Those of you who follow me on Instagram would probably have seen this exciting piece of news by now….

HOMG I GOT TO INTERVIEW LAUREN TEMPLETON!!!

In the world of investing, there are a few notable investing legends. The famous and more familiar names include Warren Buffett, Charlie Munger, Benjamin Graham, Peter Lynch, Philip Fisher, and Sir John M. TEMPLETON. You'll note that there aren't any famous female investors (we'll come back to this in a bit) 😓

Templeton is one of my favourites. Let me tell you why.

For those of you new to investing and who haven't heard of him yet!

Sir John Templeton was described by many to be the greatest stock picker of the 20th century. A lot of classic investment quotes came from him, but I won't bore you with them here.

His first major investment was in 1939 during the Great Depression. He borrowed $10,000 (a lot of money back then!) and bought $100 each worth of 104 stocks on the major U.S exchange trading for under $1.

4 years later, his original $10k ballooned to $40,000! Some stocks even went up by 12,500%!!!!!

That wasn't all. He also added $84 million to his net worth between 2000 to 2001 by shorting technology stocks exactly 3 months before the peak of the DOTCOM bubble. And he was spot on! We all know of the tragic DOTCOM crash that followed after…

Those of you who attended my workshop (30 Dec or 6 Jan) would probably remember one of my last few slides on market cycles and how human psychology affects our decisions (thus performance) during the different moments.

The one who first pioneered that idea was Sir John Templeton la!!

LAUREN TEMPLETON. Great-niece of Sir John M Templeton

Lauren is one of the rare female investors in this male-dominated scene. Her family's reputation far supercedes her own, but she has carved out an impressive record for herself over the years. Her investment theme is simple – she only buys bargains stocks when they're trading at a steep discount.

But what makes her a truly great investor, if you asked me, is her ability to control her own emotions and rein in her psychological biases.

"I was saving me from myself".

Everyone at the conference laughed when she said that, but it is seriously true. Many of us are hardwired to buy high and sell low. When our stocks crash, we tend to sell them off in fear that it'll go to zero. When everyone else is buying and the stock price keeps going up, we tend to buy in as well for fear that we'll miss out on the gains.

FOMO (the fear of missing out) never helped a good investor, but have brought down even more.

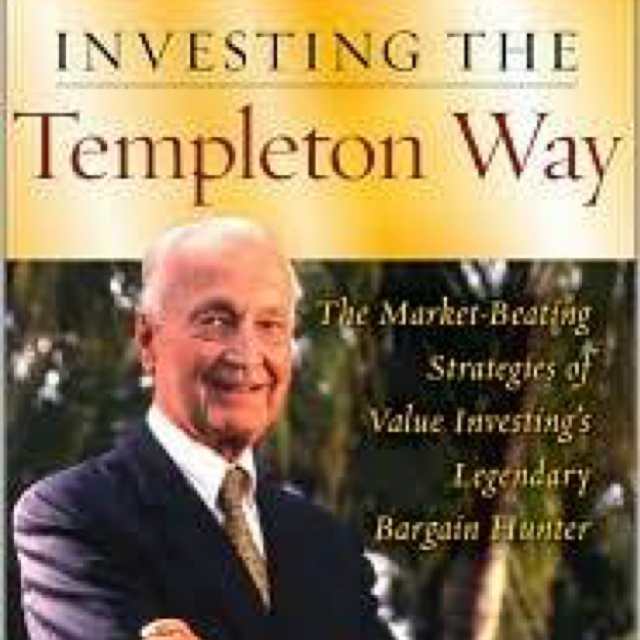

Meeting the authors of this book live in the flesh was a dream come true for a young female investor. Thanks Lauren for granting me this exclusive interview!

Channel News Asia was there today too, interviewing her. Anyone has any idea if the clip is out yet?

I'm super thankful for the opportunity to interview her, and we talked a lot about investing for females! There were so many golden insights that she shared so I'm going to have to distill them and do a proper write up on the blog so that I can do them justice.

I'll try to get this out by this week, but just wanted to share here first because I'm so excited! 😻🙀

Value Investing Summit has ended after two full days and it was quite fruitful hearing from the different presenters. Thanks 8i for having me!

I'm quite tired so I'm gonna head to bed after I watch the latest episode of Goblin, goodnight!