Tiger Brokers launched to great fanfare in Singapore a few weeks ago and given the incredibly low commission fees they were offering (0.08%), I signed up for an account and requested to speak with their CEO in order to understand the risks associated. This review is the result of my findings.

Incredibly low fees

The biggest draw that spurred me to open an account with Tiger Brokers was in their fees, because no other brokerage before them came as close.

For Singapore stocks, Tiger Brokers charges 0.08% per trade with no minimum fees. Prior to their entry, the other low-cost favourite was FSMOne (also 0.08%) and cash upfront accounts on DBS or POEMS, with a minimum of S$10 per trade. This will revert to S$2.88 in 2021, which is still pretty much the lowest, considering how traditional brokerages like Maybank Kim Eng and iOCBC charge at least S$25 per trade.

Hong Kong stocks are at 0.06% and with a minimum of HKD 15 per trade. The next lowest alternative would be Interactive Brokers at HKD 18 minimum with 0.08% commissions.

For US stocks, they charge a minimum of USD 1.99 (commission + platform fee), which is the second-lowest fees among Singapore brokerages. The other low-cost option would be Interactive Brokers (USD 1), provided you have at least USD 100,000 to invest or make at least 10 trades in a month. If not, then you’ll have to pay an additional USD 10/month for custodian fees.

Shanghai and Shenzhen stocks are at 0.06% commissions and a minimum of RMB 15 per trade. There aren’t many brokers in Singapore who offer access to the Chinese markets, and those who do (e.g. UOB Kay Hian, POEMS) charge significantly higher fees at 0.25% with a minimum of RMB 80 per trade.

Insanely low fees, but is there a catch?

None that I could find (if you do, tell me).

Why are commissions so low?

I asked if the rates are low just for the promotional launch, with the intention to raise it significantly after winning over new account sign-ups, and their CEO assured me that was not their plan.

He explained that the perks of being an online brokerage is that your operating costs are generally a lot lower, since almost everything is digitalized. By using technology instead of humans, cutting out remisers (who would otherwise earn a big cut of the gross commissions), Tiger Brokers saves on operational costs which thus allows them to offer lower fees to customers in return.

This is great news for us retail consumers – whether you’re a trader or long-term investor – because the lower trading commissions also means that we can now apply our DCA (dollar-cost averaging) strategies in smaller sums each time, making it potentially even more effective to average down (or up) when you’re unsure of what the stock prospects will be like in the near term and wanna reserve more bullets first.

Are their FX conversion rates competitive?

There’s a currency spread of 0.3 to 0.5% (not the best, but still pretty competitive) on Tiger Brokers, with no FX conversion charges imposed. (They used to charge USD 2 for each FX conversion but has since waived it.)

Please remember to convert your SGD cash holdings into the respective foreign currencies before or immediately after purchasing shares! I made the mistake of assuming that my funds would be automatically converted and ended up having to pay interest charges for the borrowing *facepalm*.

Are there fees for processing scrip dividends?

Tiger Brokers has confirmed that they do not charge for cash or script dividends, unlike their peers who usually impose a minimum S$10 fee.

Are they licensed?

Where are my funds (and stocks) held?

Tiger Brokers holds a Capital Markets Service license by MAS, in compliance with the Securities and Futures Act. Our funds and investments are kept in a segregated bank account and custodian to ensure it does not commingle with other customer accounts.

For our funds, these are held in client-segregated accounts with their banks (ANZ and DBS) and held separately from Tiger Brokers’ corporate funds used for operational purposes.

Shares are held in custodian under the following:

– Singapore shares are held with DBS as their custodian.

– US and HK shares are through reputable US and HK brokers (they didn’t share names, but I’m guessing Interactive Brokers is one of them, considering the relationship)

In the event that Tiger Brokers were to go bankrupt (touch wood!), their CEO assured that funds and assets will be kept safe with respective banks and custodians. This is similar to how most robo-advisors in Singapore operate.

Can I trust Tiger Brokers?

While Tiger Brokers is a relatively new brokerage in Singapore, its origins are less than dubious. Its founder and CEO, Wu Tianhua, was one of the early-stage founders of Youdao (a search engine by NetEase) and started Tiger Brokers after leaving his job at NetEase. Backed by Interactive Brokers, Xiaomi and notable investment legend Jim Rogers, Tiger Brokers is held under its parent company (UP Fintech Holding) which was founded in June 2014

What markets can I trade?

