Here’s to an easier and better way of planning for Millennials.

When I was single, it wasn’t too hard to track my own financial health. Sure, it was tedious at times, but I had a combination of apps and my trusty Microsoft Excel files for each purpose – expenses, income, savings, insurance, investment.

The story changed after I got married and became a mother. All of a sudden, I had to now track and monitor for multiple people, which made it almost impossible to keep up. Many apps are designed for just a single profile, so Excel sheets soon became the default way. If you already find it hard to manage your own personal finances, let me warn you first that it doesn’t get any easier.

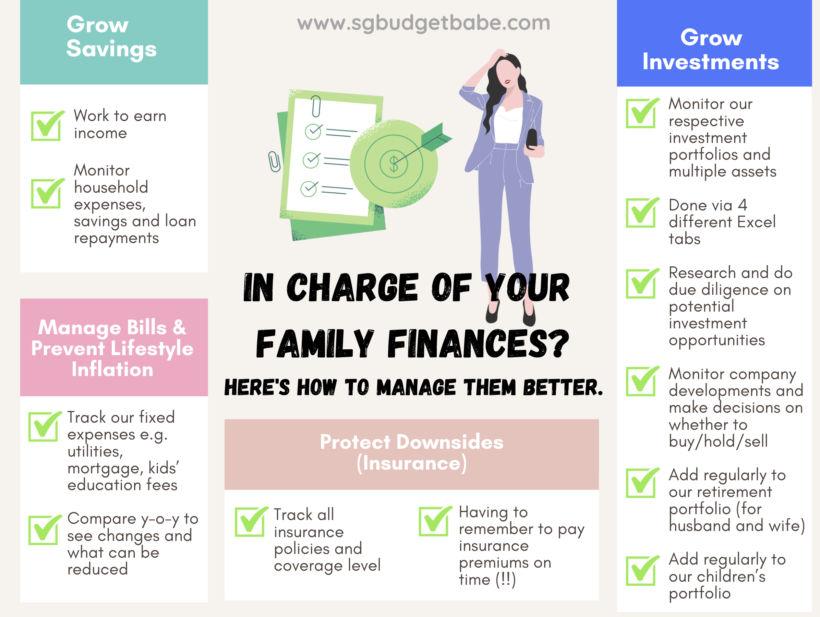

If you’re the Chief Financial Officer (CFO) in your family like me, chances are that the stress from having to manually track your household expenses, ensure that bills (especially the non-negotiable insurance premiums!) are being paid on time, etc…and all while checking that you’re on track to achieving financial freedom as a couple. Add that to the mental load that mothers already have to deal with, on top of having to juggle a full-time job or child-rearing.

It’s a tough (and thankless) job indeed.

Every month, there’s an entire list of pain points that I’ve to deal with when it comes to keeping on top of our household finances – you can see this in the graphic above.

So, when someone tells me there’s an easier way, you can bet that will certainly pique my interest.

Enter the Autumn app.

How does Autumn work?

Whether you’re planning for yourself (as an individual) or for your family (multiple profiles), Autumn is a free mobile app that you can use to plan, track and manage your financial well-being and aspirations.

As an independent and agnostic tool, it aims to simplify financial planning and provides guidance without sales pitches. In a nutshell, here’s what you can find:

