Are Singapore stocks dead?! As we celebrate National Day, I argue why many new retail investors are making the mistake of overlooking local investment opportunities. And as an investor living in one of the world’s strongest economies, we can definitely ride on Singapore’s economic growth – especially for those seeking growth and income returns on your investment portfolio.

Strong, stable companies with a defensible moat and steady growth.

These are the type of investments that I tend to gravitate towards, which is why various blue-chip SGX listed companies remain attractive – at the right valuations. For instance, my investment in DBS bought during the 2016 oil crisis currently yields me more than 8% dividends on cost1, together with a capital return of over 2X. And who can forget iFast, which I bought at $1 a few years ago?

Undervalued and dividend plays exist in our local stock market, if only you know where to look.

If you don’t have an eye for picking out individual stocks, another easy way would be to invest through Exchange-Traded Funds (ETFs).

And luckily for us here in Singapore, we have access to various SGX listed ETFs focusing on the Singapore market that allow us to ride this growth.

Investing tools unique to the Singaporean investor

As a Singaporean, I can use either my cash savings or my SRS funds to invest in local bonds, stocks or ETFs.

Singapore’s government bonds offer stable yields

For the risk-adverse, retail investors often consider investing into Singapore Treasury bills (a.k.a. “T-bills”), the Singapore Savings Bonds (“SSB”) or Singapore Government Securities Bond (“SGS”). Backed by the highest AAA credit ratings by all 3 major credit rating agencies (S&P, Moody’s and Fitch), many investors view Singapore government bonds as pretty much the safest option for investors who do not want to take any risks on their capital (especially in contrast to other countries’ government bonds).

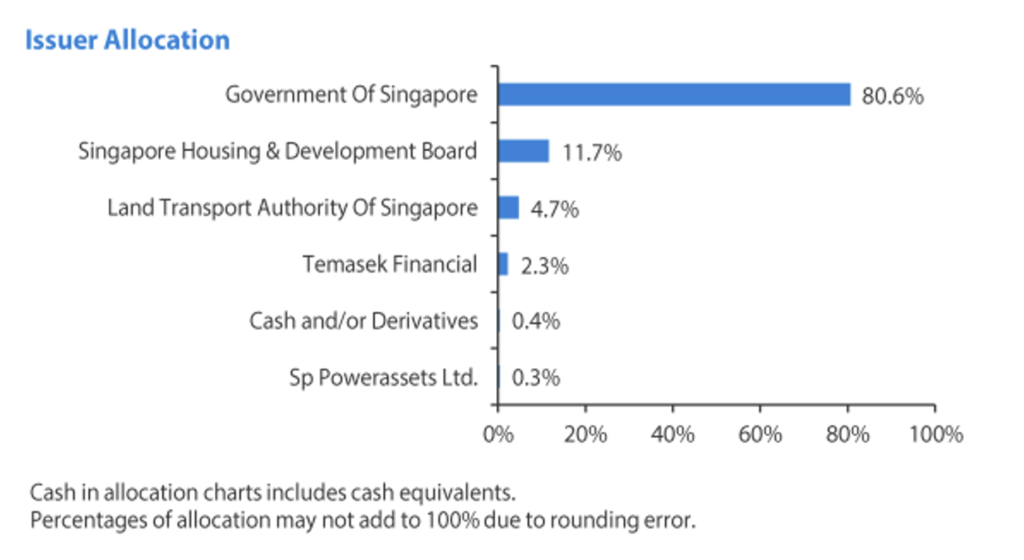

Did you know that our public authorities – such as HDB and LTA also periodically issues bonds? The only limitation is, these are typically made available only for institutional and accredited investors (but there’s a way, keep reading!).

But don’t fret, even as a retail investor, you can still get exposure to these bonds – by investing into SGX listed ETFs such as the ABF Singapore Bond Index Fund, which tracks a basket of high quality AAA rated bonds issued primarily by the Singapore Government and quasi-Singapore government entities.

Here’s a quick look at the various bond issuers in the ETF:

Bring up your yield with bonds from blue-chip companies

Other than the government, businesses typically issue bonds to finance their operations as well as capital expenditure plans. These corporate bonds often offer a higher yield than government bonds, in exchange for the credit risk spread that you’re undertaking.

