I wasn’t going to write about the latest Temasek bonds offering, but have been receiving so many PMs from friends and readers alike about it so I thought I’ll just pop in here to share my thoughts really quickly on this.

You can read the full details of the offering here yourself – I shall skip on breaking it down this time because simply put, I’m just not interested in this product offering. The last bond I bought into was the Astrea-IV bonds, which offered me a much higher yield of above 4%; while the last few equities I bought into gave me more than 7% yield, so these Temasek bonds simply can’t match up.

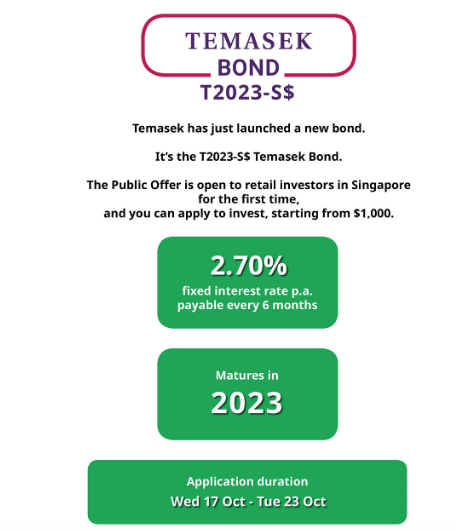

Key Details:

– The bond is launched by Temasek Financial (IV) Private Limited

– 2.70% interest, paid bi-annually

– A 5-year bond (T2023-S$ Temasek Bond) which matures in 2023

– S$200 million worth of retail bonds available for public subscription

– “AAA” credit rating

– Applications close at 12 noon on 23 October 2018

Why this bond doesn’t appeal to me

When considering what to invest in, I always look at other options available to me as well as that of opportunity costs.

At this moment, 2.7% of bond coupon interest rates is hardly attractive at all, considering other options available such as:

- 5% to 9% yield on REITs like Soilbuild, Sabana or OUE (these are NOT stock recommendations!)

- 4.35% on the Astrea IV bonds that I bought pretty recently (review here)

- 2.02% with a shorter lock-in period of 2 – 3 years via short-term insurance endowment plans (like this one by FWD, and others by Great Eastern, Prudential, NTUC Income, etc)

- 2.2% to 3% on high-yield bank saving accounts like the DBS Multiplier, Bank of China SmartSaver, UOB One, Citi MaxiGain, OCBC 360, etc.

- 2.22% on the Singapore Savings Bonds (SSBs)

- 2.3% on the Singapore Government Securities (SGS)

If you have excess cash and none of the above alternative options I mentioned appeal to you, then perhaps this might not be too bad an instrument to park your money in for the next 5 years. After all, I’m pretty sure Temasek is going to redeem these bonds in 2023 so you’re then very likely to walk away with your capital intact and a 2.7% interest that was already paid to you over the 5 years of holding their bonds. If this was issued by another corporate firm (see how I wasn’t a fan of other bonds before) I’ll be more wary, but hey, this is Temasek we’re talking about.