In bear markets, passive investors start being hit by losses and are fully exposed to the downside. But in times of volatility, with deep expertise and knowledge of companies, asset classes and sectors, it is still possible for investors to pick out winners that will generate positive returns.

In recent years, passive investing has become so popular – so much so that it has now become somewhat of a holy grail for many retail investors.

Get broad-based market returns in exchange low cost or fees. It is a beautifully simple strategy, and one that I’ve talked about often as well.

But it is not without its downsides.

| Key Benefit | Downsides |

| Get market returns for low cost. | – Performance always loses to the market, after fees – Investors are fully exposed in a market drop. Subject to currency fluctuations and FX weaknesses. – If the economy does not do well, you may have years of stagnancy or losses |

Back in my time, we retail investors would have to execute this strategy by ourselves – often buying into Irish-domiciled index funds which have lower withholding taxes than its US counterparts. Today, it has gotten a lot easier – just sign up with a robo-advisor and you’re done within minutes.

But considering how many people are now panicking on social media over their (lacklustre) robo performance, it is clear that not every retail investor has done enough due diligence on this strategy, or truly understands the limitations of passive investing.

A simple strategy, but is it always the best?

“Passive investing has turned into a decade-long momentum party where people stop questioning whether what it owns is overvalued or undervalued, so long as it is delivering high absolute returns.”

What’s more, the main selling point of a passive investing strategy boils down to a singular focus on lower fees.

But yet, isn’t the goal of investing to generate the highest returns with lowest risk? It has never been about incurring the lowest fees.

Don’t get mixed up with the two.

When we are in a bull market, investing often appears easy as almost everything is on an uptrend. Passive investing in such conditions have traditionally enabled investors to generate decent returns at a low cost. This led many investors to becoming so enamoured by the allure of passive investing, to the point where many seem to have forgotten that the passive strategy similarly tracks downward movements too.

And for the past 10 years, we’ve had an (almost) uninterrupted bull market largely fuelled by quantitative easing – started as an emergency response to the near-collapse of the financial banking system in 2008. The low interest rates and loose monetary policy boosted the appetite for, and price of, risky assets…but these will all eventually start to come down as QE starts to unwind now.

As we have seen in the last year, it has been hard for many investors to stay sane when they’re losing money (even if on paper):

- MSCI World is down by 15%

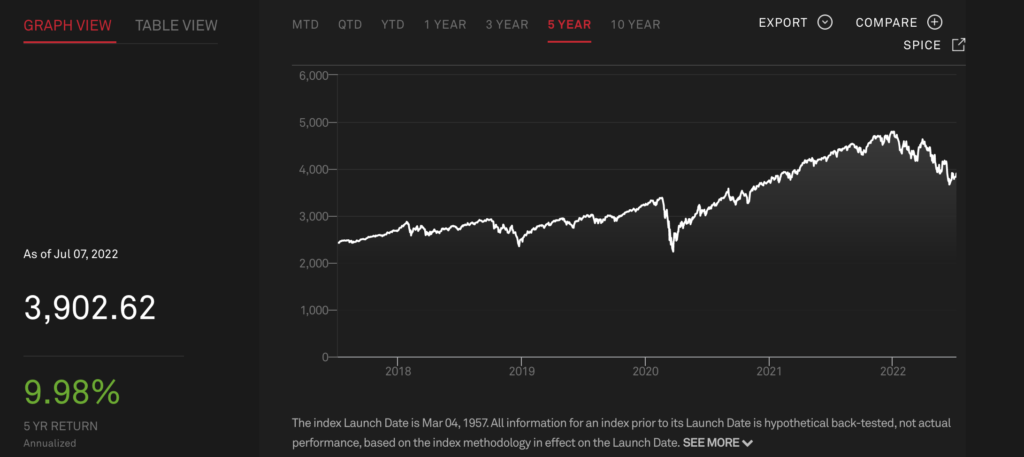

- S&P 500 is down by 15%

- Hang Seng Index has lost 25%

Closer to home, even our own Straits Times Index has stayed flat for the last decade, in contrast to inflation rates which have been slowly inching upwards.

With the brakes being pulled now, don’t expect the ride ahead to go as smoothly.

What you need to understand is that the passive investing strategy is not a sure-win. Tracking benchmarks or indices that are volatile (or in a downtrend) can similarly result in losses.

And when returns become harder to come by (such as in periods of stagflation or a bear market), passive investing starts to lose its appeal; that’s when active investing may provide investors with an edge instead.

I won’t be surprised if the narrative soon starts to shift, especially once investors start to realise they cannot rely on beta (broad equity market exposure) alone to generate satisfactory returns; they will then have little choice but to seek performance from alpha (excess returns that can be derived from superior stock picking).

After all, only active investing has the potential to generate alpha – because the benchmark cannot, by definition, exceed its own returns.

Opportunity knocks in times of volatility

If you want to do better and generate outsized returns in times of volatility, active investing and stock picking matter more than simply buying the index. And if you believe that benchmark returns are likely to be low or negative in the coming years, then you owe it to yourself to explore active investing.

What’s more, the excessive popularity of passive investing has made markets less efficient, which in turns creates moneymaking opportunities for truly active managers.

After all, volatile times are often where the biggest opportunities lie.

It’ll take you some work to sniff out these opportunities, but if you’re patient and diligent, your efforts may very well pay off.

In volatile markets such as today – active investing and stock selection matters. Everything we do at Franklin Templeton is focused on delivering our clients better outcomes through our investment management expertise. And that’s why millions of clients in more than 155 countries have entrusted us with their investments, making us one of the world’s largest independent asset managers.

