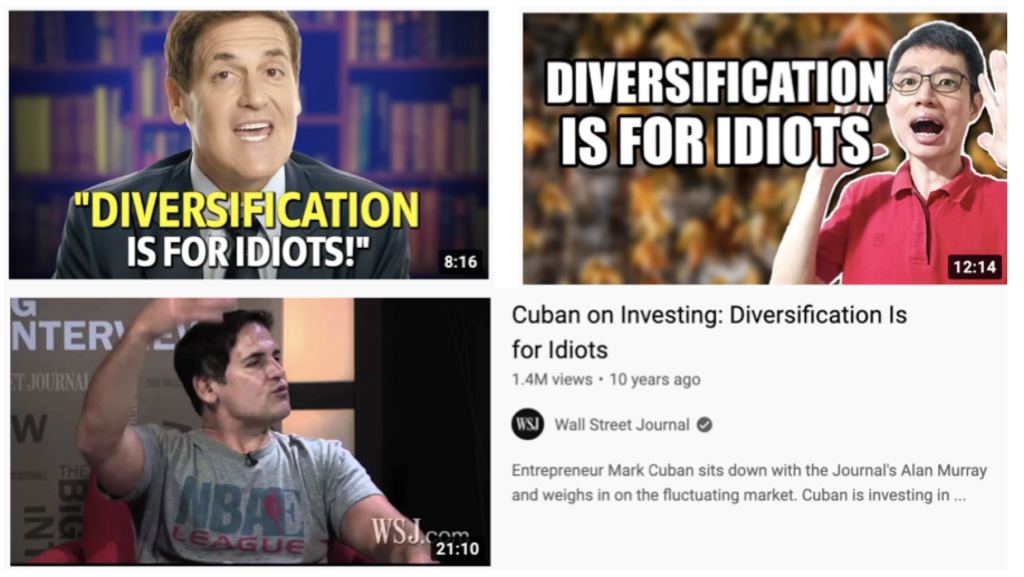

It is never a good idea to be 100% invested in growth stocks, but that’s exactly what many investors did – especially new investors who started during the pandemic. On top of that, risk management was thrown out of the window as investors put their money into stocks with lofty valuations, ignored diversification as they hankered after concentrated portfolios like several YouTubers who made the bulk of their profits from a concentrated bet on 1 or 2 stocks alone, and dissed value investors as “old-school” or “outdated”. There was even a problematic meme floating around on Reddit, giving the misleading impression that stocks only go up.

All was well…until the tides shifted.

After all, a rising tide lifts all boat, but as Warren Buffett famously said:

If you made any of the above mistakes, now is a good time to reflect and recalibrate for the future.

Reasons for the current market downturn

Fed Hikes (higher interest rates)

After years of injecting liquidity into the economy (or what others term as “printing money”), the Fed has now announced that it will now be tightening its monetary policy and raising interest rates from as early as this month. Higher interest rates means it becomes more expensive to borrow, and this has a bigger impact on growth stocks because they tend to borrow to fund their aggressive growth and expansion plans – particularly for growth stocks that have yet to turn profitable and have earnings well off into the future.

