I often get emails from readers telling me that they would like to invest in stocks after having read my blog, but are too afraid to start because they don’t know what stocks to pick, or are not sure if they have enough money to invest.

My answer has always been that if you’re a beginner starting out on your investing journey, then Regular Shares Savings (RSS) Plans might just be a good place to start.

What are Regular Shares Savings Plans?

You can also read more details on Regular Shares Savings Plans here on SGX Academy.

In a nutshell, a RSS is a plan that helps you make regular investments into shares. They’re great for folks who do not yet have a large sum of money to get started or the busy people who do not have time to manage individual stock counters.

You might have read about Index Investing – one of the easiest and most convenient strategies – to invest without having to do stock selection or attempting to time the market. RSS plans allow you to do that.

How do RSS plans work?

RSS plans help you to automate your investments by buying more shares when prices are low, and less shares when prices go up.

Think of it in this way. Imagine that you only have $100 allocated every month to buy mangoes. During mango season, mangoes can be found selling for as little as $1 each. But at all other times of the year, mangoes usually retail for at least $2.50 on average.

When mangoes are cheaper at $1, your budget gets you 100 mangoes.

When mangoes become more expensive at $3, your budget gets you 40 mangoes.

| Price per mango | Mangoes bought for $100 | |

| January | $2.50 | 40 |

| February | $3 | 33 |

| March | $4 | 25 |

| April | $4 | 25 |

| May | $4 | 25 |

| June (mango season) | $2 | 50 |

| July (mango season) | $1 | 100 |

| August | $2 | 50 |

| September (mango season) | $1 | 100 |

| October (mango season) | $2.00 | 50 |

| November | $2.50 | 40 |

| December | $2.50 | 40 |

| Total mangoes bought | 578 | |

If you regularly buy mangoes throughout the year, your average cost per mango drops to somewhere between $1 and $3. In this illustrative example, the cost per mango is now $2.07, which is almost 50% cheaper than the most expensive price ($4).

Now replace mangoes with shares, and you’ll get how RSS plans work for you.

This strategy is also called dollar-cost average, another method which you might have heard about. It is the simplest and most fuss-free strategy when it comes to buying your stocks and accumulating more when they’re cheaper. Most of us would naturally do the same – buy more when it’s cheap, and less when it is more expensive.

The difference is that RSS plans automatically do that for you, so you don’t even need to lift a finger every month to do that purchasing of mangoes shares.

What kind of risks and returns can I expect?

What I like best about RSS plans is that they allow a beginner investor to invest in a suite of Singapore’s largest blue-chip companies.

|

| Source |

Currently, as of 15 February 2019, the index consists of the following stocks:

- DBS

- OCBC

- UOB

- SingTel

- Jardine Matheson

- Hongkong Land

- Jardine Strategic

- Keppel

- CapitaLand

- Thai Beverage

- Ascendas REIT

- Wilmar

- SGX

- Genting

- CapitaLand Mall Trust

- ST Engineering

- Singapore Airlines

- Comfort Delgro

- CapitaLand Commercial Trust

- City Developments

- Venture Corporation

- SPH

- Dairy Farm

- Jardine Cycle & Carriage

- UOL Group

- SATS

- Yangzijiang

- Sembcorp Industries

- Hutchison Port Holdings

- Golden Agri

You probably recognise most of the names above, if not all of them, for they’re among Singapore’s biggest companies by market capitalisation.

When a company’s business starts declining, then it gets removed from the list and replaced with another better one, at no cost to you as a retail investor. For instance, not too long ago a particular stock was removed and replaced with CapitaLand Commercial Trust in 2016 after its share price plummeted by over 90%.

Retail investors who had bought that company’s stocks directly got burnt, but the ones who owned it through a RSS plan via the STI ETF (or Nikko AM ETF) were spared from the fire and didn’t lose their money.

That’s a pretty good benefit and the best part I like about index investing.

However, as with every investment, even RSS plans are not spared from risks. If there is a stock market crash and stocks fall across the board, all investors will experience loss in their monies, and by then even RSS plans cannot save you.

Folks who had started investing in a RSS plan from January 2013 to December 2017 (in the STI ETF) would have seen a 7.1% return over those years. That’s not too shabby at all for someone who doesn’t do stock picking nor timing of the market!

Where can I sign up for RSS plans?