The problem with many local brokerages lies with the hefty trading fees charged. In the long run, we all know that costs eat into your returns, and the one thing we can control for sure in our investment would be the trading fees we pay.

Right now, investors can trade in the following country markets:

– Singapore (SGX)

– Hong Kong (SEHK)

– United States (NASDAQ and NYSE)

– China (SZE and SSE) (Shenzhen and Shanghai)

Why is this appealing? Simple, because I no longer have to break up my shares across different brokers and can potentially consolidate into a single platform. Prior to this, I was using a local bank broker for SGX stocks, IB for US stocks and FSMOne for Hong Kong stocks.

But the best part is getting access to China, because we all know that China is the next growing market. It is now the second-largest economy in the world and will likely recover faster than any other country in the aftermath of the coronavirus pandemic. There’s a great documentary on Netflix that discusses the rise of China over the years and how it compares to America, so if the growth of the US stock market is anything to go by, I won’t be surprised to see the same in the Chinese markets.

I’m glad that I can finally ride on this wave easily now that Tiger Brokers has opened up access for us investors located here in Singapore.

Fantastic user interface

It is an understatement to say I was blown away by the features on the Tiger Brokers mobile app. Here are some aspects I really liked:

- News : tap on “News” to can view articles related to your stock(s), which are pulled from data sources including Yahoo Finance, Dow Jones, the Straits Times, etc.

- Get stock ideas : under the “Discover” tab, you can toggle by themes such as Big Data or Social Media to get stock ideas and their recent share price movements.

- Screen for stocks : their “Screener” allows you to filter by valuation metrics (P/E, market cap, P/B ratios), profitability metrics (EPS, ROE, Net Income Margin), debt levels and more. Not the most extensive, but definitely beats many of the basic screeners offered by most other brokerages. And for the quant traders/investors, you can also screen by criteria such as the KDJ Golden Cross, Benjamin Graham’s NVAC, etc.

- Company financials : tap into a stock and view the company’s fundamentals and financial numbers for quick analysis.

How do I sign up for Tiger Brokers?

2. Fund your account by transferring to ANZ or DBS bank

3. Check in a few hours time (or the next working day, if you transfer over the weekend) to ensure the funds has reached your trading account

If you encounter any issues, simply call the Tiger Brokers hotline or drop them an email / WhatsApp message. They were pretty responsive when my friend and I contacted them on different occasions.

The account opening process was pretty fast (largely due to automation), with fund deposits processed within the same working day itself! My account was ready to trade within a few hours, and this sign-up process was in stark contrast to when I opened accounts with other brokers…which usually took me several days for approval and funds to be credited into my account before I could buy any stocks.

Wait, how can approvals be so fast when there’s a W8-BEN form involved?

I posed this same question to its CEO (y’all know how skeptical I am, lol) Mr. Eng Thiam Choon – who spent 8 years at Phillip Futures – and he explained it was due to the time saved when there’s no processing of any paper forms nor manual staff needed for the task. The e-signatures are almost instanteously kept and filed to show the authorities when there’s a need to.

How do I fund my account?

In my case, my account got approved and the funding arrived in 2 hours, so it was much faster than I had expected!

Who should open a Tiger Brokers account?

If you’re a new investor starting out with a small portfolio size, Tiger Brokers is going to be your best bet, given their incredibly low fees and no minimum capital requirements.

For frequent traders (especially for those who are taking advantage of the current market volatility conditions), the low commission rates will be a real game-changer.

For long-term investors, there may be some risks involved since Tiger Brokers is, after all, a relatively new brokerage in contrast to its peers, but that’s a valid fear for any new name on the scene. I remember when FSMOne first started out, many investors were similarly skeptical, but fast forward to today and its growth and user adoption rate has been staggering.

Some folks on the Internet claim that because they are from China, so it isn’t as trustworthy, but having researched more into its history and spoken to the people behind (and running) Tiger Brokers, I am no longer as worried as I was when I first heard of them. I have also raised my concerns about Tiger Brokers being shut down by the Chinese authorities or having accusations against them for money-laundering claims, but CEO Eng Thiam Choon has shared that they have not done anything illegal so there’s little to fear.