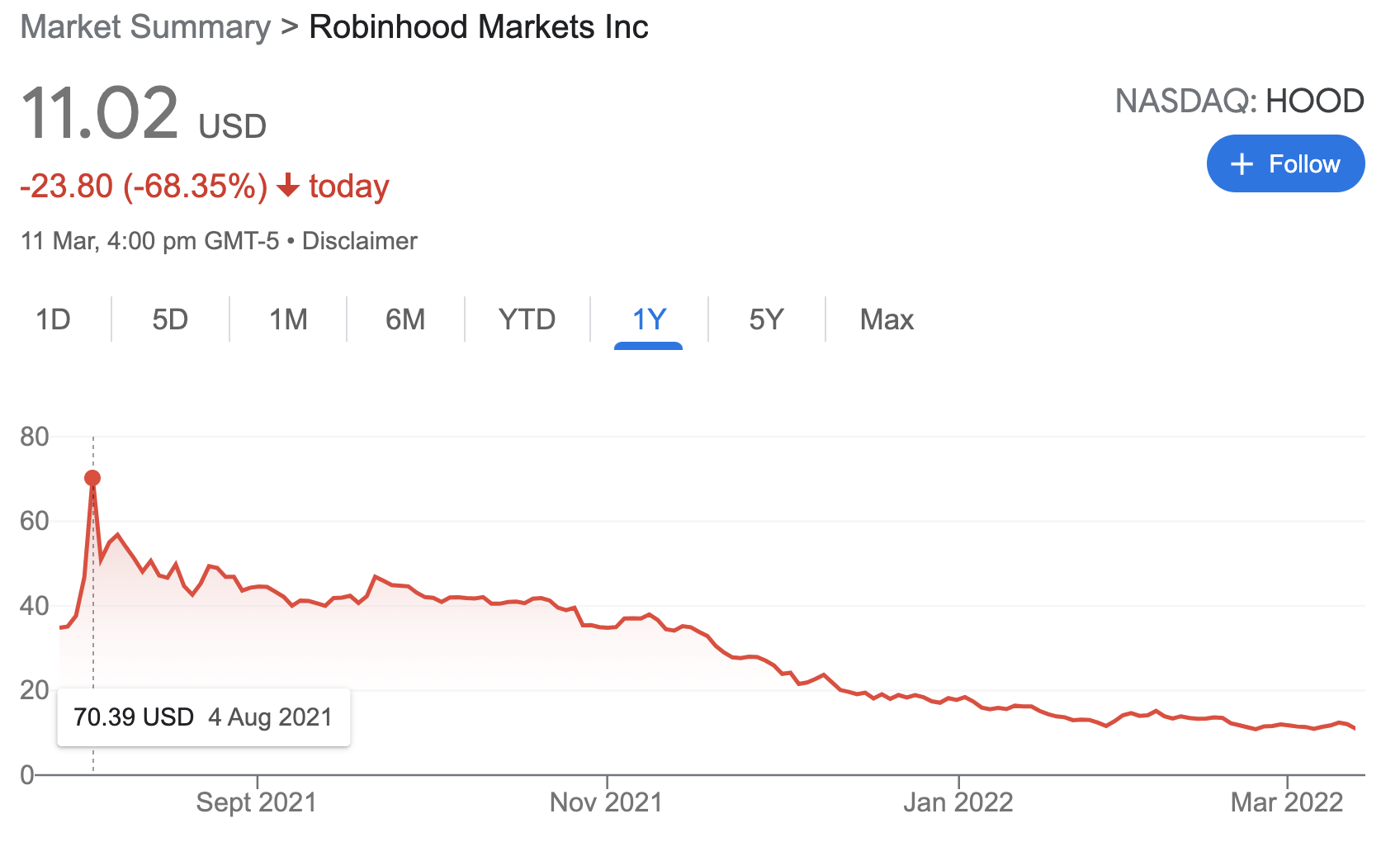

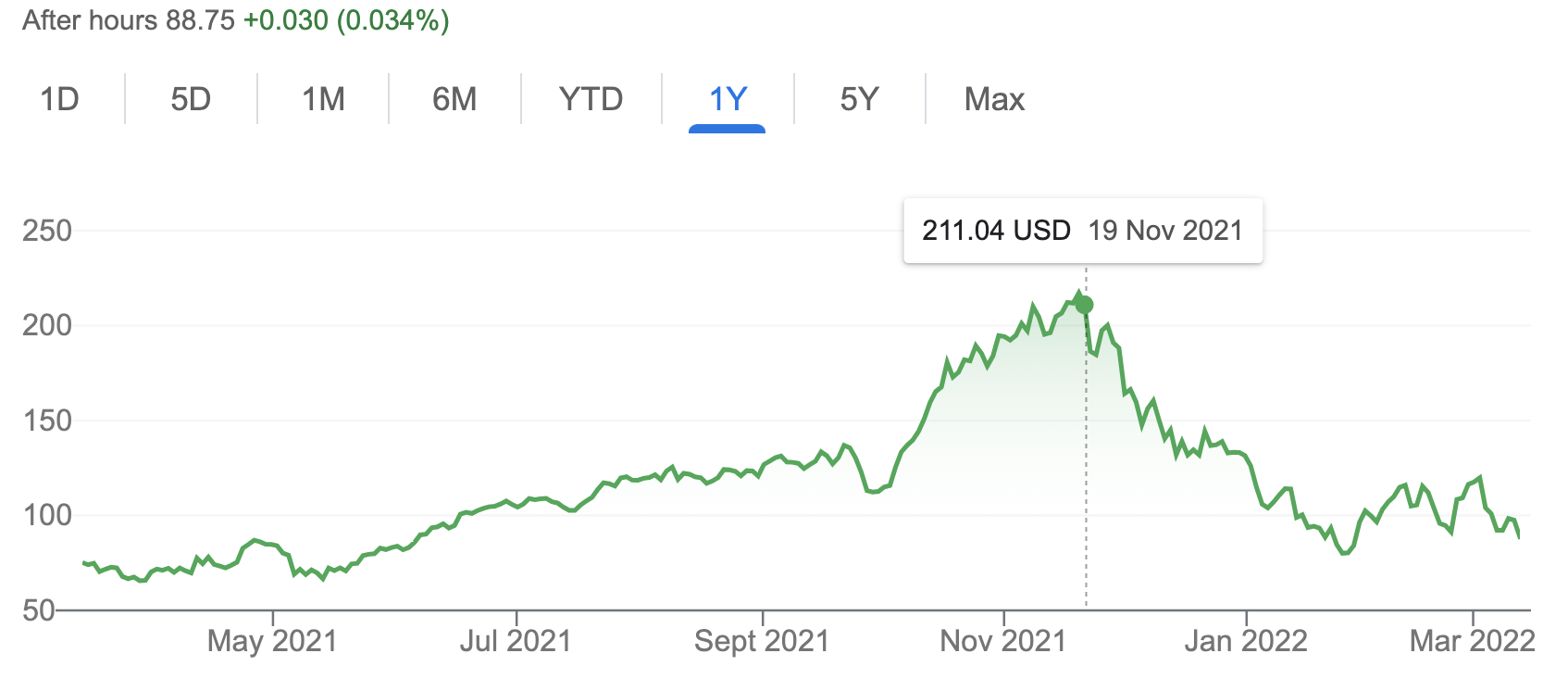

As a result, the stock market has pulled back – the S&P 500 and Dow Jones Industrial are both down more than 10% vs. the tech-heavy Nasdaq Composite which is down by 20%. High-growth tech stocks such as Cloudflare has since fallen 60% while others like Robinhood are down by 80%.