In today’s climate, these yields can range anywhere from 4% to 12%^, but you’d want to be careful with high-yield corporate bonds as it could lead to capital losses should the company default on their bonds, especially in times of crisis where liquidity can be tight.

^Note: These yields are not fixed in stone; the 4% to 12% number is based on bonds I’ve found available in the current open market as of July – August 2023.

Personally, I’d prefer to go for stable, blue-chip issuers with a low default risk – ideally companies with resilient business models even if a recession were to hit.

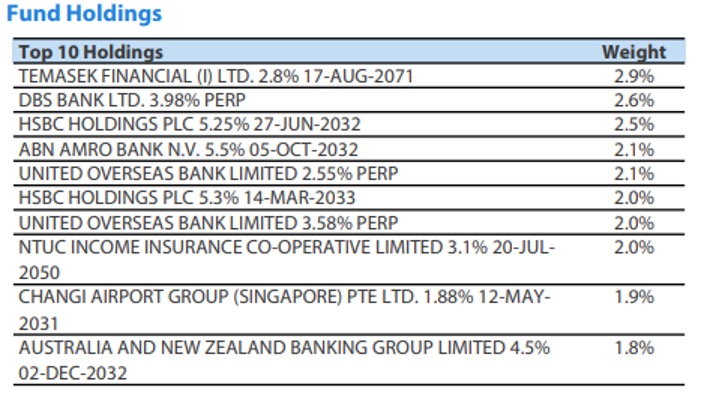

Some of these corporate bonds are also limited to only accredited investors, and require a significant capital (usually SGD 250,000 or more) for each bond purchase. If you wish to access such corporate bonds but do not wish to lock up so much of your cash in a single bond, you can consider investing through the Nikko AM SGD Investment Grade Corporate Bond ETF instead.

This ETF predominantly consists of bonds issued by recognisable institutions such as DBS Group, HDB, PUB, HSBC, NTUC Income, Temasek, Lendlease, Singtel2 and more. Its holdings consists of only investment grade corporate bonds (rated between AAA to BBB-) which have a lower risk of default, and the ETF currently has a portfolio average credit rating of A (as of June 2023)3.

Here is a quick look at the top 10 holdings of Nikko AM SGD Investment Grade Corporate Bond ETF:

I reckon that this makes it a much better option for those who want to ride on the yields found in the corporate bond market, without taking on the higher risks associated with each bond purchase. Rather than monitoring your individual bond yields and capital changes, you’d be tracking your returns in the ETF instead (which can also fall or rise).

Ride on the growth of the top 30 Singapore listed companies

Not many people realise this, but in recent years, close to half of the revenue associated with the STI was reportedly derived from abroad i.e. outside of Singapore. Singapore’s biggest firms are not only making a name for themselves domestically, but are also capturing market share outside of our local shores!

Homegrown SATS, for instance, has since ballooned into a global air cargo logistics provider, covering trade routes responsible for more than 50% of global air cargo volume with its own Americas-Europe-APAC network and global footprint of 201 cargo and ground handling stations. Or how about Wilmar, an agricultural leader which has grown into a Fortune 500 company where its flagship edible oil brand commands over 18% of India’s market share?

