A Singaporean investor lost so much money last year in stocks that he could have bought a 5-room HDB flat if he hadn’t invested instead.

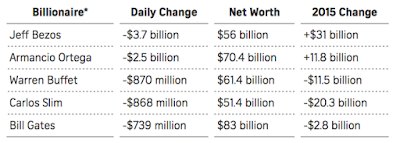

He wasn’t the only one. When the markets opened this year, over $12.4 billion was wiped out from just 5 of the world’s richest folks.

|

| Credits: The Straits Times |

Given such circumstances, would you still dare to invest today?

I was quite intrigued with AK’s recent article, which he has kindly allowed me to reference here. His guest post (found here) talks about one man’s losses in the stock market last year. Now, this may just be one person’s perspective, but remember that almost every investor saw their stocks dip significantly in 2015 as well, given how Singapore (and the global) markets performed.

Lest you think losing the equivalent of a 5-room HDB flat will not happen to you, consider this scenario.

This stock belongs to a fairly good company, which is 61% owned by Temasek Holdings. In 2009, when crude oil prices fell below $50, the stock traded in the $1.50 range. When oil prices recovered in 2011 and surpassed $100 per barrel, the stock shot to a high of $6. If you had the foresight to invest $20,000 into this stock then, your profits would be well over $58,000 in 2011! That’s almost $20,000 a year without you saving! Essentially, your money simply generated more money for you.

Sounds good, right?

Now let’s take a look at historical oil prices. I’ve back-dated this to 60 years ago (quite possible for a lifetime) from this Goldman Sachs report.

As you can see, oil prices have generally been fluctuating up and down in the last 60 years. It was on an overall uptrend during this period.

People always say history repeats itself, so of course, there were plenty of investors who didn’t invest in 2009 who saw an opportunity when oil prices started crashing again in the first half of last year. Many Singaporean investors were debating between Keppel and Sembcorp Marine.

Value investor BigFatPurse (folks whom I respect) even wrote about how the shock in oil prices created opportunities on SGX.

Going back to the original stock chart above, and knowing that even Temasek has such a strong stake in this company, would you invest?

Many did.

That company was SembCorp Marine. Imagine if you had happily invested your first $20,000 into Sembcorp Marine, full of confidence that this stock would see a rebound like it did in 2011, and waiting to gobble up your profits in a few years time when oil prices recover.

Let’s presume you bought 7,000 shares (for simple calculations) at $3.00.

Your portfolio now would sit at only slightly over $10,000. As of today, Sembcorp Marine has declined by close to 50% of its trading price this time last year. That means you would have lost $10,000 in a short span of a year.

So in this post where guest blogger STE’s portfolio lost a six-digit sum last year, it really isn’t that hard to imagine.

Statistically speaking, if the markets go down by another 20% – 30%, chances of a rebound in the following year will be high if we can hold it for a much longer period (without using much leverage). We should deploy more cash if that really happens, as what we did in 2009 – 2010.

We already know 2015 was a tumultuous year for investors, full of ups and downs and heart-stopping moments. But don’t fret too much about your portfolio losses, because many of the more experienced investors aren’t too worried either.

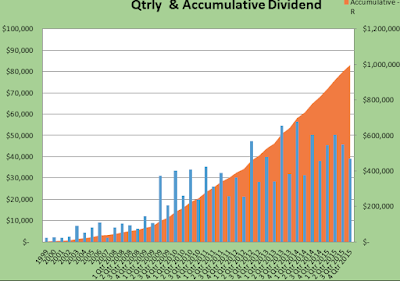

In STE’s case, even though his stocks caused him to lose a six-figure sum in 2015, these same stocks also paid him $180,454 in dividends for the whole of last year.

His total dividends collected within the last 15 years add up to over $1,000,000.

But Budget Babe, he lost MORE than he gained last year!

Yes, he did. But he wasn’t worried, because seasoned investors know that stock markets are volatile in the short-run. As long as you focus on getting your fundamentals right and investing in good companies, you’re more likely to make money than to lose over the long term.

Can Budget Babe also generate $180,000+ in dividends in a year?

Yes, and no. As I’m still in my mid-20s, I do not have a lot of cash to pump into the stock market to begin with. While I did save over $50,000 in the last 2 years from work, not all of it can go into the stock market as part of my savings have to remain as emergency funds as well.

Assuming an annualized dividend yield of 9% for STE, his portfolio could well be around $2,000,000 in order to generate $180,000 in dividends. I certainly do not even have a fraction of that sum when I’m still so young!

But can I do that in the future? Perhaps, once I’ve accumulated over a million dollars and have more money to put in the stock market. Although I would have to highlight first that I am not fundamentally a dividend/income investor, but more of a value/growth investor (partly due to age factors and a longer time horizon left for investing).

So what should I do now?

In times like this, cash is king. When buying opportunities present themselves, then it’ll be worth pumping our cash in, although pumping everything into one stock would be risky (not to mention, extremely foolish for a newbie investor).