The Russia-Ukraine war

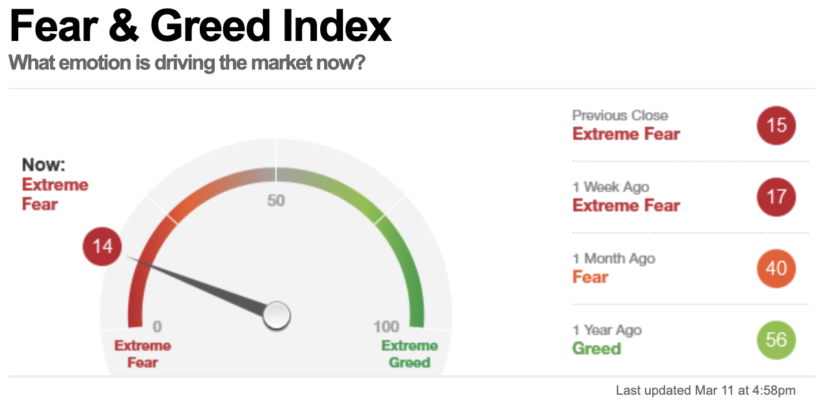

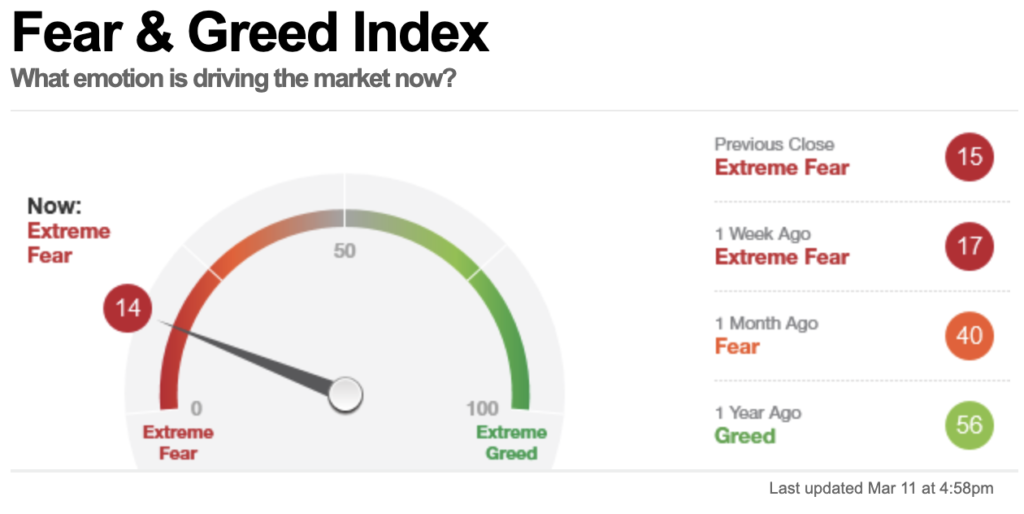

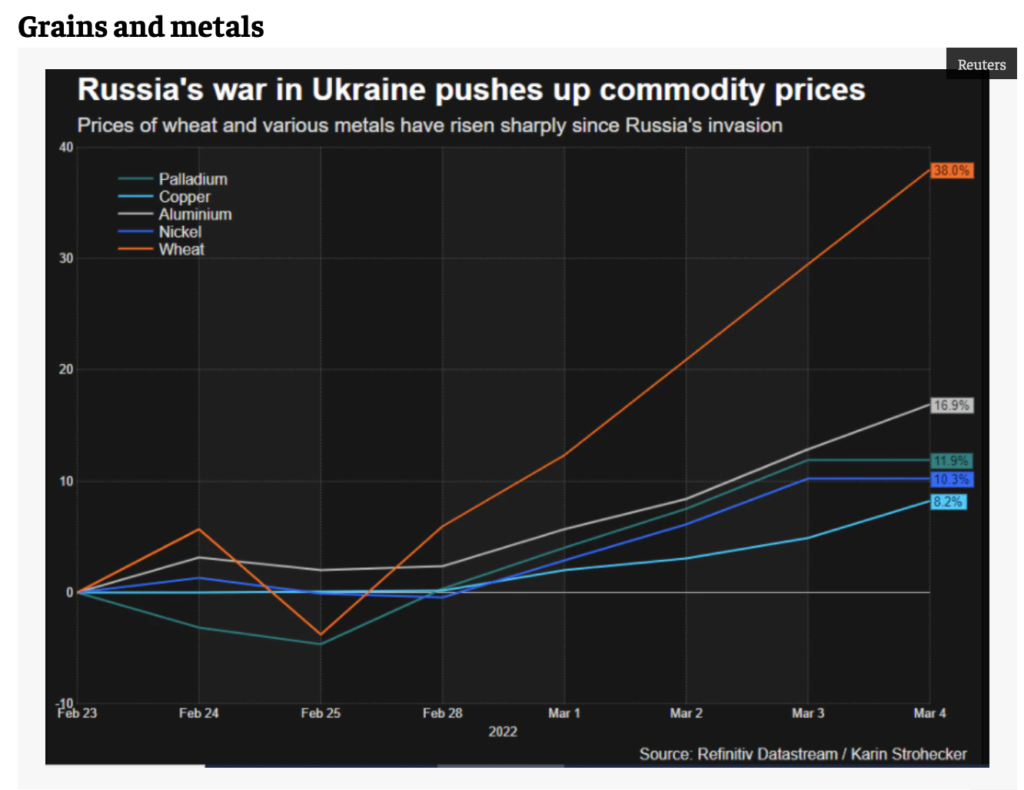

Russia’s invasion of Ukraine has sent volatility soaring and spread extreme fear across global markets. Risk assets such as stocks are being hit, while traditional safe havens like Treasury bills and gold are rising. Oil has hit levels not seen in a decade, whereas other commodities are also spiking.

But who would have known? Could you have seen this coming, or did you have access to Putin’s decision to invade Ukraine at the time that he started the war?

Don’t forget that merely just a year ago, investing in commodities was seen as “unexciting” as investors chased after tech stocks!

Inflation (or even stagflation)

We’re already seeing inflation play out – prices have increased across most goods and services, and even taxis have raised prices recently. And when the inflation rate exceeds what banks are paying out on our deposits, then savers suffer the most. Now that higher and longer inflation is almost a certainty, staying in cash alone will not be ideal. In fact, you’ll quickly see the value of your savings get eroded by inflation. For conservative folks, even fixed deposits may no longer be sufficient to mitigate the higher inflation rates ahead. What’s worse than inflation? Possibly stagflation, which has been alluded to in Singapore’s MAS Chief Tharman’s recent speech.

But investing during times of high(er) inflation is not easy, either. If we are to learn from history, it is worth remembering that the previously high inflation era in the US (in the late 1970s – early 1980s, where inflation spiked to 14%) led to a lost decade for stocks. As Warren Buffett explained, “a business earning 20% on capital can produce a negative real return for its owners under inflationary conditions” and that “high inflation rates will not help us earn higher rates of return on equity”.