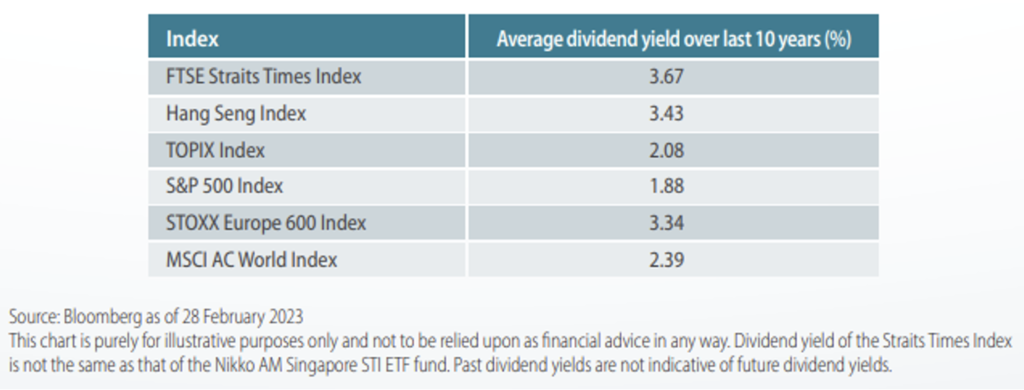

What’s more, when comparing the dividend yields across the last 10 years, the STI offers one of the highest dividend yields when compared with other global market indices.

In my view, an ETF like the Nikko AM Singapore STI ETF offers easy access to all of these companies within a single investment position, so that you don’t have to waste energy tracking individual companies since the index automatically rebalances its constituents semi-annually. Comfort Delgro, for instance, was a mainstay in the SGX for decades, but was recently removed last year and replaced by Emperador.

Investing in Singapore may not come with the excitement typically found in the US markets, but if you’re looking for stable growth and/or dividend yield, Singapore offers a sweet spot of stable growth and income.

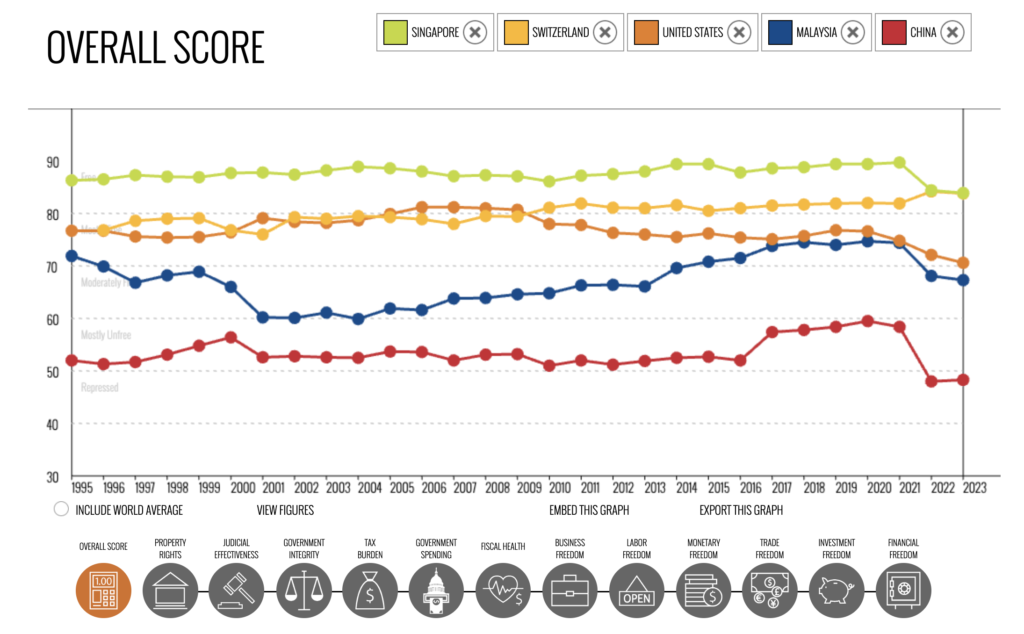

Ranked first in the world’s index of economic freedoms, Singapore’s economic growth has been stable and generally been on the uptrend in the past few decades. Although being an open economy also means it can still be subject to market downturns due to global recessions or even pandemic situations, today, Singapore has grown to become a major manufacturer of chemicals and electronics – including playing a role in global supply chains when it comes to the chips used to power artificial intelligence – and operates one of the world’s largest ports.

Singapore has consistently been a top performer in the world’s index of economic freedoms and topped the global charts for the most recent 3 consecutive years.

Companies such as Dyson, Visa and ABB have chosen Singapore to set up their innovation hubs, while our local blue-chips like Wilmar and SATS continue to expand overseas and grow revenues. As a Singaporean, I feel that we should not forget to look inwards and identify Singapore-owned companies that are quietly growing their revenues and garnering a greater market share abroad.

