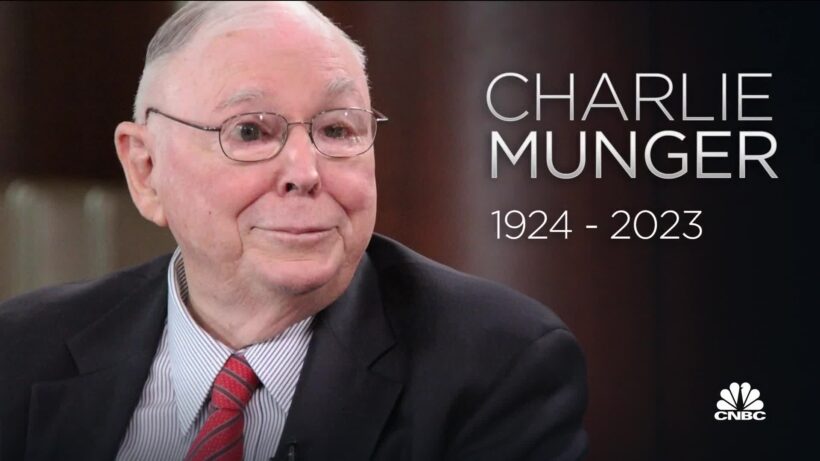

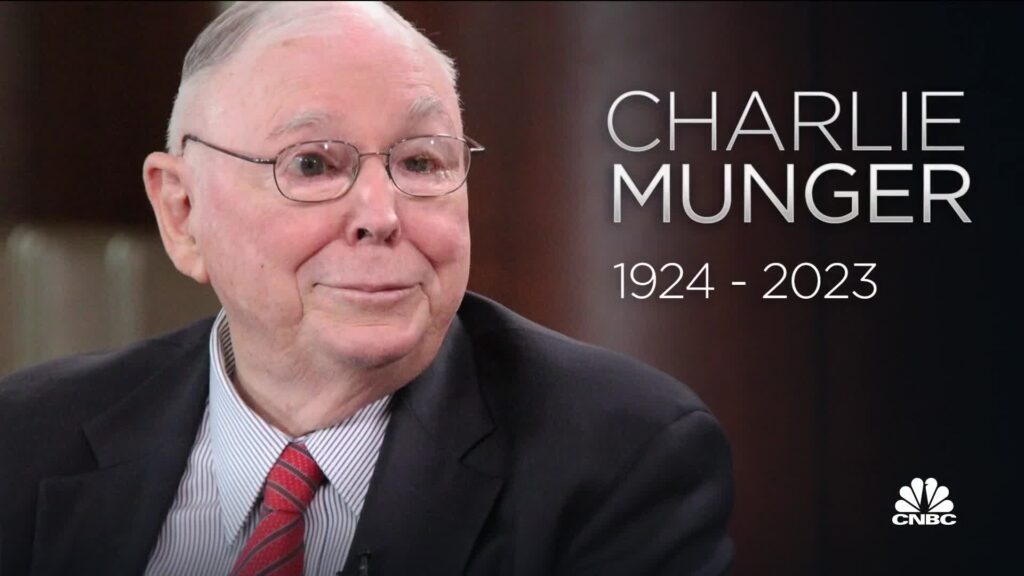

The world lost a light this morning.

I woke up to sad news this morning when I read about Charlie Munger’s passing at the age of 99. As someone who has greatly inspired and influenced me in both my life and my investing journey, Munger’s words and interviews are full of wisdom and I encourage you to dive into his works if you haven’t already done so.

So for my tribute to Charlie Munger, I’ve consolidated my favourite lessons and quotes of his to share.

Also known as Warren Buffett’s right-hand man at Berkshire Hathaway, Charlie Munger was a man of wit and wisdom, and I learned a lot from following his writings and interviews over the years. One fond memory I have was during the 2021 Berkshire annual shareholder meeting – which I was watching and covering live (on my Instagram Stories) – laughing when he inadvertently let slip that Berkshire Hathaway would be succeeded by Greg Abel (at that time, it was still a tightly-kept secret as to who Buffett’s successor would be). The looks on everyone’s faces then was pure gold.

Ahhh, good ol’ Charlie.

For many of us investors, Charlie Munger will forever be remembered as one of the “great sages”, and whom we can learn (and I’ve learnt) much from. Here’s some of the most meaningful ones that have shaped my life:

The secret to a great life

“It’s so simple: you spend less than you earn. Invest shrewdly. Avoid toxic people and toxic activities. Try to keep learning all your life. And do a lot of deferred gratification.

If you do all those things, you are almost certain to succeed. And if you don’t, you’ll need a lot of luck. And you don’t want to need a lot of luck.