Rising inflation can be costly for not just consumers, but also bode bad news for stocks and the economy. Growth stocks have enjoyed a bull run in recent years as inflation remained low, but historically, value stocks tend to perform better in high inflation periods. While we don’t know what will happen from here, what we do know for sure is that stocks are more volatile when inflation is high.

Pandemic

The COVID-19 pandemic hurt the world economy and disrupted supply chains. While the world is moving towards reopening and operating in a “new normal”, we are still not yet out of the woods – as evident in the latest lockdown in Shenzhen. We also do not yet know if Omicron is, or will be, the latest variant. Without a clear guidance, stock markets remain volatile and bearish as well.

Solutions to Explore

If you’re a short-term investor, this spells bad news as most of your investments are now likely in the red. But for long-term investors, these pullbacks could represent attractive buying opportunities. Selling into a falling market (especially since the S&P 500 is officially in correction territory now) is the exact opposite of what most successful investors do.

With inflation on our doorstep, there’s never been a more important time than now to start investing. And if you’re already invested, then it is equally important to stick through this period and not throw in the towel.

Here are some solutions you can explore right now:

Relook your portfolio allocation

Is your portfolio too heavily concentrated in growth stocks, or perhaps you’re overly exposed to a certain industry?

If you’re panicking now and feeling uneasy over your current levels of allocation, then perhaps it is best to review, rebalance and possibly reallocate. For instance, adopting a core-satellite portfolio strategy (like what Syfe advocates) could be a better idea if it’ll calm your nerves.

