UOB EVOL cardholders, take note!

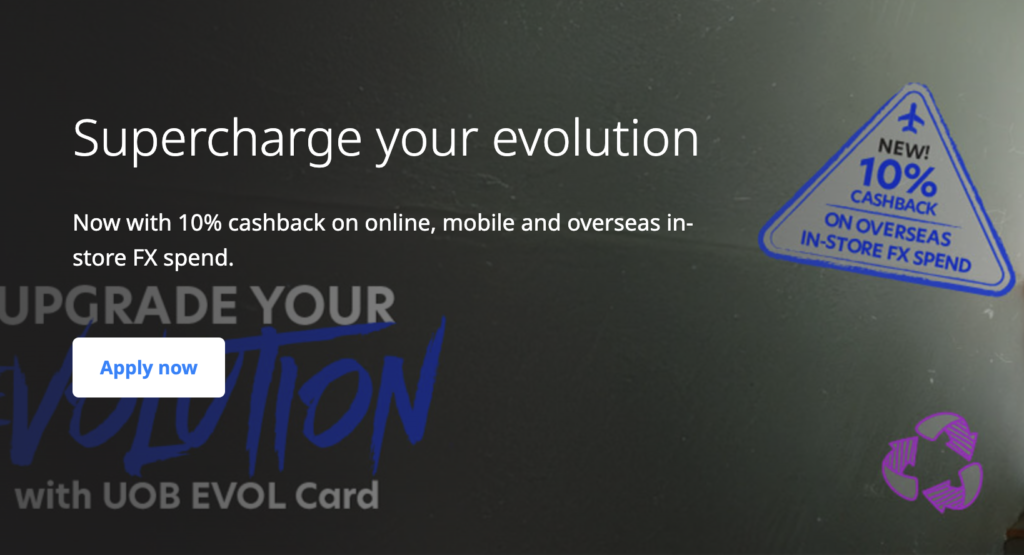

UOB has just announced major changes to one of the best cashback cards in the market, the UOB EVOL. This used to be a favourite among fresh grads, young working adults and folks who spend mostly online or pay with their phone or smartwatches.

Pay attention because these changes are pretty significant, and will forever change the way you earn your cashback on this card!

The key changes to user behaviour are:

- Whereas online vs. mobile contactless payments were separate categories previously, they’ve now been combined. This means your optimised spending is now capped to $300 for both, instead of $500 ($250 each) previously.

- $20 (out of max $80) cashback is now allocated for overseas in-store FCY spending. Realistically, I don’t think that’s feasible for some cardholders to hit unless you go into JB several times a month to pump petrol and shop enough to clock $200.

- You now need to spend MORE in order to qualify for the upsized cashback (from $600 to $800).

By no means are these changes significant. The card used to be fairly easy for most people to to hit the criteria to enjoy 8% cashback, but with the latest nerfs, how many people will end up being ineligible and get only 0.3% cashback because they failed to hit the requirements?

