By now, most of you would have seen the ads for The I Quadrant (TIQ) popping up on your Facebook or Youtube. If you’re considering whether to shell out $3000 – $4000+ to sign up for the course (TIQ charges different rates depending on how you enrolled), you might want to read this article first.

If you’re a middle-income individual, you CAN own multiple properties in Singapore and enjoy the landlord life…?

|

| Source: The I Quadrant. Am I the only one who thinks this is misleading marketing? |

Surely I’m not the only one who thought that sounds too good to be true.

Which is why I decided to investigate further.

What I found out was that technically speaking, The I Quadrant isn’t making any false promises, because there IS indeed a way to do it.

So the good news is, they’re definitely not a scam.

But here’s the problem I see:

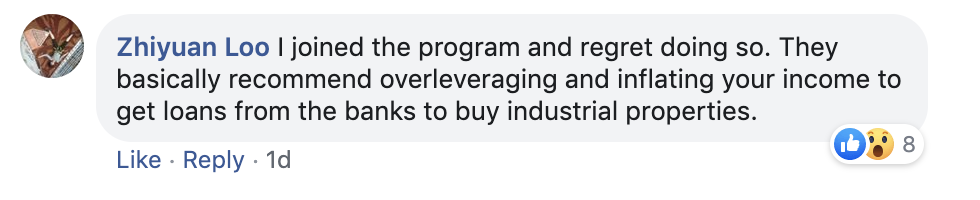

You’re not being told what the RISKS are BEFORE you enrol and pay for the course.

And after you’ve attended, if you feel uncomfortable with all the risks and the level of leverage required to pull it off, then there’s a chance you’ll end up among the students who went but did nothing in the end.

Except pay the course fees to The I Quadrant, that is.

Why I’m Writing This

One reason why I feel compelled to write this is because after my good friend attended their course, she decided to ask me for my thoughts on whether she ought to take up their offer to purchase a property (the “after-sales support”).

The part that made her hesitate?

Whether to take up a $900,000+ bank loan when she earns a $5k monthly salary.

She’s not the only one. Since then, several more of my friends have attended the course, and most confided with me that they didn’t end up buying any property because they felt uncomfortable with the risks and amount of leverage required from them.

IF you go into the course fully aware of the risks you’re required to take, then that isn’t so bad. Because while The I Quadrant certainly isn’t a scam and they aren’t lying about their system, I feel you should probably read about the risks involved first before you sign up.

