What should you do if you’re sandwiched between your parents, your children, and your own retirement?

I’ve been getting this question a lot lately, thanks to the viral video that NTUC Income launched two weeks ago, and will follow up soon with what I think are some steps readers can take. However, before that, I recently came across a sharing from a reader who managed to turn things around by being proactive and getting her finances in order. She has agreed to share her story and I hope this encourages all of you to show that not all is lost:

|

| Image credits |

Background

I am an only child, with two surviving parents and a toddler daughter. I may still want to give her a sibling later on. I worry about them as well as my husband and my in-laws (my husband has siblings, but they’re not financially well-off to be able to definitely foot the bills with us should anything happen).

My mother (early 60s):

- Has insurance, but simply not enough savings for retirement. Most of her savings went into helping my dad stem his scary spending. Even till today, my dad still dips into my mom’s savings from time to time.

- She doesn’t have any CPF, including in her Medisave.

- My dad paid for my university education in full from his CPF account, and gave me a $400 allowance every month back then.

- Has no insurance.

- Zero savings, except for his CPF retirement account which has a healthy $100k inside.

- He also has a almost fully-paid private property which he collects a monthly rental of $2000 on.

I was my parents retirement plan.

To turn things around, I needed to make sure I have insurance for all my dependents, and then come up with a plan to fund my parents retirement through passive rental income on their properties. This was what I did.

Step 1: Bought a resale flat with my mom.

Back in the late 2000s, in order to unlock the asset value of my dad’s property, I needed to get another place. The HDB rules hadn’t kicked in then, and as my dad’s property was entirely under his own name, my mom and I partnered to buy our own resale flat. My mother wasn’t able to take a loan, so I paid for the flat entirely.

Step 2: Applied for my own 5-room BTO flat with my husband and got our keys recently.

In the early 2010s, I started thinking about how I could make sure both my parents could retire and still have their own passive income to cover their living expenses, if not more. So my husband and I rushed to get our HDB BTO flat. This way, I could give my mom the resale flat for her to earn rental from, whereas my dad can continue to earn rental from his private apartment.

We received the keys to our new BTO flat recently and moved my parents in with us. This enabled them to help care for my daughter, and be able to fully rent out both their respective properties to maximise rental income.

Step 3: My parents stopped working and now enjoy a combined income of over $4000 a month from rental.

This was only possible with prior planning and careful execution every step of the way. Now that I had sorted out a steady income stream for my parents’, I still have to think about the “what ifs” and plan ahead.

|

| Image credits |

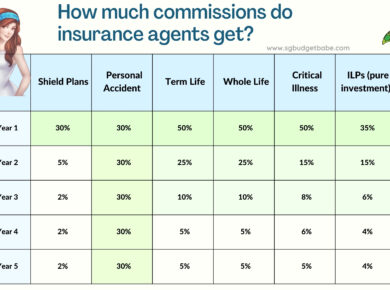

Step 4: Getting insurance for my dependents.

It is important to me that whoever can be insured, is. This was the aftermath once I had revamped my family’s insurance portfolio with our agents.

My mom has:

- Life insurance + savings plan (which she bought many years ago from her sister)

- Personal accident insurance

- Private hospitalisation plan

- no private insurance, as he is a heart patient and was rejected from various insurers

- Medishield Life is what we can only rely on

- Private hospitalisation plan

- Personal accident insurance

- Life insurance

- Personal accident insurance

- Private hospitalisation plan

- $50k life insurance

- Investment-linked plan

- 2 endowment plans (15 and 25 years respectively)

- Personal accident plan

- Private hospitalisation plan

- A pure investment plan (as I am not good and have no time to invest)

- Increased my coverage by adding a $100k term plan after our daughter was born

Step 5: Getting myself insured.

As my family’s only stable breadwinner (my husband’s job is erratic and there are times when he does not have income, due to fluctuating demand), it was crucial for me to make sure that I don’t have to worry about my parents or my daughter if I should suddenly pass on.

In total, we spend about 10% of our annual income on insurance for protection, and another 10% for my investments. Some say this is excessive, but if I could and knew how to invest well, my investments portion could be further reduced, but at this stage of my life and given circumstances, I have opted to outsource it to a trusted financial advisor (yes, I’m aware I’m paying a fee which I could eliminate if I do direct). This is my choice and preference right now.

TLDR Takeaways

- Take care of your downside by outsourcing as many big-ticket financial risks as you can to the insurers, within your affordability. Get a trusted agent to do the planning for you, if needed.

- If possible, come up with a plan to generate passive income for your parents’ retirement. This will really help offset your burden if you constantly have an inflow of cash throughout their golden years.

- Protect or boost your earned income. Work on your career progression. Get a stable job, build up side income, or generate your own passive income through investments.

I was very heartened to read of this reader’s story and glad that she was willing to share it here, to show that not all is necessarily lost even if we feel like we’re terribly sandwiched between generations. And even if your parents had failed to plan in the past, that doesn’t mean we still cannot take steps today to try and prevent our greatest financial fears from coming true.

As long as we plan well and ahead, there might still be a way out. Hopefully this inspires you as much as it inspired me!

With love,

Budget Babe

3 comments

The $2000 rental income from private property sounds a bit low though… Unless it's only rental from one room.

location also plays a part!

Cool ! Thank you for sharing! Just wondering though, how come the reader can buy a resale HDB flat + a HDB BTO flat? Wouldn’t her name be in 2 HDB properties ?

Comments are closed.