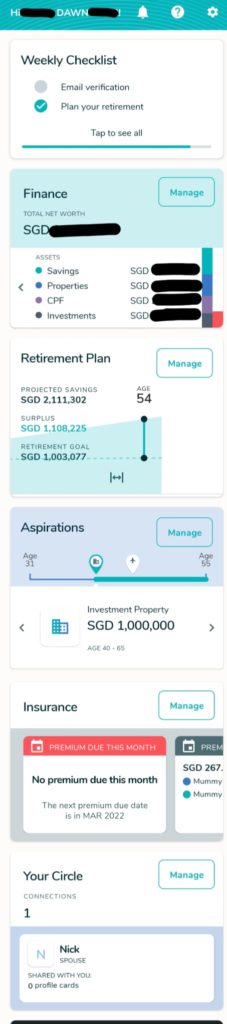

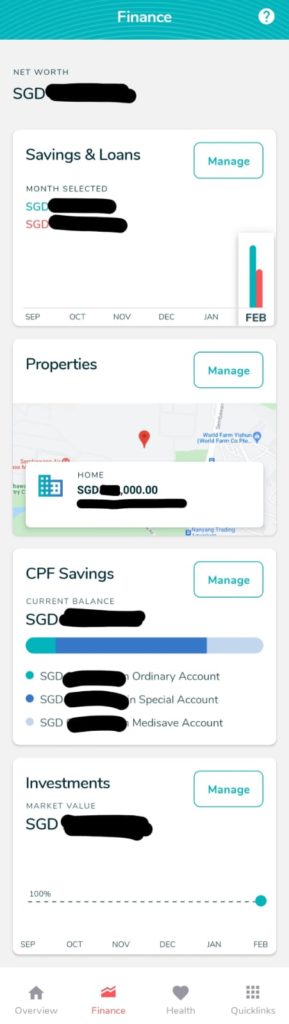

- Finance Dashboard – this is where you view your net worth across your Savings, Loans, Investments, Properties and CPF. The goal? To always make sure this increases over time, of course. Knowing how much you really have lets you know whether you are in good financial health, and if you need to make changes such as reducing your debt.

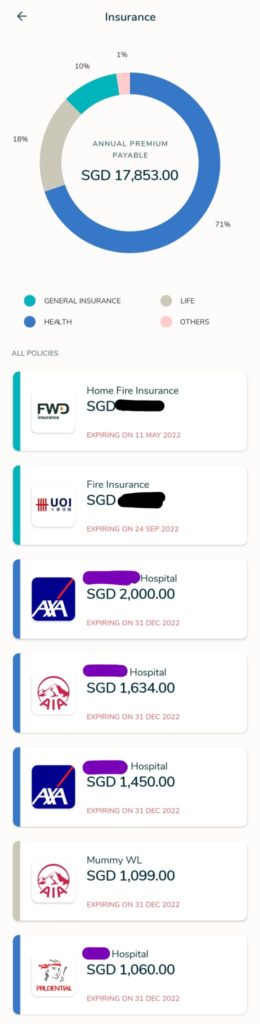

- Insurance Tracker – manage and stay on top of all your family’s insurance policies here. Since most of us have insurance policies across different insurers and/or agents and with different payment due dates, the app allows you to consolidate (and share with your loved ones) here, and even notify you about upcoming payments and expiration dates to prevent any possible lapses!

- Retirement Plan – you only have to plan out your retirement once (age, desired spending, assets and growth rate), and the app then visually shows you where you are on your retirement plan each time you log in. Serves as a great reminder to ensure that you’re on track.