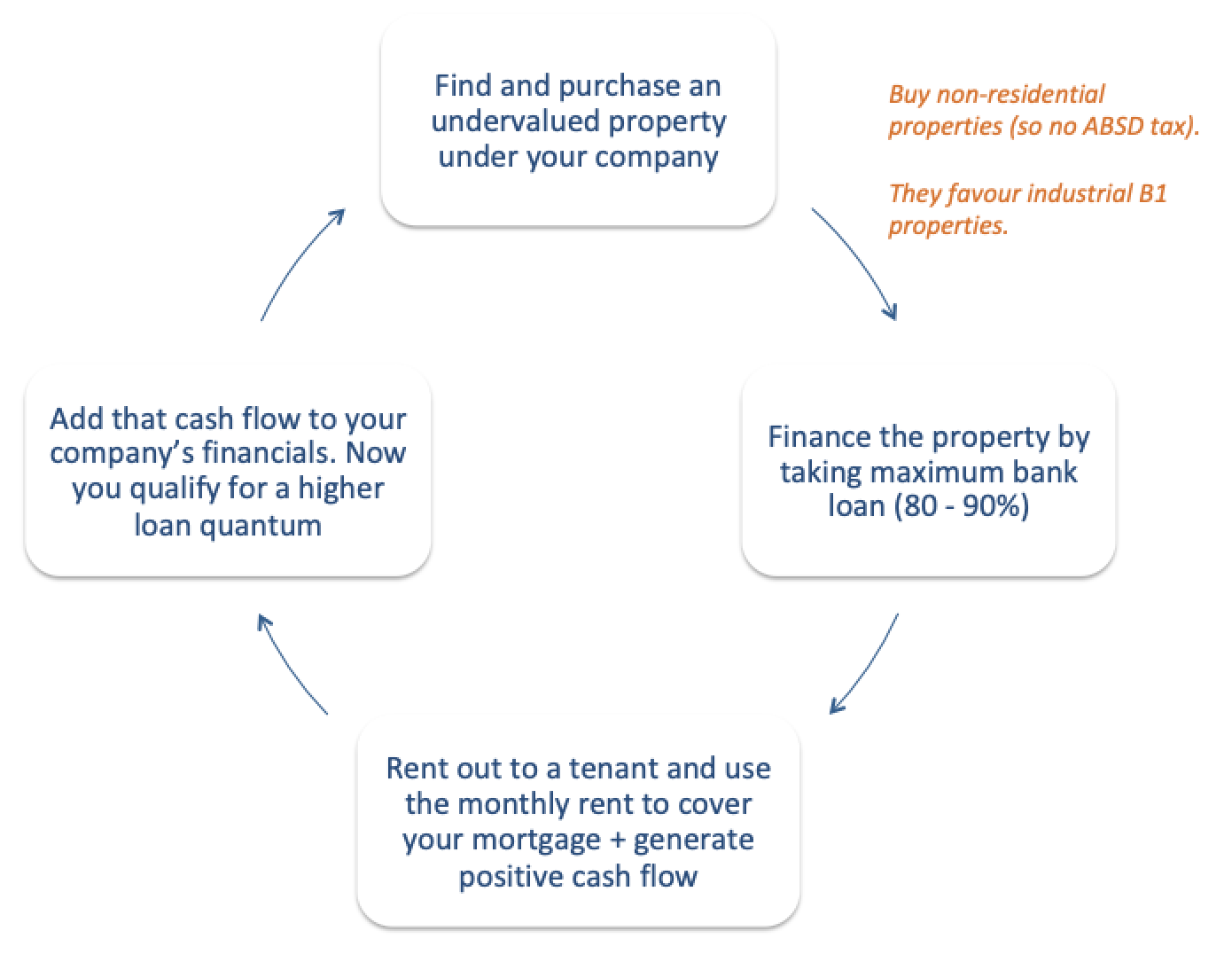

The Methodology

What’s the Recommended Criteria for Selecting Property Units?

Go only for very high occupancy buildings with a strong track record in having tenants, and only buy the units that you’re able to get maximum loan tenure for.

