Day 3 of #dayrefinancialfast ! How's everyone doing?

(I grabbed just a Mac ala carte burger for dinner instead of going for the entire meal + mcflurry 😅 it'll be harder to keep this challenge up over the weekend as we are going to a sales show!)

A few of you have been emailing me about financial tips for students so I thought I'd focus on this topic for today:

Personal Finance starts with cutting your expenses and saving up

(Scroll to the end of this post for Part 3 of the free Finance Crash Course I've been doing for Dayre readers. The focus this time is on Personal Finance for Beginners!)

How many of you track your expenses?

My habit of monitoring where my money goes started when I went overseas for my university exchange program (which I funded without a single cent from my parents! But that's a story for another day…)

Back then, I had only a fixed sum of money to go for exchange – and this was meant for 6 months of living expenses. Food, accommodation, transport, school books, travel, etc.

I didn't have a PMS (papa mama scholarship) and my parents didn't fund my studies.

If I ran out of money…that was it!

So I decided that I'll track down every single expense just to make sure I stayed on track. I created an Excel spreadsheet to track my spending, and during the day I would key in my expenses into my Notes app on my mobile, then manually enter it at night when I reached home.

(Hey, those were the days when mobile apps weren't so savvy yet k!)

Doing so really helped me make sure I didn't run out of money during my study trip. For instance, I never thought I spent a lot on clothing and shoes until my spreadsheet showed me so. 😅

Thankfully I didn't run out of money, as it kept me disciplined, and I even had a small sum left over to fund another mini exchange to China's "Harvard" when the opportunity came up! 😀😀

A lot of people I know don't really bother tracking their expenses. The usual excuses are that it is too time-consuming.

It doesn't have to be! Here's 3 simple reasons why you should track your expenses:

1) it shines the light on your spending habits

2) you'll be aware of questionable charges

3) it allows you to save more effectively

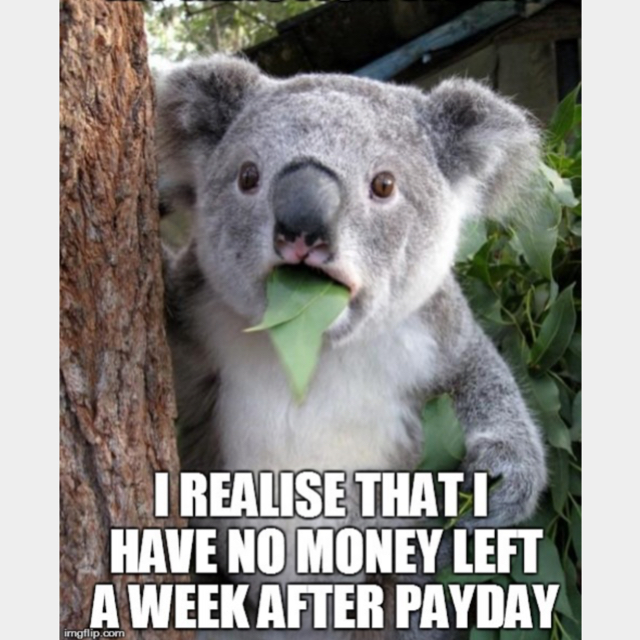

If you're like many of my friends, who often live paycheck to paycheck and wondering where their money went to / how it disappeared so quickly, then tracking your expenses is probably the first step to getting your financial life in order.

Is this your normal reaction? How many of you encounter this?

It just takes me less than 5 min a day to track my expenses!

Today, there are so many great mobile apps that can help you track where your money is going, and they're available for free too. Tracking expenses has seriously gotten so much simpler and convenient compared to when I first started tracking years ago.

I either do it immediately after making a purchase, or at the end of the day when I'm on the train home. By making it a daily habit, you'll find that it isn't as difficult as you might have initially thought it to be.

