When I first embarked on my investing journey last year, I started out by reading various books on the topic and trying to pick up some skills through the self-taught method.

Needless to say, I made quite a number of amateur mistakes along the way, but that’s a story for another day.

After making some of these mistakes, I thought that perhaps attending investing courses would help me – after all, I get to learn from the experts, and pick their brains on how I can become a better investor. Unfortunately, I realised what I wanted out of the workshops and what the trainers wanted were two completely different things – while I wanted to learn techniques and skills which I could then execute myself, most of them were more interested in (hard-)selling me a 4-digit course fee instead.

Many of these “workshops” were simply previews of a more expensive course. For these, I felt like I had wasted my day at the place because I hardly learnt anything new. Here’s how their “workshops” go:

– Introduce value investing. Talk about Warren Buffett, the kind of amazing results he made, how he is the only person on Forbes’ list to have earned his riches through investing and not through business, etc.

– Share their (the trainers’) personal life story. I was stuck in the civil service working a 9-to-5 job and was a slave to my bosses! Then I stumbled upon this XX course and my investing PASSIVE income was now exceeding my monthly income! I quit my job because I really believe in financial education and knowledge!

– Show off their company’s track record. Cue performance charts of their returns. Show cheques or slips of money they’ve received through dividends. Show stock prices with arrows pointing at buying high and selling low.

– Say they’ll now teach you the secret of value investing. Mention “buy high sell low”, “calculate intrinsic value”, “invest in companies with economic moats”, etc.

– Go through case studies of value stocks. Among the most popular examples used include SATS, Starhub, VICOM, etc. Sorry if you’re hoping for stock tips because these stock prices are now over-valued.

– Ask the audience “Wouldn’t you like to learn how to find these stocks for yourself?”

– Introduce their members-only scheme. Share about their members track record. Play videos of interviews with their members proclaiming how glad they were that they signed up and the kind of returns they are making.

– Sell a 4 or 5-digit course to you. This is the part where I leave while shaking my head in disgust at how I’ve wasted an entire day listening to them talk about themselves with nothing of value to me.

I’m not here to lambast or smear anyone’s name(s), so I shall not name the courses I went for. But there is one particularly course I want to single out today: BigFatPurse’s Value Investing Mastery Course (VIMC).

I attended VIMC over the weekend, expecting to go through somewhat the same flow. Boy, was I wrong.

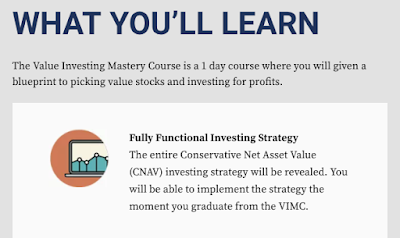

VIMC was not a preview – it was the real deal. In the 8 hours I spent there, I learnt a method and step-by-step calculations which I could apply immediately once I stepped out of the class. There was no need to sign up for anything more; I had learnt the skills to now execute and put into practice by myself.

Whether you’re a beginner or experienced investor, you’ll find that this course will really open your eyes up to investing and introduce a new way of valuing stocks that you’ve probably never encountered before. The trainers – Alvin and Louis – taught us about BigFatPurse’s proprietary investing strategy which focuses on capital gain rather than dividend yield.

This is their Conservative Net Asset Value (CNAV) strategy which they’ve created themselves which provides a systematic approach to valuing stocks and finding out when to buy and sell them.

Unlike many other courses on value investing, what they taught here is NOT available in any books out there. Even after reading so many investment books and websites, I’ve never encountered their strategy nor calculations before. This alone made my entire day spent at the workshop worth it.

I’m not paid to promote them, but if you asked me, this is the most REAL investment course I’ve ever attended with absolutely no hard-selling. It was a breath of fresh air compared to all the other courses I’ve attended this year. VIMC starts by giving you a short introduction of value investing (not just Warren Buffett, surprise!) and then it goes straight into the CNAV methodology and calculations. At the last hour, you’ll then play an investment game (I don’t want to give anything away here, but this is frankly the most exciting and insightful part of the course where you’ll discover more about your own investing style and assumptions).

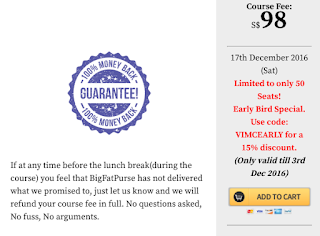

SGD 98 is far too cheap given the value I got from this 1-day workshop. In fact, I even spoke to Alvin after and told him they ought to raise the price (considering what others are charging) to at least 3-digits, but he politely declined my suggestion. I don’t understand it.

SGD 98 is far too cheap given the value I got from this 1-day workshop. In fact, I even spoke to Alvin after and told him they ought to raise the price (considering what others are charging) to at least 3-digits, but he politely declined my suggestion. I don’t understand it.

Update: the folks at BFP have just informed me that their higher rental costs leave them with no choice but to increase prices so each ticket will now be $128 for next year. (I can attest to this: venue rental prices are about $800 – $1500 on weekends when I tried sourcing for event spaces. Try Googling yourself.)

When I told them I would be publishing a review of their course, Alvin went one step further to offer a further discount for my readers. Frankly speaking, I think he’s crazy to not want to charge higher.

VIMC even comes with a money-back-guarantee if you’re not satisfied with the course. I really don’t understand what these folks are thinking.

Disclaimer: I was invited to attend VIMC for free, but after going through the workshop, I can honestly say this is something I’ll gladly and extremely willing to pay for because of the tremendous value I got out of it. This is not affiliate marketing and I do NOT get a single cent if you sign up using the link or my coupon code, but I’ve promoted it here anyway because I frankly think this course is the most valuable one I’ve ever attended.

Find out the dates for their next VIMC course at this link and apply coupon code BUDGETBABE for a $20 discount!

Aside from value investing, they also teach on other investments:

– Investing in Bonds (13 May 2017)

– Investing in REITS (3 June 2017)

Now excuse me while I go check on my queue order for my first CNAV stock purchase 😀 I had spent my Saturday night poring over the research right after I came home from the course. See, I wasn’t kidding about being able to use the skills immediately!

Aside from value investing, they also teach on other investments:

– Investing in Bonds (13 May 2017)

– Investing in REITS (3 June 2017)

Now excuse me while I go check on my queue order for my first CNAV stock purchase 😀 I had spent my Saturday night poring over the research right after I came home from the course. See, I wasn’t kidding about being able to use the skills immediately!

With love,

Budget Babe

6 comments

Hi Shu Zhen, for sure! It is great for beginners as well as it really teaches you the basics to the methodology 🙂

Hi! I am Singaporean but based in Canada. I see that there is an online course as well for those not located in Singapore. Do you recommend that? I might go back Singapore in March so could enroll in this. Do you have any other recommendation in other financial coaching courses in Singapore when I make a return or should I just go for this?

Hi! I've not tried the online course so I can't really comment, but yes if you could do one in March I think you should definitely sign up! Few courses catch my eye and I can only comment on the ones I've gone for, and VIMC is one of them 🙂

Thanks so much for your reply! Cool I will email them and see if I could book a session 🙂

This comment has been removed by the author.

Hi! I'm contemplating if I should join as a VIMC member. Would like to ask if you joined as a member? Is it possible to use the strategy without the database as there are so many stocks to calculate for? Appreciate your input!

Comments are closed.