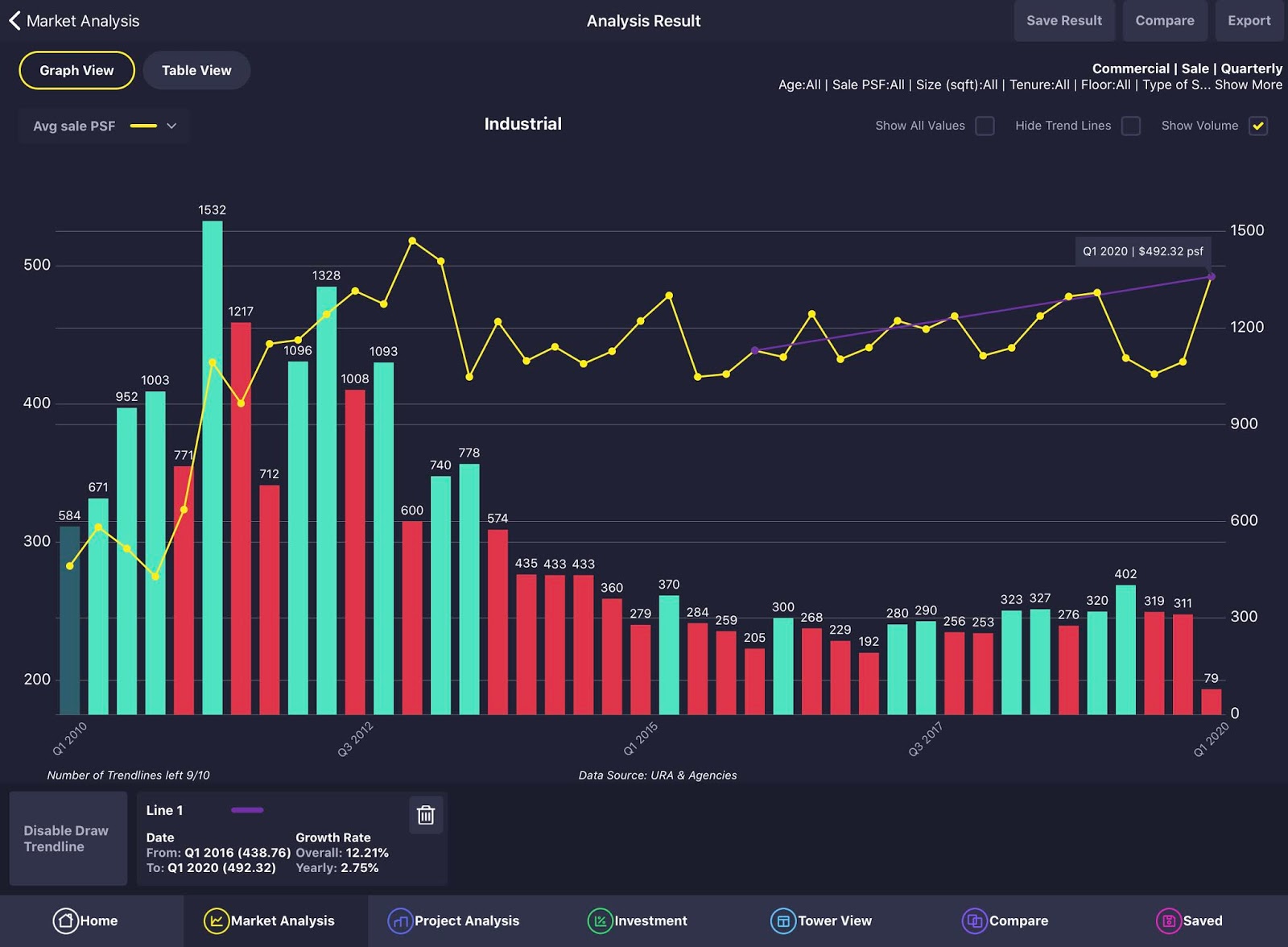

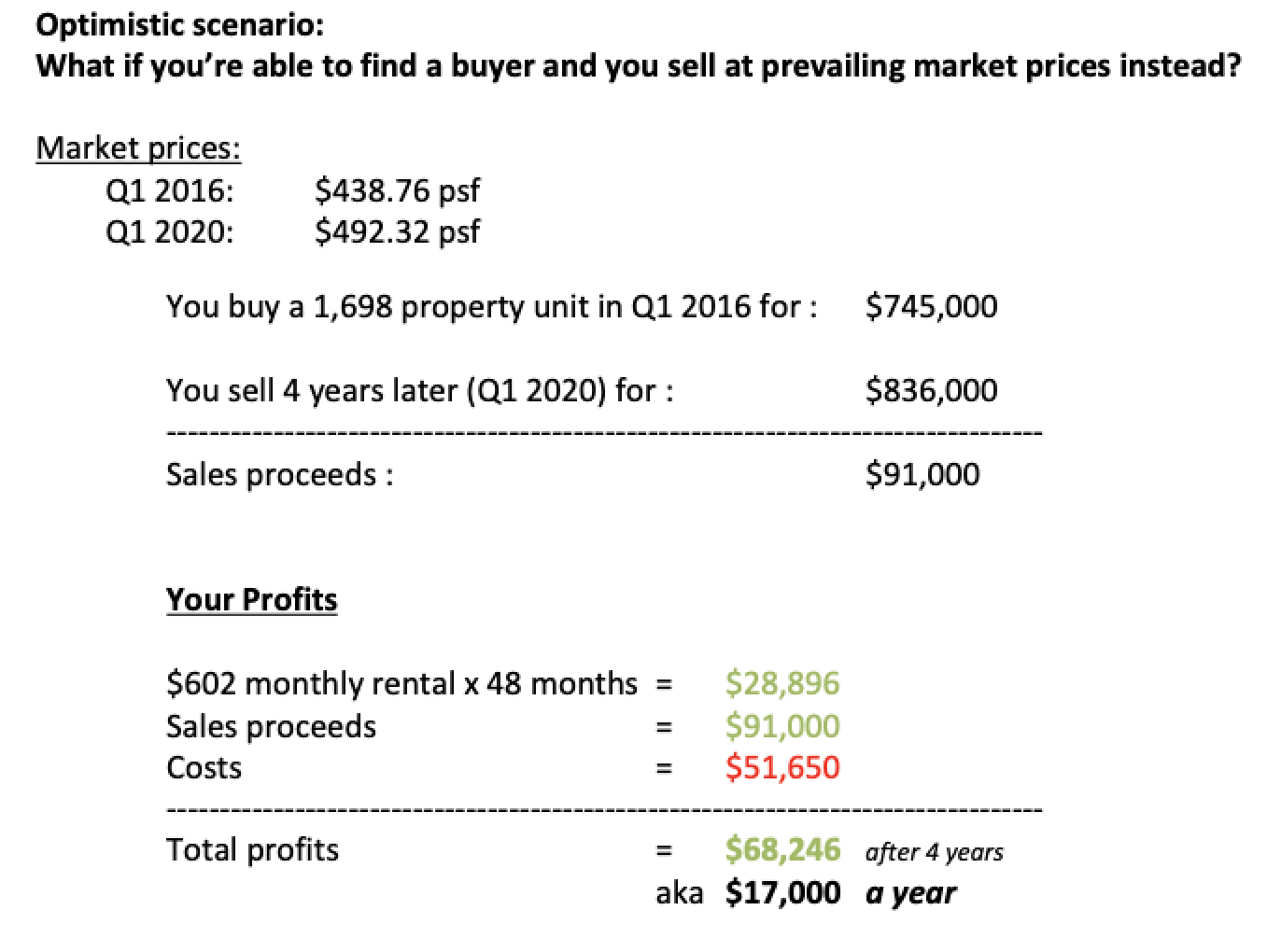

TIQ acknowledges that the capital appreciation for industrial properties is slow, but counter that by saying the rental is predictable with decent yields.

So the short answer is, the method CAN work.

How?