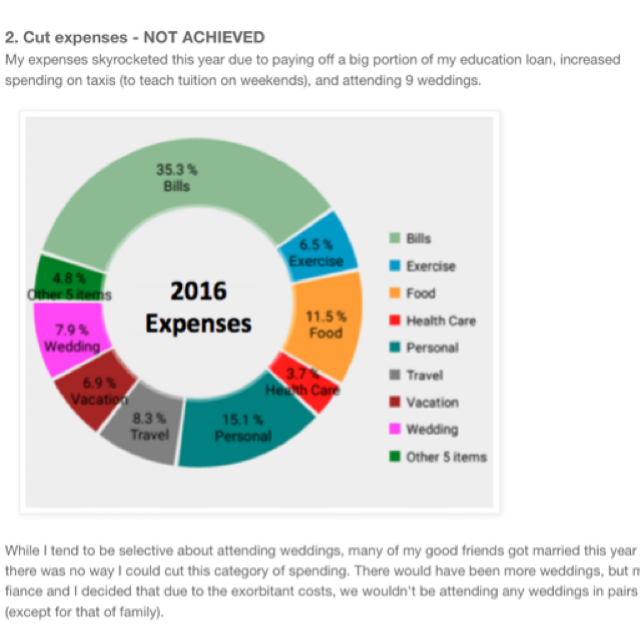

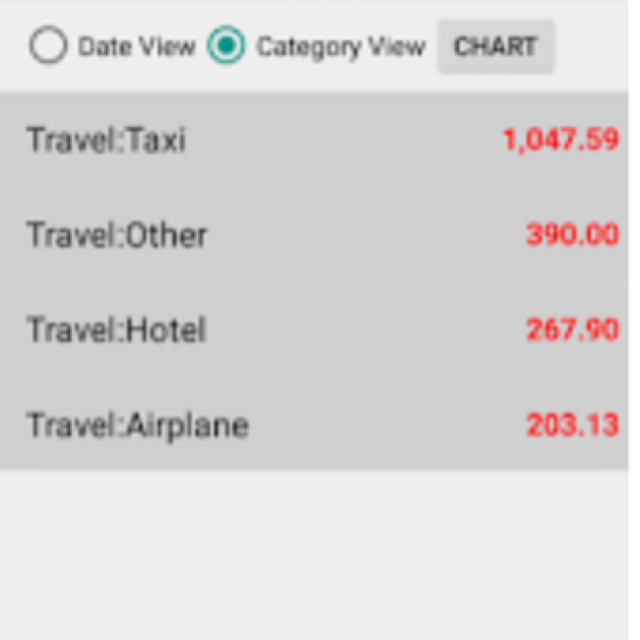

I'm able to see charts like this to understand where exactly my money has been going to, and it helps me to prioritise what I need to cut down on.

For instance, while my expenses for 2016 went up, it was due largely to giving wedding angpaos and paying off a large portion of my loan, so it is actually a good thing instead. If I hadn't tracked, I might have fretted over my higher expenses, when in fact there's nothing to worry about.

This, however, surprised me. Even though I knew my cab expenditure had gone up (due to a tighter work schedule which makes cabs a necessity on certain days in order to be able to squeeze all the meetings in one day), I had no idea it exceeded $1000!

Definitely looking into reducing this for 2017.

Unless you track your expenses, you won't know where to cut.

And that's crucial to help you maintain your habit of saving in the long run. While the #financialfast is great, some of you may lose steam after a while. But by tracking and reviewing your expenses every month, you'll be able to decide where to cut and how you can do that.

What about tracking cashless payments?

I'm using Expenses Tracker, which has been my favourite for many years now because it allows me to create categories that are meaningful to me.

But one downside is that I need to input the data manually. It also doesn't really show me my overall net worth – I've to calculate that separately myself.