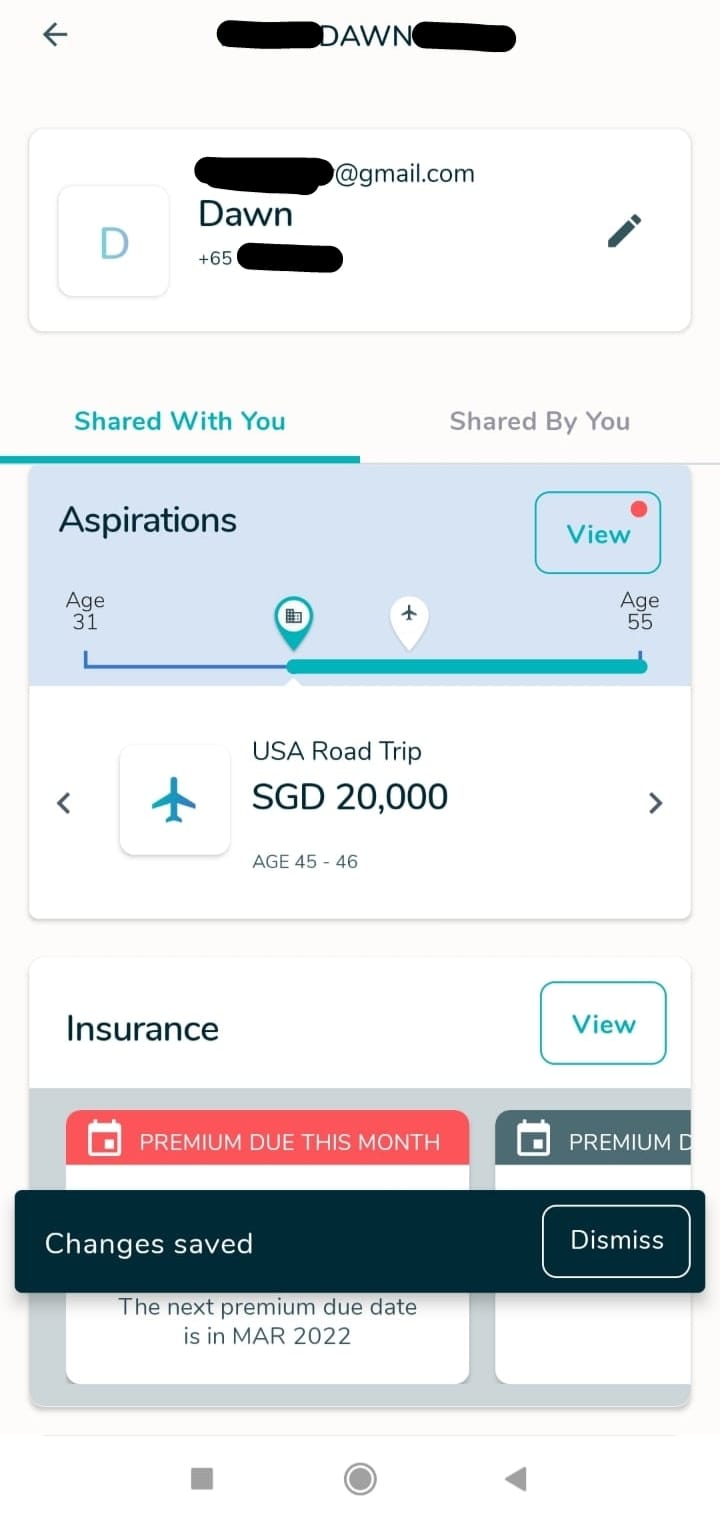

- Aspirations Planner – use this to help you prepare for your next big financial purchase, such as a downpayment for a new condo. This useful chart also helps you to make informed decisions about your spending, and see the trade-offs incurred e.g. can you still go on a $10,000 family trip to Europe without sacrificing your kids’ education fund?