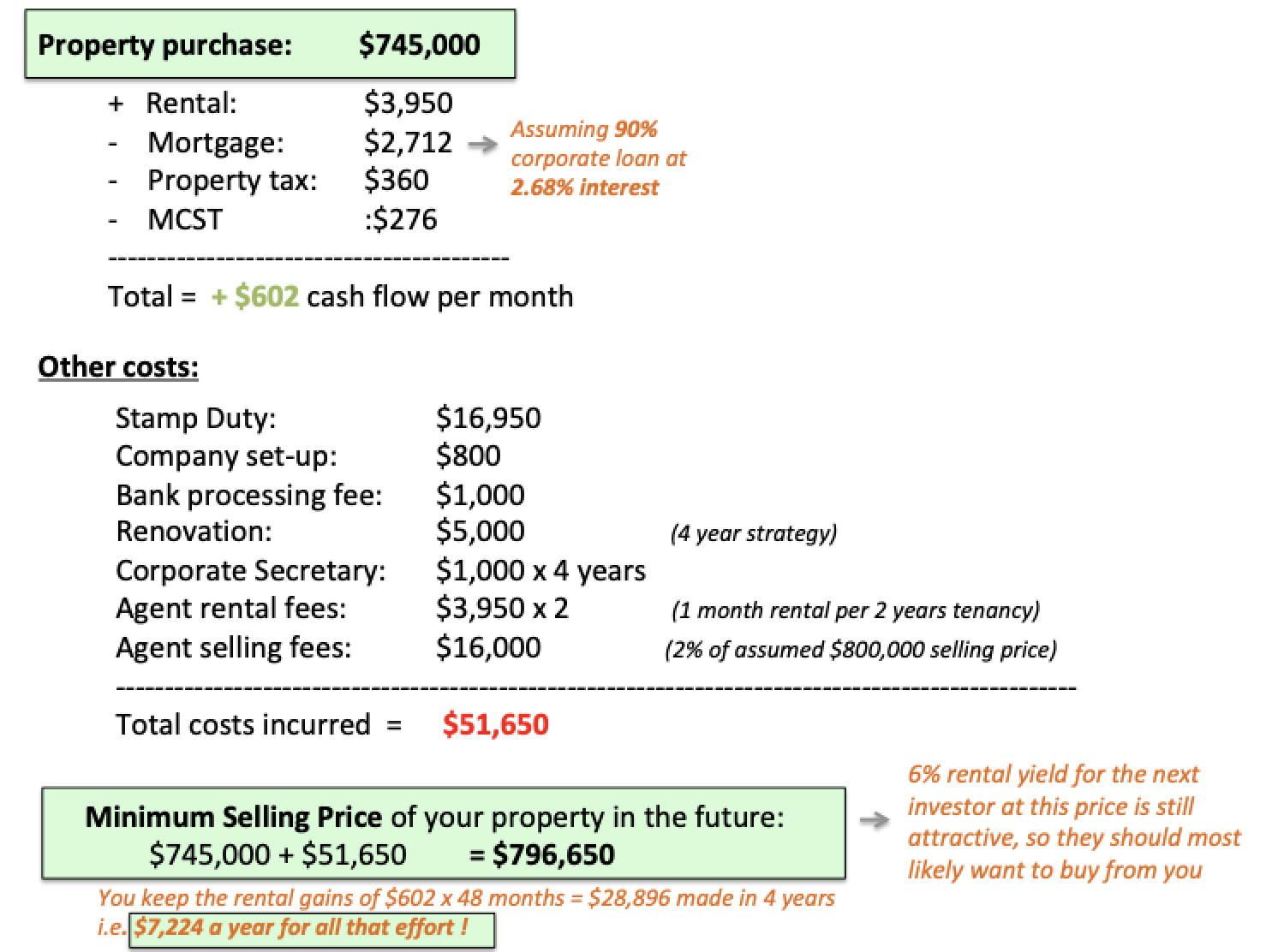

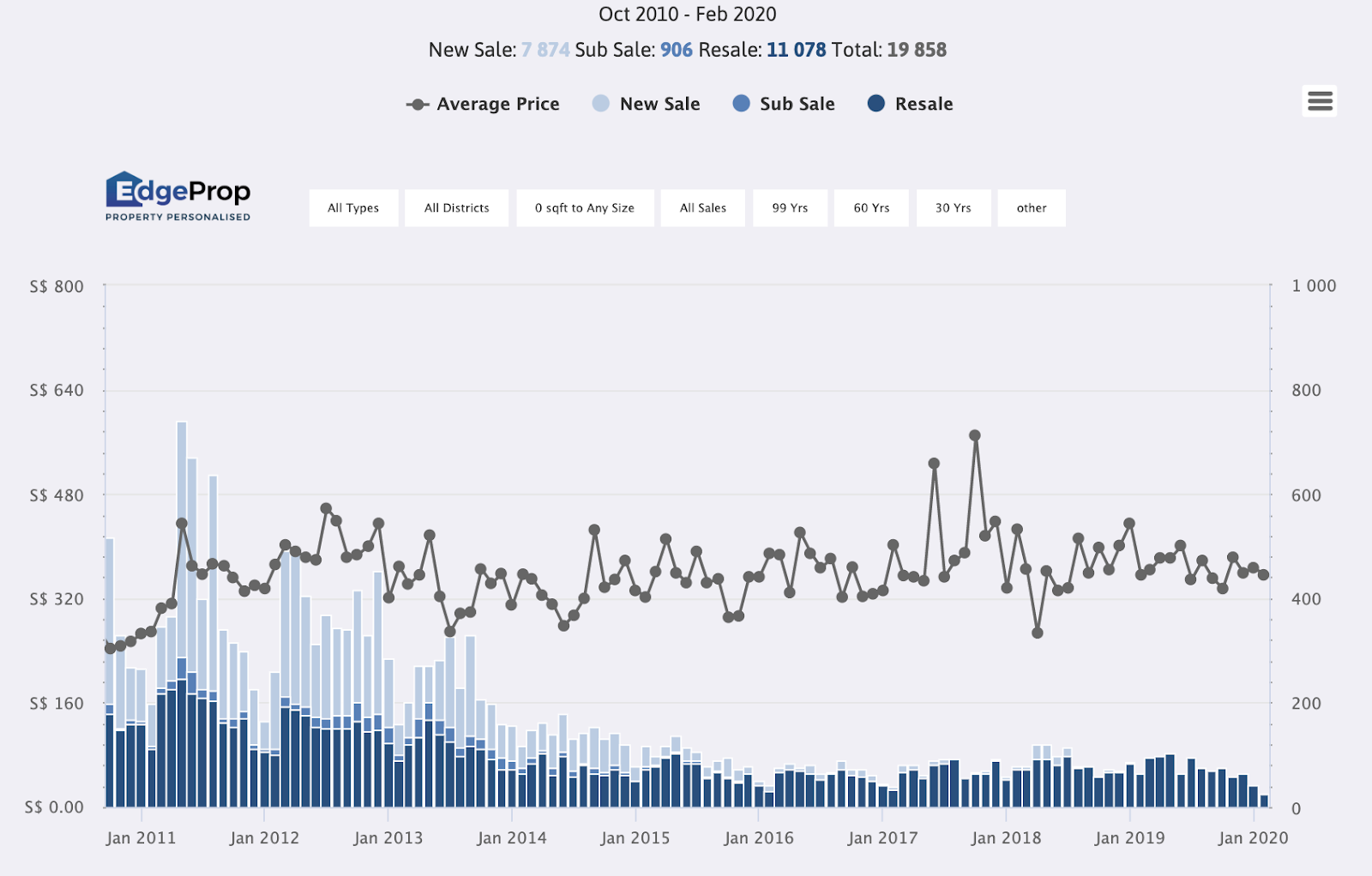

The Numbers

EDIT: The profit analysis above did not factor in 1 crucial component – click here to watch and find out.

You’ll need to pay the cash downpayment portion for the property purchase, and in the event that you don’t have this kind of money lying around, The I Quadrant teaches you how to buy using other people’s money i.e. how to convince your friends or family to fork out their own cash and invest in your property, so you don’t have to.

