Never heard of them? They were formerly known as ASVIDA, so if you’re looking to research a little more on their industry track record, searching on that past history might give you a little more insights like it provided me.

The IPO prospectus is a lengthy 440 pages, so it took me quite a while before I was able to distil my thoughts into the analysis below. Here’s what I think.

Background

For those interested in the growth of the data centre industry, Procurri might catch your eye. Its three main businesses are (i) the resale of excess or used data centre equipment, (ii) IT hardware maintenance services and (iii) the disposal of IT assets.

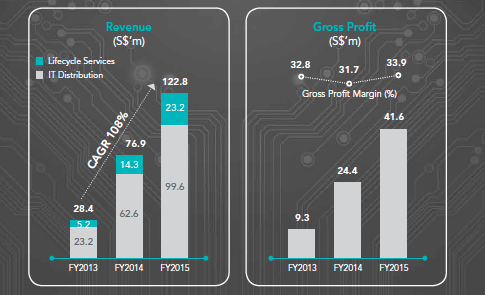

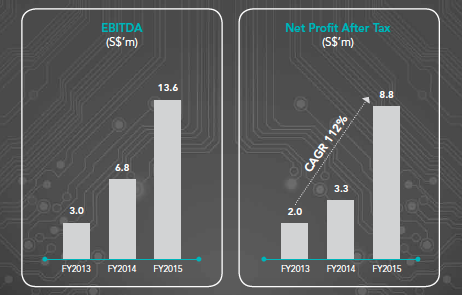

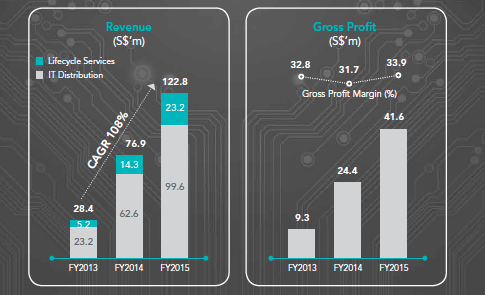

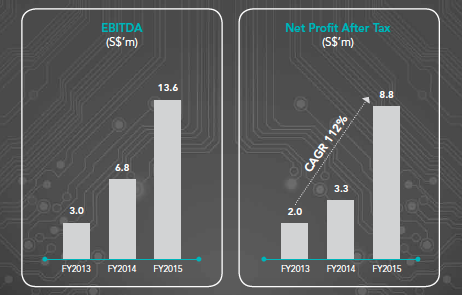

Financial performance looks good.

The company is in good financial standing at the moment, and management is promising a great growth story full of potential. Thus, the IPO.

Concerns

Dividends: If you’re an income investor, you should note that Procurri currently does not have a fixed dividend policy, although management has said they intend to distribute 25% of their net profits as dividends for FY2016 and FY2017. However, these “shall not constitute legally binding statements…which may be subject to…reduction or non-declaration thereof”.

Dilution of shareholder interests: IPO investors will face immediate and substantial dilution in NAV per share, and management has conceded that future dilution may occur. After all, if they are unable to maintain sufficient working capital for their growth plans, Procurri has admitted that they may have to raise additional capital in the future through debt or equity offerings, with an intention to issue options and share awards at a later stage.

Not a value stock: Price-to-earnings ratio here is 14.7, which I find a little high in today’s market environment. For value investors, Procurri’s IPO price of $0.56 is much higher than Declout’s NAV per share (24.6 cents). In other words, you’re paying a premium of 243.6%! Procurri has even admitted that “there is an immediate and substantial dilution in the NAV per share for investors who purchase”.

Competition: The IT industry is a highly competitive one, and there is no guarantee that Procurri will indeed become a market leader given that there are many other firms offering similar services, albeit not as a whole. I used to work in the industry, and have seen price cutting and discounts as common when firms are bidding against other competitors for contracts or RFPs. I recommend a further competitor analysis for those who are keen to invest in this counter.

High capex: To fund its growth strategy, Procurri requires a lot of capital. As it also offers a transaction-based pricing model for its clients for some of their solutions, this requires them to incur significant upfront costs, adding to higher operating expenses. Thus, having sufficient free cashflows or easy access to capital will be crucial in order to finance their purchase of the necessary IT hardware and equipment. If any of its clients were to default, there is a possibility that Procurri might not be able to collect back the sum owed.

Forex risks: Procurri’s financial statement will be reported in SGD, but their operating currencies include SGD, USD and GBP due to their global offices. If the SGD appreciates, this could lead to an adverse currency translation effect on the financial statements, which may then prompt a market reaction and drive its share price lower.

Data breaches or lawsuits: The IT business has its risks, especially in data privacy and loss or leaks of customer information. Although Procurri has some insurance coverage, this may not be enough if they were to run into a major lawsuit over loss or breach of data. In this age of tighter privacy rules and regulations concerning data privacy and retention, this is a valid risk that investors should be factoring into their analysis.