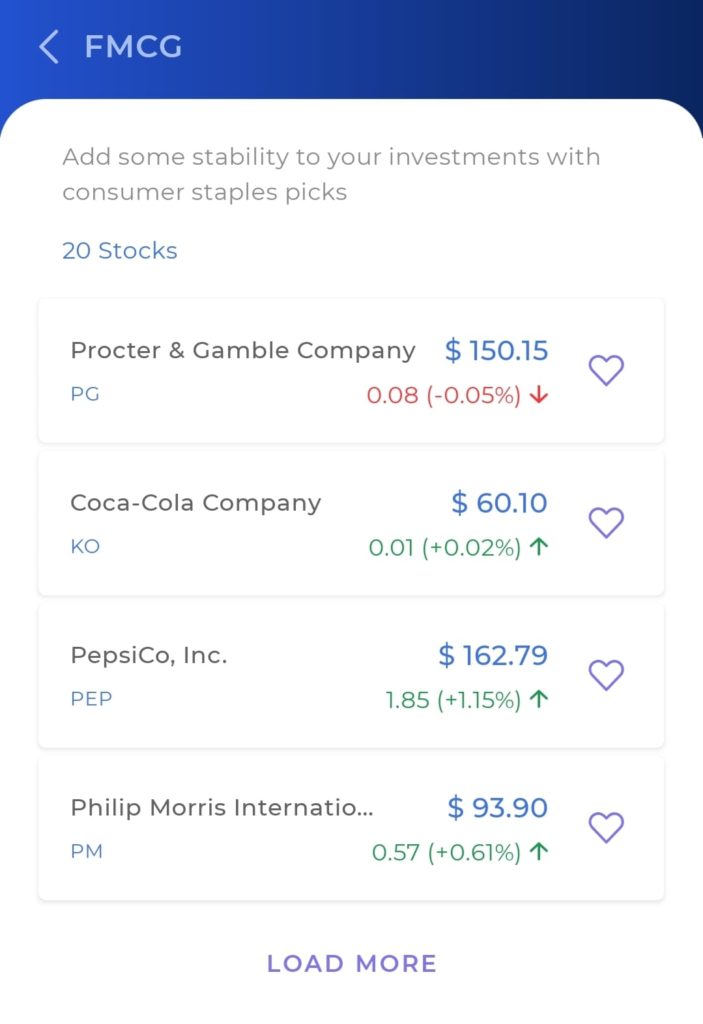

Don’t be too quick to dismiss defensive stocks

Defensive plays such as consumer staples, utilities, healthcare, real estate investment trusts (REITs) and strong dividend stocks may become increasingly popular if the current fear and volatility persists. After all, you can seldom go wrong with them. Regardless of whether we’re living through a recession or an inflationary period, people will still be eating and drinking, consuming medical services and utilities, etc.