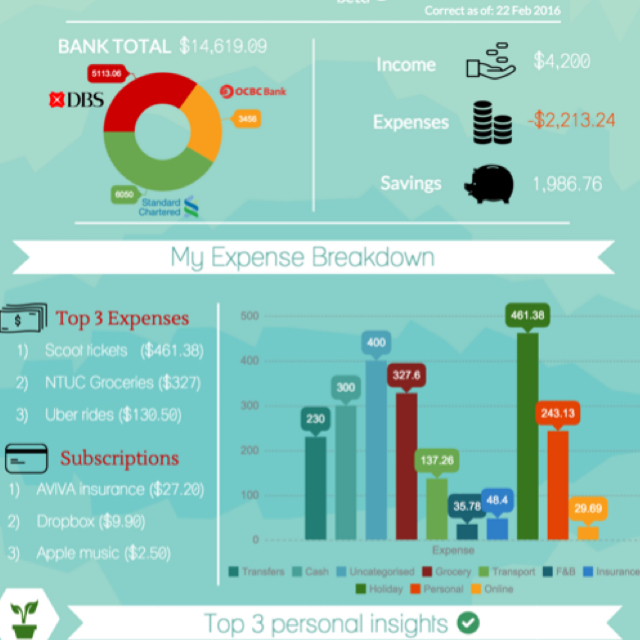

What if you could get insights like this? An app that consolidates all your finances in one place, and your money coming in and out.

It can even give you meaningful insights across your spending categories, and tell you if there are ways to cut down by taking advantage of promotions available!

(I suggested this feature to the app developers k hehe)

Free apps for tracking your expenses:

Seedly

Expenses Tracker

Pisight

Dollarbird

Goodbudget (limited features for free)

Penny

Wallaby

MINT (the most popular)

Wally

The problem with most of these apps though, is that they aren't tailored for the Singapore market. For instance, Expense Tracker's default payee list are companies that don't have a presence here – Best Buy, Costco, Walmart, etc 😓

My personal favourite? Seedly!

Because I like supporting #startups and stuff created by students. Haha. Seedly was created in NUS and only launched last year after getting the support of DBS Bank and a few others! The founders are super humble and wrote to me over a year ago inviting me to coffee so that I could look at their beta app and tell them what features ought to be added / removed.

I don't get a single cent for promoting them, but I loved their work so much that I've been telling my friends about it!

(I also told them to keep it free, or I will stop using it HAHAHA)

———————————————-

Dayre Meet-up / Financial Crash Course!

Just received the event photos from tonight! Thanks guys for attending! I had so much fun sharing what I know with all of you and playing the games too!

Deciding to do this as my Christmas giveback was definitely the best move last year! Thanks to everyone who spent your TGIF with me!

It was so fun watching all of you guys playing! I hope I didn't give you guys wrong instructions 😅

Sharing my personal formula to financial freedom.

Due to the shorter time we had today, I didn't manage to go into a worked example of an actual investment so you guys can see what goes on in my brain when I analyse stocks – but hmm you can get a glimpse of my thoughts on my blog too if you're curious!

Huge thanks to Xeo and his Wongamania team for lending us the game sets to play for free! I didn't want anyone to pay for rental anyway..

I didn't think I would be able to pull off the event giveaway entirely by myself otherwise. It was also really cool to meet all of you guys in person after exchanging comments on Dayre!

———————————————-

We had to cut some people out because of the limited seats by the venue sponsors, and I've been feeling quite bad about it. Many of you have also been asking me about finances for students and how to start from savings (before going into investments). Some of you also commented that you were bummed to have missed the events because you didn't know of my Dayre prior to EP, so I've decided to hold one last Dayre meetup before I get busy with my wedding again!

24 Jan, Tuesday 7pm

Agenda for the night:

📌 personal finance 101

📌 how to track your expenses effectively

📌 10 ways to save more money immediately!

📌 understanding how your tuition fee loan works

📌 how to save as a student

📌 basics of insurance (what should you get?) if we have time!

Sign up at http://bit.ly/2ikcQXW

We will only hold this event if there's at least 35 people attending, so do grab your friends and get them to sign up too!

If you've any specific topics you'll like me to touch on, please let me know in the comments below.

Thanks for letting me know what you'll like me to cover during the workshop guys! I'll add them into the slides 😊