How will the IPO proceeds be used?

S$6,081,000 will be taken to pay DeClout, which shows up in the IPO prospectus as loans. I almost missed out on this, as it didn’t show up in the prospectus until page 89, almost hidden in a whole paragraph of text.

In addition, management intends to use the IPO proceeds for growth, especially to acquire new businesses that can add value to their portfolio, and also to grow their services segment, which currently provides extremely high profit margins of above 50%.

After about 2 hours of reading, I found another area of concern on page 310 – Procurri leased their HQ premises for until May 2019, but intends to spend $1.71 million for renovation of the office space. Would you consider this smart spending? I’m not sure if this is wise, because I personally would never spend so much money on a place I only own for 3 years.

Other Thoughts

An analyst report by NRA issued in April had valued Procurri at between S$141 million – S$300 million, given that a similar-sized company in France was sold at a S$208 million valuation in 2015. The listing of Procurri at a market capitalization was then estimated to be at least $150 million, which isn’t too far off from the offered price of $0.56 (putting its market value at approximately $156 million). The report had a very catchy title of “

Declout: Shocking S$50m windfall if spinoff succeeds“.

The question here is, why list?

I’m not too sure if I buy that story.

For existing shareholders who already owned Procurri prior to its IPO (unfortunately, that describes none of us retail investors), the successful IPO will represent an immediate increase of 50.9% in NAV per share, whereas it will result in 56.1% decrease to new investors taking part in this IPO exercise.

After digesting the prospectus, I’m wondering if DeClout has more to gain by spinning off Procurri, in contrast to us as retail investors should we buy into Procurri’s shares at this moment, considering all the dilution that we’re going to exposed to. In fact, I won’t be surprised if Procurri’s share price drops after IPO, although there’s also a possibility it may go up if (i) enough people believe in its growth story (ii) it continues to deliver outstanding financial results.

So what reasons would make you buy it? I’m not sure about you, but I’m definitely out of here. Goodbye!

With love,

Budget Babe

9 comments

Call me skeptical but most IPOs are just a way for the existing shareholders to cash out and pass on the risk to new shareholders hahah

Thanks for the analysis. Not sure if you go through every mainboard prospectus but thumbs up for going through this.

Just like to point out that the comparison of one company share price to their mother share NAV is not comparing like for like. Hence, that "premium" over NAV of Declout is not a fair basis of comparison. That should not weigh as a factor in decision making.

My 2c in return for your freely available opinions.

1) Financials were only good because of acquisition in 2014 and 2015. Assuming none for 2016 (being conservative), this growth has to come from organic. And there were only one mention of a 20+million organic growth in 2015 out of the revenue of 122m. [Can't remember which page]

2) Company seems to be tough to understand but comes across as a services firm. Hence, NAV should not be high. For such companies, they don't typically trade at NAV. PE might be a better quick ratio to compare. Even then a growth company tends to trade at a high PE.

3) IPOs always list at a premium. That's the incentives for existing shareholders to sell. The dilution you mention is typical. Magnitude of dilution is another topic altogether.

4) Existing shareholders gain in 1) the issued equity is higher (more cash in the company) and 2) higher valuation of the company post-IPO. This is common.

5) The use of proceeds should be most important. Of which the highlights page itself mentioned that 6million loan repayment to Declout.

6) Your point on the renovation is well spotted. Missed that out so thanks to you.

The rest are well covered by the popular IPO blog in SG that i will not advertise in this comment. I'm sure you know.

-WJ

That's a good way of looking at IPOs!

Thanks for weighing in on this Wei Jian! I generally agree with you so I won't comment much but on NAV and PE, I looked at both to evaluate instead of a single one. For NAV, I merely cited Procurri statements as worded, you might have seen the table drawing a more accurate NAV of Procurri instead of the group but I won't mention that. Thanks for adding in more risks that I didn't include in this analysis for everyone else to read! 🙂 I look forward to hearing more of your thoughts on the other stocks writeups.

P.S. yup read that article! I sought to focus more on direct and immediate risks though so I only wrote about a few select ones that stood out to me 😉 to each their own due diligence!

thanks budget babe and wei jian, enjoyed reading both your analysis. It was very helpful in my decision making process. Glad I found your blog !

cheers

EL

Hi Budget Babe . I chanced upon your blog when I was looking for some insight of this IPO that make headlines in BT today plunging close to 20% . Enjoy your open sharing and hope to learn more from your other insights as I go through your blog . Thank you . HS

Glad it helped you! Yes, huge thanks to Wei Jian for sharing more insights with his comment above 🙂

Hi Hong San, I didn't know BT reported such a headline! That certainly explains the sudden spike in traffic to this article! I've written a few other stock analysis (use those keywords to search) together with other insights on personal finance, insurance and investments. Have fun browsing! 🙂

eToro is the most recommended forex trading platform for newbie and professional traders.

Comments are closed.