This concept isn’t new. Other high-ticket “gurus” are teaching it too.

Another alternative idea they sell you on during the course is to band together with other people to co-invest. If you’re short of money, you can always combine strength with their student population (at time of writing, more than 1,500 people have attended their course) and buy a property together.

So yes, the math does work out.

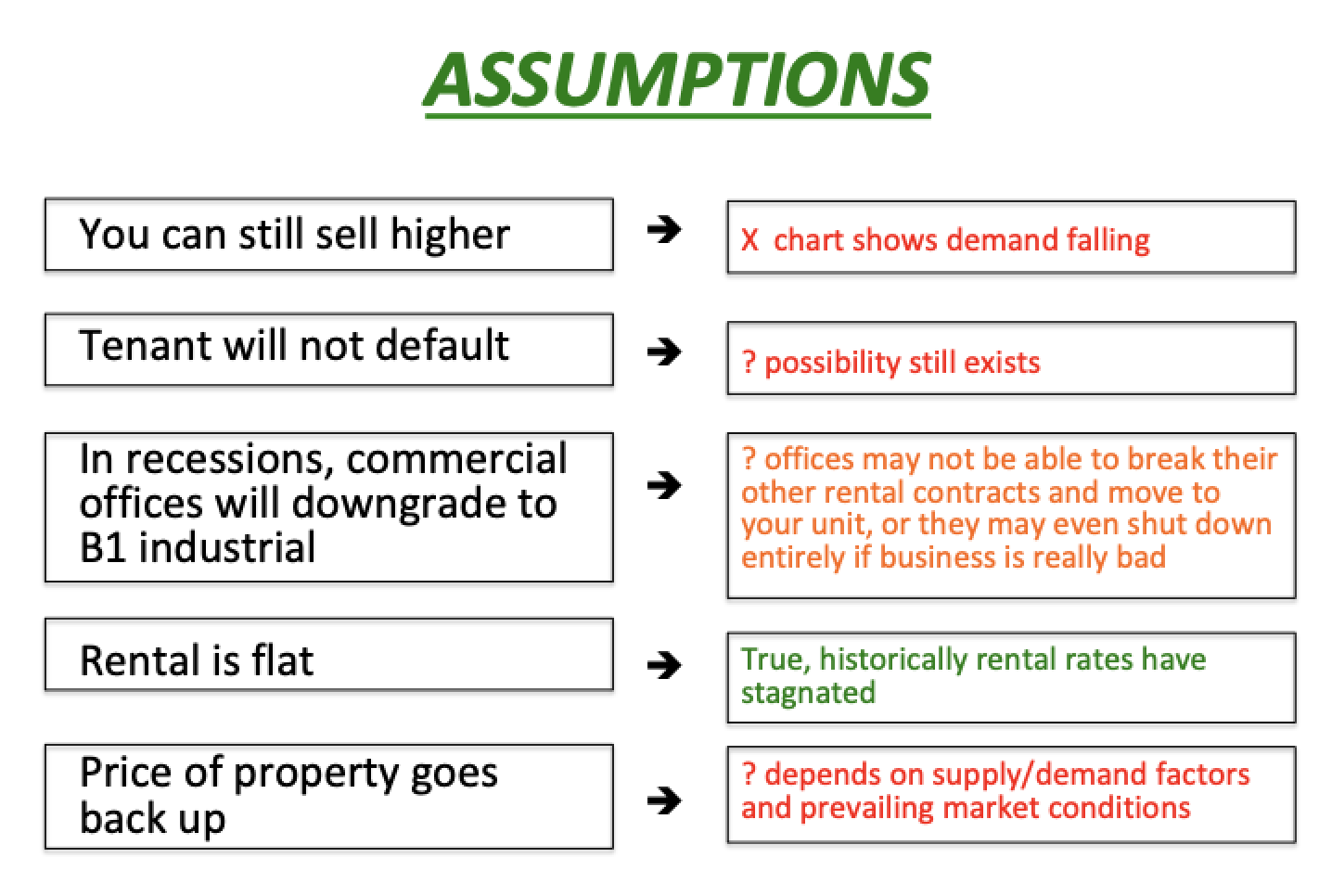

What’s the RISK?

