When I was previously hospitalised in KKH during my first pregnancy at 24 weeks (after tumbling down an overhead bridge), the financial consultant there had advised me that if I were to give birth then and choose the lowest-class ward, my baby’s NICU bills could run into an estimated $250,000.

This made me realise how scary the potential financial burden can be to a couple in the event that a pregnancy encounters complications, which prompted me to speak to over 8 insurers to understand their maternity insurance plans in detail. It has been 3 years since I last published the results of my efforts in this comparison (one that was lacking in the public domain back then) during my first pregnancy. My experience also made me realise that none of the maternity plans offered by local insurers would cover:

- pre-natal expenses (e.g. OB/GYN bills, scans)

- doctor’s fees during delivery (we had 3 doctors the last time around whose operation/attendance fees were payable, i.e. my gynaecologist, anesthesiologist and paediatrician)

- emergency delivery

- neonatal intensive care unit (NICU) hospital bills

These are the largest expenses that you’ll likely incur during your pregnancy.The problem is there are few insurance plans that will help you with that, especially none of the local insurers – Prudential, AIA, Aviva, etc.

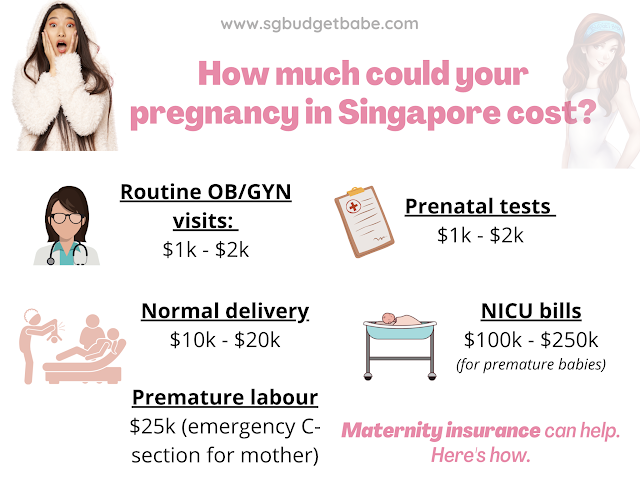

How much could these cost?

You may want to make a backup plan for this. Within my own social circle, one of my friends was hit by a bill shock due to her emergency C-section – which was deemed medically necessary by her gynaecologist back then as the baby was in distress (even though she had planned for a normal delivery and had already taken epidural); her total bill came up to over $26,000. Another friend had to deliver her baby prematurely at 25 weeks via an emergency C-section due to an infection that caused her water bag to burst, and their baby has since been in NICU for over 120 days – and the bill continues to climb.

The financial expenses incurred are no small sum, especially for NICU bills which can be $1,000+ per day of hospitalisation.

How then do couples cope? In both of my friends’ cases, they had to dip into their savings and work hard to earn the money to pay off the bill. Some others have no choice but to turn to family and friends, or even strangers, to appeal for funds. You can see from the various appeals online for donations from desperate parents, such as this $280,000 appeal for NICU bills that made it to Mothership, or even this $300,000 appeal for SGH’s NICU bills or this $120,000 donation fund-raiser to pay NUH’s NICU on GIVEasia. While the bills for foreigners tend to be higher, even Singaporeans have to bear substantial costs after government subsidies, as seen from this $50,000 NICU bill last year. Such premature births are also on the rise, which prompted public hospitals like KKH and NUH to expand their NICU bed capacity in recent years.

While we all hope for the best during pregnancy, there is a chance that premature birth or complications could occur.

in May 2021 at Singapore General Hospital.

Pre and post-natal expenses

Each pregnancy, doctor and mum-to-be is different, so there is no fixed amount of required consultations or scans. Pricing is not fixed in Singapore either, and doctors/specialists in the private sector may charge dramatically different rates for consultations, therefore the cost of your pre-natal expenses will also vary depending on your choice of doctor/clinic.

In the majority of cases, you would expect scans and consultations with an OB-GYN every 4 to 6 weeks in the early stages of the pregnancy, and eventually once a week or once every 2 weeks closer to your due date. Of course, there could always be complications that can lead to bed rest or unexpected procedures and costs (this was exactly what happened to several of my friends). For example, some pregnancies can be considered ‘high-risk’ and might require amniocentesis and a higher number of consultations with a specialist as well. It is therefore difficult to plan and save towards an accurate figure for pre-natal expenses and everything required prior to giving birth.

Complications

Another aspect seldom discussed is that the risk of major costs would also be in relation to complications associated with the newborn (e.g. premature birth, congenital disorders, distress, neonatal stroke, etc.). With the potential for these fees to reach thousands of dollars per day, it is therefore important for parents to consider securing health insurance or ensure that their existing policy provides newborn coverage benefits.

Can I use insurance to cover this?

As you can see, the risk of major costs largely comes from complications of pregnancy/childbirth and newborn care (e.g. premature birth, congenital conditions, etc). With the high likelihood of these expenses reaching thousands of dollars per day, it can therefore be a huge relief if your insurance plan can financially protect you against that.