TLDR: One of the best low-cost brokerages

For investors starting out with lower portfolio capital, your brokerage costs eat significantly into your returns at this point. Which is why I feel Tiger Brokers’ incredibly low fees are a huge game-changer, because you no longer need to start with a larger position sizing just so you can keep your cost-per-trade low (a good gauge has always been to aim for under 1%).

We all know that emotional competency is key to long-term investing success, and you can train this with Tiger Brokers – remember, paper portfolios won’t give you that kind of emotional training because you need to use real money. Start with smaller sums and watch how you react to sharp drops/surges, and you’ll be able to better manage your own emotions from there before you move into larger position sizes.

All in all, I have to say I am pleasantly surprised by what Tiger Brokers has to offer, and after speaking to their team about the concerns I had, I feel more assured that they’ll be here for the long run.

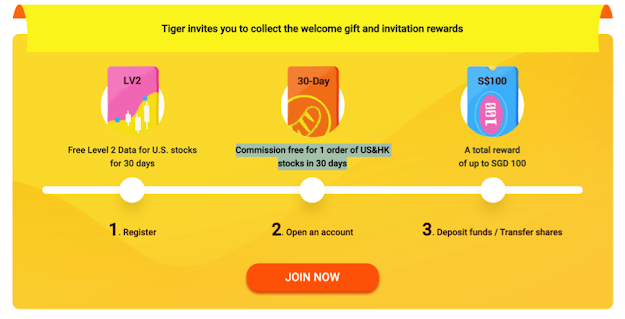

Sign-up perks and promotions

I won’t be surprised if the generosity of the promotional perks start to taper off in the near term once a certain number of user sign-ups have been hit, so I recommend signing up now rather than later.

Here’s what Tiger Brokers is currently offering for new user registrations:

You can also scan this QR code to get the rewards:

If you’re a SG Budget Babe reader, do use my promo code to get free Level 2 US market data (originally USD 26) and 30-day commission-free trading here. You will also get up to S$100 in stock vouchers when you successfully fund your account with at least S$2,000.

Controlling your investment costs should always be one of the first things you do as an investor (read this article to understand how paying just 1% in investment fees can mean giving up to 1/3 of your wealth in the long run) so in this regard, I reckon Tiger Brokers will continue doing well.

Their mobile brokerage app is also one of the best I’ve seen, and I look forward to seeing whether any of the other brokerages are going to start reducing their fees as well to remain competitive. That will only spell good news for us retail investors.

What else are you waiting for? Sign up here today!

Disclosure: This post contains affiliate links and is written in collaboration with Tiger Brokers (a conversation which was instrumental to giving me the reassurance I needed to write this review). All opinions are that of my own, based on my trading experience with Tiger Brokers.

8 comments

Hi BB, i have sign up with promo code. How long it takes to recieve $100 stock credits?

Now that Interactive Brokers Singapore has opened (recently too), allowing new IB-SG accounts to trade SGX (also at 0.08% commissions), there are not one but 2 low-cost brokers that cover both local and global stocks in the same platform.

Would be nice to do a comparison of the 2 platforms now that IBKR can trade SGX too.

(Note: existing IB-LLC accounts will need to be migrated to IB-SG to be able to trade SGX. There are more info about this on the IBKR thread on HardwareZone Singapore forums)

It took a few days for me iirc!

I'll get to that review another day, haha, cos I haven't yet migrated my IB-LLC account to Singapore! and frankly, because at that point where they announced the news I was already happily settled into my Tiger Brokers account, I didn't see the need to immediately switch #lazy but I'll get to it eventually 😛

if you tried both, write to me and let me know your experience leh!

I can't see their fees for custody, dividends or corporate actions on their website. Would you happen to have asked them about these?

Hi all dear !!

great article and information, with your blogcomment.

I see your blog daily, it is crispy to study.

Your blog is very useful for me & i like so much.

thailand uplay365 คาสิโน

Hi budgetbabe,

Can I ask will Tiger Brokers charge me an amount if I do not trade for a period of time? Similar to what Interactive Brokers is doing for USD$10 for inactivity. Thanks

Hi Budgetbabe,

Just happen to chance upon this article. Would like to check with you if the sign up perks and promotions (e.g. 30 days commission free trading and $100 stock voucher) still valid?

Comments are closed.