Advantages as a Singaporean investor

While investing overseas can open up more choices, I believe nothing beats having a homegrown advantage. And as a Singaporean, we benefit from not being taxed on our dividends or capital gains, and there are no foreign currency exchange risks involved, which makes the case for investing locally an even stronger one.

And if you don’t have much time to analyse individual stock or bond positions, a less time-consuming way would be to use local ETFs to get exposure within a few single clicks.

Half of my own portfolio consists of Singapore bonds and stocks, as many of them pay good dividends and have decent growth prospects. This is also an easier way for me to get potential income (from dividends), with a lot less headaches compared to my investments abroad (where the weakening currency against SGD could drag down my returns).

Did you know? As a Singaporean, you can even use your CPF funds (Ordinary Account) to invest in these 3 ETFs mentioned above. There are only 6 ETFs that are included under CPFIS, of which 4 ETFs are managed by Nikko AM. For those employing a dollar-cost averaging approach, you can also automate your investment through a Regular Savings Plan (RSP) offered by your local brokerages and banks. Find out more about where you can set it up here.

Learn more about the local ETFs mentioned above:

– ABF Singapore Bond Index Fund

– SGD Investment Grade Corporate Bond ETF

– Singapore STI ETF

Footnotes

- Based on 2021 dividends based by DBS against the purchase price of DBS shares back in 2016. ↩︎

- Reference to individual securities are for illustrative purposes only and does not guarantee their continued inclusion in the fund/ETF, nor constitute a recommendation to buy or sell. ↩︎

- Cash is included in the calculation of the average credit rating and is rated as AAA regardless of currencies held. The credit ratings of the underlying fixed income securities are determined by S&P or Moody’s, and where official credit ratings are unavailable, iBoxx implied credit rating followed by Nikko AM Asia’s internal credit ratings are used. ↩︎

Disclosure: This post is brought to you in collaboration with Nikko Asset Management. All research and opinions are that of my own. I highly recommend that you use this as a starting point to understand more about the various ETFs offered by NikkoAM which you can use for SRS and CPF investing, and then click into the respective links above to retrieve the fund prospectus and performance so as to help you decide whether it fits into your investment objectives.

Important Information by Nikko Asset Management Asia Limited:

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”).

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information as at the date of publication, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks' interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units does not guarantee a liquid market for the units. Investors should note that the ETF differs from a typical unit trust and units may only be created or redeemed directly by a participating dealer in large creation or redemption units.

The units of Nikko AM Singapore STI ETF are not in any way sponsored, endorsed, sold or promoted by FTSE International Limited ("FTSE"), the London Stock Exchange Plc (the "Exchange"), The Financial Times Limited ("FT") SPH Data Services Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Parties") and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Straits Times Index ("Index") and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by FTSE. None of the Licensor Parties shall be under any obligation to advise any person of any error therein. "FTSE®", "FT-SE®" are trade marks of the Exchange and the FT and are used by FTSE under license. "STI" and "Straits Times Index" are trade marks of SPH and are used by FTSE under licence. All intellectual property rights in the ST index vest in SPH and SGP.

Neither Markit, its Affiliates or any third party data provider makes any warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herewith nor as to the results to be obtained by recipients of the data. Neither Markit, its Affiliates nor any data provider shall in any way be liable to any recipient of the data for any inaccuracies, errors or omissions in the Markit data, regardless of cause, or for any damages (whether direct or indirect) resulting therefrom. Markit has no obligation to update, modify or amend the data or to otherwise notify a recipient thereof in the event that any matter stated herein changes or subsequently becomes inaccurate. Without limiting the foregoing, Markit, its Affiliates, or any third party data provider shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the content, information or materials contained herein. Copyright © 2023, Markit Indices Limited.

The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index are marks of Markit Indices Lmited and have been licensed for use by Nikko Asset Management Asia Limited. The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index referenced herein is the property of Markit Indices Limited and is used under license. The Nikko AM SGD Investment Grade Corporate Bond ETF is not sponsored, endorsed, or promoted by Markit Indices Limited.

Nikko Asset Management Asia Limited. Registration Number 198202562H.