This next chart shows more clarity as well.

- spend time researching to find undervalued properties

- take up the loan(s)

- settle all the required paperwork

- liaise with the property agent at your buy/rent/sell transaction stages

- monitoring the market situation to sell when price goes up

|

| Not everyone is comfortable with leverage. |

Hold on… isn’t this similar to a REIT?

You’re not wrong, this does seem pretty similar to how a REIT operates, especially if you got investors to fork out cash for your downpayment on the properties.

Perhaps you’re now thinking, huh, you mean I can operate like a REIT without the license? Technically, this is the legal grey area, because there’s currently no regulations stating this is illegal and that you cannot do it.

|

| Source: Seedly’s Facebook Group |

Other Common Objections

- What happens if you can’t lease out the property?

- Apparently, this shouldn’t happen because you’re purchasing high-quality properties in good locations.

- What happens when your tenants default on their lease?

- TIQ shares during class that since you’re purchasing B1 industrial properties, the rent is fairly cheap (less than a fresh grad’s salary) for companies to afford so they shouldn’t default, theoretically. There are also offices in such buildings, which are cheaper than rents elsewhere in commercial buildings so TIQ believes that companies would “downgrade” here instead if times are bad. You might also want to read this article by The Business Times about the misuse of industrial premises.

- What happens if your tenants default, and you don’t have enough cash to repay your monthly mortgage?

- They recommend that you should have enough cash to repay, if you do your sums right and hedge your risks well

- What happens if there’s a shareholder dispute and someone wants their money back?

- You should technically be able to cover that with your surplus cash fund, or get someone else to buy over their share

What will you do then?

Are There Any UPSELLS?

|

| Photo taken at The I Quadrant workshop |

Note: There are conflicting information about the Property Leader services offered from the ex-students I interviewed for this article, especially on the 10% stake required. Please contact me if you have more insights on this to contribute.

Nov 2020 update: I finally managed to interview one of their Property Leaders, and she said none of them have ever received 10% sweat equity.

So, Does the I Quadrant Method Work?

My Personal Take

So if you prefer to learn all the steps yourself and execute it, just make sure you cover your downside well, and go in only after knowing what it requires of you.

In other words,

So I’ll leave it to you to decide for yourself.

41 comments

We need more of such posts 🙂

Kevin

Thanks for the frank post. Always good to hear from someone who has researched the process.

I personally find that there isnt much focus on what happens if relationships go sour. That could complicate a lot of things especially if close personal relationships are ruined.

Another thing is that where would one find a $750K property to rent at almost $4K in this market? That seems highly implausible.

One would definitely need to have a huge risk appetite and courage to venture into something like this.

For consideration I think the depreciation component should be included in the numbers breakdown as most of these industrial have lower lease (30/60 years)

Thought might be hard to quantify as it boils to the market pricing.

Hi Dawn,

Thanks for the post. I noticed that income taxes is absent in your computation. Since the proposed structure is set up in a company, you will have to account for 17% income tax on the rental income right?

If yes, the return on investment / effort becomes abysmal.

Regards,

KK

Indeed! Except that income taxes was not addressed in their course either so that wasn't included in the numbers.

Yes, lease, depreciation and valuation depends so it is hard to pinpoint a specific number or rate to apply.

Thank you for raising more food for thought!

Thank you for this post! Attended the free preview and was not comfortable with the risk as we are still paying our hdb loan. BUT it may work for older couples who have fully paid off their housing loans and are sitting on a pile of cash.. So i guess it depends

Thanks for your post! We need such sharing to educate the public!

I am also impressed by the sharing of Carrine, an influencer on https://www.asiaone.com/digital/instagram-influencer-shares-what-happens-seminars-run-internet-marketing-gurus-spore

What are your thoughts on such business consulting / digital marketing courses like Md Imran?

indeed

Yes, the method definitely works for some people. But perhaps not for the vast majority, which their marketing ads seem to be targeting.

I've not attended those courses nor know of folks who did and raised those as a red flag yet, so I'm unable to comment.

It is extremely misleading to go around touting that you can buy properties with no money without mentioning the high borrowings involved or using other people's money to do that. Also, iquadrant is not licensed by MAS. These people are no different from Nigerian scammers and should be reported to police! Wolf in sheep's clothing. Omission is failing to share the full picture which is also a form of misrepresentation. Wonder why no one has taken them to CASE yet or put a POFMA against them for spreading harmful untruths!

With due respect, you should change the subject heading to "Is I Quadrant a scam? Perhaps?" It's definitely not a resolute no and the current heading seeks to lend some credibility to them….