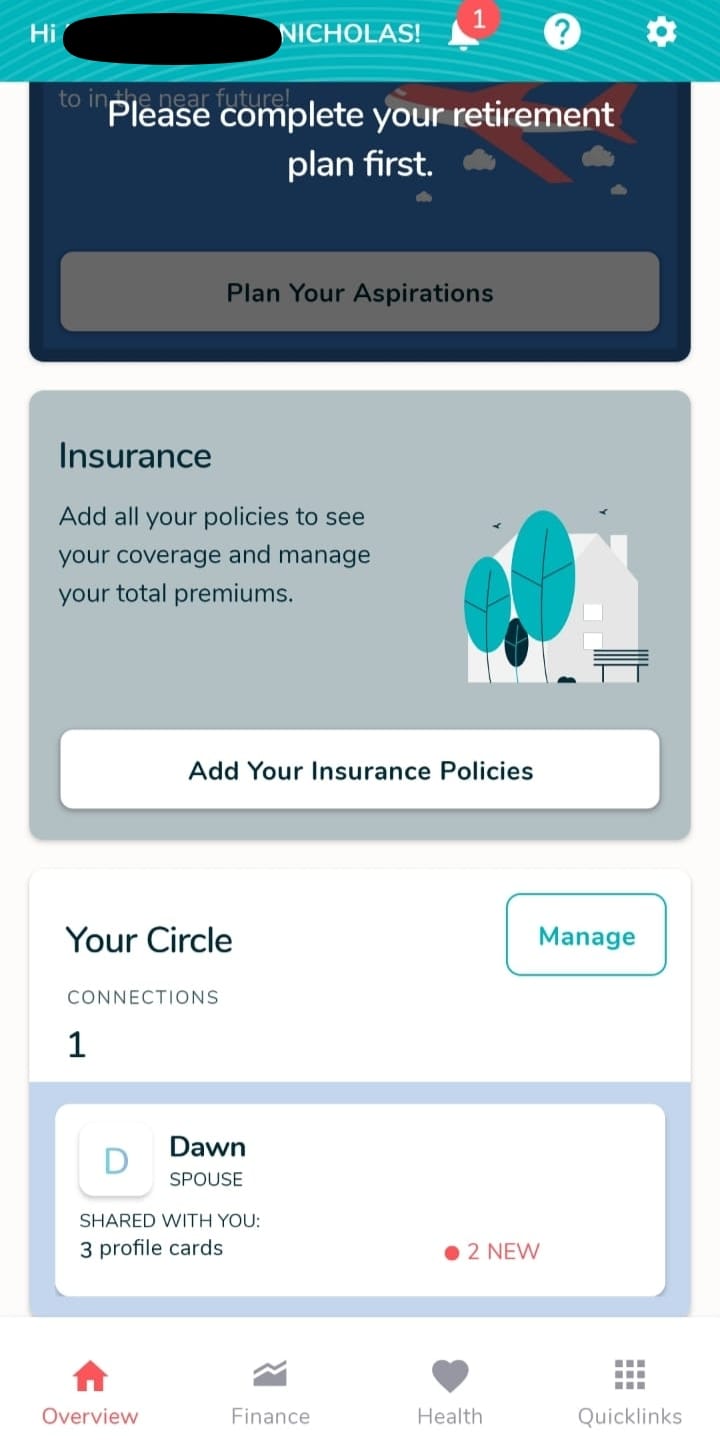

- Your Circle – this is where it can be powerful for families, because you can share your financial details with your spouse so both of you are in the loop! After all, being transparent about our finances is important as a couple, isn’t it?

Even though it isn’t marketed for families, I tried it out recently and found it to be the best tool I’ve come across so far that I can use to help me manage my family’s finances and goals – all within a single app.

How to use Autumn to manage your family finances

I’ll walk you through how to use the app, but in the meantime, here’s an idea of what you can expect to see on your homepage screen once you’re done:

Step 1: Plan and set your goal(s)

After you’ve downloaded the app, you can register with SingPass and then start by filling in your retirement plan and aspirations.

Some ideas to get you started:

- hit $1 million for retirement

- save $12,000 for a family vacation

- save $100,000 for a house downpayment

- reach $80,000 for child’s education fund

Step 2: Review your current progress against your goals

Key in the value of your financial assets i.e. savings, properties, CPF and investments. If you have your money spread out across different banks and investment positions (e.g. a diversified portfolio), then this will take you longer to fill up.

Note: While you can sync your bank information to speed up the process (it pulls your savings and loans), note that this is completely optional as you can also input the details manually, especially if you’re not keen on providing your iBanking username, password and OTP.

Step 3: Input your insurance policies

If you have many insurance policies like I do (for myself, husband, Nate, Finn and 3 elderly parents), then this will take you a while to fill up. However, it’ll be worth the effort because you can share this with your spouse later on!