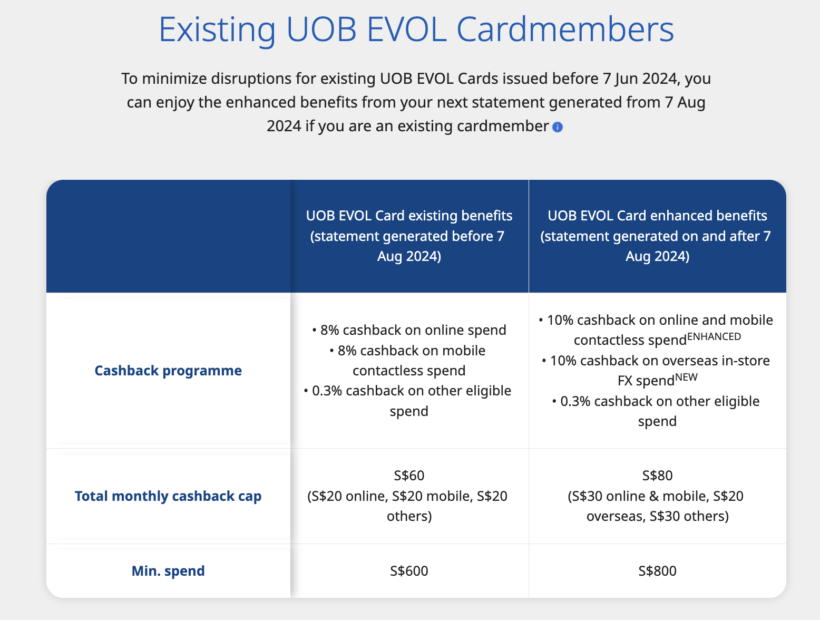

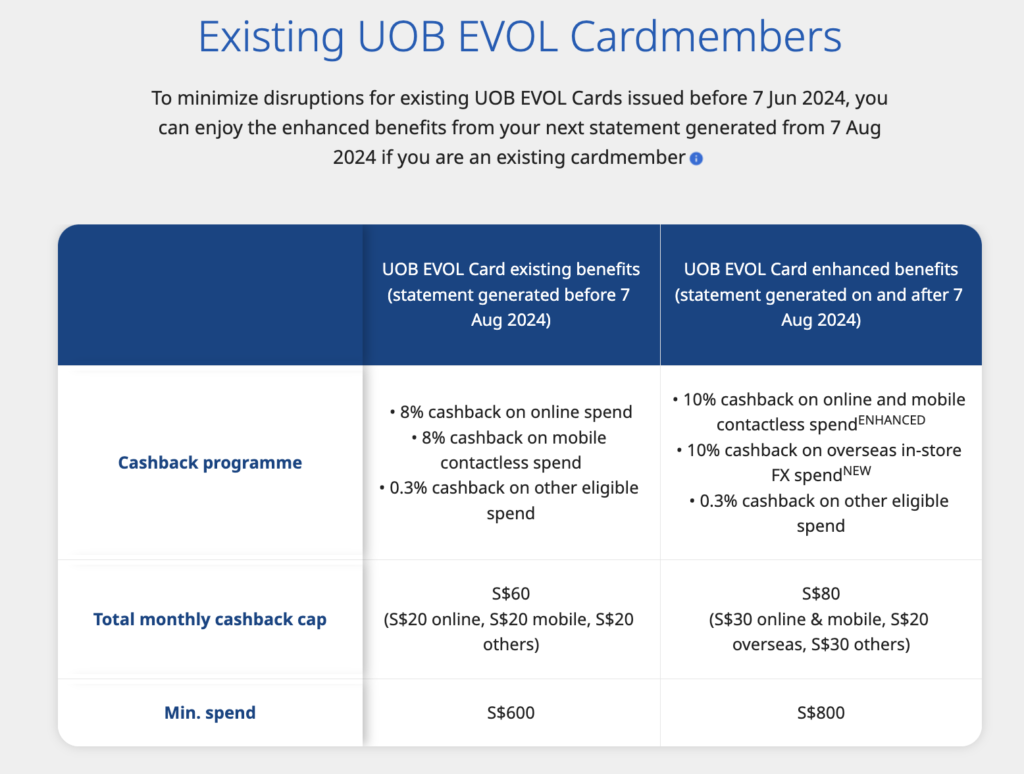

I did up a table summarising the changes, here’s how they look:

| Previously | Now | |

| Earn rate | 8% on mobile contactless payments or online purchases 0.3% for all other spend | 10% cashback on Online Spend and Mobile Contactless Spend 10% cashback on Overseas in-store foreign currency spend 0.3% for all other spend |

| Minimum Monthly Spend | $600 min. spend | $800 min. spend |

| Cashback Caps | $20 cashback on mobile contactless $20 cashback on online purchases $20 on all other transactions | $30 cashback on mobile contactless AND online $20 on overseas in-store FCY spend $30 on all other transactions |

| Optimised Categories to max out cashback | $250 mobile contactless $250 online Min. $100 others (0.3% cashback) | $300 mobile contactless and/or online $200 overseas in-store FCY (go JB?) and at 3.25% fees Min. $300 others (0.3% cashback) |

| Notes | No UOB$ merchants | No UOB$ merchants |

These changes become effective as of 7 June, although if you already own the card, you have until 7 August before you’ll be hit by these changes.

Seriously, these kind of changes are exactly why I could no longer stick with cashback cards and made the switch a few years ago to accumulate miles instead.

Check out my list of best miles cards here.

Is UOB EVOL still worth keeping in your wallet after all these? It’s a no for me, because the 10% on overseas in-store FCY spend (don’t forget the 3.25% FCY fees) and the higher minimum spend makes it much harder to hit the card’s upsized cashback criteria…and honestly no longer worth the effort.

And if you fail to keep up? You’ll get a miserly 0.3% cashback instead.

If you’re disappointed by these changes too and thinking of switching cards, here are some alternative cashback cards I would suggest you look at:

- Maybank Family & Friends (same min. spend of $800 but gives 8% across 5 (broader) categories, with a spending cap of $312 each for optimised cashback)

- UOB One (up to 10% cashback on 5 categories, min. $500 spend)

Or even better, join me on Team Miles 😉

Most cardholders don’t keep up with these changes, so if you know anyone with a UOB EVOL card still in their wallet, send this PSA to them now!

With love,

Dawn