Actually, they don't have to be licensed by MAS because they're technically not a financial services provider. You don't see property companies or REITS being licensed by MAS either (it's a different regulator / industry), so The I Quadrant did nothing wrong when asking MAS to remove them from the MAS Investor Alert List.

Misrepresentation, legally defined, refers to false statements of facts. Omission does not fall under misrepresentation legally, that would be more of an ethical question that needs to be addressed separately.

Which is why I felt this post was so necessary. Hope that clears it up!

But that's the point of this whole post – I'd love to say they're a scam but unfortunately (or fortunately!) my investigations showed they're not. The biggest issue here is just the lack of information about the risks.

Hi, my friend send me this link and i am a full time industrial property agent. Looking at this concept teach from them. It is very dangerous if were to stretch your loan to buy a industrial properties (bank will need you to be Personal Guarantee), only a small fraction of industrial unit are able to fetch this +positive cash. But you are renting to SME or some sole proprietorship company. I have personally seen many tenant default in rental and close the company. Nothing much you can do. Ultimately, the real winner are the course provider. One of the person teaching the course is also a real estate agent. He achieve $500k commission in month of Jan 2020.

Please think twice and do more research before trusting many course provider out there painting positive energy and selling old fashion method in investing.

Hi Eric! agreed with you, I checked in with several property experts as well and they all echoed the same sentiments. There are definite risks involved, and so far although the premise is to "buy undervalued, sell back higher later", even the founders have acknowledged during the classes that they have yet to sell any of their properties yet. Optimism about having tenants is good, but like you said, there's no guarantee that the tenant won't default / unit won't be left vacant for a prolonged period of time. I guess at the end of the day, we can only hope that those who decided to go into this have done a thorough consideration of the risks involved!

https://m.facebook.com/story.php?story_fbid=3418073788208338&id=228490203833395

$500k commission from their student. Good luck to their student

Hi Eric, if that's true then it is indeed worrying. But has it been verified that co-founder Ivan's $500k commission for the month of January 2020 is from transactions that his students made through him, and not from his other clients who are non-I-Quadrant members?

Unfortunately I already paid money before I saw this post..but I’m now more aware what are the risks involved and not to just commit if I don’t have the means. Really appreciate you writing this article!

i attended their free webinar recently. my conclusion: avoid.

Wow, great to have your insights. Thanks a lot.

Thanks for the insightful article.

I attended their free webinar and have registered for their online workshop, which is less than S$300. Even if I dont end up investing, I get to learn what their strategies are about. Which I reckon is not a bad deal for a few hundred bucks.

As mentioned in earlier posts by other people, Marko markets as he owns multiple properties. In fact they are all co-shared by different investors. So this is wrong… this is technically breakdown into 3 areas to buy industrial property,

1. cash partner (gets 40% frm rental yield)

2. loan bearer (gets 40% frm rental yield)

3. deal + resource finder (gets 20% frm rental yield)

So basically, if you have no cash or cannot secure loan, you just be a deal finder to keep finding good below market value industrial properties. And you get a share typically 10% to the person who finds the deal. The other 10% goes to being able to find cash and someone who can get the bank loan.

So technically you contribute hardwork, like a minion runner or asset manager some sort & you get 20% of the rental yield…

thats why M&F students is constantly looking for cash partners and young people who can get loans which can loan for max tenture.

Next they will also teach you to stay in land-properties which you do not really own it but stay in it through rental… Basically you buy a condo in town or near marina bay etc and you rental out to pay for your landed rental thats it …. of course the reason being the condo gives potential investment returns. landed nope as not everyone can afford one.

I paid for marko and friends and under their 1 year support program via telegram. They are pretty much like TIQ… but I can say most of the people who spent on this course felt cheated. I dont think this is considered educational course… more like sharing session where everything can be learnt in 1hr or less. Trust me… The rest are just playing games like team building…in this 3 days course. Waste of time and the main aim is conditioning students to invest their cash in industrial properties.

The reason is M&F are just creating the investment industrial property market for themselves & his community. To find people. willing to part their cash.., selling the dream of going for holidays and collecting passive rental income marketed as "boring landlords"…. do you actually think they are boring?? And whats the purpose of teaching so many students?? If 1 student is being charged $3k – 5k and fees, 100 students per group will meant half a million to Mr. Marko & friends yah.. In a year can you imagine how many people is being enticed by greed? Mr Marko is a millionaire yearly :).. And not everyone will take action to invest as time passes by as people felt fishy… so only 1 or few will manage to swim through as 1 of his live examples that he will use him/her to market in his FB as successful students owning "multiple" properties…. Of course many who commented positive things in his FB comments are existing cash/loan partners who already park their $ or have some form of partnership agreement yah…of course have to support right…

The "volunteers " on actual course days are earlier batches of marko students who came to help @ his 3-day course.. some owns Porsche but are actual pre-own renewed COE Porsche which cost less than a new Japan/Korean car to show-off the new students that they are successful.. So ….. invest in me.. park your lump some cash with me..be my cash partner… M&F call it the money magnet. coz it attracts investors as if you are successful living a high life.

These earlier batch students who came dont serve the community for free. They come with agenda.. to look for potential cash partners or you can say "investors or fishes" who do not know whats the actual plan they are cooking behind.