Rules for a happy and successful career

“Three rules for a career: (1) Don’t sell anything you wouldn’t buy yourself; (2) Don’t work for anyone you don’t respect and admire; and (3) Work only with people you enjoy.”

“The best way to get what you want in life is to deserve what you want. It’s such a simple idea. It’s the golden rule. You want to deliver to the world what you would buy if you were on the other end.

“There is no ethos in my opinion that is better for any lawyer or any other person to have. By and large, the people who’ve had this ethos win in life, and they don’t win just money and honours. They win the respect, the deserved trust of the people they deal with. And there is huge pleasure in life to be obtained from getting deserved trust.”

On how to handle problems

“I just try to avoid being stupid. I have a way of handling a lot of problems — I put them in what I call my ‘too hard pile,’ and just leave them there. I’m not trying to succeed in my ‘too hard pile.’”

Be fast to recognize and admit mistakes

“There’s no way that you can live an adequate life without many mistakes. In fact, one trick in life is to get so you can handle mistakes. Failure to handle psychological denial is a common way for people to go broke.”

“The ability to destroy your ideas rapidly instead of slowly when the occasion is right, is one of the most valuable things. You have to work hard on it.

“Ask yourself what are the arguments on the other side. It’s bad to have an opinion you’re proud of if you can’t state the arguments for the other side better than your opponents. This is a great mental discipline.”

Every blow in life is an opportunity to learn and improve

“Another thing, of course, is life will have terrible blows, horrible blows, unfair blows. Doesn’t matter. And some people recover and others don’t. And there I think the attitude of Epictetus is the best. He thought that every mischance in life was an opportunity to learn something and your duty was not to be submerged in self-pity, but to utilize the terrible blow in a constructive fashion.”

“You should never, when faced with one unbelievable tragedy, let one tragedy increase into two or three because of a failure of will.”

On being 1% better every single day

“I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than when they got up and boy does that help — particularly when you have a long run ahead of you.”

On how he convinced Buffett to switch from buying cheap companies to purchasing great businesses

“Over the long term, it’s hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you’re not going to make much different than a 6% return—even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result. So the trick is getting into better businesses. And that involves all of these advantages of scale that you could consider momentum effects.”

Investor temperament is a key to success

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder and you deserve the mediocre result you’re going to get compared to people who do have the temperament, who can be more philosophical about these market fluctuations.”

Invest aggressively into your best ideas

When you know you have an edge, you should bet heavily. They don’t teach most people that in business school. It’s insane. Of course you’ve got to bet heavily on your best bets.

“One of the inane things [that gets] taught in modern university education is that a vast diversification is absolutely mandatory in investing in common stocks. That is an insane idea. It’s not that easy to have a vast plethora of good opportunities that are easily identified. And if you’ve only got three, I’d rather it be my best ideas instead of my worst. And now, some people can’t tell their best ideas from their worst, and in the act of deciding an investment already is good, they get to think it’s better than it is. I think we make fewer mistakes like that than other people. And that is a blessing to us.”

How to decide what to invest your money in

“We have three baskets for investing: yes, no, and too tough to understand.”

“You’re looking for a mispriced gamble. That’s what investing is. And you have to know enough to know whether the gamble is mispriced. That’s value investing.”

Exit when the odds are against you

“What you have to learn is to fold early when the odds are against you, or if you have a big edge, back it heavily because you don’t get a big edge often. Opportunity comes, but it doesn’t come often, so seize it when it does come.”

The importance of business models and management

“Invest in a business any fool can run, because someday a fool will. If it won’t stand a little mismanagement, it’s not much of a business. We’re not looking for mismanagement, even if we can withstand it.”

Patient investing will always win the short-term gamblers

“The big money is not in the buying or selling, but in the waiting.”

“It’s waiting that helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.“

“The world is full of foolish gamblers and they will not do as well as the patient investors.”

“What Buffett and I did is we bought things that were promising. Sometimes we had a tailwind from the economy and sometimes we had a headwind and either way we just kept swimming.“

On envy and comparing yourself with others

“Here’s one truth that perhaps your typical investment counsellor would disagree with: if you’re comfortably rich and someone else is getting richer faster than you by, for example, investing in risky stocks, so what?! Someone will always be getting richer faster than you. This is not a tragedy.”

Avoid hype and meme stocks

“Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.”

Stay away from leverage when investing

“There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.”

“Warren still cares more about the safety of his Berkshire shareholders than he cares about anything else. If we used a little bit more leverage throughout, we’d have three times as much now, and it wouldn’t have been that much more risk either. We never wanted to give the least chance of us screwing up our basic shareholder position.”

Learn, adapt and be fast to change

“You have to keep learning if you want to become a great investor. When the world changes, you must change.”

“Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.“

I’ve learned a lot from Charlie Munger when it comes to life and investing. He may have left this world this morning, but his words will continue to live on and inspire generations to come.

With love,

Budget Babe