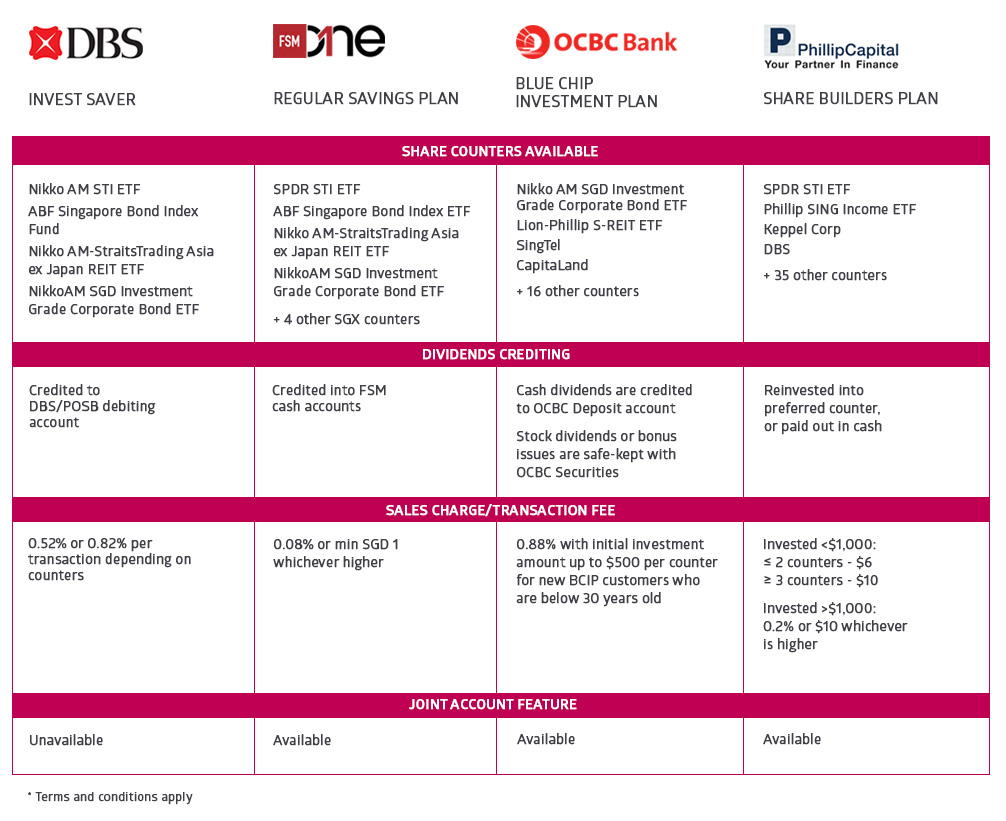

There are various RSS plans you can pick to invest in the Singapore market:

[June 2019 update: an earlier version of this article showed 4 providers. Maybank Kim Eng has since ceased their Monthly Investment Plan, and has been removed from this comparison.

December 2019 update: updated with latest plan changes and OneFSM as a new RSS provider]

If you’re investing anywhere between $100 – $600 a month, DBS Invest Saver has the lowest sales charge. The former is tied directly to your existing debit account for automatic deductions, whereas the other requires you to pre-fund it prior to purchasing.

For $500 a month, OCBC’s Blue Chip Investment Plan looks be the most ideal given its charges.

If you’re investing $600 – $999 every month, then the Phillip Share Builder Plan would be the one with the lowest costs.

The assumptions above are if you invest in the local index i.e. STI ETF or Nikko AM. counter charges refer to if you’re buying individual counters eg. stocks like SingTel or CapitaLand via a RSS plan. I generally don’t use RSS plans for buying of individual stocks since I may not necessarily buy the same stock every month but recommend them for beginner investors who wish to utilise the strategy I’ve just described.

Who are RSS plans suitable for?

Profiles:

- Students

- Beginner investors who are new to investing and unsure where to start

- Folks without a sizable investment capital

- The busy stay-at-home mother, who has the hardest job in the world (in my opinion, after I’ve experienced being a SAHM myself during my maternity leave)

- The busy working mother, who juggles between earning money and pumping milk / spending time with her kid(s) once she gets home

- The busy working father

- The parents, who are trying to invest for their child’s financial future

Perhaps recently with my new foray into motherhood, many fellow mummies have also reached out to me to ask about investing given how time-pressed they are. (For the males reading this, if you still think mothers on maternity leave have a lot of time on their hands, please read this post to see how hectic our schedules are.)

So fellow Mummies, if you’re looking for a super simple plan for the superwoman in you and have no time or energy to invest, I would highly recommend that you consider subscribing to a RSS plan to automate your investments for you.

Your returns may not be as high as if you learn how to invest directly in individual stocks (which also risk you losing money), but over the long term, it should beat the returns offered on your bank savings account.

For more details on Regular Shares Savings Plans, you can check out SGX Academy’s website here.

2 comments

If you have more available spare cash, Dollar Cost averaging will definitely yield more as compared to pure Regular Monthly Sum Investment plan 😉

Indeed, but that's only provided they have more money to spare. The minimum units per purchase on the open stock market is 100 shares, if they're buying a stock like DBS where it is currently trading at $25, that works out to be $2,500 per purchase minimum.

Or, even if they were to buy the index directly, that would be $300+ minimum each time. Most brokerages charge a minimum transaction fee of $25 (SC charges less, but it is a custodian account so they don't technically own the shares). $25/$300 = 8.3% in costs! At this rate, they'll be better off simply buying from even ILPs (woah) where the costs are much lower.

But the RSS Plan allows them to Dollar Cost Average into the market for those with smaller capital base. The charge is fixed at a low rate, which makes it difficult for anyone to beat those percentage fees if they were to invest direct.

Hence TLDR:

For investors with a bigger capital base, doing direct is usually the case.

For investors with a smaller capital base, RSS plans might be better.

Comments are closed.