this is where I take issue with. For instance, is a smaller condo even realistic for a family with kids?

Moreover, there are many hidden fees not addressed:

– Condo maintenance fee

– Vacant periods where you’re in between tenants

– Property tax

– Higher income tax (due to rental income)

A few assumptions that we used in order for the backward projection to work out:

– Your HDB was a Built-To-Order (BTO) flat which you bought more than 5 years ago for cheap

– You sell your BTO flat for more than at least $100k – $150k of what you bought it at

– You “upgrade” to a condo but with smaller area (eg. 1 or 2-bedder)

BUT! Don’t forget that:

While you’ll indeed be “upgrading” from a HDB to a private condominium lifestyle, ask yourself if a smaller house, possibly in a further location, is truly an “upgrade” at all.

Think about all your transport costs for a location much further away from the MRT station.

Next, now that you’re so highly leveraged, what happens if you lose your job? Will you be able to continue servicing your monthly mortgage debt?

What happens if the Fed raises interest rates, and your mortgage loan suddenly becomes more expensive to service?

What happens if you’re unable to find decent tenants to rent your second property to? Where will you get that additional income?

So…what’s in it for these property agents? Why are they hard-selling this lifestyle to me?

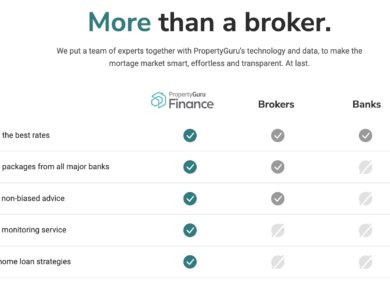

Plenty. They earn not just the commission from selling your HDB, but also TWO more commissions for helping you to buy your condo and additional property.

As for you, congratulations! You’re now knee-high in debt.

Is that what you REALLY want?

|

| Images are not mine, but I’ve removed hyperlink credits as some readers have commented it is indirectly promoting these agents, which defeats my intentions. Hence, source credits will only be provided upon request. |

If your agent is simply selling you unicorns and rainbows instead of telling you the hard truth behind this magical-sounding strategy, I’d be wary of working with such an agent.

Property investment can indeed be your pot of gold, but if you go into it blind without really realising what you’re signing up for, don’t blame anyone but yourself (and your agent certainly isn’t going to take responsibility when it explodes on you years down the road…)

Look for one who is REALISTIC about fitting in such a strategy into your life and financial circumstances, without landing you knee-high in debt while they walk away with a smile earned from the three commission deals they’ve done for you.

Notes:

– To obtain the full backward projection I used in this post, please fill up my contact form here and I’ll send it over to you (when I have time). Note that any requests after 31 Dec 2017 will not be entertained.

– One key limitation of our calculations are in the numbers projected, which match only a very small fraction of Singapore’s population. I personally think it is more realistic to do your own calculations, or get an agent to do them up for you, in order to assess your suitability. If you’re a HDB owner who’s keen on pursuing this strategy and wish to know whether your numbers and financial situation makes this realistic, please approach an honest agent whom you can trust to evaluate your situation without hard-selling you this dream. If you know of none, drop me an email if you want me to get my own agent to speak with you.

With love,

Budget Babe