In fact the students are their prospects and minions to find good quality bmv industrial properties in singapore..as all potential industrial leads need to be screened through by 1 of their senior batch student – Joo Hong.. He will see if this unit is being booked by other students. But in actual fact they may be keeping for themselves because no one knows if they are really booked.. only marko admins knows. They will just tell the students to move on and find another industrial property.. So imagine if you found a industrial property giving you more than 10% rental yield and you ask for verification, they will say its being booked and told to move on.. so what will you feel??? 🙂

You can lease out your condo in town, use your rental income to pay for the landed rental only if your condo is fully paid (they left out the fully paid portion). Otherwise, your condo rental income is mostly used to offset your mortgage, MCST and property tax.

And I believe most people will definitely take a bank loan to buy that million-dollar condo.

Hi, thank you so much for all the feedback on ITQ and MF. Looks like all are the same and using similar tactics. I don't have appetite for their tactics and think not so straight forward to own so many properties without high risks. Attended Dr Patrick Liew free webinar and only USD 548 to join for life long membership. Didn't sign up on the spot but they sent email everyday to remind you to join them. it is very much cheaper than MF which is 5000 plus for 1 year mentorship. Anyone can comments?

Thank you.

Spotted a familiar face in M&F FB video. Which is also 1 of the I QUADRANT Co-founder – Ivan cai.

Can you also put disclaimer that you didn't get any kickbacks from Iquadrant for this articlse ? It "can" work. Anyone who leveraged so much will be soon looking for a rope to hang from.

You forgot to add the mortgage paid as part of the sales proceeds, which is pretty handsome even if he broke even on PSF. Also not a fan, it is very risky.

thanks! very good summary of the course. i think it is very dangerous advice to give ppl when you ask them to leverage in this manner. Apart from everything that has been mentioned above, the reasons why i don't even think what they are proposing is workable is as follows –

a) high occupancy commercial properties would typically attract a higher entry price, because the potential of the building would have already been realized. It is unlikely to be undervalued and i doubt that there is much capital appreciation.

b) as you mentioned the returns aren't that great for just one unit (especially after all the hard work put in) unless you leverage and have multiple units. but when the scale increases, so does operational/maintenance/compliance and maybe even manpower costs. the costs of running the entire enterprise seems to be understated.

c) based on the scale which they are talking about (owning multiple industrial properties), some expertise in building management, legal and human resource is required to manage the property well. For example, it can get very messy (legally or otherwise) if you don't have the experience to handle tenant disputes well.

d) banks are not stupid. they won't lend money to just anyone, especially if it is a newly set up company or individual without a track record. it is easier to use for an existing company with legitimate business operations to get a bank loan.

e) i am not sure how this strategy is relevant to an individual retail investor. experienced businessmen with existing companies do not need such advice. they are planting lofty ideas into the heads of retail investors without a full appreciation of the risks are even asking them to get their family members and friends involved! this is not acceptable.

e) the increase in loan quantum (even with an increase in earning from rental income) may not be sufficient leverage for you to purchase a second property.

in short, investment in commercial and industrial properties is a large scale investment and it requires a considerable amount of skill and business acumen. there are proper investment management courses with more prudent approaches which will be more suitable for people who are just starting out in their investment journey.

I think the authority needs to step in and see if it's a scam. It looks like fishy.

"I'd much rather invest in REITs instead, which require less work, less starting capital and no leverage."

Don't mean to be pedantic, but to be accurate, REITs have leverage, just not at the investor/individual level 😉

Hey, why didn' you attend their course? We would like to hear first hand account from you. ")

but…why should I pay $3k out of my own pocket just to write a review when I don't get paid or earn any money from such articles? This expose took me at least a year of investigative work + interviews but I haven't earned a single cent from this article in the past 8 months…lol

Disclaimer: I did not, have not and will not get any kickbacks from this article, nor affiliate fees, nor any payments from The I Quadrant or their associated entities/personnel at all.

Thanks for this. Seeing their ads all over YouTube. Hope the vulnerable aren't mislead. Hoping to rent out properties in this kind of economy is going to be very, very hard.

I echo what マイライフ mentioned. I attended the MF paid session as well as another (GEX) property related "course".

Did I learn something out of the MF sessions? I'd say yes.

Is it applicable in the real world ? Probably yes. Did I do anything about what I learnt? No. It does not fit my investment appetite.

And yes, during the MF session, he did mention that some of his ex-students came out and setup another company doing the same course.

Like it was rightly put, which was what I observed as well, is to find "partners" where they can either borrow their name or their money.

If no money, you can lend them your name (assuming you are young enough with a suitable paycheck – to be used against borrowing from the bank).

What I do not really appreciate is the very quick brush-away response when someone in the class ask "what about my current HDB?". The response, without batting an eyelid was "sell", without understanding the real situation behind the question (of course, I'm not expecting him to be a financial consultant to help someone work out the finances). But the fact that such 'advice' was dolled out so flamboyantly sheds light on their perception & attitude.

It was rightly so in the description above that they flaunt their material wealth… Good that he is able to make money out of it; not so good to paint a one sided picture with minimal focus on potential risks.

Would I encourage my friends to go for his talk? I'd say go for the free session but keep the money (don't sign up)…

Even if the system is workable (unlikely) the fact that I-Quadrant constantly markets in its ads that no payment is required to purchase a property already makes it a misrepresentation.

Comments are closed.