If not, there’s always the option of mutual funds – investment vehicles for retail consumers to tap into the strategies of firms like Franklin Templeton and ride on their research work instead, albeit for a small fee.

And unlike investing in direct stocks, mutual funds offer an easy way for portfolio diversification and higher liquidity without a need for any lock-in period. You can redeem your investments at the prevailing NAV per unit on any business day, as and when you need.

Active could be superior for markets outside of the US

My belief is that in a world where global risks are becoming increasingly disparate and unpredictable, active management may make a lot more sense if your goal is to identify significant moneymaking opportunities.

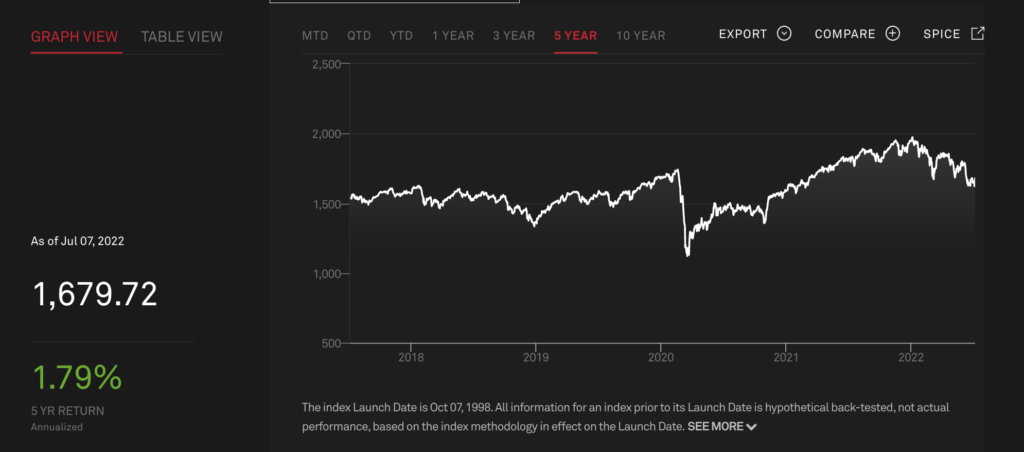

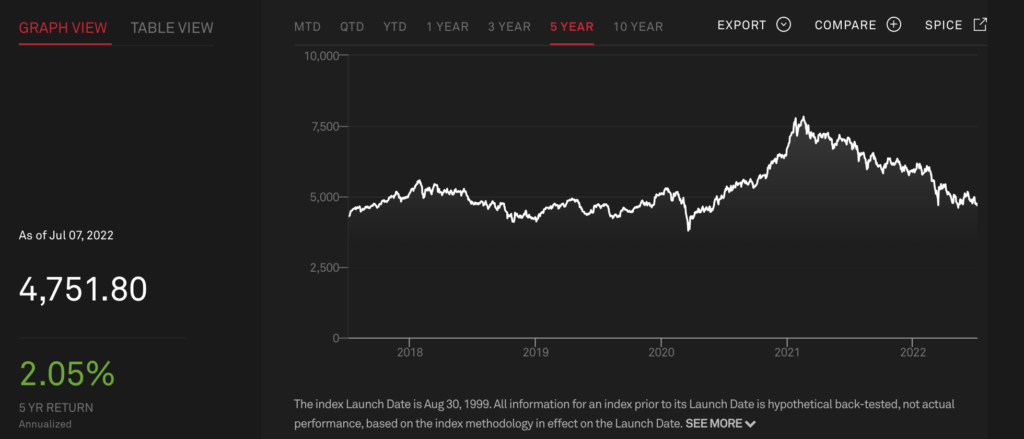

The S&P 500 may have gone steadily up in the last few decades, but let’s not forget that it might be the exception, rather than the norm:

While the debate is still ongoing on whether the US stock market is overvalued, let’s focus instead on diversifying our portfolio across different geographies to avoid singular geopolitical risks.

And when you do that, you cannot ignore the various idiosyncratic risks in the region – such as regulatory crackdowns in China, demonetisation of bank notes in India, bankruptcy in Sri Lanka, etc.

Navigating these risks will require a more nuanced understanding of the business, economic and political environment here – something which passive strategies such as ETFs will not be able to address.

Plus, when you consider how capital markets and research coverage in emerging economies are not as deep, it is pretty clear that investors can benefit from tapping the scale and expertise of active managers with local footprints in the region.

Given how Asian companies are starting to make a name for themselves on the world economy, these can offer offer great opportunities for us to ride along on – if we do it right.

Why not both?

Instead of decrying passive or active investing, why not employ a mix of both strategies in your portfolio?

Depending on your risk appetite and priorities, there’s nothing stopping you from allocating capital to both passive strategies (be it via robos or ETFs) as well as actively managed one (be it stock picking or via a professional fund manager).

If you need some ideas, you can visit the websites of professional fund managers like these for a start.

Disclaimer: This article is for information only and does not constitute investment advice or a recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. I am not your personal financial advisor and have no idea about your individual financial circumstances or actions that you need to take. You may wish to seek advice from a licensed financial adviser before making a commitment to invest in any shares of any named Funds, and consider whether it is suitable to meet your own individual goals. Copyright© 2022 Franklin Templeton. All rights reserved. Please refer to the Important Information on our website. This post is written in collaboration with Templeton Asset Management Ltd, Registration Number (UEN) 199205211E, and Legg Mason Asset Management Singapore Pte. Limited, Registration Number (UEN) 200007942R. Legg Mason Asset Management Singapore Pte. Limited is an indirect wholly owned subsidiary of Franklin Resources, Inc.