Start looking out for undervalued stocks

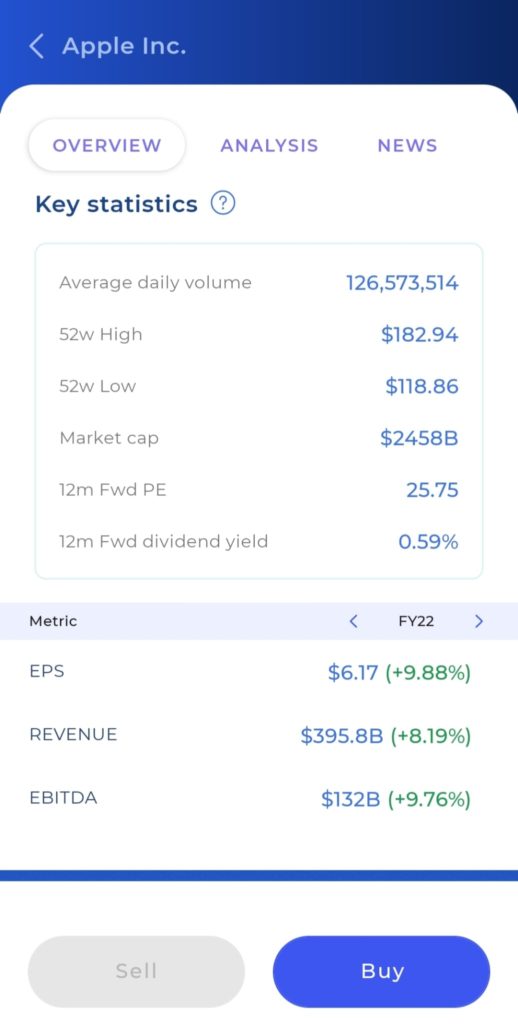

Due to the broader market decline, even fundamentally strong companies have been sold down in this climate. This is a good time to start hunting for undervalued stocks i.e. companies that are trading for what they are actually worth. Some common metrics to look at include price-to-earnings or price-to-book ratio and net asset value, but just make sure you use the right metric for the right industry and company.

If you don’t know how to carry out fundamental analysis, then go and LEARN! Whether you choose to learn through books or courses is up to you (and if you want a crash course to bring you up to speed in the shortest possible time, check out my Academy here). Learn how to fish, so that you don’t have to keep relying on stock tips from others.

Don’t try to time the market

Instead of trying to time the market, you may be better off with regular dollar-cost averaging (DCA) to reduce your cost per basis. What’s more, adopting a DCA strategy will also be less stressful for you as it doesn’t require you to react immediately to market events or changes.

Having said that, DCA might be difficult to execute if you are invested in the Hong Kong market due to the minimum order size, which differs across each stock. But there’s a solution for US equities – Syfe Trade is one of the only local brokerages offering fractional investing, which enables you to DCA during these volatile times more effectively. What’s more, you can also DCA into stocks that are priced higher (e.g. Amazon or Alphabet) without having to use up a large capital each time. Click here to read on the important role that fractional investing plays in building a truly diversified portfolio e.g. without it, a monthly cash injection of S$3,000 would only be able to afford 1 Amazon share with little to spare for other companies in your portfolio.

Conserve your bullets

If the current market climate persists, or if the war drags on, or if we enter stagflation, or if investor sentiment towards growth stocks remain muted…

Regardless of the scenario, as long as the market continues its downtrend for now, you will need to have sufficient cash so that you can continue deploying at every turn and average down. The good news is, if you have income still coming in from other sources during this time (e.g. from your corporate job or business), you get fresh capital each month to deploy again once more.

Psst, if you need to deploy multiple trades each month, doing so via Syfe Trade makes sense because you get free monthly trades and the ability to buy fractional shares, thus allowing you to make the most of your fresh capital every single time.

For DIY investors: focus on strong companies

You can never go wrong when you invest in fundamentally strong companies, and even more so when you buy them at the right (or low) valuations. As such, continue to focus on companies that generate (rather than consume) cash, as well as companies that have the power to increase prices without fear of significant losses. (Apple and McDonald’s are some good example of companies with strong pricing power.)

TLDR: Don’t panic and stay the course

Whatever happens, the stock markets have proven to be fairly resilient over time, so investors will do well NOT to panic. If you’re made a poor investment, think about whether you should average down (if the thesis is still valid) or cut loss and redirect the funds elsewhere. If nothing has changed in your investments other than general sentiment, then you’ll likely do best to stay the course.

I’ll leave you with this image (from LPL Research) that pretty much reiterates this point:

Sponsored Message from Syfe

Looking for an effective way to do dollar-cost averaging? Check out Syfe Trade here. Invest in US stocks and ETFs with as little as US$1, and get commission-free trades each month. For March 2022, you get to enjoy 5 free trades and a super-low fee of US$0.99 per trade thereafter!

Use code BUDGETBABE to get an additional $10 bonus when you make your first trade! New Syfe Trade customers will also receive $60 in cash credits when they fund $1,000 in their account and start trading. T&Cs apply.

Disclaimer: This post was written in collaboration with Syfe. All writings (save for the sponsored message) and opinions are that of my own. This is not financial advice and all information is for educational and informational purposes. Past performances are not necessarily indicative of future performances and you should not interpret my returns as what you'll get. Always do your own research before investing! This advertisement has not been reviewed by the Monetary Authority of Singapore.