To date, most people do not realise that there ARE in fact maternity insurance plans that can cover you for such routine maternity and delivery costs (especially if you intend to give birth via an elective C-section).

I jumped in on the discussion and decided to write this article after seeing how many people were answering this particular mummy’s question with recommendations to their plans or agents from Prudential, AIA and AXA. That is a gross misconception, and you only need to look within the product brochure or T&Cs to realise that.

Instead, your solution lies in comprehensive insurance plans offered by international insurers, such as Bupa, Cigna or TM Henner. I’ve highlighted the key benefits it protects you for (which the other local insurers’ plans named here do not cover) in yellow, in particular:

- Routine maternity and delivery costs in private or public hospitals with the doctor of your choice: this covers your OB/GYN check-ups, scans, blood tests, normal delivery, etc.

- C-section (both elective and emergency)

- Newborn coverage: including NICU care for premature babies, treatment fees or hospitalisation bills

For instance, here are some of the pre and post-natal care items covered by one of the insurers:

While each insurer has different definitions under “complications”, these plans also generally cover a broader scope, rather than the common 10 – 12 conditions that most local insurance plans cover. As an example, here’s one by TM Henner:

But why are the premiums higher than local maternity plans?

Since the benefits covered are wayyyy more than what the local insurance plans provide, the premiums payable are naturally also higher. The local plans have very limited coverage (rare complications or specific time periods for which they are applicable) and/or have very limited payouts (small hospital cash amount per day, overall low combined limits of $5K or $10K payouts, etc).

Which is why you’re essentially paying more to get higher coverage for greater peace of mind.

But here’s what I think – even though the premiums may appear high at first glance, once you consider the fact that you are able to make claims even for your pre/post-natal treatments and delivery bills, does it still look pricey to you? If you ask most couples who gave birth in private hospitals how much their bills came up to, the range is generally between $10,000 to $20,000 at least.

What’s more, by getting such an insurance plan, you’re effectively topping up a small sum to insure yourself against the potential financial risks of complications and NICU stay. Here’s how the math could look like:

- Premiums (Insurer D): $14,000 over 2 years

- Claims

- OB/GYN visits and tests: $1K – $3K

- Delivery: $10K – $15K (normal) / $20K (elective C-section)

Is it worth it? You decide.

What about the costs for a smooth pregnancy?

To date, what most people have been doing is saving up and paying for their own pregnancy expenses, and I’d previously documented the fees you might need to prepare for here. You can potentially reduce the costs by going through the public hospitals as a subsidised patient, but that option comes with several drawbacks as well – such as longer waiting times and being assigned to random OB/GYNs for each visit.

The estimated cost? Back in 2018, our routine maternity costs which included OB/GYN consultations, mandatory tests (OSCAR, detailed foetus scan and gestational diabetes) and delivery bill at the hospital easily came up to over $12,000. That’s not even counting the other bills we incurred for our confinement nanny, herbs, breastfeeding, diapering, insurance and more.

Even if you have a smooth pregnancy with no complications, you’ll likely still be able to benefit from such expat insurance plans, while having peace of mind against large financial bills.

Should I get an international maternity insurance plan?

If you’re planning to try for a baby and you’re worried about the costs, here’s a rough guideline on costs for complex cases that you might want to consider:

- OB/GYN visits: $1K – $2K

- Pre-natal tests: $1K – $2K

- Premature labour: $25K delivery for mother (emergency C-section)

- NICU bills for premature baby: $100K – $250K (before subsidy. If you need a reference for bills after subsidy for Singaporeans – here’s one I found at $50k for a 4-month stay)

Don’t forget that in the event that your baby is born with any pre-existing conditions, it would also be difficult for your child to get insurance coverage from any insurance company. But if you had gotten one of the above plans from an international insurer, then you wouldn’t have to worry as long as you add your baby to the plan within 30 days of their birth (a pro-rated premium will need to be paid, of course). This is in sharp contrast with many local insurers, whose restrictions will only allow you to insure your baby after at least 2 weeks upon their discharge from the hospital.

Thanks to Pacific Prime, I found out about this useful nugget of information when I was close to delivering my firstborn and was planning to get it before I conceived my second child…but then I completely forgot and missed the waiting period. If we do decide to have a third child, I’ll definitely be trying to purchase this before we conceive.

As a broker, they’ve been an incredible help throughout, and whether you need a quote for yourself (or even someone to explain further the above comparison table to you), you can contact Pacific Prime here to find out if such plans will be suitable for you.

Disclosure: This post is written in collaboration with Pacific Prime. A huge thanks to the PP team for helping with all my questions and requests!

Sponsor’s Message

Whether you are planning on starting a family now or in the next few years, it is highly important to make sure you include maternity benefits in your insurance policy at an early stage, especially because most comprehensive maternity benefits come with a waiting period ranging from 10 to 24 months.

At Pacific Prime, we have an in-house team of maternity experts who have not only had babies in Singapore but also know the ins and outs of maternity cover from the top insurers. What really sets us apart from other brokers in the city when it comes to maternity insurance is our extra service, offered at no cost to you. This service includes elements like claims assistance, day-to-day plan administration, delivery pre-authorisation, and more.