Each insurance policy type has different details for you to fill in e.g. hospital type for Health vs. TPD amount for Life. But don’t worry if you’re overwhelmed by the sheer number of fields, as that’s for folks who want to digitalize and track everything in one place. Instead, you can leave many of them blank if you wish to just use the app at its most basic functionality.

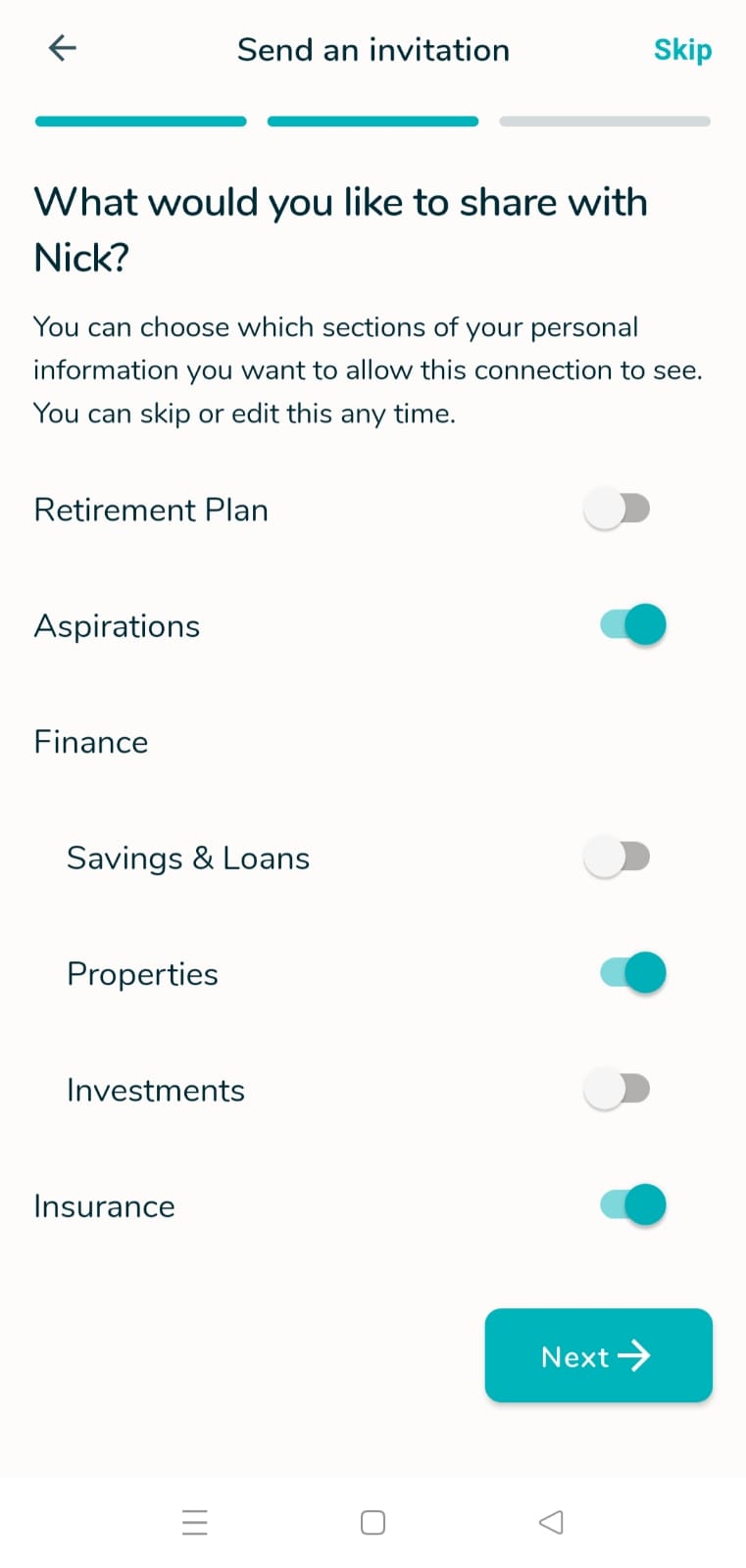

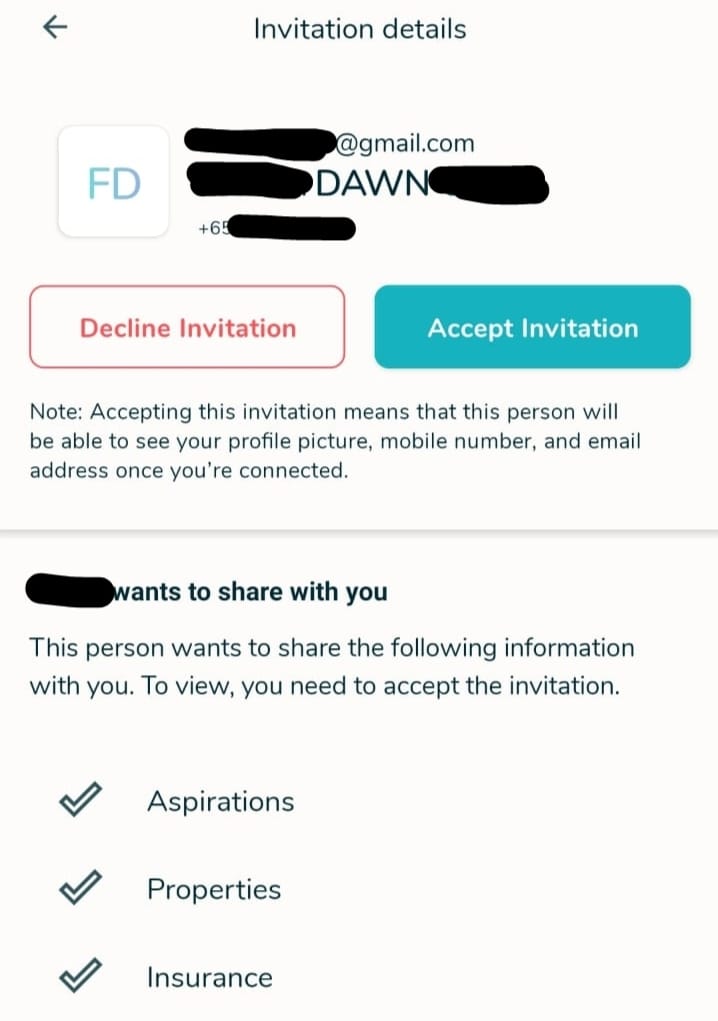

Step 4: Share with your family members

This feature is where it gets powerful for families. Use the “Your Circle” feature to invite your family members to be involved. Here, you can share your savings and insurance policies information which your family can then easily access in emergencies. What’s more, it is a great way to start that conversation about money e.g. what your financial goals and future should look like, and what it will take to get you guys there.

For couples who wish to maintain some confidentiality, you don’t have to share ALL the details e.g. keep your personal savings a secret!

My husband then downloaded the app via the email invitation link I sent, and note how the connection shows up under “Your Circle”. Clicking into it then enables him to see all the details of our family’s insurance policies that I had painstakingly keyed in, as well as track the premium due dates!

