What is a credit co-operative? Unless you’re in one, most Singaporeans do not know of them nor the important role they play in society. More importantly, you may not be aware that there are plenty of benefits you can get from being a member of a credit co-op.

Co-ops are basically regulated social enterprises. They are organised on a voluntary basis, democratically controlled and member-owned, to achieve the common social or economic aim that benefits their members and/or society at large. In fact, co-ops are founded on values of self-help, mutual assistance, equality, care for community and co-operation.

As its name suggests, credit co-ops provide financial services to their members, and as I mentioned earlier, there are plenty of benefits you can get from being a member of a credit co-op.

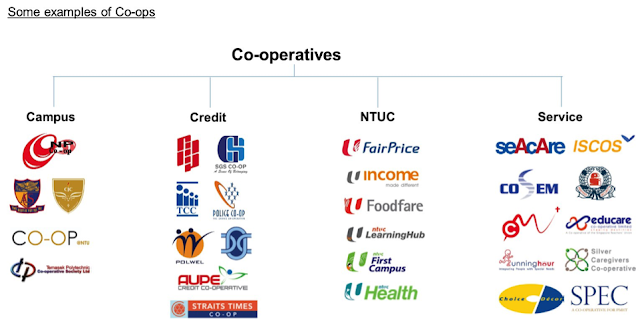

You might not be familiar with the term credit co-op, but surely you’ve seen some of these brands before! Take a look:

Some co-ops are profession-based in the sense that only individuals belonging to certain professions can join as members. For instance, a teaching staff or full-time employee of a school, you can join the Singapore Teachers’ Co-Operative Society Ltd. Whilst staff from the Ministry of Home Affairs, Corrupt Practices Investigation Bureau, Certis CISCO, AETOS etc. can join the Singapore Police Co-Operative Society. There are also credit co-ops that are open to public membership e.g. TCC Credit Co-Operative. There’s a really great introductory article that you can read here for more information on some other co-ops in Singapore.

Another Savings Option?

One good example is that of the Singapore Teachers’ Co-Operative Society Ltd, which gives an interest rate of up to 3.08% per annum on its bonus savings account upon maturity. This is relatively higher than similar products offered by financial institutions.

The Singapore Government Staff Credit Co-Operative Society Ltd is another good example. It is a co-op for public service officers looking to build financial resilience. If you are employed in the Singapore Civil Service, Statutory Boards and Government-linked Companies, you are eligible to join them as a member.

Their member benefits include:

· Maximise financial growth through savings

· Receive FD for better returns

· Loans at reasonable interest rates

· Hospitalisation benefits

· Educational awards

· Free insurance coverage

· Loyalty benefits

· Funeral fund grants

· Birthday gift

· Provision of family membership and other privileges such as highly subsidised overseas tours and annual gala dinner

Avoid Taking a Loan?

Here on this blog, I’ve always advocated avoiding loans if you can help it (with some exceptions to the rule, such as a housing loan) and paying them off as soon as you can before you spiral down the path of bad debt.

I’ve also mentioned numerous times at my talks that credit card debt is something you should fear and be wary of. The interest rate on your credit card (if you don’t pay off in time every month) is much higher than most people think. It is easy to fall into the cycle of simply paying the minimum $50 payment each month, but many people forget that there are plenty of other rollover charges, not to mention an exorbitant interest rate. That is how credit card debts can so quickly spiral out of control! UOB and DBS charges 25.9% per annum whereas OCBC charges slightly higher interest of 25.92% on all outstanding amounts owed.

|

Source: The CPF Board, YouTube

Borrowing from a moneylender, especially an unlicensed one (like loan sharks), can be even more detrimental. If you’re not careful, your debt can easily snowball into an avalanche that you may not be able to pay off even if you sold all your assets.

But what about if one REALLY is cash-strapped and needs a loan?

Well, you can consider options like a credit co-op. They’re an alternate means of seeking out financial solutions, and since they’re less profit driven than most commercial enterprises, credit co-ops tend to be more willing to go the extra mile for their members. This includes extending loans to lower-income members or even rescheduling members’ loans, and they can even work out a debt restructuring plan with you to help clear it off.

Well, you can consider options like a credit co-op. They’re an alternate means of seeking out financial solutions, and since they’re less profit driven than most commercial enterprises, credit co-ops tend to be more willing to go the extra mile for their members. This includes extending loans to lower-income members or even rescheduling members’ loans, and they can even work out a debt restructuring plan with you to help clear it off.

AUPE Credit Co-Operative Limited, for instance, offers financial assistance to its members for the purpose of:

· Children’s educational needs

· Medical expenses

· House renovation

Members of co-ops can take short to medium term loans as the interest rate is relatively lower according to their websites. This is a HUGE difference if you compare to the interest charged by credit cards and moneylenders and are often even more competitive than personal loans offered by commercial banks.

So if you ever need to take a loan (although I sure hope you’ll never have to, but I understand life has a funny way of throwing us unexpected surprises sometimes), do weigh your options rather than the usual credit card loans or seeking out moneylenders which many people resort to.

If this has piqued your interest, and you’re keen to learn more about the various co-operatives in Singapore, head over to SNCF’s website to find out more!

Disclaimer: This is a sponsored post written for the Singapore National Co-operative Federation to promote greater awareness of credit co-operatives in Singapore in conjunction with the World Credit Union Conference which is being held in Singapore for the first time. All opinions are that of my own.