If you’re still uncertain, check out the free finance resource pack that I’m giving away as a gift to all readers to welcome 2016. There’s a wealth of information inside, but my favourite is the “Investing Your First $20,000” e-book which I co-authored together with 13 other finance bloggers. That means you get to hear from 14 different perspectives on how we would each choose to invest our first $20,000. Some of us are still fresh in the workforce, while others have already retired. From young and old, there’s surely a portfolio / strategy that you will find relevant.

If you haven’t already claimed your copy, don’t forget to check out this post on how you can get your hands on that! Particularly for the investing e-book, which we’ve decided not to sell but to give it absolutely free to our loyal readers.

With love,

Budget Babe

11 comments

"Let's presume you bought 7,000 shares"…Aren't you supposed to be a General Paper tutor? You should know the difference between presume and assume

Wow,I had to read your comment twice because it was such a snide comment. There's no need for this if your intention was only to help correct a potential language error. Anyway, I do know the difference, and went with presume instead because the probability of someone buying in the above scenario is quite real. Assume also works here, although it wouldn't carry the same underlying meaning that I was trying to bring across. Thanks for pointing out regardless.

On hindsight everything is perfect. I think the way you presented your Sembcorp example can be a bit misleading, as the premise is that the price will go back to previous high. At the very least should look at their earnings, balance sheet etc then and now, instead of fixating on the price. Eg if you choose NOL as your example, will things turn out that well? Could Sembcorp marine be privatised as well?

It would be much easier to just accept your mistake. But since you insist on being defensive, I must point out that nope presume does not work here. And I bet you would get the same reply from any 'actual' English teacher you ask. Learn to be humble in your posts.

Actually Vikas I still don't sex why it is a mistake. Perhaps you can enlighten me since your English is supposedly better, and if I'm wrong, I will humbly acknowledge that I made mistake.

From what I know, assume is a complete guess. People assume something that they do not know. For instance, I assume the boy on the street I see with a sad look on his face is miserable because he failed his test. This would be a totally random guess. But if he's dressed in a school uniform and I see him walking out of the school gates on the day of the O level results, I would presume (not assume) that he is sad because he did not do well in his O levels. Presumed is used here instead because it is based on a very likely probability given the factors.

In my blog post, I detailed a scenario where a beginner investor is being convinced that it is worth investing into an oil stock based on the historical uptrend trend of oil prices and the previous 2 cases where oil dropped drastically and recovered to all-new highs twice within the past 60 years. Using a good oil company with a strong past record of trading prices reflecting the drops and gains of oil prices, including stable dividend payouts, being backed by Temasek Holdings and also actively eyed by other retail investors, the probability of a newbie investing a large portion of money into this company in hopes to replicate the profits betwer 2009 and 2011 is quite possible. Since the main difference between presume and assume is based on probability, I went with presume in this case.

If you can explain and enlighten me on why presume does not work here, I'll be glad to listen and understand if I really got my fundamentals wrong between the two. In which case, I will be editing the post accordingly to correct this language error.

Oh and btw, even if a student mixes up presume and assume in their General Paper, it is unlikely that they get deducted anything more than 1 mark under the language component, which carries a maximum weightage of 20/50 marks. In this case, such an error would only affect 0.5% of the grade. I therefore really don't see the need for you to have brought my credentials as a General Paper tutor into question over such a small error (assuming you're right that the word should not be presume), moreover when this is a blog entry and not a General Paper argumentative essay.

Hear from you soon. I'm curious to understand why you think presume does not work here, and with such conviction too.

Hi RK, exactly! On hindsight everything always is perfect. I agree with you that the premise for Sembcorp is a little too simplistic, but I deliberately picked that as my example because Sembcorp indeed was a darling (together with Keppel) for such investors in these shoes last year. Plus the fact that Sembcorp Marine and DBS were the largest drag on the STI index in 2015.

I'm still following the news closely to see if Sembcorp Marine will be privatized or resort to raising funds through equity to finance them through this crisis, especially with so many orders being cancelled / delayed. What are your thoughts?

Sorry can't add any inputs as I never study these companies in depth also. Only know Keppel is in net (sizeable) debt position and has decreasing operating cash flows for the past few years. Good luck to those who those who think they will be able to maintain their dividends payout.

Long term investing is about winning the War and not that few losing battles before we reach the Land of our retirement life to build up sustainable retirement income for life.

Along the way, we will lose some battles as losing money is part of the Game; but if we could pick a few great winners to overcome those few fairly large losers and with bulk of them as average, we should still be okay!

For retail investors who have full-time job to take care, our job is most important as it is foundation that provide our war chest for the long War. For long term investing, it is about less analyzing and more investing; the Past is not the Present. The Present is not the Future. How to analyze so much?

Retail investors should learn to focus more on mind and money management as these are the areas we still have some control over them.

Could have use Stop-Loss to minimize losses.

Yes and no. Sometimes it's easier said than done!

Find out how THOUSAND of people like YOU are earning their LIVING from home and are living their dreams TODAY.

GET FREE ACCESS TODAY

Comments are closed.