What I Didn’t Like – To Be Improved

Of course, no app is bound to be perfect, and given that this app is still in early beta access, there were several areas that I felt the team could improve on:

Insurance

Pain points:

- extremely tedious to enter details manually

- taking photo of the policy didn’t translate into auto-population of the fields to speed up the process (note: Autumn has since said they’re currently exploring OCR technology into future updates of the app)

- had to keep manually adding family members

- messy order of the insurance policies, making it hard for me to search for what I wanted to edit

- did not have disability insurance as a category (I had to park CareShield Life under either “health” or “others”, which made little sense because there isn’t a field for me to input what the monthly future payouts will be)

Suggested improvements:

- Add Family Members: once a name and relationship has been added, allow users to easily select them again vs. repeatedly having to fill in the forms each time

- Add Disability / Long-Term Care category: fields and data points specific to disability insurance (income replacement) and CareShield Life (with its supplements) should be added

- Arrange by type OR individual: the current colour coding of each policy by type helps, but there’s no coherent order of how the policies are ranked or arranged. Suggest to either arrange by type (e.g. group all the Hospital plans together) or to allow a “view by individual” selection. Or, why not enable both? 😀

Investments

Pain points:

- Bloomberg tickers are not intuitive for many retail investors

- Some stock counters did not work e.g. Micron

Suggestions:

- Instead of Bloomberg, could there be a better data partner to sync with? e.g. would Google work?

Retirement

I’ve tested out many retirement planning apps and this is where I feel Autumn’s version may be a tad too simplistic (although it achieves its objective). My suggestions would be to:

- allow users to input inflation rate vs. savings growth rate

- from a monetization perspective, there’s opportunity for the app to suggest better places to park one’s savings for the short-term e.g. link up with fixed deposit providers, Singapore Savings Bonds, etc

Finance

One last idea would be to add a Credit Cards section, which will allow users to be able to track what credit cards they own (and their respective credit limits). It’ll also give them a better view of their expenses, which the app can use to link back to their retirement progress (are they spending too much this month vs. previous months?)

If syncing with SGFinDex is possible, this should be easily done.

Is Autumn app safe to use?

Autumn is financially backed by SC Ventures (a subsidiary of Standard Chartered Bank), and so they use the same bank-level security measures to protect its users’ private information i.e. from their website: from powerful encryption to identity verification, we use recognised methodologies such as ISO 27001 & CIS 20 to secure your data.

Specifically, Autumn uses the SaltEdge API to connect to your bank account – even though you key in your iBanking credentials, these are sent directly from your browser and Autumn’s servers never see or store your login details or passwords, as Autumn’s system is built to only parse and import the financial data. You can also read more details on their security policy here.

And of course, if you’re still worried and prefer not to disclose your iBanking login credentials, you can simply skip the auto-sync function and manually update instead!

More developments ahead

Autumn has also shared that users can look forward to 3 new upcoming features launching later in 2022:

- Files – you will be able to upload, store and share important documents with your family and loved ones in the future here e.g. insurance policies, medical documents, wills.

. - Health – it is difficult to build wealth when you’re in poor health, so get evaluated on your wellness score across your physical health (body), mental health (mind) and lifestyle habits. Based on your scores and the goals you set, the app will then curate recommendations to guide you towards improving your health. You will also be able to connect the app to your activity tracker (or external health app) soon enough.

. - Autumn Academy – an in-app financial knowledge and resources developed in conjunction with Franklin Templeton to help improve your financial literacy through bite-sized videos and short quizzes.

Overall Rating & Conclusion

I’m giving this app 4.5 out of 5 stars because it’s probably the best one in the market right now of its kind, and I really want to see it succeed further.

No one has done a review on how to use it for families so far, but I really like how you can add your loved ones and share important financial data with them. That way, you’ll always know where to find them, even if something ever happens to the CFO one day.

What’s more, the app is free to use, so what are you waiting for?

Seriously, do yourself a favour and go download the app. I’m pretty sure you won’t be able to find anything better than this!

Sponsored Message

Want to start planning for your future, but not sure where to start?

Headquartered in Singapore and backed by Standard Chartered, Autumn is a holistic financial, health and lifestyle app. Through Autumn, you can seamlessly manage your money through our single-view Finance Dashboard, share your finances and joint aspirations with loved ones through Your Circle, and take steps to prioritise your health with our Health Tab (launching soon).

Download the app here today!

Disclosure: This post is brought to you in collaboration with Autumn.